Original Author: rosie

Translation | Odaily Planet Daily (@OdailyChina)

Translator | Ethan (@ethanzhangweb3)_

Editor's Note: In the crypto industry, there is no shortage of advice on "how to issue tokens": you need interaction, venture capital, and hype. However, when we actually pull out data to verify these "consensus" claims, the results are unsettling—often, the loudest voices are the furthest from the truth.

Odaily Planet Daily has compiled a systematic research article based on Simplicity Group's analysis of 40 mainstream token issuance projects for 2025, encompassing over 50,000 data points, attempting to restore a reality obscured by emotions, algorithms, and false KOL noise: interaction ≠ success, venture capital ≠ value, hype ≠ growth. In this season of frequent TGE events, we hope this article can provide a calm and reliable reference for project teams, operators, and investors. Data does not lie; we just haven't listened carefully for too long.

Spoiler: The loudest voices often have the worst opinions.

Crypto Twitter loves to teach you how to issue tokens: first, get 100,000 followers; use "tasks" to boost interaction; raise funds from top VCs; only circulate 2% of the tokens; create the biggest buzz during TGE week.

The problem is: this is all nonsense.

I recently delved into an incredible study by @SimplicityWeb3—they analyzed 50,000 data points from 40 major token issuances in 2025, and the results… will unsettle anyone who believes in traditional Crypto Twitter wisdom.

The Great Lie of Interaction

Everyone (including me) is obsessed with Twitter metrics: likes, retweets, replies, impressions—the whole "vanity metrics circus." Project teams spend thousands of dollars boosting interactions, completing tasks, and buying followers.

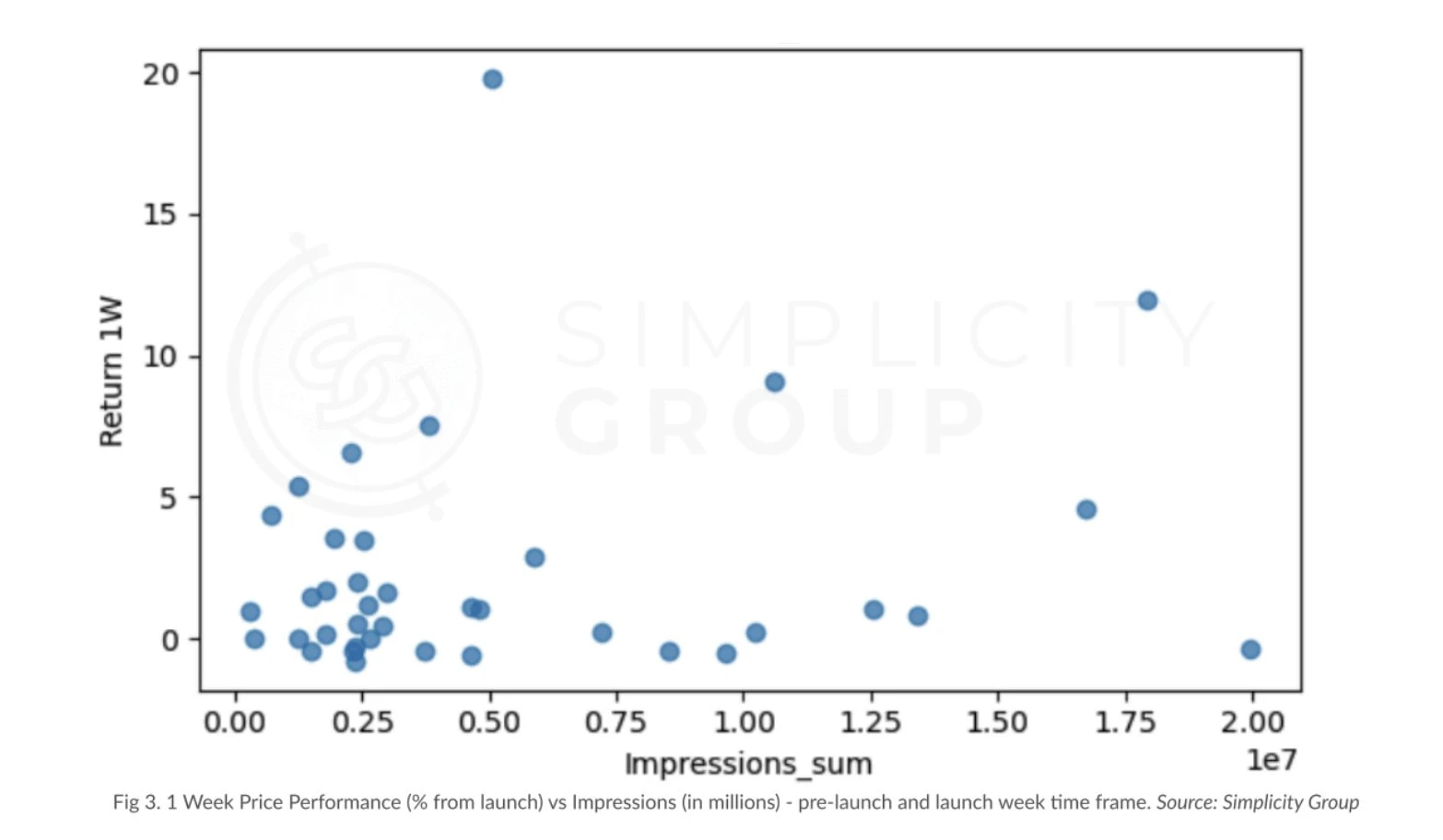

Correlation with one-week price performance? Essentially zero. Simplicity Group's regression analysis shows that the R² of interaction metrics with price performance is only 0.038. In simple terms: interaction levels hardly explain the differences in token success.

Likes, comments, and retweets are even slightly negatively correlated with price performance. This means that projects with more interaction sometimes perform worse. Projects like GoPlus, SonicSVM, and RedStone frequently post but their interaction levels do not match their user base.

Data Source: https://docsend.com/view/khn4nms2ehjjskv3

The only metric that shows any positive correlation is surprisingly: the number of retweets in the week before issuance. The coefficient is 0.094 (p-value barely close to statistical significance), and even so, the correlation is pitifully weak.

So, when you spend money buying bots and designing complex task activities, you are essentially burning money for Instagram-level satisfaction.

The Myth of Low Circulation

Crypto Twitter is obsessed with "low float, high fully diluted valuation (Low Float High FDV)" issuances. The narrative logic is: issue with extremely low circulation to create artificial scarcity and wait for the token price to rise.

Wrong again.

The proportion of initial circulation to total supply has zero correlation with price performance. The research shows no statistical significance.

What really matters is: the dollar value of your initial market cap (Initial Market Cap).

R² is 0.273, and the adjusted R² is 0.234, showing a very clear relationship: for every unit increase in log(initial market cap), the one-week return rate decreases by about 1.37 units.

In simpler terms: for every 2.7 times increase in initial market cap, the price performance in the first month decreases by about 1.56%. This relationship is very strong and can almost be seen as causal.

The lesson: the key is not how much of the token you unlock, but the total dollar value you throw into the market.

The Illusion of VC Endorsement

“Wow, they raised $100 million from a16z, this token is going to the moon!”

Narrator: It did not go to the moon.

The correlation between the amount raised and one-week returns is 0.1186 (p-value 0.46); the correlation with one-month returns is 0.2 (p-value 0.22). Both lack statistical significance. The amount a project raises has no relationship with how the token performs.

Why? Because larger funding usually means higher valuations, which need to overcome greater selling pressure. Extra funds do not magically translate into better token performance.

However, Crypto Twitter treats funding announcements as buy signals. This is like judging a restaurant's quality based on how much rent the owner pays.

A perfect example: projects that raised large amounts of funding did not naturally outperform those with moderate funding amounts. Raising $100 million does not guarantee better token economics or a stronger community than raising $10 million.

The Fallacy of Marketing Timing

The traditional view is: save the biggest announcements for the issuance week. Create maximum FOMO and attract everyone's attention when the token goes live.

The data says the exact opposite.

Interaction drops dead after issuance. Users chase the next shiny airdrop, and your carefully planned post-issuance content is ignored.

Projects that maintain performance are those that built awareness before the issuance week (not during it). They understand that pre-issuance attention brings real buyers, while attention during the issuance week only brings "tourists." Projects like Kinto saw their interaction peak before TGE (they released pre-heating content leading up to the issuance moment), rather than after issuance (when everyone has turned to the next opportunity).

What Really Works?

Since Twitter interaction, low circulation, VC endorsement, and hype timing are not important, what is important?

Actual product utility:

Projects that can naturally generate content (like Bubblemaps providing on-chain investigations, Kaito tracking market narratives) perform better than accounts filled with memes. Bubblemaps and Kaito have huge and sustained interaction because their products organically create content full of Alpha.

Volume retention:

Tokens that can maintain trading volume after the initial pump show significantly better price performance. The Spearman rank correlation coefficient is -0.356 (p=0.014)—the more trading volume declines, the worse the price performance tends to be. The top quartile (Q4) of volume retention has significantly higher median and mean price performance in the month following issuance.

Reasonable initial market cap:

This is the strongest predictive indicator of success (coefficient of -1.56 with statistical significance). Issuing at a reasonable valuation allows for upward potential; issuing at a valuation above $100 million is like fighting against gravity.

Sincere communication:

Consistent, product-matched communication tone. Powerloom raised $5.2 million but used an overly playful tone, which was mismatched—its token POWER plummeted 77% in the first week and has since dropped 95%. In contrast, Walrus sincerely used humor and saw a 357% increase a month after TGE. Hyperlane insisted on providing factual updates and surged 533% in the first week.

Why Does Crypto Twitter Get It Wrong?

This disconnect is not due to malice but is structural.

Crypto Twitter rewards interaction rather than accuracy. Posts like "10 Ways to Make Your Token Skyrocket 100x" get more retweets than "What the Data Actually Says."

Influencers build their audience by catering to existing beliefs rather than challenging them. Telling people that their interaction boosting is meaningless does not make money.

Moreover, most Crypto Twitter celebrities have never issued a token themselves. They are commenting on a game they have never participated in. Meanwhile, projects like Story Protocol that have genuinely delivered products see sustained performance regardless of their Twitter follower count.

The Real Strategy

According to the data, successful projects actually do the following:

Focus on building things that people genuinely want to use.

Set a reasonable price for the token at issuance.

Communicate sincerely with the audience.

Measure what truly matters, rather than just looking at likes.

I know, this sounds like a revolutionary discovery.

Take Quai Network as an example: they focused on deeply explaining their unique blockchain consensus model and conducting educational outreach. During TGE, they averaged about 24,000 views. Their token QUAI rose 150% in the first week after issuance. This was not because they had millions of followers, but because they built genuine interest around real innovation.

In contrast, projects that burned money on task platforms and interaction boosting saw their tokens plummet because no one understood or cared about what they were building.

Ironically, while everyone is playing with Twitter algorithms, those quietly building practical products and issuing them steadily are the real successes.

A cautionary tale: Zora failed to communicate the details of its token economics in a timely manner, plummeting 50% within a week after TGE. In contrast, projects that maintained transparency about their plans and focused on product-driven content performed consistently well.

Crypto Twitter does not lie intentionally. But when the incentive structure rewards "hot takes" rather than hard data, the real signals get drowned out in the noise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。