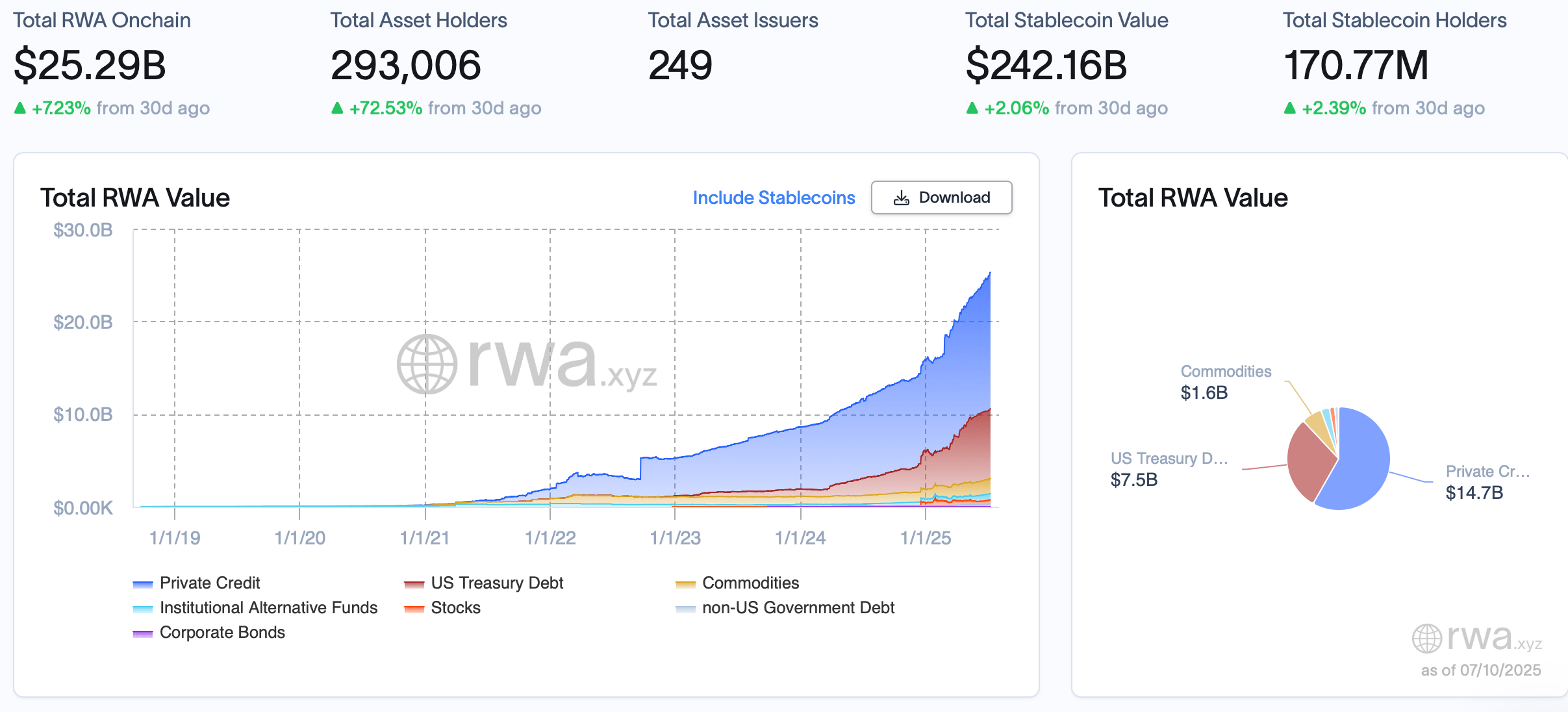

As of Thursday, July 10, 2025, the value of tokenized real-world assets (RWAs) has climbed past $25 billion. That’s a 7.23% increase since June 10. Right now, private credit claims the top spot in onchain value.

A hefty $14.73 billion is parked in blockchain-verified private credit offerings from firms like Figure, Tradable, and Maple. Leading the pack, Figure boasts $13.6 billion in cumulative onchain loans, according to data compiled by rwa.xyz.

Source: Rwa.xyz

U.S. Treasury debt or tokenized Treasury funds hold the second spot, totaling $7.53 billion—up 1.96% over the past week. Blackrock’s BUIDL leads the pack with $2.82 billion onchain. Franklin Templeton’s BENJI follows with $790.44 million as of July 10, while Superstate’s USTB clocks in at $711 million. Just behind Treasurys, tokenized commodities land in third with a current market cap of $1.61 billion.

The bulk of that comes from the two heavyweight gold-backed tokens, PAXG by Paxos and XAUT from Tether. Further down the chain are sectors with smaller onchain footprints, including institutional alternative funds, stocks, non-U.S. government debt, and corporate bonds.

Having ballooned nearly fivefold over the past three years, the RWA market shows no signs of slowing down. Looking forward, projections from top financial institutions and consulting giants differ in scale but agree on one thing: this market’s heading for the trillions.

McKinsey puts the estimate at $2 trillion, while Boston Consulting Group (BCG) envisions a leap to $16 trillion by 2030.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。