A trim to the federal funds rate (FFR) doesn’t appear to be on the Fed’s agenda when officials reconvene on July 30, 2025. The last cut came during President Biden’s term, when the central bank lowered rates on Dec. 18, 2024, bringing the FFR to its current range of 4.25%–4.50%.

Those decisions wrapped up the Fed’s moves in Biden’s final months, signaling confidence that inflation was cooling and hinting it was time to lend more support to jobs and economic momentum. But since then, the Fed’s stayed on pause—even as other central banks around the world have eased. That contrast hasn’t gone unnoticed by U.S. President Donald Trump, who’s growing increasingly frustrated with the Fed and Chair Jerome Powell.

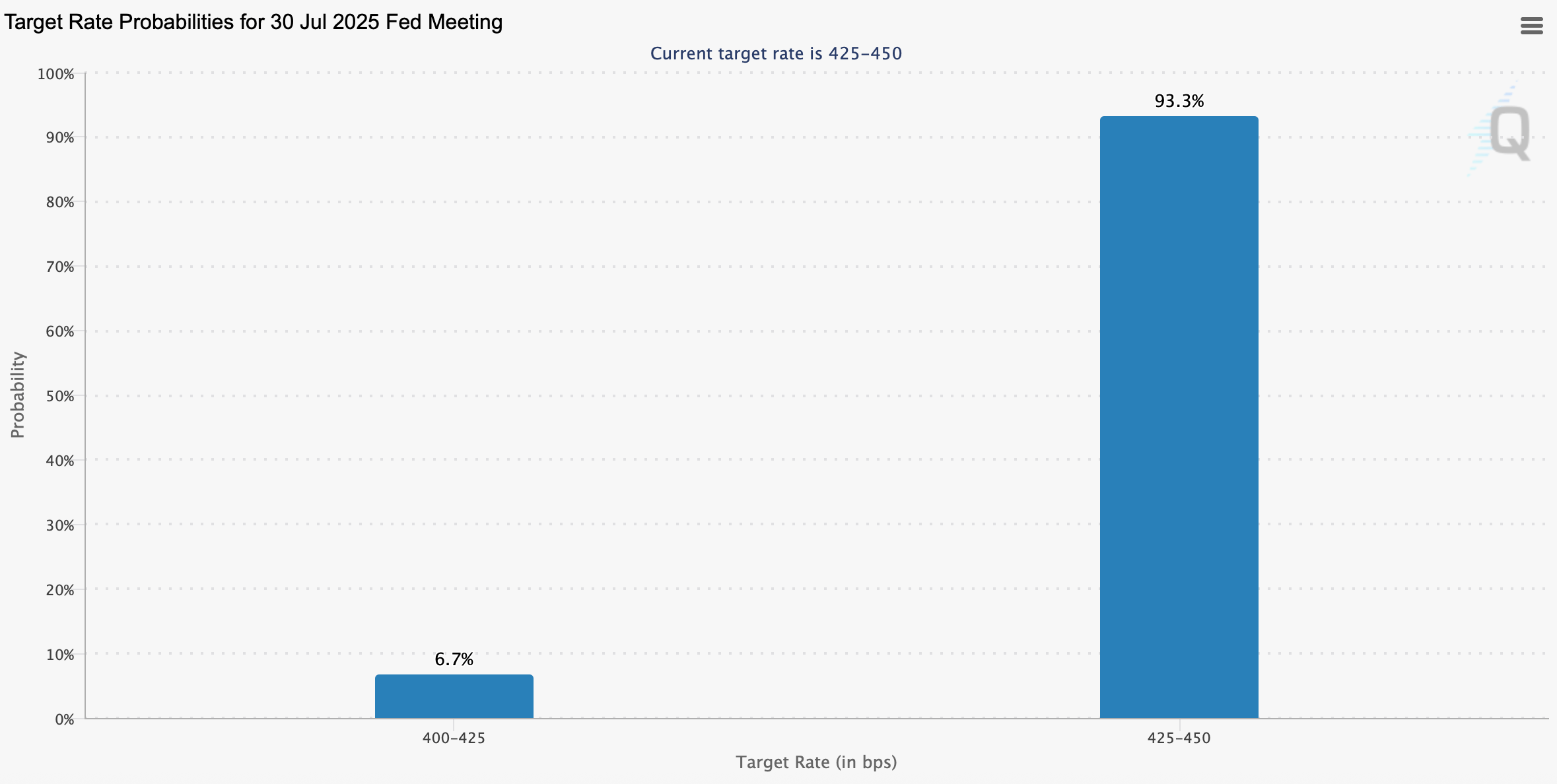

As of July 10, 2025, the CME FedWatch tool puts the odds of a quarter-point rate cut at a slim 6.7%. A hefty 93.3% of CME futures market participants expect no move at all. Similar sentiment is echoed on prediction markets like Polymarket, where a bet with $34.96 million in volume prices in just a 5% chance of a cut.

Source: CME Fedwatch tool on July 10, 2025.

A commanding 95% of traders on Polymarket are sticking to the view that rates will stay put. Meanwhile, over on the regulated U.S. predictions platform Kalshi, the probability that the Fed holds steady sits at roughly 94% as of July 10. But the CME FedWatch tool paints a different picture for the September FOMC meeting—63.9% are anticipating a quarter-point trim, and 4.4% think a half-point move is possible.

Roughly 31.7% still believe the Fed won’t make any adjustments come September. Of course, all these bets could shift drastically in the next two weeks leading up to the July 30 FOMC meeting. That outcome will likely reset the board for September’s odds. One thing’s for sure: the market—and the Trump administration—will be paying close attention. These Fed moves could end up steering how equities, crypto, and precious metals behave in the weeks ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。