Today's homework, although not easy to write, was indeed anticipated. Last week, we discussed that we would return to the game of tariffs and monetary policy this week, especially since it was mentioned over the weekend that the average tariff in the U.S. for 2024 is 2.5%. Over the weekend, Bessent revealed that the reciprocal tariffs for some countries would be based on 10%, and then added on top of that, combining with the base tariff, it would be a minimum of 20%. The most basic would also be an eightfold tariff for 2024.

Today's actions regarding Japan and South Korea should be around neutral. The total tariff of 25% is only slightly higher by 5%, which is not a lot, and there is still an open exposure. As long as it meets the conditions for opening up to the U.S. and tax reductions, the tax rate can still be lowered. Personally, I estimate that 15% is currently the bottom line for the U.S., and this bottom line may not be implemented all at once; it might start from 20% and gradually weaken.

The market's response to tariffs is quite direct. On one hand, the tariffs on Japan and South Korea are already not low, and on the other hand, the situation regarding China, which has not been announced, may not be very optimistic. However, there is not no good news; the EU stated today that negotiations are still possible and has reached a certain agreement with the U.S., which is also estimated to be a guaranteed minimum of 20%.

Finally, the most difficult issue should be China. Every time the issue of Chinese tariffs arises, it causes some market turbulence. After the news was announced, U.S. Treasury bonds began to rise, with 20-year and 30-year Treasury bonds breaking through 4.9%. Trump's days are getting tough, and the pressure from the analysis will be passed on to the Federal Reserve. Will Powell buy it? I don't think so, so Trump can only jump up and down and quickly select a new Federal Reserve chairman to boost the market.

If I am not mistaken, after the comprehensive announcement of the tariff policy, the nomination for the new Federal Reserve chairman should come out. The new Federal Reserve chairman will inevitably implement a rate cut plan and make statements to revive the market. Although Powell's term ends in May next year, if the next Federal Reserve chairman is already a member of the Federal Reserve Board, it is not ruled out that Trump will seek more positions from the board.

Oh, I almost forgot about Tesla. Musk's actions will undoubtedly cause panic among Tesla shareholders. This is without a doubt. The lowest price during the last argument was $273, and this time it should be more serious than last time. I wonder if it can drop below $270. If it can, I will build a position and see.

The third quarter is a quarter of the game between monetary policy and tariffs. How difficult it is, I leave it to you to assess.

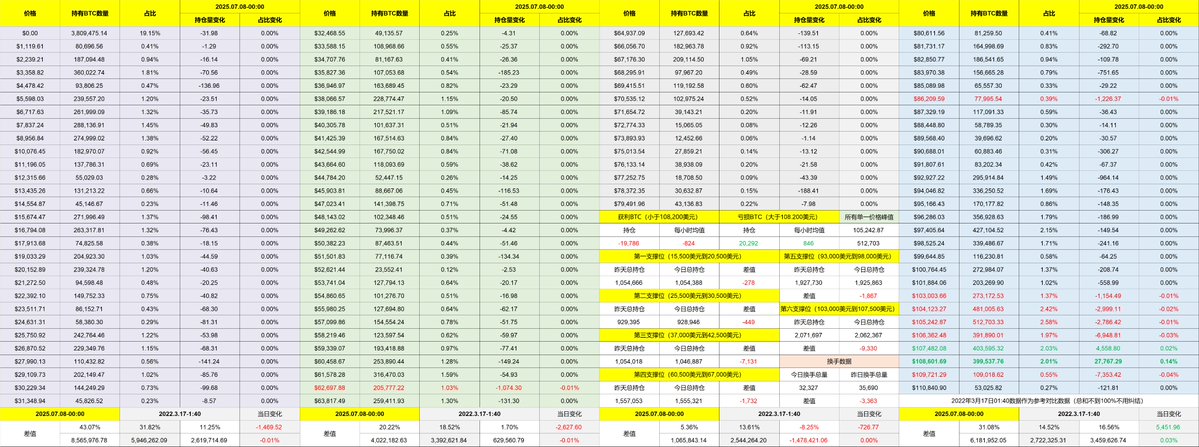

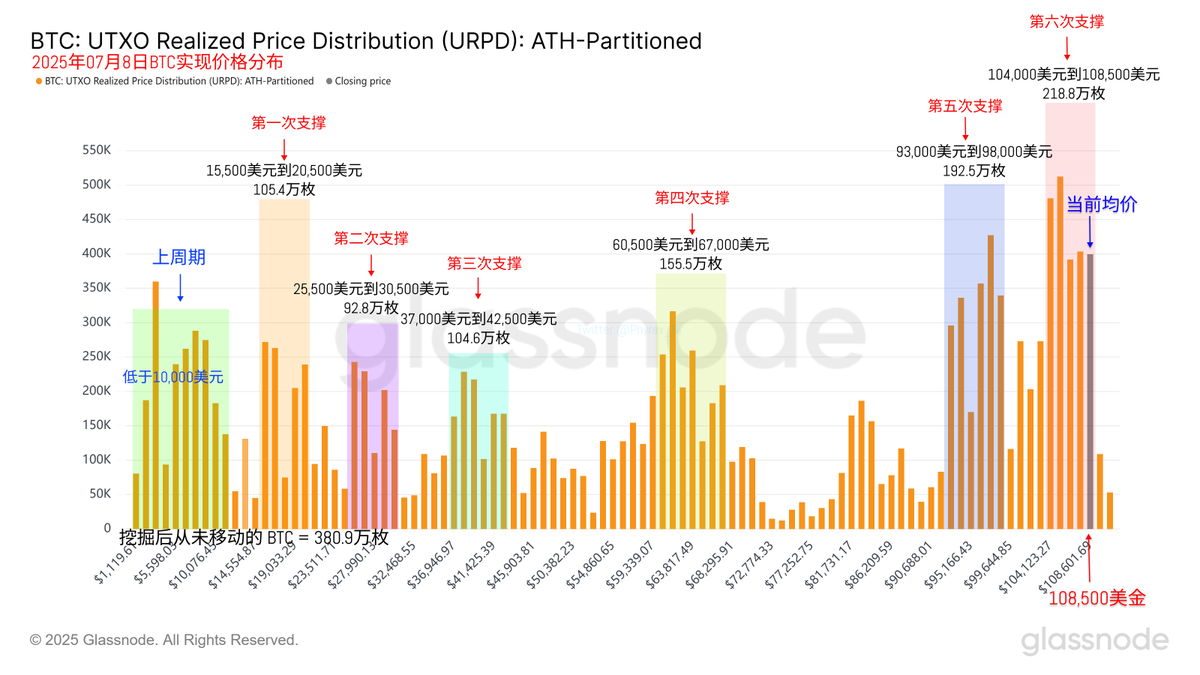

Returning to Bitcoin's data, I didn't expect the turnover rate on Monday to be lower than on Sunday. Are American investors not back to work yet? However, a lower turnover rate puts less pressure on the price. The market sentiment is a bit poor, mainly worrying about whether Trump will pull any tricks on July 9.

I have slightly adjusted the supporting data. Currently, the most concentrated $BTC is between $104,000 and $108,500, with the stock nearing 2.2 million coins, but the stability is still good. Of course, this is mainly because the U.S. stock market has not reacted much. Overall, Bitcoin is still highly correlated with the U.S. stock market. By observing the reactions of the S&P and Nasdaq, one can roughly know BTC's response.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。