Trump Tariff News Sparks Global Concerns Over Trade Tensions

President Donald Trump tariff news latest blitz has sent shockwaves through diplomatic circles, global markets and the crypto community. As letters go out to 14 nations outlining steep new levies, the move has sparked concerns over trade retaliation, currency shifts, and even crypto’s evolving role as a hedge.

These are set to take effect on August 1. Trump tariff news warned that any retaliatory action by the affected countries would be met with additional hikes.

Here's a full breakdown of what this means– politically, economically, and digitally.

Source: X

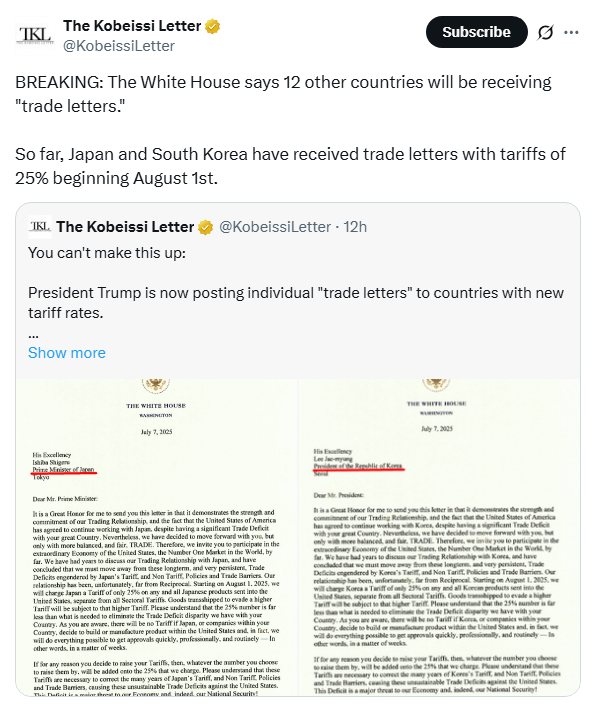

Why Did the President Announce New Tariffs Before the Japan Deal?

The announcement came even as negotiations with key trade partners like Japan were ongoing leading many to question the timing. Analysts suggest that Trump tariff news strategy is one of pressure and leverage. By laying down threats early, the administration hopes to compel faster concessions from negotiating nations.

This isn’t just about trade– it’s also a calculated move in Trump tariff news political playbook. With the 2024 elections behind him, he’s doubting his ‘America First’ stance to show strengths and decisiveness in foreign policy.

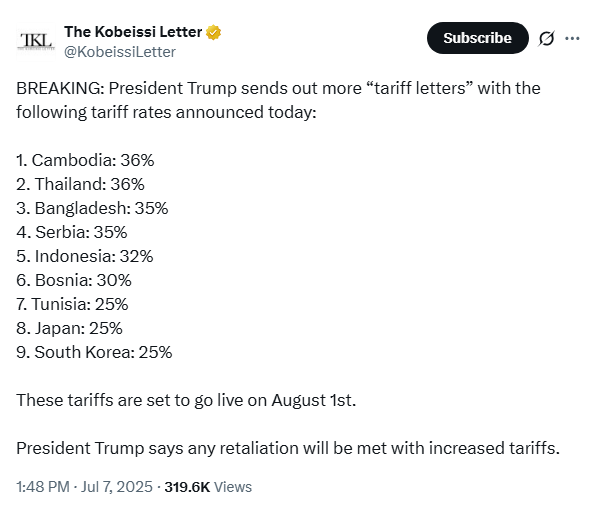

Countries Hit Hardest by Trump tariff news Letters – Full List and Impact

So far, 14 Countries have received official notices. Among those facing the toughest measurries.

-

Laos and Myanmar: 40% tariffs on targeted imports.

-

Japan, South Korea, Tunisia, Kazakhstan: With 25% tariffs.

-

Some of others' names are yet to be expected to follow in the upcoming weeks.

This increase could disrupt supply chains mainly in electronics, manufacturing and auto parts. For countries Like South Korea and Japan which have strong trade ties with the US, this could be a trigger for economic ripple effects.

Source: Twitter

Countries that received letter from Trump tariff news

-

Myanmar with 40%,

-

Thailand with 36 %,

-

Cambodia with 36%,

-

Bangladesh with 35%,

-

Laos with 40%,

-

Serbia with 35%,

-

Indonesia with 32%,

-

South Africa with 30%,

-

Bosnia and Herzegovina with 30%,

-

Malaysia with 25%,

-

Tunisia with 25%,

-

Japan with 25%,

-

Kazakhstan with 25%, and

-

South Korea with 25% tariff

Economic and Political Strategy Behind Trump’s Sudden Escalation

This sudden hike aligns with Trump’s long-standing philosophy– reciprocal tariffs, reduced deficits and stronger domestic industry. The goal is to push other countries into better deals under pressure.

The Trump tariff news also comes at a time when he is seeking to consolidate his policy legacy post-election, appealing to his voter base that supports tougher stances on foreign trade.

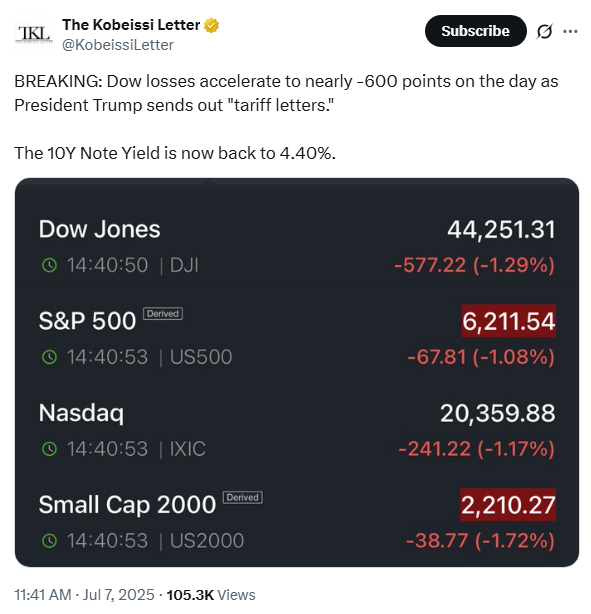

Market Reacts Sharply Trump tariff news

Following reliance the “Tariff letters,” the global stock market and crypto currency market also responded with immediate volatility:

The Dow Jones (DJI) dropped by 577 points (-1.29%), while the S&P 500 index crashed by 67.81 points (-1.08%), as well as the Nasdaq also slipped by 241.22 points (-1.17%).

Apart from this, the global cryptocurrency market cap is also down by 4.2%, breaking the major support of $3.50 trillion and currently hovering near $3.41 Trillion in the last 24 hours.

Source: The Kobeissi Letter

What Global Markets and Crypto Traders Should Expect

From affected nations likely, either through counter-tariffs or with new regulations targeting US import’s Retaliation. This kind of possibility has already started to weigh on global markets.

Crypto traders are watching closely historically, during periods of instability, digital assets like Bitcoin see increased demand as a hedge. The uncertainty short-term volatility– and long term opportunity – in the crypto market. If the trade war and the American Party issue hold on then a panic can be seen all over the global market.

Could This Move Accelerate De-Dollarization and Crypto Demand in Asia?

With trust in the US policy shaken, some countries may look for alternatives to the dollar. The ideal of de-dollarization- trading in local currencies using blockchain based systems– is gaining momentum in Asia.

This could be accelerated with the shift towards stablecoin one even with CBCDs, especially in countries like China, which have been developing digital finance infrastructure to reduce dollar dependence.

Crypto as a Hedge: Will Protectionism Fuel Bitcoin and Stablecoin Adoption?

As rise and global trade becomes more uncertain, digital assets offer a decentralized borderless alternative. The Trump tariff news may unintentionally drive more adoption of crypto– both as a hedge and as a transactional tool in regions affected by protectional policies.

For both policymakers, crypto’s role in the future of global commerce may grow faster than expected.

Also read: $4.2B STRD Stock Offering Fuel MicroStrategy Buy Bitcoin Strategy免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。