Author: C Labs Lao Wang, C Labs Crypto Observer

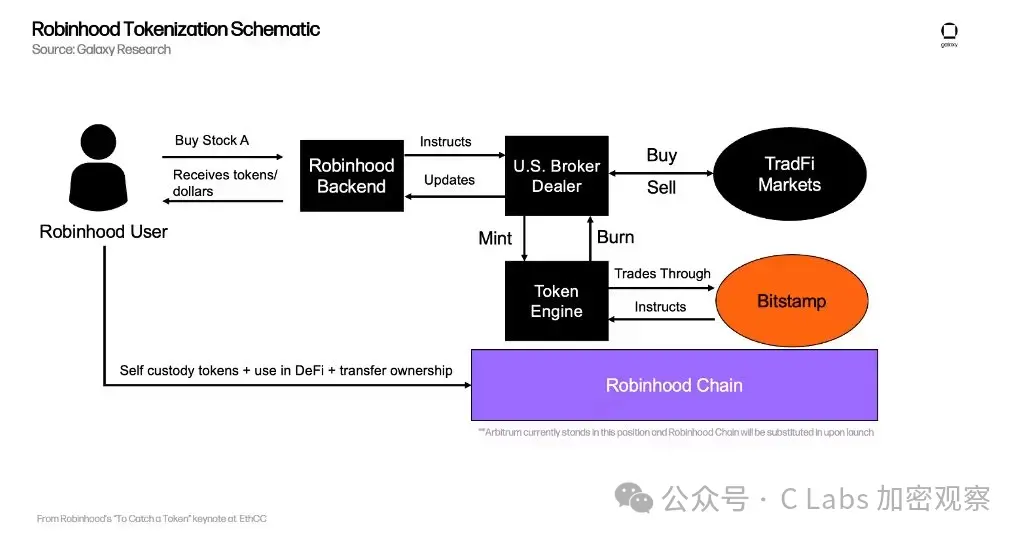

A few days ago, Robinhood just announced in Cannes, France, that EU users can trade tokenized versions of over 200 U.S. stocks and ETFs through its crypto application, including stock tokens of private companies like OpenAI and SpaceX. (See Overnight, on-chain stocks became popular!)

Robinhood stated during the event that EU users can receive OpenAI and SpaceX stock tokens worth 5 euros each by registering for the app and trading stock tokens (a total of 1.5 million euros, with 1 million for OpenAI and 500,000 for SpaceX).

However, just a few days later, according to CNBC, the Bank of Lithuania (Robinhood's registration location in the EU) has launched a preliminary investigation, requesting clarification on the token structure and user information disclosure, and stated that the bank is "assessing" whether these token products comply with financial regulations.

Before this, the involved OpenAI had already distanced itself from the situation.

OpenAI publicly stated that it has not collaborated with Robinhood, has not authorized or recognized these tokens, emphasizing that they "are not OpenAI equity," and warned investors to be cautious.

SpaceX has not publicly commented, but Elon Musk, who supports crypto, clearly favors stock representation, joking on the X platform that OpenAI's own equity is "fake." (In the early days, OpenAI was supported by Musk as a nonprofit organization, which he still holds a grudge about.)

In fact, this incident does not significantly impact the "on-chain stock" business.

The main point of contention is that OpenAI and SpaceX are private companies, and their stocks are undoubtedly unregistered securities.

Robinhood stated that these stock tokens of private companies represent the "economic rights" of these companies, rather than formal equity, and do not include voting rights; these tokens are not "securities," but a type of "new digital asset" aimed at providing users with access to private markets.

Everyone thinks crypto projects are wilder, while brokerages are more compliant.

Unexpectedly, this time it was the brokerage Robinhood that stumbled first, as the key business it launched received a regulatory warning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。