Recently, the performance of global bank stocks has been really impressive, even catching the attention of seasoned investors like me.

First, let's talk about the overall trend—since the end of 2022, global bank stocks have been on a steady rise, and by 2025, this upward momentum not only hasn't stopped but the "gap" between them and the overall market index has widened. You can imagine it like this: while other stocks are walking, bank stocks have already hopped on motorcycles.

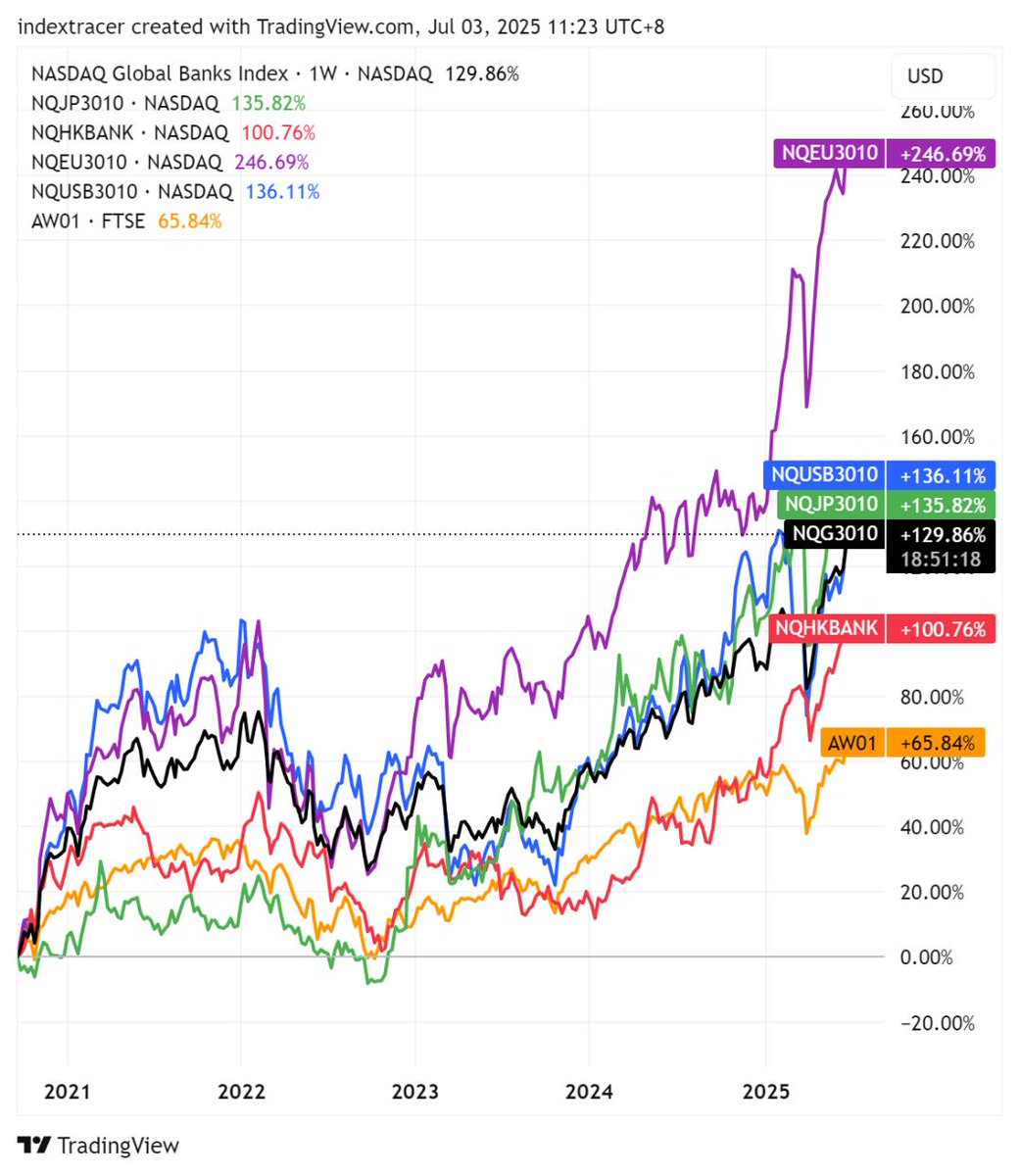

🔍 See Image 1:

Black represents the global bank stock index;

Blue is for the United States;

Green for Japan;

Purple for Europe;

Red for Hong Kong;

And finally, orange is the global overall stock market index.

Basically, global banks are outperforming the market. What does this indicate? It shows that this wave for banks is not just a rebound; it is a systematic strong market trend.

Why is it rising so sharply?

1️⃣ The interest rate environment has changed.

Since the 2020s, the U.S., Japan, and Europe have all been raising interest rates. When rates go up, banks' "interest margin income" increases (simply put, the difference between loan interest and deposit interest becomes larger, allowing banks to earn more). Naturally, profits rise, and stock prices follow suit.

2️⃣ Even in low-interest areas, such as the A-shares and Hong Kong stocks, bank stocks haven't lagged; instead, they are being bought up more and more, with insurance funds and public funds behind this buying. What does this indicate? It shows that everyone wants stable, dividend-paying, and risk-resistant assets.

3️⃣ The world is lacking growth points, and funds are starting to lean towards a "high dividend" conservative strategy. In the current situation where there is no obvious economic growth and #AI has been driven to high levels, what investors care about most has become one word—dividends. Whoever can provide me with cash flow, I will invest in them.

Now, let's talk about U.S. bank stocks:

🔺 U.S. bank stocks have risen for nine consecutive days, tying the record for consecutive gains from the 1990s.

The reason is straightforward: the Federal Reserve recently hinted at relaxing capital constraints on banks (eSLR). This essentially tells the market that large banks will have more "spendable money"—and the result? Everyone guesses they will either buy back stocks or increase dividends. As soon as investors heard this news, they rushed into bank stocks.

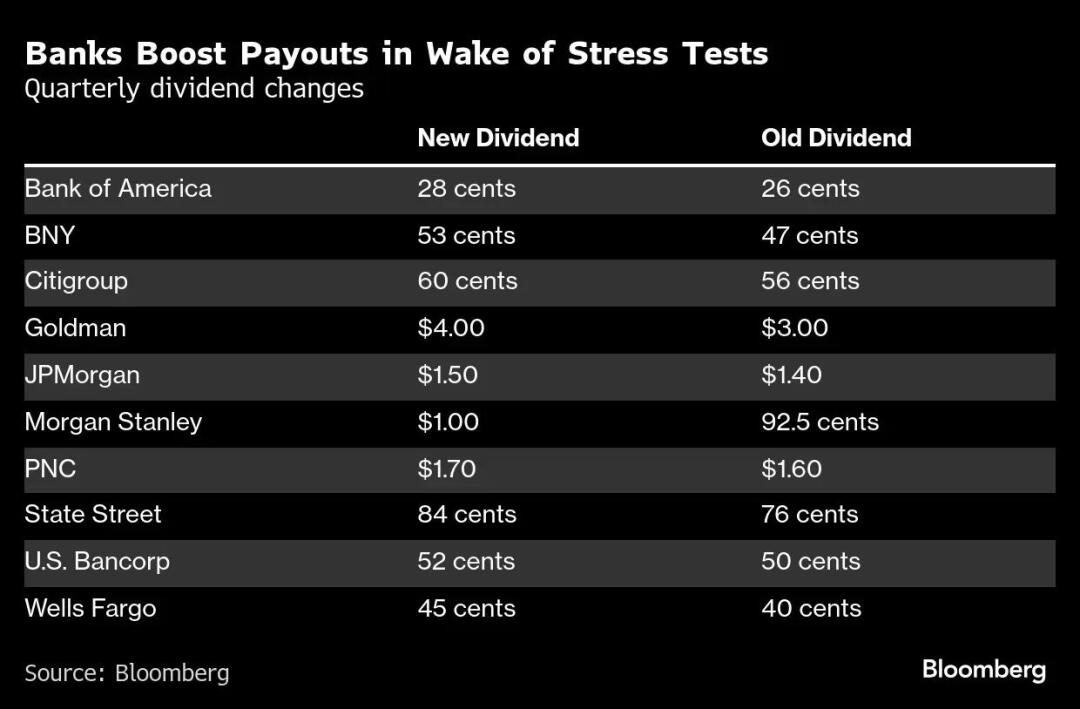

🔺 Bank stocks have increased their quarterly dividend payouts, especially among large banks.

The actions of hedge funds last week were also very evident: they bought bank stocks at the fastest rate in the past decade. See Image 2.

In the current global environment of high interest rates, mediocre growth, and risk aversion, bank stocks have become a safe haven. They are not as aggressive in growth as tech stocks, nor as fragile as small-cap stocks; they are stable, can pay dividends, and are still undervalued—this is the "top student" in a scarcity of assets.

In my current portfolio, I have added quite a bit of U.S. bank stocks, especially those with high dividend yields and solid balance sheets. It’s not about betting on a doubling; it’s about securing a medium to long-term source of cash flow with high certainty. In simple terms: don’t think about getting rich quickly with bank stocks, but relying on them for retirement is a reliable option.

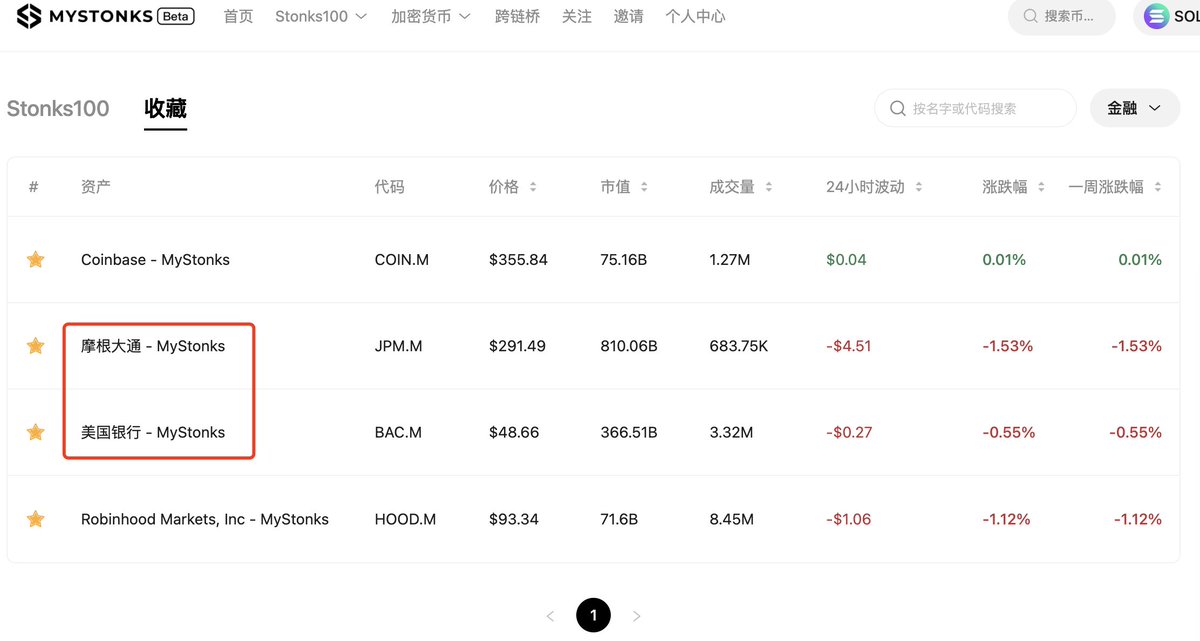

If you don’t have Futu Securities or Tiger Brokers, there are also two U.S. bank stocks on the #RWA U.S. stock tokenization platform #mystonks, namely JPMorgan Chase and Bank of America. See👇 Image 3.

U.S. stock tokenization participation link: https://mystonks.org/?code=Vu2v44

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。