Written by: Jessy, Golden Finance

On July 12, the token Pump from Pump.fun will be publicly sold. This public sale is in collaboration with several second-tier exchanges such as Kucoin, Bitget, MEXC, and others.

The total issuance of PUMP is 1 trillion tokens, with 33% allocated for ICO at a sale price of $0.004. Among this, $600 million will be raised publicly on exchanges, while $700 million worth of tokens will be sold to institutions through private placements.

The timing of this token sale coincides with a market recovery, as Bitcoin has once again reached new highs, and overall liquidity in the cryptocurrency market is slowly recovering. Many in the industry are skeptical about the issuance of Pump.fun tokens, as the Meme market has significantly cooled down, leading to a substantial decline in Pump.fun's returns. This token issuance is also seen as another harvesting action, taking advantage of the recovering market liquidity.

Jocy, founding partner of IOSG, stated on social media that this public offering by Pump.fun resembles a liquidity exit for participants, describing it as a highly speculative gamble.

Is the PUMP token worth buying for retail investors?

33% ICO, Team Holds Nearly 40%

The maximum supply of PUMP tokens is 1 trillion, with the distribution ratio allocating 33% for ICO (18% private sale + 15% public sale), 24% for the community and ecosystem, 20% for the team, and 13% for existing investors, among others. The private and public sale prices are the same at $0.004, and the tokens sold during the ICO will be fully unlocked on the first trading day, July 12, while the lock-up period for team and investor tokens remains unknown. Residents of the U.S. and the U.K. are unable to participate in this ICO.

The token distribution plan has also been widely criticized within the community, with cryptocurrency researcher Rex bluntly stating that its tokenomics is "exploitative." He pointed out that the team has allocated over 40% of the token supply (20% for the team + 13% for existing investors + 2% for the foundation + 2.4% for the ecosystem fund ≈ 37.4%, plus potential control over some community/ecosystem funds) to themselves and related parties, while the platform's revenue of over $750 million in the past year largely depended on community contributions.

Moreover, the unlocking rules appear opaque to community members; the 33% of public and private sale tokens are fully unlocked on the first day, but the lock-up terms for team and investor tokens have not been disclosed, posing a risk of "internal arbitrage"—using retail funds to support the price before selling off.

Jocy from IOSG believes that the Pump.fun team neither has the willingness nor the ability to "pump" or "control" the market. They have already amassed significant wealth through transaction fees, and this ICO seems more like a final "exit liquidity."

No Technical Barriers, Market Share Surpassed

The Pump.fun team has indeed made a fortune solely from transaction fees.

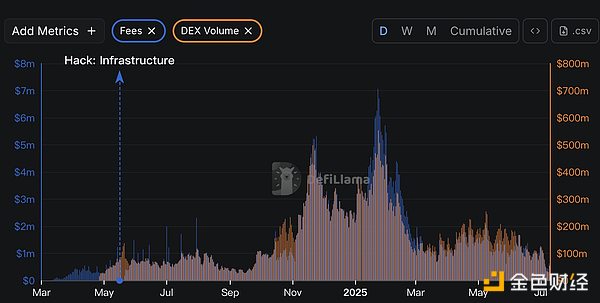

This Meme launch platform on the Solana chain was established in 2024, and according to DeFiLlama data, its peak trading volume and revenue occurred in January 2025. Currently, both trading volume and fee revenue have sharply declined. According to a post by the founding partner of IOSG Ventures on X, Pump.fun's daily revenue has plummeted over 92% from its peak of over $7 million on January 23, 2025, to about $500,000 recently.

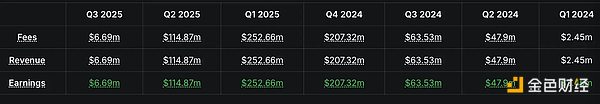

Since its establishment in January 2024, its quarterly revenues are as follows:

With the temporary cooling of the Meme narrative, Pump.fun is also seeking transformation. The team recently disclosed two strategic adjustments, planning to expand its current team of fewer than 20 people to 70, covering professional fields such as engineering, compliance, and legal, and is testing its own AMM in an attempt to build a trading closed loop.

These actions also confirm that the Pump.fun team has realized that, as a Meme launch platform, it does not have any significant technical moat. Its market share has already been surpassed by another platform on Solana, LetsBonk.

All of this indicates that Pump.fun is not a unicorn in the Meme launch platform space; without a technical moat, it can easily be replaced.

Although Bitcoin has recently reached new highs, bringing a new short-term liquidity overflow effect, Meme coins may experience a temporary revival. However, there are too many "zero-sum" projects associated with Pump.fun, and user stickiness is quite poor. Coupled with the perception that its founding team has made a fortune, the market may not be inclined to support the PUMP token.

Additionally, the token's institutional approach is unfriendly to retail investors, the project's launch valuation is not low, and the Meme hype is unlikely to return to its peak, all of which suggest that this project may not possess long-term investment value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。