Original Title: "Top Ten Core Reasons for a Strong Bullish Outlook on Ethereum"

Original Source: Ebunker Chinese

As U.S. regulators signal a green light, traditional institutions on Wall Street quietly accumulate assets, Vitalik has amassed several Ethereum L1 scaling ideas, and the Federal Reserve subtly shifts its focus towards interest rate cuts— all grand narratives converge on a single main line: Ethereum.

Regulatory thaw, technological iteration, macro trends, and "ultrasound" monetary mechanisms are driving a runway for acceleration over the next 3–18 months.

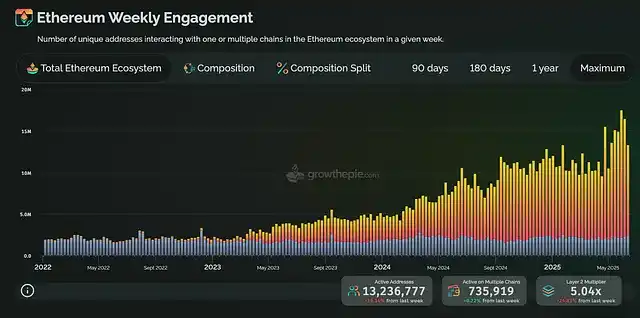

The net inflow curve for ETH ETFs continues to hit new highs, fuel fees on block explorers are about to break 5 million, Ethereum has returned to the weekly MA200; the on-chain staking rate is approaching 30% and still climbing. From North America's Ethereum version of MicroStrategy, SharpLink, writing ETH into its balance sheet, to Robinhood announcing that Ethereum L2 can be used for trading U.S. stocks in Europe, and Hong Kong announcing acceptance of ETH as proof of immigration assets, the core value of Ethereum is becoming a global consensus.

Political maneuvering, capital momentum, protocol improvements, and foundation reforms are all roaring in sync— the market is left with one key question: Are you ready?

The following 10 reasons will layer by layer dissect how ETH has leapfrogged from industry consensus to a cross-cycle explosion engine.

1. The Largest Regulatory Favor and Policy Introduction in History

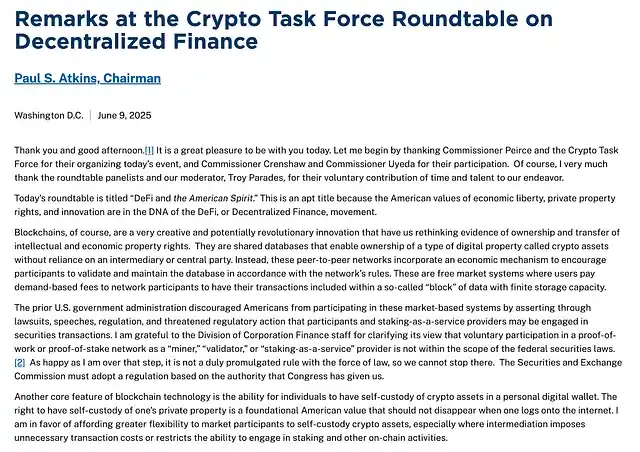

The dramatic shift in the U.S. regulatory stance has brought new optimistic expectations for Ethereum. The new chairman of the U.S. Securities and Exchange Commission (SEC), Paul Atkins, has expressed support for crypto innovation— a stark contrast to the era of Gary Gensler.

Atkins has withdrawn proposals from the Gensler era targeting decentralized finance and self-custody, opting for an "innovation-first" strategy. In a recent roundtable, Atkins even emphasized that developers should not be punished for writing decentralized code.

This marks a significant policy turnaround: the SEC under Gensler had viewed Ether as "unregistered securities" and investigated it. Now, under pro-crypto leadership, Ethereum enjoys a clearer regulatory outlook. With decentralized finance receiving top-level recognition—Atkins called self-custody "a fundamental American value"—the threat of hostile regulation has significantly diminished, greatly encouraging institutional participation in the Ethereum market.

Additionally, recent legislative movements in the U.S., particularly the Senate's "GENIUS Act," signify a key turning point in the clarity of crypto dollar stablecoin regulation.

These bills aim to establish a clear framework for payment stablecoin issuers, given Ethereum's role as a primary settlement layer for regulated stablecoins like USDC and PYUSD, as well as one of the most important public chains for the largest stablecoin USDT, its adoption will receive strong impetus:

Source: U.S. Congress

Comprehensive Stablecoin Framework

The "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (GENIUS Act) passed smoothly in the Senate with bipartisan support in June 2025. It imposes strict standards on stablecoin issuers, requiring 100% cash or treasury reserves, monthly audit disclosures, and bankruptcy protection for token holders. Crucially, it allows banks and non-bank companies to issue stablecoins under license and accept regulation.

Ethereum as Stablecoin Infrastructure

By explicitly legalizing and regulating stablecoin issuance, these bills validate dollar-backed tokens primarily existing on the Ethereum network. For example, Circle's USDC and PayPal's PYUSD are ERC-20 tokens on Ethereum, relying on Ethereum's security and global reach. The federal framework solidifies Ethereum's role as a settlement backbone.

Legislators themselves acknowledge that well-regulated stablecoins can "enhance the dollar's status as the world's reserve currency" while maintaining U.S. competitiveness. This mission essentially leverages public networks like Ethereum (where dollar stablecoins circulate in DeFi and payments).

DeFi and Dollar Liquidity

Ethereum's DeFi ecosystem, from lending protocols to decentralized exchanges (DEX), operates on stablecoin liquidity. By legalizing stablecoins, the GENIUS Act effectively secures the foundation of DeFi. Participants can use assets like USDC with greater confidence, without worrying about sudden shocks or legal ambiguities.

This encourages institutional participation in DeFi (e.g., trading, lending, and payments using stablecoins). In short, the legislation connects traditional finance (TradFi) with DeFi: it invites banks, payment companies, and even tech firms to issue and use Ethereum-based stablecoins while providing guardrails (KYC/AML, audits, redemption rights) to reduce systemic and legal risks. The ultimate effect is the formation of a supportive policy environment that anchors Ethereum's role in the digital dollar economy.

Finally, another crypto bill, the CLARITY Act (H.R. 3633), has also made significant progress recently.

The CLARITY Act was first advanced by the House. On June 13, 2025, the bill was passed by the Financial Services Committee and the Agriculture Committee with votes of 32:19 and 47:6, respectively. The bill is currently in the rules committee process, awaiting scheduling for a vote in the full House.

Data Source: U.S. Financial Services

The CLARITY Act eliminates the biggest cloud hanging over Ethereum in the U.S.: whether ETH is considered a security.

By explicitly classifying ETH (and any sufficiently decentralized Layer-1 token) as a "digital commodity" regulated by the CFTC, the bill eliminates the possibility of SEC retroactive enforcement, creating a safe harbor for secondary trading and clarifying when developers and validators do not qualify as "brokers." This combination significantly reduces the regulatory risk premium, paving the way for Wall Street products related to spot and staked ETH, and greenlighting DeFi to continue innovating on the network.

In summary, given Ethereum's dominance in custodial stablecoins and DeFi, these multiple regulatory green lights greatly strengthen the prospects for mid-term adoption, trading growth, and Ethereum's integration into the traditional financial system.

2. "ETH Version of MicroStrategy" Leads Institutional Fleet

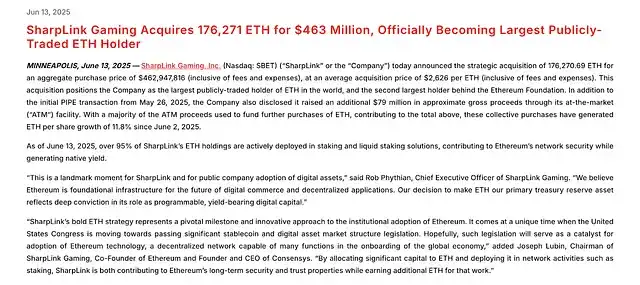

An increasing number of large capital players are viewing Ethereum as a strategic asset, a trend accelerated by a notable move from SharpLink Gaming. The Nasdaq-listed company recently completed a milestone funding allocation: acquiring 176,000 ETH (approximately $463 million), making Ethereum its primary reserve asset, and overnight becoming the world's largest public holder of ETH. Currently, over 95% of this asset has been staked to earn yields and enhance the security of the Ethereum network.

Source: SharpLink Gaming

SharpLink's CEO called this a "landmark moment" and explicitly compared the strategy to MicroStrategy's Bitcoin strategy, just with Ethereum instead. This bold financing is strongly supported by Joseph Lubin, founder of ConsenSys and one of Ethereum's eight co-founders, who has taken on the role of SharpLink's new chairman. Lubin has stated on various occasions: "SharpLink's bold ETH strategy marks a milestone in institutional adoption of Ethereum," and pointed out that "ETH not only possesses Bitcoin-like value storage attributes but also, due to its predictable scarcity and ongoing yield, becomes a truly productive reserve asset; as Ethereum increasingly becomes the underlying architecture of the digital economy, ETH is also seen as a strategic investment towards the future financial architecture."

Crypto treasury suddenly becomes a trend: SharpLink's success (its stock price soared 400% after the announcement) has prompted peers to rush to emulate this strategy. The publicly listed company Bitmine Immersion (BMNR) also recently announced it is raising $250 million specifically to purchase ETH, positioning itself as an "Ethereum treasury strategy company." Bitmine is led by Fundstrat co-founder Tom Lee, and its stock price surged over 3000% within a week of the announcement, attracting investments from top-tier institutions like Founders Fund, Pantera, and Galaxy.

Meanwhile, observers report that several companies, including those in Europe, are also exploring ETH-focused reserve allocations. Although some forward-looking companies like BTCS Inc. had already begun holding ETH prior to this, SharpLink's move represents a new height of mainstream adoption.

For Ethereum, the accumulation of ETH by an increasing number of corporate treasuries is undoubtedly a positive development—this locks in supply (especially since most tokens will eventually be staked) and sends a signal of institutional confidence.

At the same time, institutions are also positioning through funds: the first Ethereum futures ETFs are set to launch by the end of 2024, and the approval of spot Ethereum ETFs is also imminent, potentially releasing billions of dollars in new demand. BlackRock CEO Larry Fink stated in a CNBC interview: "I think launching an Ethereum ETF is valuable. This is just the first step towards asset tokenization, and I truly believe this is our future direction."

It is evident that Ethereum is increasingly being viewed as a strategic investment and reserve asset by publicly listed companies and funds, similar to the trajectory of Bitcoin in the previous cycle.

3. Weekly Technical Indicators Return to MA200

Ethereum's price chart shows multiple bullish technical signals, indicating that the trend may reverse upwards.

After a prolonged slump, in May 2025, ETH has once again risen above the weekly MA200—one of the most classic indicators of a bull market return.

Data Source: Binance ETH Weekly MA200

From a technical perspective, the overall market structure of Ethereum has improved: a series of lower lows are gradually being replaced by higher lows, breaking out of a long-term descending channel.

From May to June, ETH has been above the 200-week moving average, which is approximately $2,500, serving as a support "launchpad"—ETH is building a base above it, similar to the recovery phase of past cycles.

Momentum indicators confirm the positive structure: weekly candlestick charts show long bodies and shallow wicks, indicating strong buying pressure with less selling pressure during pullbacks. The rising slope of key moving averages and the upward trend of the MACD indicator show that upward momentum is strengthening. Additionally, bullish chart patterns are emerging—several analysts have pointed out a potential bull flag pattern on the ETH chart, which, if confirmed, could target a mid-term price above $3,000.

This indicates that traders are confident in ETH, believing that downside risks have been effectively controlled and the path of least resistance is upward. Overall, Ethereum's technicals have re-established above the 200-week moving average, combined with higher highs and lows and enhanced momentum, suggesting that the asset is in the early stages of a significant bullish reversal, supporting a positive outlook for the next 3 to 18 months.

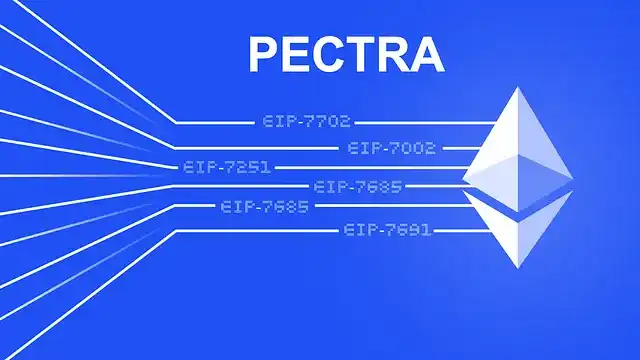

4. Ethereum Pectra Upgrade Rapidly Advancing Roadmap

Ethereum's technical roadmap is steadily advancing, continuously enhancing its foundational value. The Pectra upgrade (i.e., Prague + Electra hard fork) launched on May 7, 2025, marks a new phase for Ethereum, encompassing 11 EIPs that cover improvements from smart wallets to scalability.

Among the most significant changes are: raising the staking limit for individual validators from 32 ETH to 2048 ETH and recalibrating fees to significantly enhance Layer-2 throughput. These changes reduce costs, improve L2 performance, accelerate the adoption of optimistic Rollups and zk-Rollups within the ecosystem, and clear obstacles for future L1 scaling.

At the same time, the Pectra upgrade supports account abstraction, such as gasless payments and batch transactions, laying the groundwork for the large-scale adoption of stablecoins and further widening the gap in user experience and flexibility compared to other public chains. As Ethereum core developer Tim Beiko summarized on April 24: "A highlight of Pectra is EIP-7702, which enables use cases like batch transactions, gas payment on behalf, and social recovery without the need to migrate assets."

At the mainnet level, Ethereum is also gradually increasing the Gas Limit from an initial 15 million to 36 million, with future plans to raise it to 60 million, resulting in a 2–4x increase in the number of transactions that Ethereum L1 can process per second, reaching 60 TPS. It is anticipated that after multiple expansions, Ethereum could see TPS exceed three digits. Ethereum researcher Dankrad Feist even proposed: "We have a blueprint to increase the Gas Limit by 100 times within four years, which could theoretically raise Ethereum's TPS to 2,000."

Meanwhile, Ethereum is actively advancing zero-knowledge (ZK) integration as part of the "Surge" roadmap phase. Upgrades like Pectra (and the upcoming Fusaka) lay the foundation for comprehensive ETH ZK implementation and ZK-based lightweight clients.

Clearly, Ethereum's core protocol is rapidly evolving, keeping it technically ahead of its competitors.

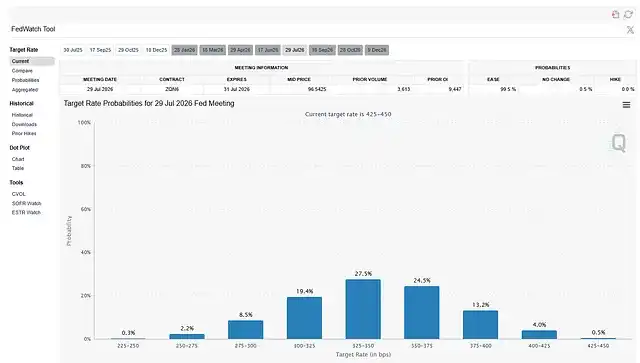

5. Imminent Interest Rate Cuts Favorable Macroeconomic Environment

In the coming months, changes in the macroeconomic environment will be favorable for Ethereum. After a year of high interest rates, the market expects the U.S. Federal Reserve to shift towards interest rate cuts, which may bring benchmark yields below the returns from ETH staking.

Data Source: CME Fed Watch

According to CME Fed Watch predictions, the federal funds rate is expected to drop to 3.25% or lower by mid-2026. Meanwhile, Ethereum's on-chain staking yield (currently around 3.5% annualized) is expected to rise due to increased network activity and transaction fees.

This convergence of trends creates a "dual shock effect": traditional risk-free yields decline while Ethereum's native yield rises, potentially turning the spread between ETH staking and treasury yields positive.

If Ethereum staking can provide returns significantly higher than U.S. treasuries or savings accounts, it will enhance ETH's appeal as a high-yield and liquid asset. Staking not only brings robust returns, but ETH itself also has upside potential, making it an attractive combination for investors seeking returns that are hard to find elsewhere.

Additionally, it is well-known that more accommodative Federal Reserve policies (along with improved inflation outlooks) often weaken the dollar, which historically benefits all crypto assets.

Such a loose monetary policy macro trend is very favorable for ETH in the next 3 to 18 months.

6. Staking: On-Chain Staking and ETF Staking in Tandem

Ethereum core researcher Justin Drake pointed out in multiple podcast interviews between 2024 and 2025: "Ethereum staking has become fundamental to network security and economic models; if the U.S. approves staking ETFs, it could bring in billions of dollars in new institutional demand."

Ethereum's transition to proof of stake (PoS) has opened up new dynamics around staking, and U.S. regulators are gradually becoming open to investment products that utilize staking yields. With the SEC approving several spot Ethereum ETFs in 2024, preparations are in place for the next phase of innovation: a U.S. staking ETF that provides exposure to ETH along with staking returns.

Thus, Ethereum's future staking will become a dual approach:

1. Traditional Institutional Staking: How a staking-supporting ETF might impact Ethereum's ecosystem and value;

2. On-Chain Protocol Staking: The role of protocols like Lido and Ether.Fi in popularizing staking.

Growing Staking Participation: Ethereum staking has experienced strong growth following the Merge and Shanghai upgrade. As of the first quarter of 2025, approximately 28% of the total ETH supply is staked in validator nodes, reaching an all-time high, reflecting strong confidence in the network.

Data Source: Dune https://dune.com/hildobby/eth2-staking

On-Chain Staking Bullish Progress Breaking Centralized Staking

It is noteworthy that ETH staking has not moved towards centralization: Lido Finance remains the largest single staking provider, but its previously dominant market share (over 30%) has not continued to concentrate. The reason lies in Lido's personal promotion of Community Staking (CSM) and Decentralized Validator Technology (DVT), which has gradually increased its share in the Lido staking pool, thereby dispelling past concerns about ETH staking heading towards centralization.

At the same time, the staking landscape is becoming more diverse, with new platforms like Ether.Fi seeing approximately 30% growth in staked ETH over the past six months, and a net increase of over 310,000 ETH staked in just the past month. Particularly, strategies related to circular lending have shown how innovation can make Ethereum staking more accessible and capital-efficient: users can easily participate with small amounts, maintain liquidity, and even amplify returns, all of which encourage broader staking participation.

Staking returns have changed investors' considerations—ETH is no longer a non-yielding asset but is gradually resembling a productive asset, with yields comparable to dividends or interest, even addressing Warren Buffett's past criticisms of non-yielding assets like gold and Bitcoin. Overall, the amount of staked ETH continues to reach all-time highs, indicating that holders view staking as an attractive long-term strategy (earning returns while securing the network) rather than short-term speculation.

Expected U.S. Staking ETF and Its Impact

With spot Ethereum ETFs already trading in the U.S., a natural progression is to launch an ETF that not only holds ETH but also participates in staking to earn yields. Such a product would be groundbreaking, providing traditional investors with exposure to ETH price appreciation and approximately 3–4% annualized staking returns in a single, regulated tool. If a U.S. staking ETF is approved, the impact on Ethereum could be significant:

Increased Demand and Reduced Circulation: A staking ETF could attract institutional capital and retirement accounts that prefer the convenience of ETFs. This would lock more ETH in staking contracts, effectively reducing the liquidity supply in circulation, and a popular ETF could exert a "push" effect on ETH prices.

Validation of Staking Legitimacy: Especially as the new SEC chairman has clarified that "validators and staking-as-a-service" do not fall under securities jurisdiction, this would send a strong signal for the approval of staking ETFs in the U.S.

Data Source: SEC

Industry experts like Bloomberg's James Seyffart and ETF analysts from The ETF Store predict that by the end of 2025, the SEC may allow staking features in ETFs for major assets like Ether. In short, U.S. staking ETFs seem to be a matter of "when, not if."

Essentially, it will normalize staking in the eyes of traditional investors as a form of "crypto dividend" or interest similar to bonds. This mainstream acceptance could expand Ethereum's investor base, attracting not only growth-oriented investors but also those seeking yields and income.

In summary, Ethereum staking has become a core pillar of the network's value proposition, and the emergence of U.S. staking ETFs could be a game changer. This growing staking base reduces circulating supply and encourages long-term holding, supporting ETH's price. If regulators allow ETFs to integrate staking, it will invite a new class of investors to participate in Ethereum's yields within a familiar framework, potentially boosting demand for ETH and reinforcing its status as a yield-generating asset.

Allen Ding, founder of Ebunker, stated: "As Asia's top staking service provider, I want to discuss Ethereum's potential from the perspective of nodes. Ethereum currently has over 1 million nodes and thousands of node operators, making it one of the most decentralized protocols among all organizations in the blockchain industry and even in human society as a whole.

Although Ethereum has underperformed in terms of application ecosystem prosperity and user growth in recent years, I believe that the long-standing reputation it has built in terms of decentralization and security is its true, unassailable moat. We have recently seen many commercial companies, such as Robinhood, still choosing ETH L2 to launch their on-chain securities, which reflects Ethereum's unbreakable position in people's minds.

Therefore, I boldly say that Ethereum cannot be killed—both in the literal and figurative sense."

7. Layer 2 Adoption Surges Amidst a Thousand Chains Competing

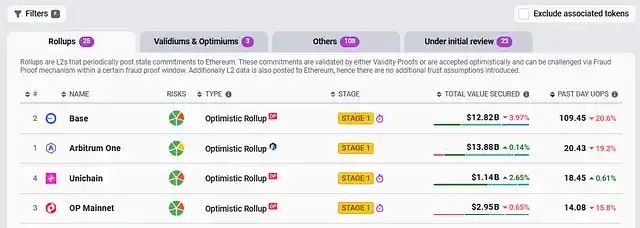

Data Source: L2Beats

Ethereum's strategy of scaling through Layer-2 networks is achieving significant results. The L2 strategy has eliminated many potential "Ethereum killers."

Ethereum is not competing with every emerging blockchain but empowering them as L2 solutions, with even large enterprises joining in. For example, Sony has launched its own Ethereum L2 blockchain, Soneium, aimed at bringing Web3 into gaming, entertainment, and finance. Sony's platform will utilize Optimism's OP Stack technology, inheriting Ethereum's security while providing customized scalability. This marks the first time a global consumer technology giant has built a platform directly based on Ethereum's L2 framework, greatly validating Ethereum's strategy.

Recently, Robinhood also joined this trend, announcing plans to build its own L2 blockchain based on Arbitrum to support new business lines such as tokenized stocks and crypto perpetual contracts launched in the EU. As one of the hottest financial platforms in the U.S., Robinhood's involvement signifies the ongoing appeal of Ethereum's L2 strategy to mainstream fintech companies.

At the same time, the L2 network Base from the U.S. exchange Coinbase has seen a surge in activity since its launch in 2024. Base processes over 6 million transactions daily, even surpassing traditional L2s like Arbitrum in usage. In fact, by the end of 2024, Base accounted for about 60% of all L2 transactions, demonstrating the potential for large-scale expansion of Ethereum L2 with the support of major platforms.

Data Source: L2Beats

Not to be outdone, Binance has also adopted Ethereum's technology—its opBNB chain is based on Optimism's L2, achieving over 4,000 TPS in testing and processing 35 million transactions during the beta period. By utilizing Ethereum's EVM and OP Stack, opBNB extends Ethereum's influence to the BNB Chain ecosystem while maintaining compatibility.

The conclusion is: Ethereum's network effects are so strong that they have turned potential competitors and large enterprises into part of its L2 superstructure at an early stage. This widespread L2 adoption (from Sony to Robinhood, Coinbase to Binance) drives more usage and fee revenue back to Ethereum, emphasizing its position as the preferred settlement layer.

8. Dual Adoption in Mainstream and Politics

Beyond price, signals from the broader ecosystem indicate that Ethereum is increasingly deeply integrated into the structures of technology, business, and even politics.

A striking example is the Trump family's entry into the crypto space through the new platform World Freedom Financial (WLFI). WLFI aims to provide high-yield crypto services and digital asset trading—essentially bringing the DeFi concept to the masses.

Trump's son, Trump Jr., publicly predicted that WLFI has the potential to "reshape DeFi and CeFi, fundamentally changing the financial industry," emphasizing, "We are just getting started." Around the time of this tweet, WLFI spent $48 million to buy ETH to support its DeFi business.

The Trump family's involvement—reportedly holding a majority stake in WLFI and even appointing Trump himself as "Chief Crypto Advocate"—indicates that even traditional conservative figures are beginning to see the value of Ethereum-based finance, which can be viewed as an indirect recognition of Ethereum's technology.

Meanwhile, the attitude of institutional investors is also undergoing a fundamental change.

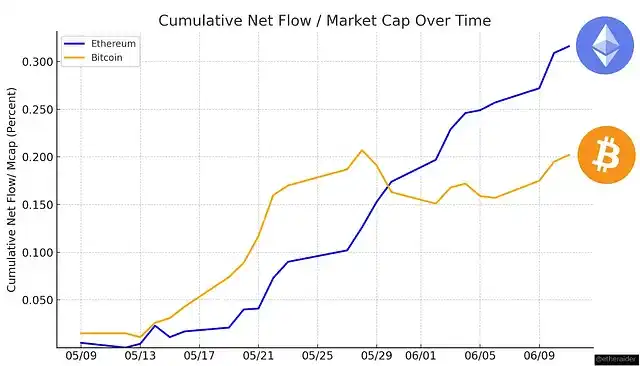

Data Source: SoSoValue

In June 2025, net inflows into Ethereum spot ETFs exceeded $1.1 billion, setting a new monthly record for 2025 and accounting for over 27% of the current cumulative net inflow total ($4.18 billion), indicating that institutional capital is rapidly and massively entering the Ethereum market. More importantly, this is not a short-term capital movement but a wave of sustained allocation trends:

As of June 12, 2025, Ethereum spot ETFs recorded positive fund inflows for 19 consecutive trading days, breaking the historical record for consecutive net inflows in crypto ETFs; on June 11, a single-day net inflow reached $240 million, far exceeding the $165 million for Bitcoin ETFs during the same period, further highlighting the market's growing preference for ETH.

Data Source: X @etheraider

This series of changes in fund flows sends a clear signal: institutions are no longer just "watching" Ethereum but are firmly "allocating" to Ethereum.

The logic behind this is not complex:

- Ethereum has a diversified yield structure (staking yields, MEV capture, L2 revenue sharing)

- It has a more efficient technological upgrade path (such as EIP-4844, modular architecture)

- And it maintains a leading developer ecosystem and application vitality

For institutions, ETH is no longer merely an alternative to Bitcoin but more like a "proof of equity in the digital financial system"—representing the underlying rights of future global network finance. This shift in role positioning is driving ETH to gradually become one of the core assets in mainstream financial allocations.

Morgan Stanley analysts recently reiterated: "If Ethereum can continue to upgrade smoothly, more institutional investments (such as a new round of ETFs) will continue to drive ETH prices upward. We still maintain a bold long-term target of $15,000."

Additionally, this highlights Ethereum's development journey: from being overlooked by regulators and traditional powers to now being adopted by the U.S. president. Other signals within the ecosystem are abundant: for instance, PayPal has launched a stablecoin based on Ethereum (PYUSD), and Visa is using Ethereum to settle USDC payments.

Moreover, mainstream adoption in other countries and regions outside the U.S. is also accelerating.

Since 2021, Europe, Asia, and emerging markets globally have been actively adopting Ethereum in policy, finance, and technology:

Europe: After the MiCA regulations came into effect, Deutsche Bank, BNP Paribas, and others are using Ethereum as a platform for issuing and settling digital bonds. French asset management giant Amundi has explicitly stated: "Ethereum is at the core of our digital securities strategy." In 2023, the London Stock Exchange (LSE) announced support for the listing of digital assets based on Ethereum. The SIX exchange in Switzerland has been offering Ethereum spot and derivatives since 2022.

Asia-Pacific: In 2024, Hong Kong will launch a spot ETH ETF that supports staking, with compliant exchanges like HashKey and OSL adopting Ethereum as the underlying asset for custody. Singapore's DBS Bank has been piloting Ethereum DeFi liquidity pools since 2022, with ETH as the core collateral. Japan's MUFG is leading the Progmat Coin initiative, issuing yen stablecoins on an Ethereum-compatible framework. Australia's eAUD is also being implemented using Ethereum-compatible EVM.

Latin America and the Middle East: Brazil's central bank CBDC, the UAE, and Abu Dhabi are promoting asset tokenization and digital identity, preferring Ethereum and L2 platforms.

Africa: Nigeria's central bank collaborated with Consensys in 2022 to promote a national payment system based on Ethereum architecture called eNaira.

These cases indicate that whether in Europe, America, Asia, the Middle East, or Africa, Ethereum has become the preferred underlying technology for digital asset issuance, asset custody, compliance pilots, and corporate innovation.

As more governments, fintech companies, and enterprises globally integrate Ethereum into their actual operations, the real demand for ETH and its practical implementation will further enhance the supply-demand structure, providing broader space for an upward cycle in the next 3 to 18 months.

9. Vitalik's Continued Push and Ethereum Foundation Reform

Ethereum is not only breaking through on technical and market levels, but the organizations and thought leaders behind it are also entering a new stage of development. Vitalik's ongoing research, the restructuring of the foundation, the establishment of the Etherealize department, and the collaborative evolution of L1 and L2 are collectively driving the Ethereum ecosystem toward a more mature and influential direction.

Vitalik: The Only Crypto Leader After Satoshi Nakamoto

Vitalik Buterin is hailed as "the only true god of the post-Satoshi era." He is not only the founder of Ethereum but also continues to influence the ecosystem as a pioneer in industry research and a prominent figure on social media. Currently, his focus includes:

ZK Strategy: Vitalik has established zero-knowledge proofs (ZK proofs) as the core technological line for Ethereum's next decade. He continues to promote the dominance of ZK proofs in scalability and security while emphasizing that Ethereum should not overly rely on a single technological route. Although breakthroughs like real-time ZK proofs have been achieved in the industry, Vitalik reminds us that performance optimization, auditability, and usability remain shortcomings, and ZK proofs will play a key role in enhancing Ethereum's efficiency and security in the long term.

RISC-V + ZK-EVM Performance Innovation: Vitalik advocates for a general-purpose RISC-V virtual machine as a long-term goal, believing that if the mainnet can achieve this upgrade, execution efficiency could improve by 50-100 times or even more. Meanwhile, ZK-EVM will serve as a mid-term transition and supplement. Through architectural innovation, Ethereum is expected to significantly outpace similar public chains in verifiability and performance, continuously strengthening its core competitiveness.

Light Node Roadmap: Vitalik promotes innovative ideas like "partial stateless nodes," allowing ordinary users to participate in network validation by retaining only the sub-states they care about, thereby lowering hardware barriers and reducing RPC centralization pressure. This direction helps enhance Ethereum's level of decentralization and user participation, laying a technological foundation for broader social engagement in the future.

In the crypto space, he has the second-highest number of followers on Twitter after CZ, and his voice alone is enough to influence the crypto industry and spark discussions. Vitalik continues to contribute in-depth research and cutting-edge discussions to the industry, showcasing his absolute dominance as a blockchain thought leader.

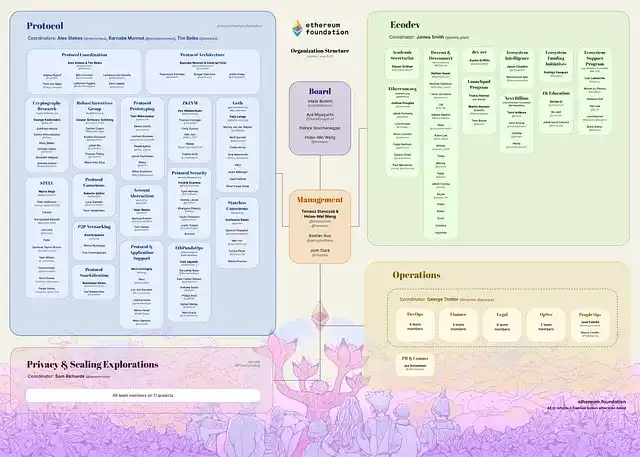

Foundation Restructuring: Organizational Optimization and Core Talent Promotion

In 2025, the Ethereum Foundation (EF) released a new organizational structure. Former Executive Director Aya Miyaguchi was promoted to President, focusing on global strategy and external relations; the board now consists of Vitalik Buterin, Aya Miyaguchi, Swiss legal advisor Patrick Storchenegger, and newly appointed director Hsiao-Wei Wang, responsible for long-term vision and compliance oversight.

On the operational level, the foundation has introduced a "Co-Executive Directors" model for the first time: former Protocol Support head Hsiao-Wei Wang and Nethermind founder Tomasz Stańczak will jointly manage daily operations; meanwhile, Bastian Aue (organizational strategy, recruitment, training) and Josh Stark (project execution, market communication) have joined the management team to form horizontal collaboration.

This restructuring clearly separates decision-making and execution powers, forming a "board-management" dual governance structure, thereby dispersing single-point risks, enhancing execution efficiency, and providing smoother collaboration channels for core R&D (Protocol & Privacy & Scaling), ecosystem development (Ecodev), and operational support.

Overall, the EF is evolving from a "linear" management model to a more flat, multi-centered governance model, providing a solid foundation for Ethereum's next phase of cross-L1/L2 scaling and multi-domain collaboration.

Etherealize: A New Breakthrough in Wall Street Strategic Alignment

In January of this year, a new independent non-profit organization, Etherealize, was added to the Ethereum ecosystem. This organization is funded by the Ethereum Foundation but maintains independence in governance and operations, positioning itself as "the institutional market and product hub for Ethereum." The Etherealize team is led by Wall Street veteran banker Vivek Raman, and in March, Danny Ryan officially joined as a co-founder.

Etherealize primarily provides research, education, and product alignment services to banks, brokerages, and asset management institutions, focusing on advancing the practical application of asset tokenization, customizable L2 solutions, and zero-knowledge privacy tools. The establishment of this organization signifies that the Ethereum ecosystem is transitioning from a purely technical community to financial infrastructure, targeting specific lobbying efforts on Wall Street, further solidifying ETH's position as an institutional-grade digital asset.

Shift in Technical Thinking: Collaborative Development of L1 and L2

While Ethereum deepens its L2 scaling efforts, it is also accelerating the enhancement of the mainnet (L1) foundational performance. Vitalik Buterin pointed out in a Decrypt interview on June 2 of this year: "I think we should aim to scale the Ethereum mainnet by about 10 times over the next year or so."

The most intuitive progress is the dynamic adjustment of the Gas Limit, which will increase the mainnet Gas Limit from 15 million to 36 million in 2024, and after entering the voting phase in 2025, it is expected to rise to 60 million, allowing the ETH mainnet's peak TPS to reach 60, achieving a historical fourfold increase.

Unlike Bitcoin's fixed block size, Ethereum's Gas Limit is dynamically adjusted by validators across the network through voting, eliminating the need for hard forks and enhancing the flexibility of on-chain governance and community participation. Recent radical proposals like EIP-9698 suggest significantly increasing the Gas Limit in the coming years, but the community overall tends to prefer a balanced approach between security, decentralization, and performance.

Recent tests indicate that a 60 million Gas Limit has a controllable impact on the performance of most nodes and block propagation delays, laying a solid foundation for future L1+L2 collaboration and serving user scenarios in the hundreds of millions.

Token Economics: Ultrasound Money Still Works

The native token economics of Ethereum continues to strengthen its investment value. The theory of Ethereum's "ultrasound money" is being realized: transaction fee burns often exceed new issuance, resulting in net deflation of ETH supply during periods of high activity. Since the London upgrade, over 4.6 million ETH have been burned, continuously reducing circulating supply.

Data Source: Ultrasound Money

From a supply perspective, higher staking participation does slightly increase the protocol's issuance (more validators = more reward ETH released), but since transitioning to PoS, Ethereum's issuance remains far below the proof-of-work (PoW) era—approximately 700,000 ETH issued annually (corresponding to 30 million staked ETH), significantly lower than the 4.5 million ETH issued annually under the old mining system.

From a consumption perspective, on-chain activity remains strong—Ethereum consistently processes tens of billions of dollars in transactions daily, covering decentralized finance, NFTs, and payments, far exceeding any other smart contract chain. Despite being in a bear market, this healthy network usage indicates that Ethereum's practicality (and thus the demand for ETH as fuel fees) is on a robust upward trend.

Data Source: growthepie.com

Even with approximately 28% staking participation, the annual ETH issuance through staking accounts for only about 0.5-1% of the supply, and during periods of high network activity under the EIP-1559 fee burn mechanism, net deflation of ETH supply can still be observed.

In fact, Ethereum's net issuance hovers around zero, and at times can even be deflationary, depending on network fees. In cases where the burn mechanism offsets expenses, Ethereum's monetary policy can often be described as deflationary or neutral. Therefore, as staking grows, Ethereum's "inflation rate" remains low, while its "yield" stays high, allowing more and more ETH to be locked to secure the network, achieving a "want it all" scenario.

As L2 adoption (as previously mentioned) drives more transactions to settle on L1, Ethereum's fee revenue (and thus the amount of ETH burned) should continue to grow. Overall, Ethereum's mid-term supply-demand situation is very bullish: effective supply is decreasing, while demand from network users and long-term stakers/investors is rising.

Conclusion

Across the four dimensions of regulation, technology, capital, and macroeconomics, Ethereum is entering a "compounding interval at the inflection point." As the policy ceiling is pried open, protocol performance continues to iterate, institutional allocations shift from exploration to strategy, and global liquidity loosens again—these four forces are not isolated additions but are coupled and resonating exponentially.

History tells us: assets that truly change the game often complete their valuation reshaping quietly before consensus is fully solidified. Now, ten core reasons have lined up, illustrating a clear timeline—from regulatory approval to treasury entry, from Pectra upgrade to staking ETFs, from L2 scaling to deflationary monetary policy. All signals point to the same answer: ETH is no longer just "the opportunity of the next phase," but "the most certain increment of the present." The market will ultimately realize this logic through price—the only question left is whether you will choose to turn the last page before or after the story is written.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。