As bitcoin BTC continues a now multi-week consolidation just below its all-time high of $112,000, an interesting accumulation phenomenon is occurring.

Both short-term and long-term holders have been increasing their stacks as distinct cohorts, which is unusual because these groups typically act in opposite directions, according to Glassnode data.

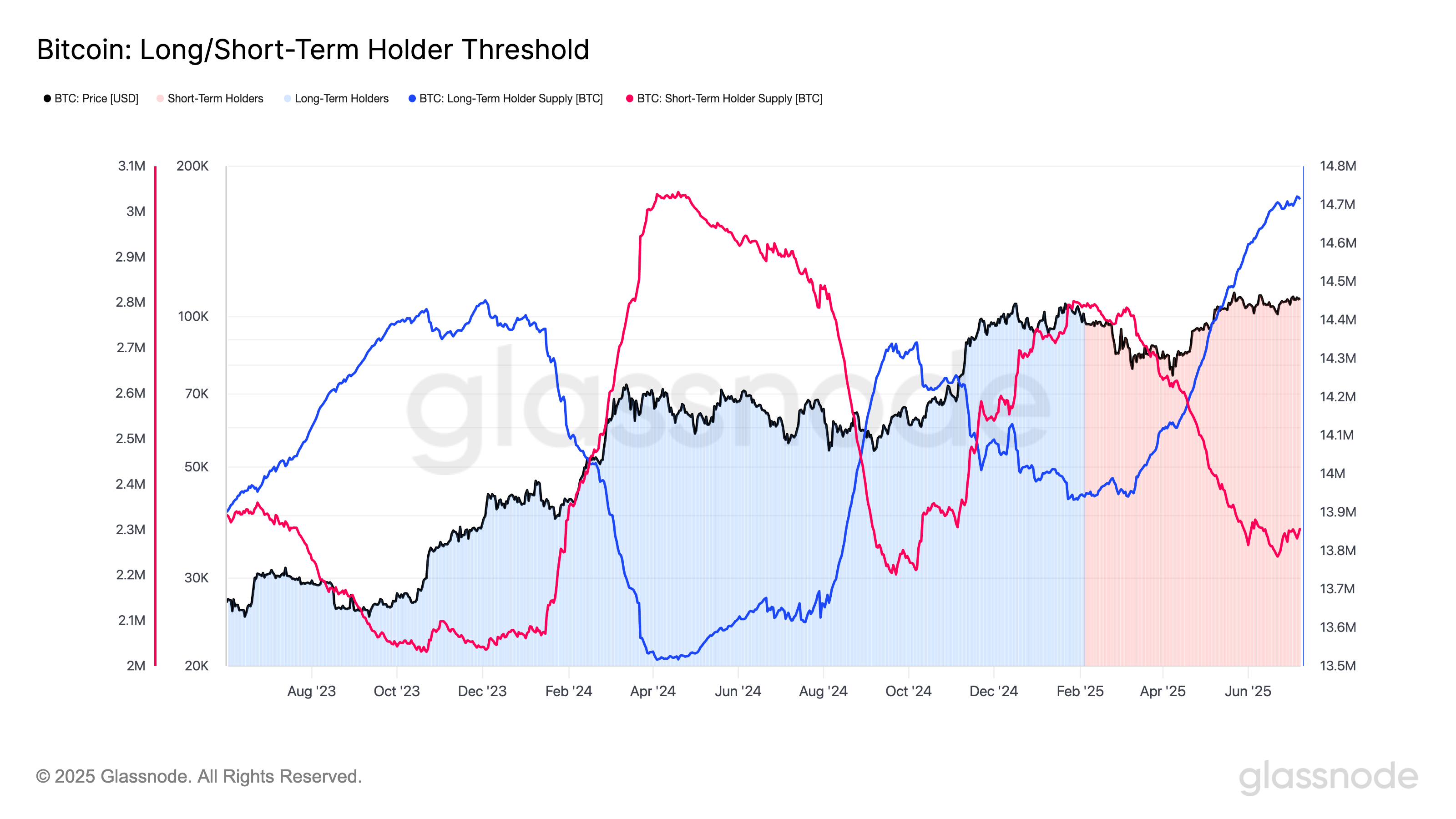

The chart below from Glassnode illustrates the 155-day threshold used to classify coins as belonging to Long-Term Holders (LTH) or Short-Term Holders (STH).

Since June 22, the LTH supply has increased by 13,000 BTC, returning to an all-time high of 14,713,345 BTC. Meanwhile, over the same period, STHs have grown their BTC supply by more than 60,000 BTC and now hold over 2.3 million BTC.

According to Glassnode data, LTH and STH cohorts usually diverge because LTHs often sell into bull market strength, while STHs tend to buy amid market greed and euphoria.

This alignment suggests that both groups of market participants are expecting higher prices. If both cohorts continue increasing their supply, there is a strong possibility that all-time highs will be surpassed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。