The one-hour chart shows XRP in a short-term bullish pattern characterized by a steady recovery following a recent retracement. After peaking at $2.354, the price dipped to $2.249 before forming higher lows, indicating strong buyer interest. A potential long position could be initiated around $2.28 to $2.29 if the current pullback holds. An intraday breakout above $2.31 to $2.32, confirmed by high-volume green candles, would serve as an aggressive scalping opportunity. The short-term target sits between $2.33 and $2.35, with a prudent stop-loss placed near $2.26.

XRP/USDC via Binance 1-hour chart on July 8, 2025.

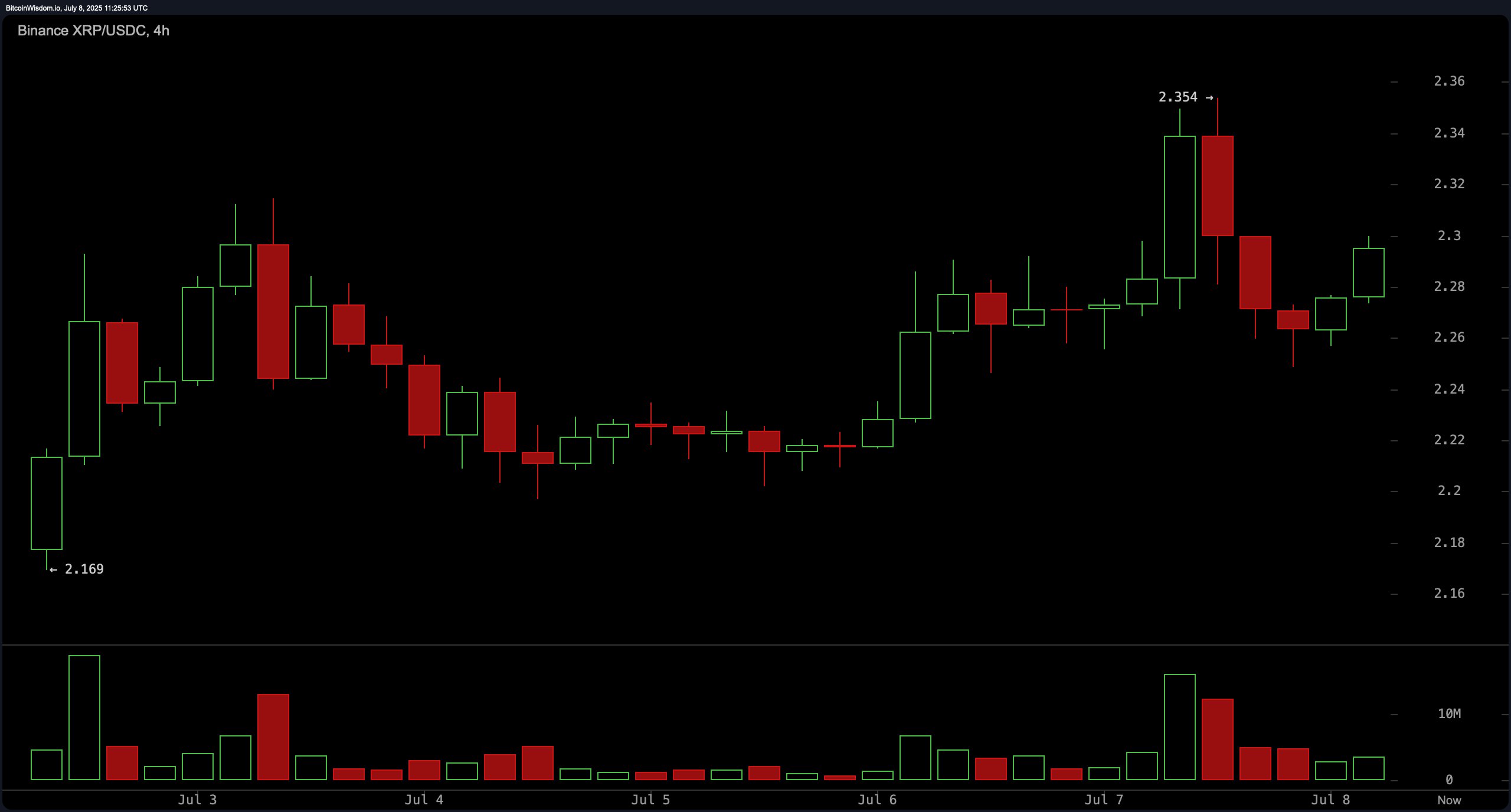

The four-hour chart presents a classic cup-and-handle formation, hinting at a continuation of the upward momentum. XRP found solid support in the $2.25 to $2.27 zone, rejecting resistance at $2.35 twice, but showing renewed attempts to breach this level. A noticeable volume spike occurred during the July 7 rally above $2.30, suggesting institutional interest. Traders may consider re-entering around $2.27 to $2.29 if a handle confirms, or enter on a volume-backed breakout above $2.354. Profit-taking targets range from $2.42 to $2.45, with protective stops set below $2.25.

XRP/USDC via Binance 4-hour chart on July 8, 2025.

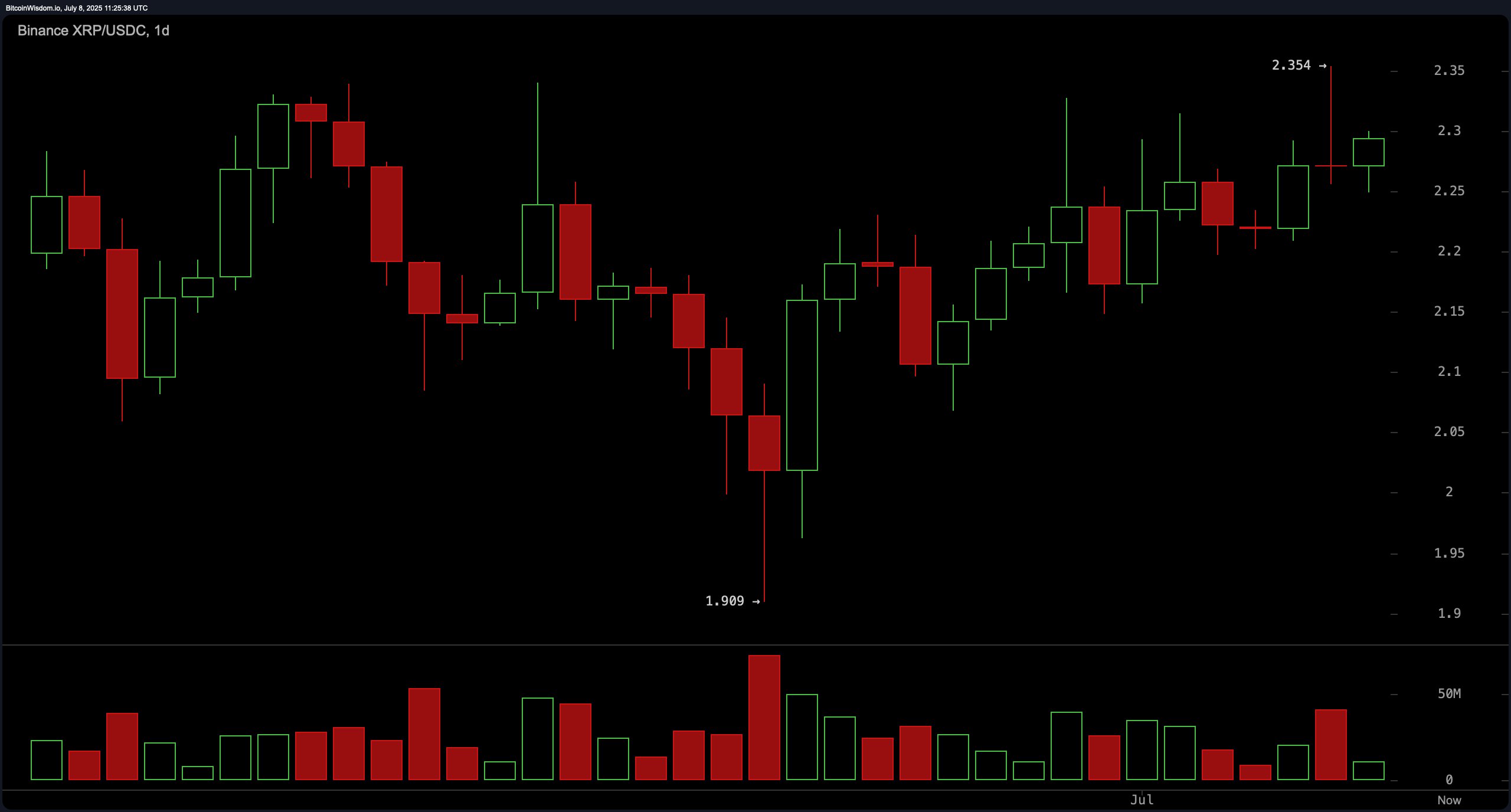

The daily chart maintains a bullish macro structure, with XRP continuing its uptrend from the $1.909 low. Price action has carved out a higher high at $2.354, backed by declining volume during pullbacks and increased activity on upward moves—an encouraging sign for long-term holders. Immediate support lies between $2.15 and $2.20, and the $2.35 level remains a key resistance. Swing traders are advised to watch for retracements into the $2.20 to $2.25 area or a breakout above $2.35 with volume confirmation. Target projections sit at $2.45 to $2.50, with a trailing stop recommended below $2.20.

XRP/USDC via Binance 1-day chart on July 8, 2025.

Oscillators paint a largely neutral outlook with slight divergences. The relative strength index (RSI) at 58.00, Stochastic at 78.39, and the Awesome oscillator at 0.065 all align with a neutral stance, indicating no immediate overbought or oversold conditions. The commodity channel index (CCI) at 111.22 and momentum at 0.1077 suggest a brief corrective bias, issuing bearish signals. Conversely, the moving average convergence divergence (MACD) level at 0.019 signals positivity, hinting at potential upward continuation.

Moving averages (MAs) lend robust support to the bullish bias across timeframes. All short- and medium-term indicators, including the 10-period exponential moving average (EMA) at $2.2396, the 20-period EMA at $2.2170, and the 50-period EMA at $2.2188, register bullish signals. Similarly, the simple moving averages (SMA) for the same periods echo this sentiment. Longer-term indicators such as the 100-period EMA at $2.2291 and 200-period EMA at $2.1127 confirm the trend. The only bearish indicator is the 200-period SMA at $2.3608, which remains above the current price and acts as a long-term resistance.

Bull Verdict:

Given the strong uptrend across all timeframes, supportive volume dynamics, and unanimous buy signals from nearly all moving averages, XRP appears poised for continued upward momentum. If price sustains above key support zones and breaks past $2.35 with conviction, a move toward $2.45–$2.50 remains well within reach in the near term.

Bear Verdict:

Despite the prevailing uptrend, multiple oscillators are issuing neutral to sell signals, and XRP faces stiff resistance at $2.35. If buying volume fails to materialize and price falls below the $2.25–$2.20 support zone, the structure may break down, paving the way for a deeper retracement toward the $2.15 or lower levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。