Original Title: "Pump.fun's sky-high valuation and token issuance face collective criticism, founder's past statements are thrown back in his face, is public fundraising worth participating in?"

Original Author: Nancy, PANews

The moment Pump.fun officially announced its token issuance, the already tense atmosphere in the blockchain space tightened once again. Some criticized its valuation as inflated after being overtaken by competitor LetsBONK, while others worried it might quietly exit after squeezing the last wave of liquidity.

Launching public fundraising with a $4 billion valuation, contract trading opens before spot trading

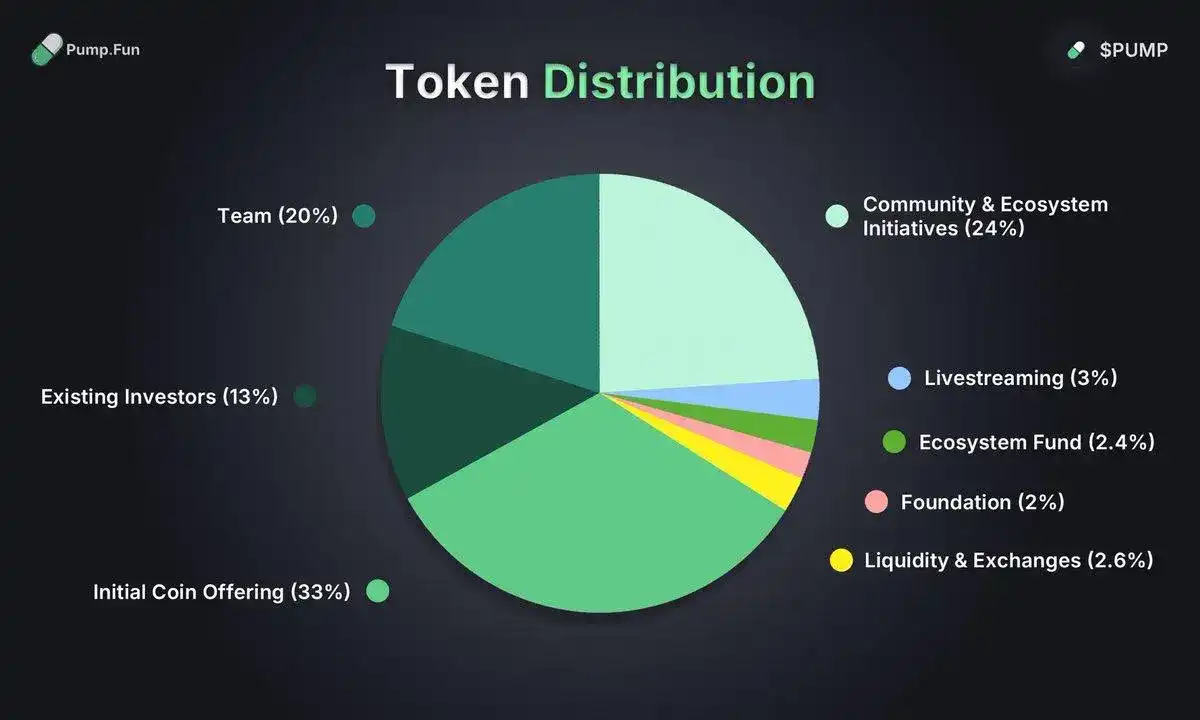

On the evening of July 10, Pump.fun, which had repeatedly hinted at token issuance, finally broke its silence and officially announced that it would launch the initial coin offering (ICO) for its native token PUMP on July 12, promising a large-scale airdrop soon. According to official disclosures, the total supply of PUMP tokens is 1 trillion, with 33% allocated for ICO sales, 24% reserved for community and ecosystem plans, 20% allocated to the team, 13% for existing investors, and the remainder distributed to the ecosystem fund and foundation.

This ICO will sell 150 billion PUMP tokens at a price of 0.004 USDT, accounting for 15% of the total supply, with expected total fundraising reaching $600 million, corresponding to an overall project valuation of about $4 billion.

Unlike other popular projects that often choose to launch on top platforms like Binance, this public fundraising by Pump.fun will be conducted through trading platforms such as Bitget, Bybit, Kraken, and Gate.io, where participants can purchase using assets like bbSOL, SOL, or USDT. Surprisingly, Binance Futures announced the pre-sale trading of PUMP/USDT perpetual contracts even before the PUMP public fundraising. This public sale will continue until the tokens are sold out or until July 15 at 14:00 UTC. It is important to note that users from the United States and the United Kingdom will be unable to participate in this ICO due to compliance issues.

According to the PUMP release schedule, tokens allocated to the team and existing investors will begin to unlock gradually starting in July 2026; the portion allocated to community and ecosystem plans will gradually unlock from the first day of token issuance and will be fully distributed by July 2026; other allocations for ICO, liquidity + trading platforms, and the foundation will be fully unlocked on the first day of token issuance. Additionally, the official stated that the PUMP token will open transfer functions within 48 to 72 hours after the sale ends, with free trading not available in the initial phase.

Subsequently, Pump.fun founder Alon released a tweet outlining the project's future key development strategies: 1. Improve the quality, sustainability, and diversity of already launched tokens: the future creator revenue-sharing mechanism will expand to CTO projects, and the fee structure will be further adjusted. 2. Increase investment in the social field: further invest in and focus on Pump.fun's live streaming features. 3. Continuously invest in enhancing user experience. 4. Expand team size: the basic framework of the current team has been preliminarily established, with over 70 core members covering various fields such as engineering, data, security, trust and compliance, legal, operations, and growth; the team will continue to actively expand through recruitment and strategic acquisitions, with the first acquisition announcement coming soon.

Pump's token issuance faces overwhelming criticism, founder's past statements are "thrown back in his face"

Currently, the liquidity and sentiment in the MEME market have changed dramatically. As a long-term leader in the MEME sector, Pump.fun is now facing a significant decline in daily revenue and active users, and has been overtaken in market share by competitor LetsBonk (related reading: Letsbonk's comeback as the top MEME launch platform, surpassing Pump.fun in several key metrics for the first time). However, Pump.fun has initiated public fundraising with a valuation as high as $4 billion, leading to overwhelming skepticism and criticism from the community, with accusations that it may drain the already limited market liquidity, further exacerbating market weakness.

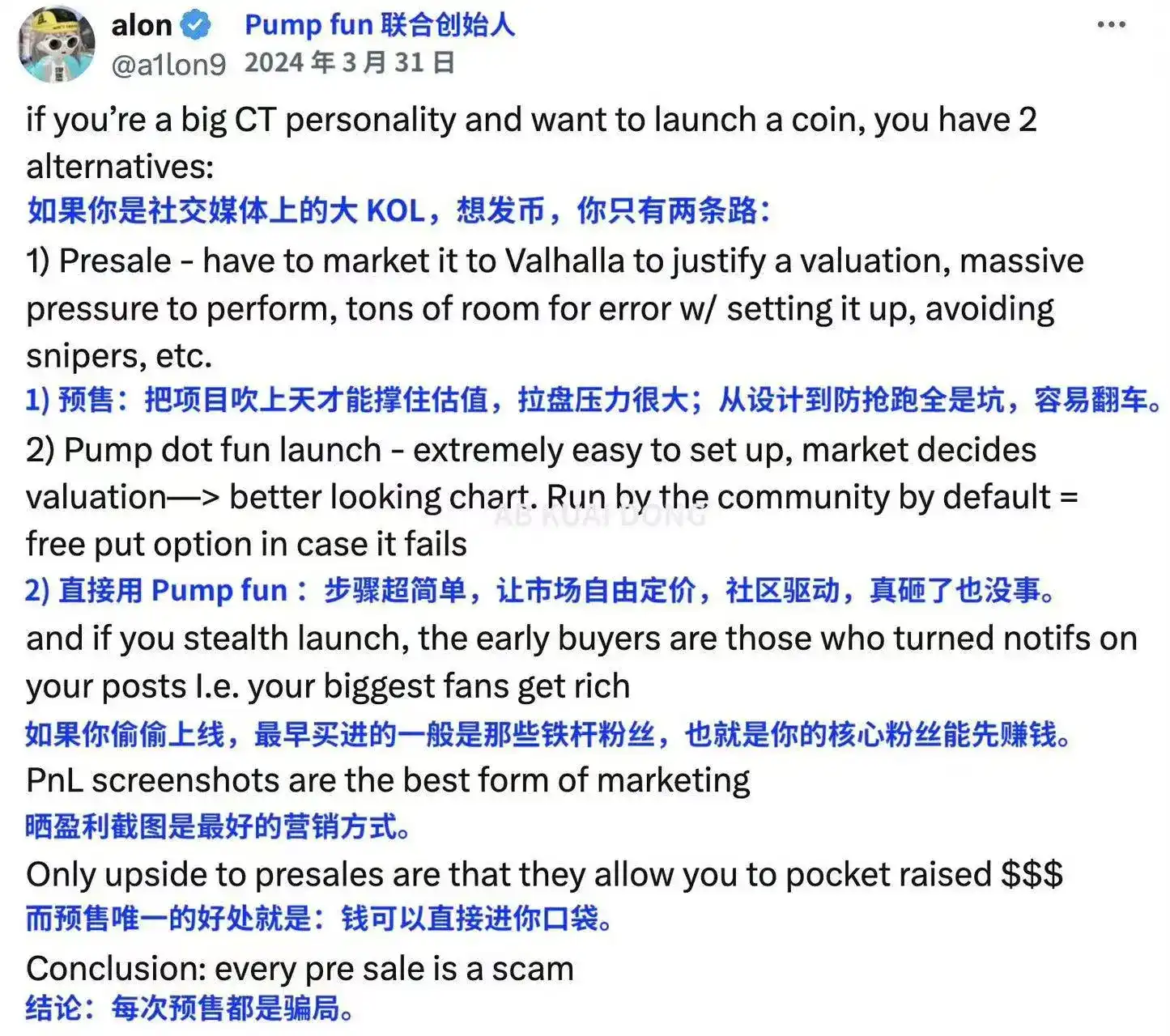

Even more awkwardly, past statements from Pump.fun founder Alon have been dug up by the community, creating a "face-slapping" moment. Alon stated in March 2024 that pre-sales must be marketed to prove their valuation is reasonable, bringing immense performance pressure. The only benefit of a pre-sale is that it allows you to pocket the funds raised. Conclusion: every pre-sale is a scam. Moreover, he bluntly stated that listings on trading platforms are dead, and a lack of transparency in listings leads to violations and poor currency choices.

According to jocy, a partner at IOSG Ventures, while Pump.fun once generated a remarkable $700 million in protocol revenue, recent data shows its daily revenue has plummeted by 92%, and its market share has dropped to 39.9%, overtaken by competitor LetsBonk. The $4 billion valuation for this ICO has serious issues: opaque governance structure, unclear team release terms, and excessive over-leveraging of valuation during the altcoin downturn. He believes the team has amassed enormous wealth through transaction fees, and they have neither the willingness nor the ability to "pump" or "control" the market. This ICO seems more like an "exit liquidity" rather than a long-term development plan. He advises investors to view this as a highly speculative gamble, not a fundamental investment; to patiently wait a week after the token goes live before making decisions, and to adopt a phased participation strategy to reduce risk exposure.

Regarding the valuation controversy, crypto KOL @Michael_Liu93 also raised similar doubts, stating that if Pump were still a leader, a $4 billion valuation could be justified, even having room for upward valuation. However, the reality is that Pump is a second-tier player, with a business size only one-third that of bonk, yet it has set a valuation twice as high as the leader, making it hard to convince the market to continue raising Pump's price. If Pump, as a "benchmark project," performs poorly in the public sale, it would be a disaster for the entire launchpad sector, signaling the end of the game.

Crypto researcher @rezxbt sharply pointed out that Pump.fun is staging a complete "harvesting operation." Its token economic model appears to be a money-grabbing scheme from every angle, having generated $750 million in revenue over the past year while investing almost nothing back into the ecosystem, and now attempting to squeeze more funds through public fundraising. The team holds over 40% of the $PUMP tokens, yet they are now selling the tokens to the very community that once supported Pump.fun and helped it earn a fortune, which is essentially a way to harvest retail investors.

However, some voices hold a different view, with rumors that several top crypto funds have sold their altcoins to participate in Pump's fundraising. KOL @0xShual believes it is unfair to single out Pump.fun for criticism compared to other competitors. If $PUMP fails, other projects (like launchcoin or bonk) will not be able to stand alone either. They are making rational financial choices, which is not a sin. Pump is a profitable company; they have identified problems, proposed solutions, demonstrated delivery and growth capabilities, and have thus made a lot of money. Compared to high-valuation L1s without real users, he prefers to hold shares in a profitable, rapidly growing company. If the market is willing to sell other assets for $PUMP, it precisely indicates that it is a quality asset. He believes that the narrative of "the MEME sector is dead" is merely a temporary sentiment; if Pump can successfully implement airdrops, launch a product matrix, and establish a revenue-sharing mechanism in the future, the market sentiment could quickly turn around.

He further pointed out that the key factors determining whether a project is worth holding long-term are twofold: first, whether it has a strong narrative and market-following expectations; second, whether it has real sustainable revenue and is willing to return value to token holders in a systematic way.

The token issuance controversy surrounding Pump.fun actually reveals the collective dilemma currently faced by the MEME market, namely a retreat in sentiment, tightening liquidity, and over-leveraged valuations. However, despite the meme narrative nearing exhaustion and very few real beneficiaries, there are still those willing to line up to place bets like playing the lottery. The business of token issuance has not stopped, and new platforms continue to launch one after another.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。