Author: Nancy, PANews

Despite the controversies surrounding Pump.fun's token issuance, PVP games continue to thrive. Behind this commotion, some hidden winners do not seize the narrative, do not gamble on token prices, but are responsible for building the fire and quietly collecting chips amidst the traffic. This article will delve into the data to analyze Metaplex, Raydium, and Axiom, revealing how they have become the steady winners behind the scenes in the Solana launch platform battle.

Raydium

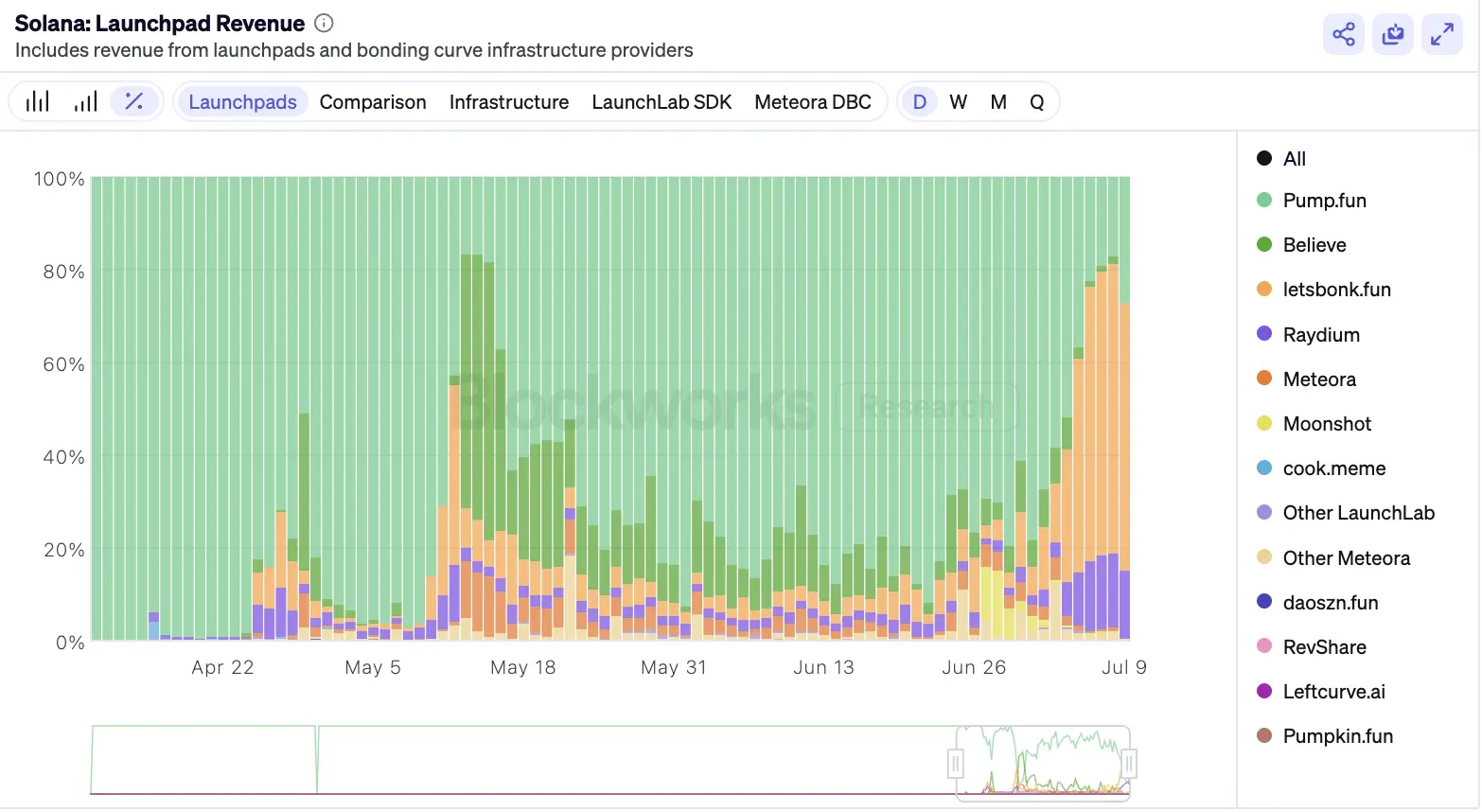

After Pump.fun "backstabbed" by launching its own DEX PumpSwap, Raydium quickly responded by launching the token issuance platform LaunchLab and collaborating through SDK to introduce several similar platforms, including LetsBONK.fun, cook.meme, daoszn.fun, and leftcurve.ai. This SDK strategy significantly enhanced Raydium LaunchLab's competitiveness in the Solana launch platform, especially with the explosive growth of LetsBONK, which became a key driving force.

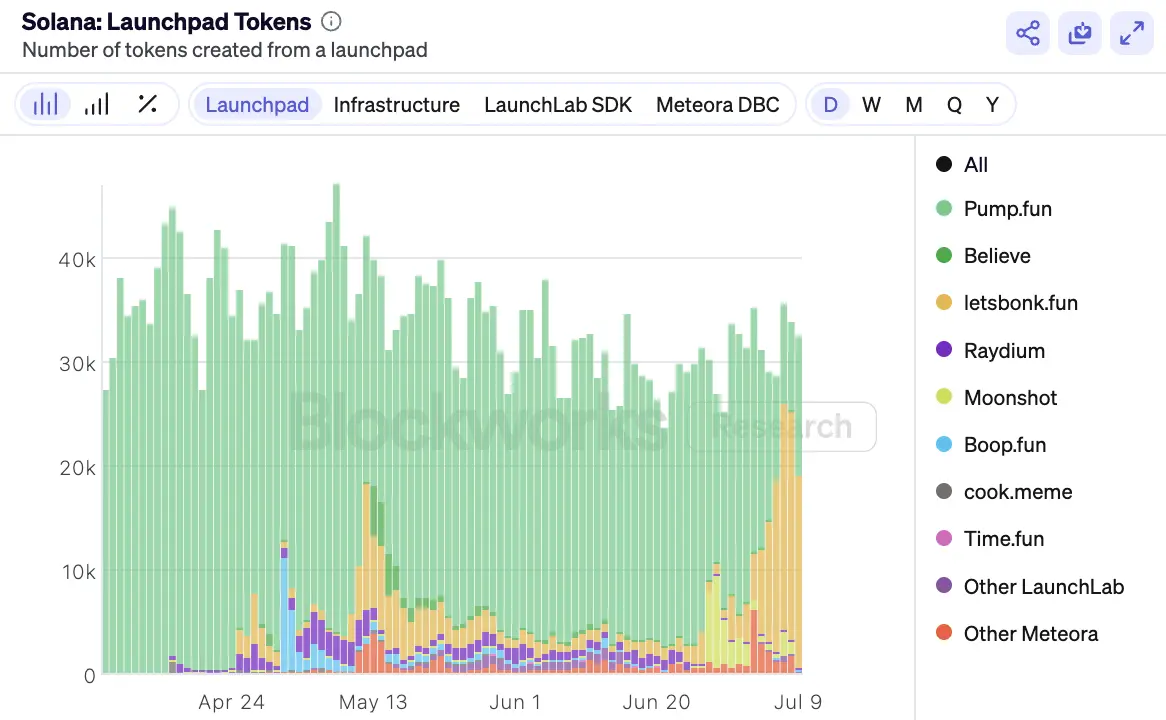

In terms of the number of tokens launched, according to data tracked by Blockworks on July 9, over 32,000 tokens were created on the Solana Launchpad, with nearly 19,000 coming from the LaunchLab SDK, accounting for nearly 58.3%. Furthermore, LetsBONK created over 18,000 tokens that day, with a staggering 97.5% coming from the LaunchLab SDK, and the token graduation rate was close to 98.3%.

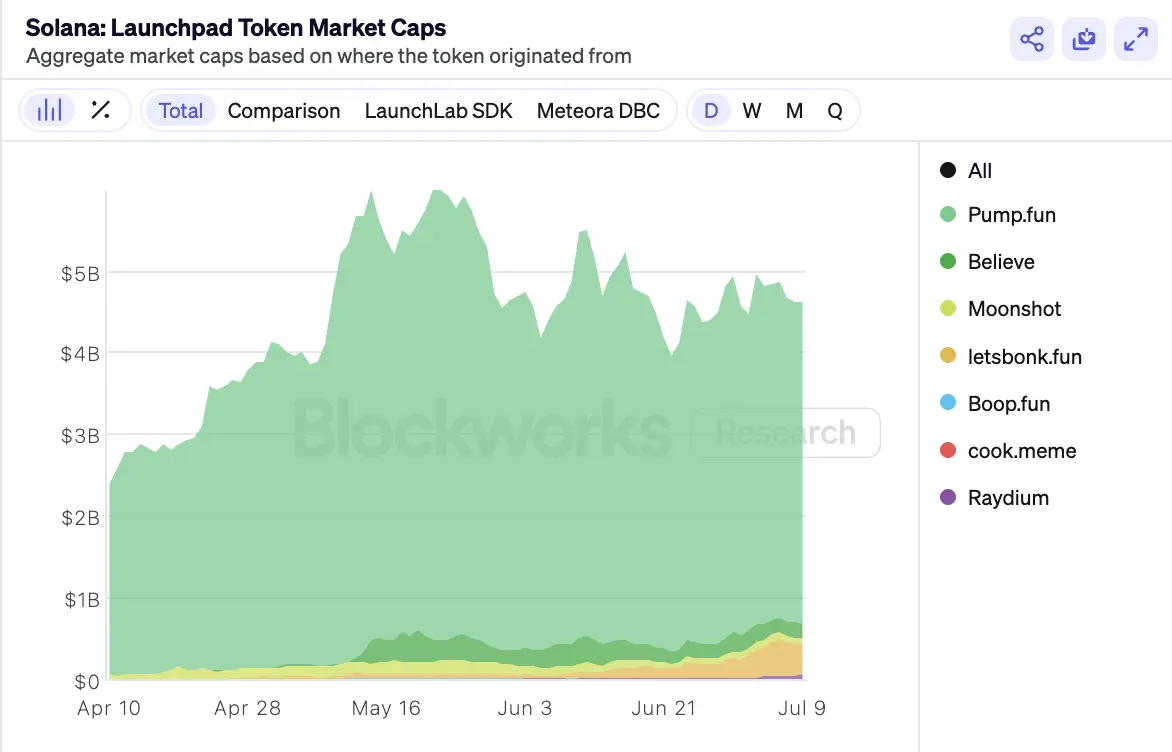

From the perspective of token market capitalization, as of July 9, the total market capitalization of the Solana Launchpad exceeded $4.63 billion, with Pump.fun contributing 85.1% of the share, while the LaunchLab SDK accounted for only 9.2%. However, it is worth noting that the market capitalization growth rate of tokens on the LaunchLab SDK was rapid, increasing by approximately 353.2% over the past month. Among them, LetsBONK contributed 85.5% of the LaunchLab SDK market capitalization.

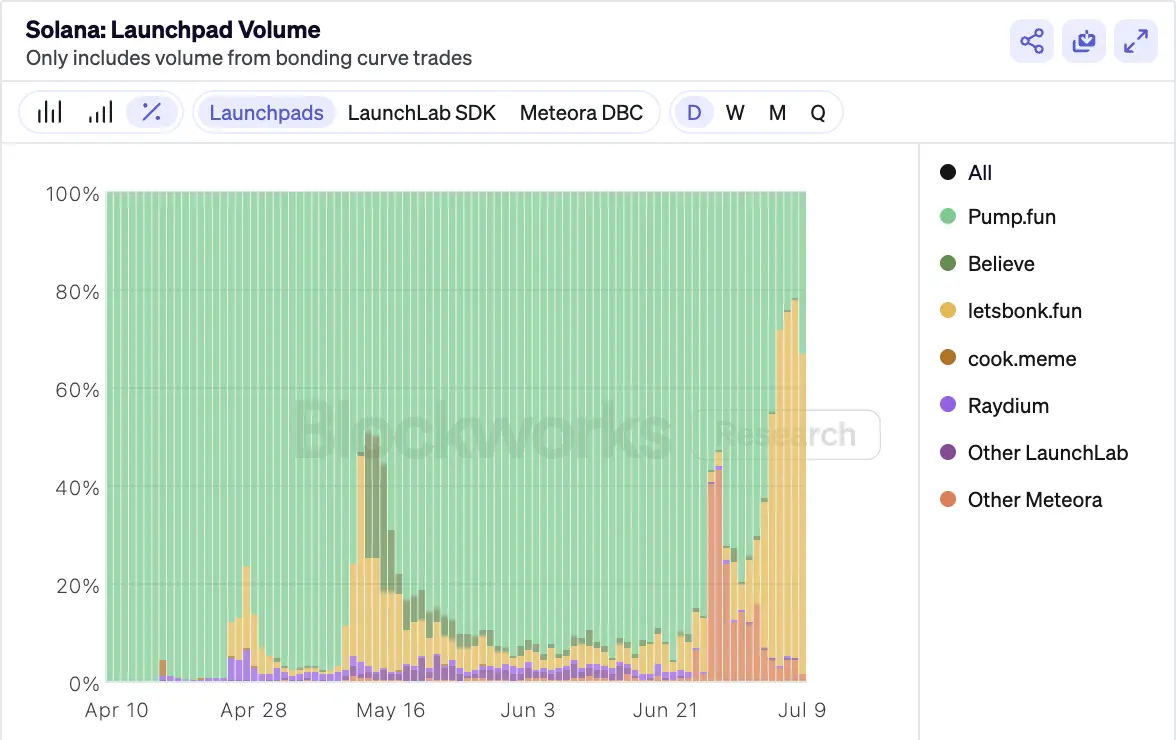

In terms of trading volume, the Solana Launchpad achieved a total trading volume of nearly $190 million that day, with approximately $97.2 million traded through the LaunchLab SDK, accounting for 65.2%, and 99.7% of that trading volume came from LetsBONK.

Additionally, in terms of revenue, the Solana Launchpad generated approximately $1.909 million in total revenue on July 9, contributing over $1.375 million, accounting for 72%. Among this, LetsBONK's revenue accounted for as much as 79.8%.

Overall, driven by the strong performance of LetsBONK, Raydium LaunchLab has surpassed competitors like Pump.fun in several core metrics such as the number of tokens launched, trading volume, and platform revenue, significantly enhancing its influence in the Solana MEME ecosystem. Raydium LaunchLab will allocate 25% of the transaction fees for repurchasing the RAY token.

Metaplex

As the core open-source protocol on Solana, Metaplex provides a complete set of tools and standards for developers, creators, and enterprises to build decentralized applications, having facilitated the creation of over 900 million on-chain assets to date. Its native token $MPLX recently launched on Binance's Alpha section, attracting market attention.

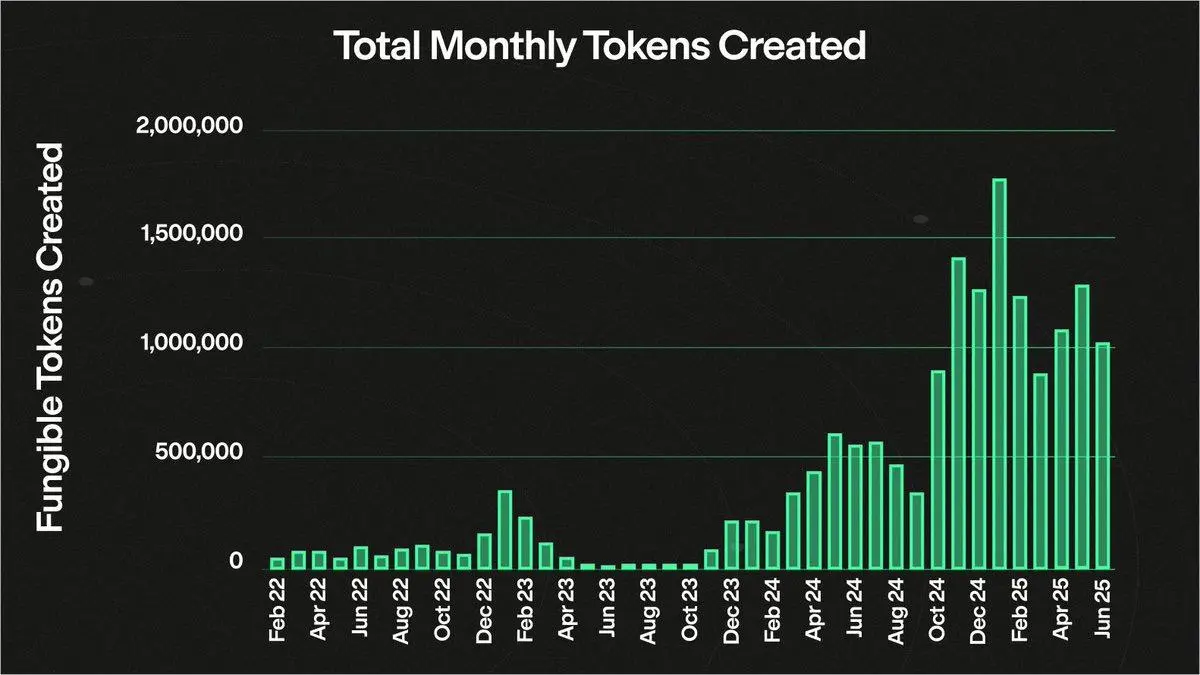

In the Solana launch platform battle, Metaplex has become a beneficiary of the token issuance frenzy. According to official disclosures from Metaplex, the main source of revenue in the first half of this year came from new assets created through the protocol, including platforms like Pump.Fun, Believe, Raydium, LetsBONK, Jupiter Studio, Boop, Meteora, and Time.fun, all of which used the Metaplex standard to create tokens.

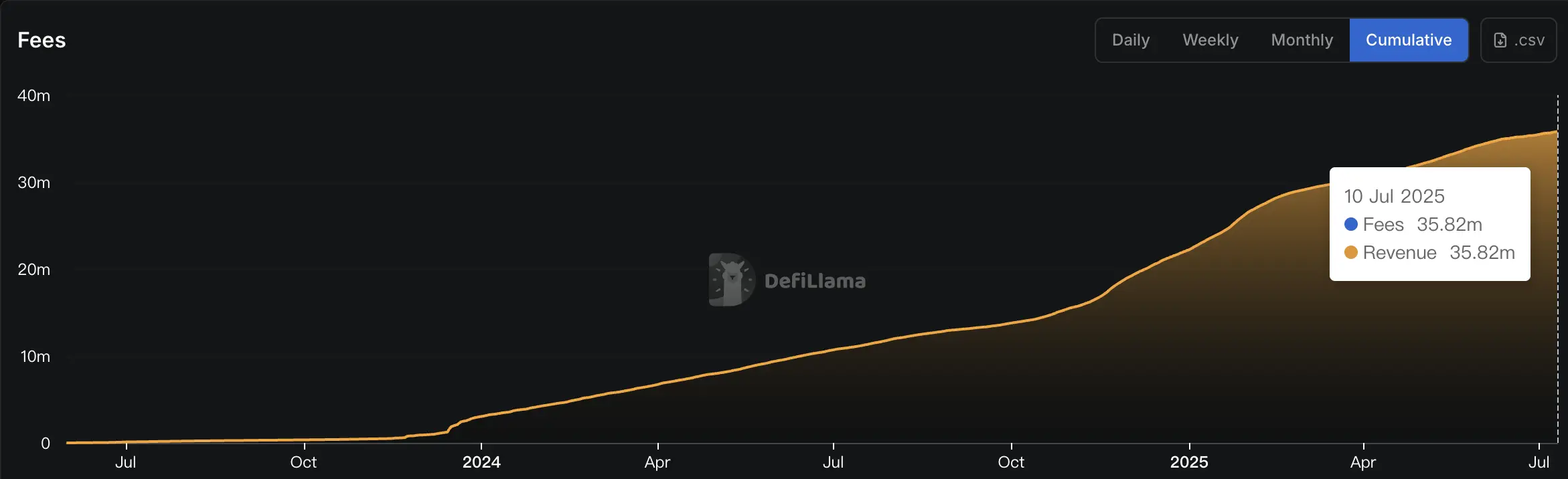

Data from DeFiLlama shows that as of July 10, Metaplex's revenue reached $35.82 million, earning approximately $13.57 million in the first half of this year. In June alone, the Solana launchpad created over 1 million tokens through Metaplex, with the protocol's fees reaching approximately $1.7 million that month.

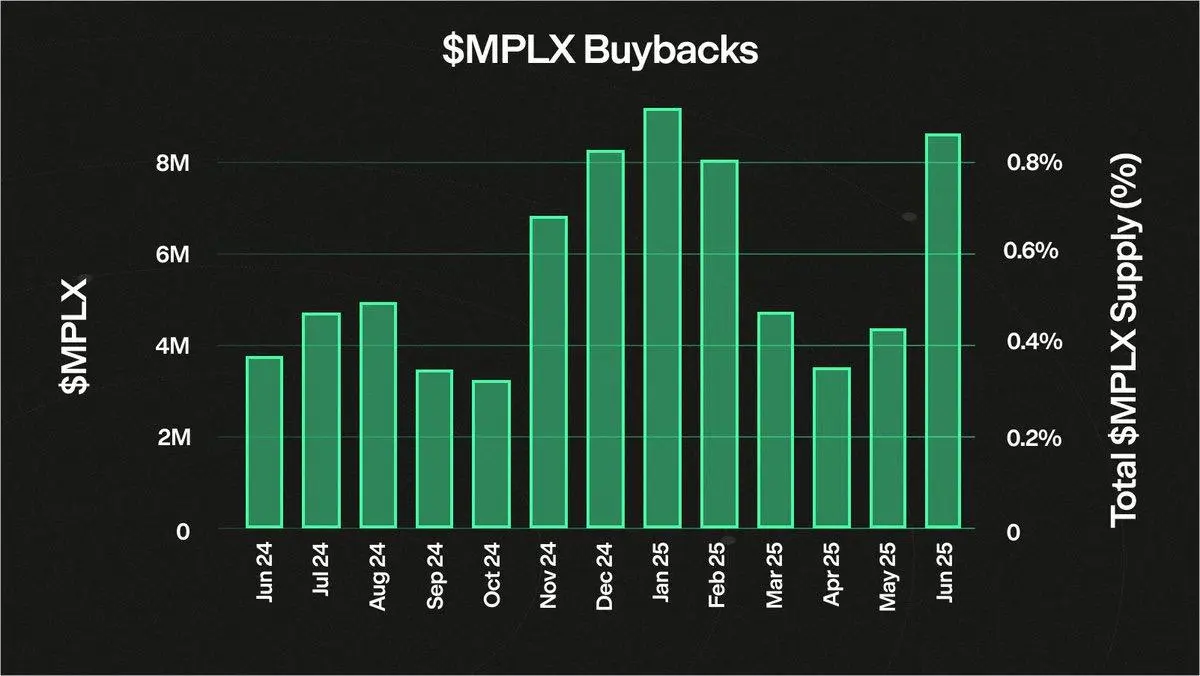

Metaplex charges a certain percentage of protocol fees from all newly created tokens and NFTs, with 50% used to repurchase $MPLX and inject into the Metaplex DAO. In the first half of this year, Metaplex has repurchased a total of 38.5 million $MPLX tokens, accounting for 3.9% of the total supply, and there are no further token unlock plans in the future.

Axiom

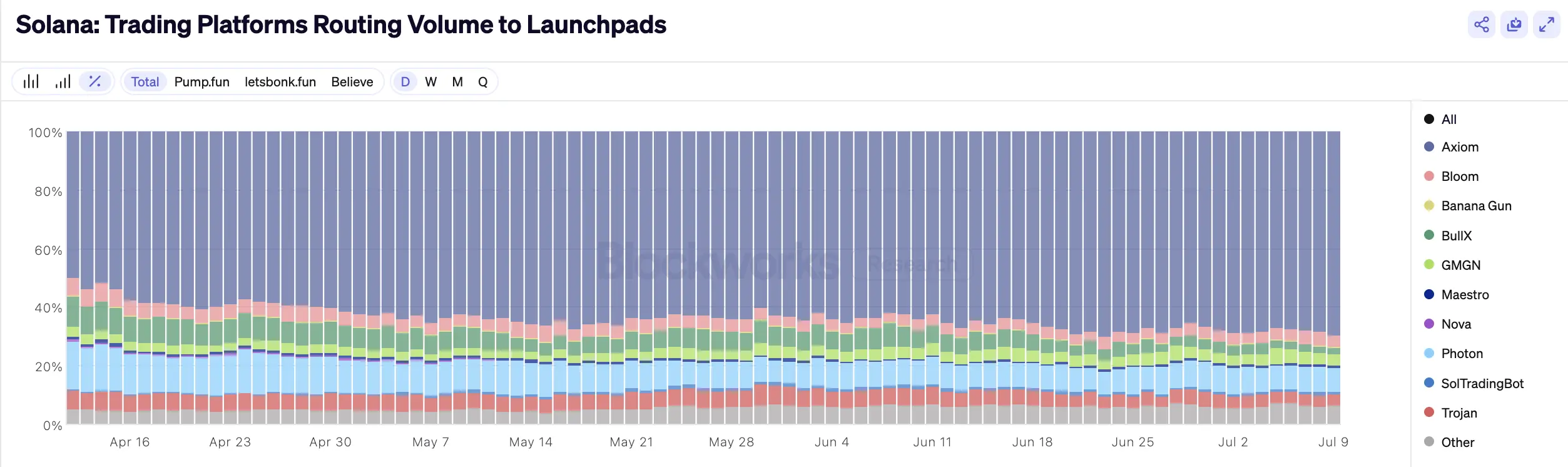

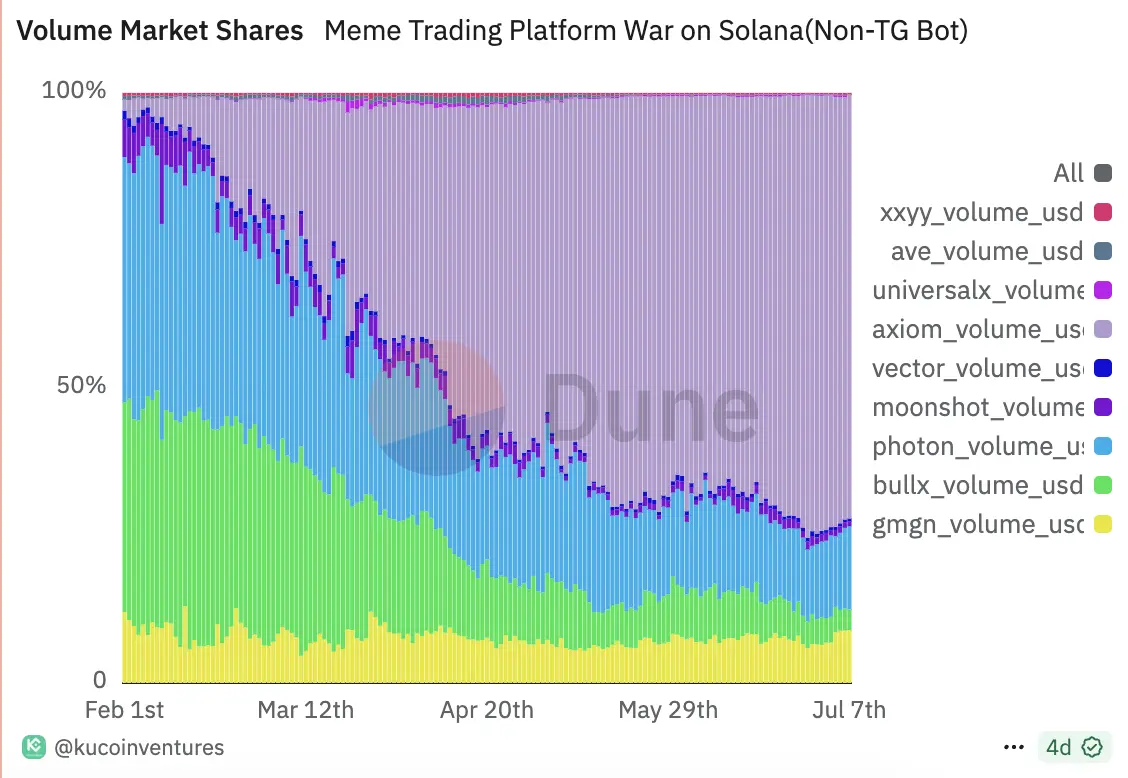

The competitive landscape of the launchpad market continues to evolve, with trading bots represented by Axiom gradually becoming passive winners. These efficient user entry points not only optimize the trading experience but also become the core competitive point for various launch platforms in the battle for traffic and users.

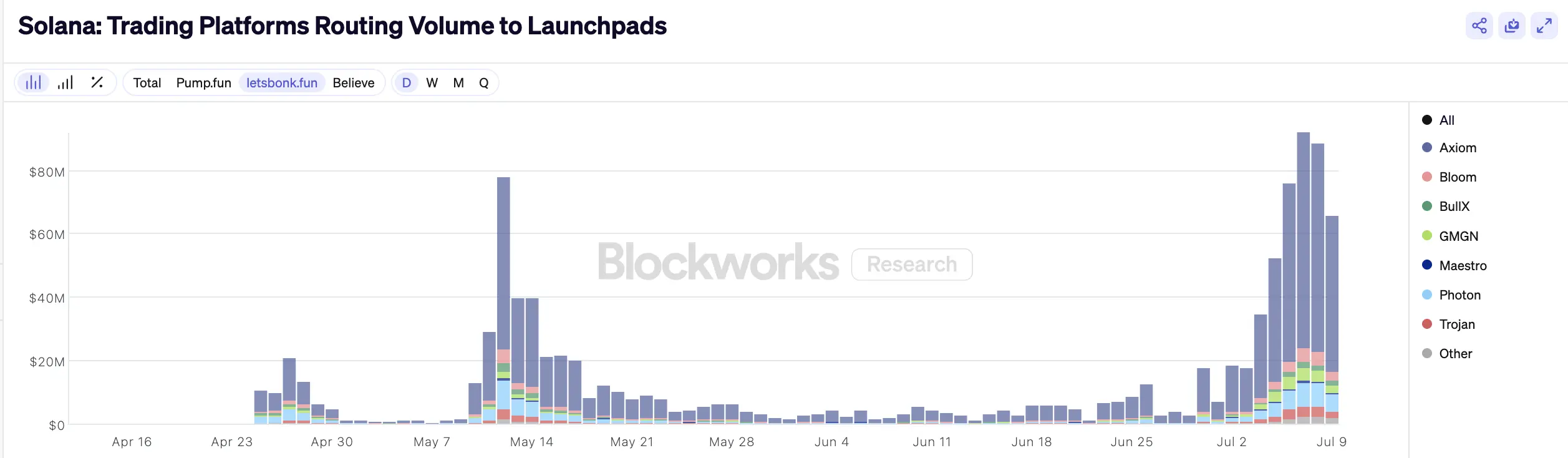

According to Blockworks data, Axiom has long maintained the top position in trading automation and bot tool platforms. For example, on July 9, the total trading volume of these trading bots reached $92.281 million, with Axiom contributing over 69.6%, demonstrating strong market penetration.

At the same time, Axiom has deeply integrated with multiple launch platforms, becoming an important traffic entry point. Blockworks data shows that on July 9, Axiom accounted for 63.6% of the trading volume on Pump.fun, and 74.5% and 67.3% on LetsBONK and Believe, respectively, significantly boosting the trading activity across various launch platforms.

From the usage of trading bots on the Solana chain, Dune data shows that as of July 7, Axiom's trading volume reached $42.505 million, accounting for 72% of the total trading volume ($59.219 million), with an average transaction amount of approximately $2,293, far exceeding competitors like Moonshot and Photon; on that day, active users exceeded 17,000, with a market share of 49.1%.

In terms of revenue, Axiom has demonstrated strong revenue-generating capabilities. Token Terminal data shows that since its launch in January this year, Axiom's cumulative revenue has surpassed $160 million, with an average daily revenue of approximately $1.7 million; the number of active users has also approached 287,000, reflecting its market recognition and user growth potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。