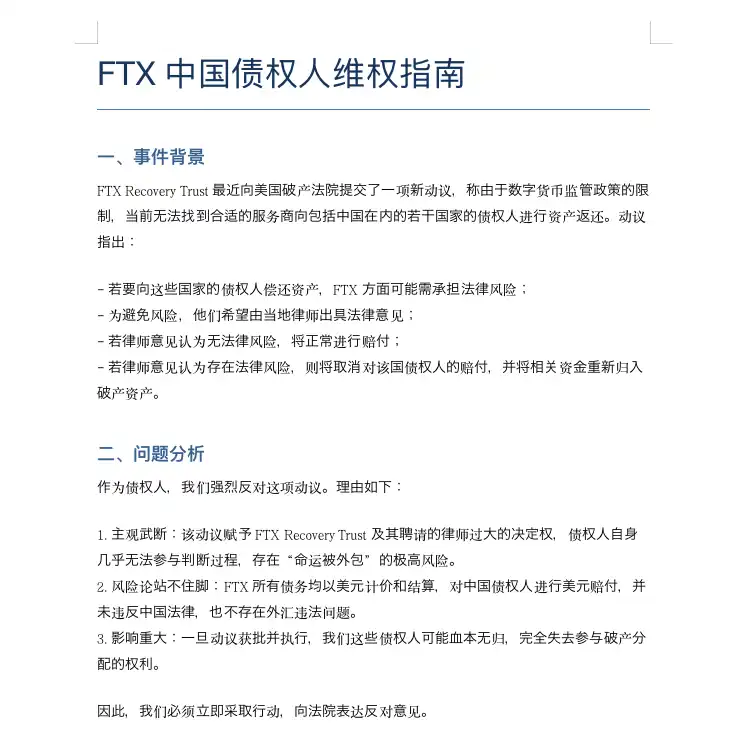

As the bankruptcy liquidation of FTX enters a critical stage, a highly controversial motion regarding the claims processing for users from "restricted countries" has sparked a global uproar among creditors.

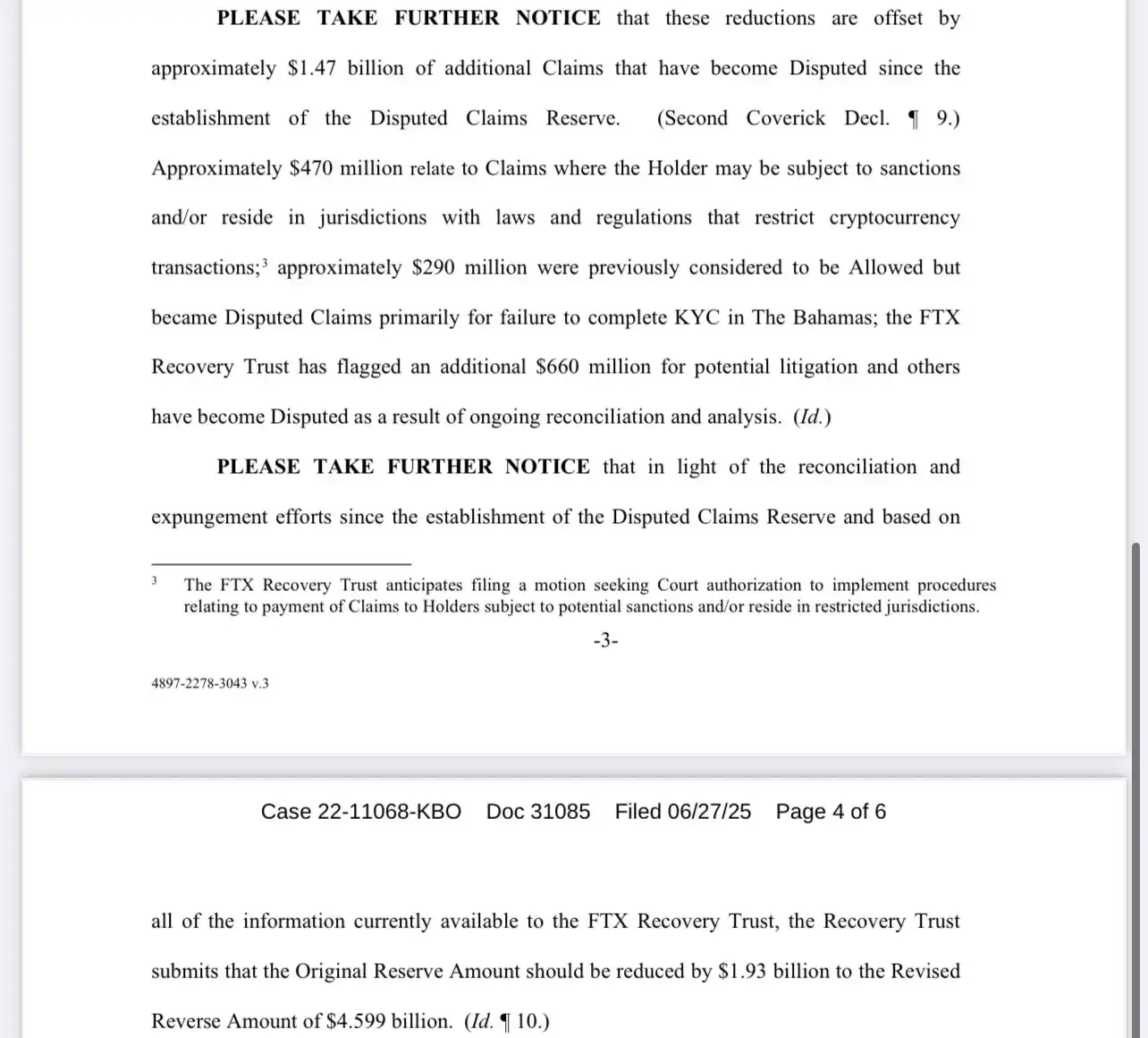

The FTX liquidators stated that they will first seek legal advice to determine whether assets can be allocated to these jurisdictions; if the conclusion is that compensation is not possible, the relevant claims may even be "legally confiscated" and transferred to a liquidation trust account. This means that Chinese creditors may not only receive nothing but their assets could also become "forfeited funds" for the trust fund.

According to data disclosed by FTX creditor representative Sunil on social media, the total claims from restricted jurisdictions amount to $470 million, with Chinese investors being the largest group of FTX creditors, holding $380 million in claims, accounting for 82% of the restricted claims.

BlockBeats conducted an exclusive interview with Will (@zhetengji), who is not only one of the high-profile creditors of FTX but also a key initiator opposing this motion and raising objections. He detailed why he decided to stand up and lead this fight, the operational process of opposing the motion, the actual difficulties faced by the creditor community, and his deep observations on the motives behind the motion.

Here is the full content of the interview:

BlockBeats: Please introduce yourself and share your experience in the crypto industry.

Will: I am Will, with a background in science and engineering, having studied geophysics for both my undergraduate and graduate degrees, later obtaining a PhD in geophysics. I officially entered the crypto industry in 2017, initially working in a centralized exchange (CEX), and later started investing myself, participating in several projects and running my own Crypto Fund for a while, which was an early attempt. I have also invested in many funds and collaborated deeply with several LPs. Additionally, I have mined—previously owning a significant number of Bitcoin mining machines, as well as Litecoin and Dogecoin miners. However, due to domestic policies prohibiting mining, I basically exited that part.

Currently, I consider myself semi-retired from the industry, mainly monitoring some assets I invested in years ago and occasionally trading in the crypto market.

I have always been a Bitcoin-centric investor. For me, Bitcoin is not just an asset; it is a belief. Over the past few years, my significant gains have actually come from several major cycles and waves of Bitcoin trading. Many of my decisions and judgments are made from a Bitcoin-centric perspective.

BlockBeats: What assets do you have pending compensation on FTX? Are they mainly cryptocurrencies or USDT?

Will: The reason I allocated a considerable amount of assets on FTX was influenced by the industry atmosphere at that time.

I clearly remember the major drop on March 12; I basically went all-in to buy Bitcoin at the bottom. After that, as Bitcoin rose, I gradually liquidated my position. My thinking at that time was to wait for the next pullback to re-enter, so I transferred most of my USDT to FTX, preparing to catch the next low point.

Unexpectedly, FTX itself became the trigger for the next major drop.

Another point is that I was used to keeping my assets in wallets, but due to the tight regulatory atmosphere at that time, I thought it would be better to make a transfer through a trading platform first and then withdraw the funds back to my wallet. Because of this, I even transferred my Bitcoin holdings to FTX, intending to transfer them out at a more opportune time. So, in summary, my main assets on FTX are USDT and Bitcoin.

BlockBeats: Can you disclose the approximate scale and magnitude of your assets on FTX?

Will: I can only say that I am a major creditor, and the total across several accounts definitely places me in the top 100.

Why raise an objection?

According to documents provided by the FTX creditor representative, the core of this motion is to classify users from certain jurisdictions (mainly China) as "restricted foreign jurisdictions" and seek legal advice to determine whether compensation can be made; if the legal opinion denies the possibility of compensation, the corresponding claims will be regarded as "disputed assets" and may be transferred to a trust, with no further distribution to the relevant users.

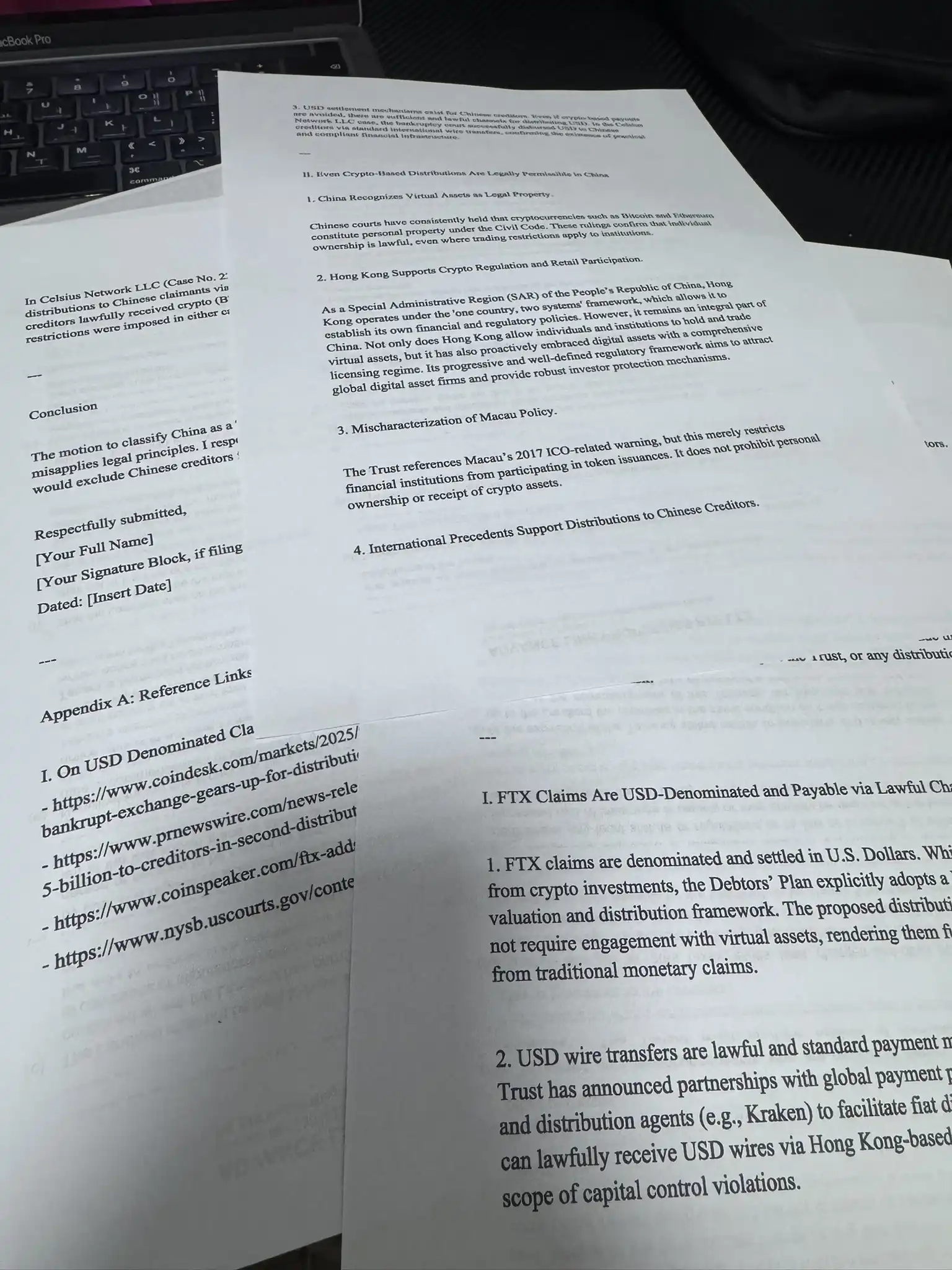

In a formal objection letter to the U.S. bankruptcy court, Will explicitly pointed out that the motion lacks factual and legal basis and violates Section 1123(a)(4) of the U.S. Bankruptcy Code regarding "equal treatment of creditors in the same class."

The letter outlines three main reasons:

Compensation is calculated in U.S. dollars, which is no different from traditional bankruptcy claims. FTX's recovery trust has clearly stated that compensation will be made in U.S. dollars or stablecoins. Even without using crypto assets, Chinese users can receive U.S. dollar wire transfers through legal channels such as Hong Kong accounts, which does not constitute any legal obstacle. In the Celsius case, U.S. courts successfully paid U.S. dollar compensation to Chinese creditors through international wire transfers.

Even if compensation is made in crypto assets, Chinese law does not prohibit individuals from holding or receiving them. Court cases at various levels in China have recognized that virtual assets like Bitcoin fall under the property category of the Civil Code, and Hong Kong has established a compliant regulatory framework for crypto. The regulatory statements in Macau also do not prohibit individuals from holding coins or participating in liquidation, and the policy texts cited by the trust do not have legal binding force.

The market is being manipulated due to the motion. The letter also specifically points out that some distressed asset funds have used this motion to exert pressure, claiming that Chinese creditors should immediately sell their claims at a discount, or they will "never receive compensation," and manipulating market sentiment by stating, "as long as 5% of Chinese creditors are excluded, the remaining 95% will support it." This not only amplifies panic but also turns the bankruptcy liquidation into a game of wealth redistribution.

Will earnestly requests the court to reject the motion to avoid creating an arbitrage mechanism of "low-price acquisition + full compensation," while ensuring that global creditors have equal opportunities for compensation both procedurally and substantively.

BlockBeats: Are there any precedents in previous international compensation cases that excluded Chinese creditors?

Will: This motion can actually be divided into two steps. The first step is for the liquidators to hire lawyers from 49 countries to issue legal opinions to determine whether compensation can be made to users from these countries. The second step is more controversial; if the legal opinion concludes that compensation cannot be made, the funds in question will be reclaimed into the trust account they established.

From what I understand, this second step has been unprecedented in past bankruptcy liquidation cases. The "confiscation" of assets belonging to users from a specific country has never occurred in history. To put it bluntly, I believe this is not merely a refusal to compensate but a form of confiscation.

As for completely excluding Chinese creditors and denying them any claim eligibility, I have not seen this in other cases. I have studied many precedents of bankruptcy and liquidation, but systematically excluding users from a country like this is indeed the first time I have seen it.

BlockBeats: Why did you decide to express your objection to the motion?

Will: The process of this motion is as follows: first, the deadline for creditors to oppose the motion is July 15. Once the motion is passed, the liquidation trust will hire lawyers to issue legal opinions regarding the 49 "restricted countries" users to determine whether compensation can be made.

The total claims from restricted jurisdictions amount to $470 million, with Chinese investors being the largest group of FTX creditors, holding $380 million in claims, accounting for 82% of the restricted claims.

I believe the real key lies in this point—if the motion is passed, the Trust will control the selection of lawyers and legal judgments, significantly reducing the controllability of the matter. Because these lawyers are chosen by them, we cannot know whether they truly understand the actual situation of cryptocurrency regulation in China or whether they can accurately grasp the boundaries of law and policy. Once we reach this step, we basically lose our initiative.

Therefore, my purpose in initiating this opposition to the motion is to fundamentally prevent the establishment of this motion. Only in this way can we retain more proactive space, and there will be more things we can do in the future.

Additionally, we have seen a very anxiety-inducing viewpoint; some creditors, especially those acquiring claims, openly state that Chinese creditors currently only account for about 4% to 5% of the total claims, while the remaining 95% are creditors from other countries. If this motion passes smoothly, the vast majority will benefit, while only Chinese users will be excluded.

In other words, this motion has a high likelihood of passing in the overall vote. Therefore, we must stand up to oppose it at this stage; once it enters the next stage, it will be extremely disadvantageous for us, which is why I decided to initiate this opposition to the motion.

BlockBeats: What key steps, materials preparation, and submission processes did you follow when opposing the motion?

Will: Regarding the operational process for opposing this motion, there are actually two main ways to submit objections.

The first way is to submit through a U.S. lawyer you are working with. The lawyer will complete the formal objection document submission through the electronic system of the U.S. bankruptcy court, which is the most recommended method in terms of compliance and efficiency.

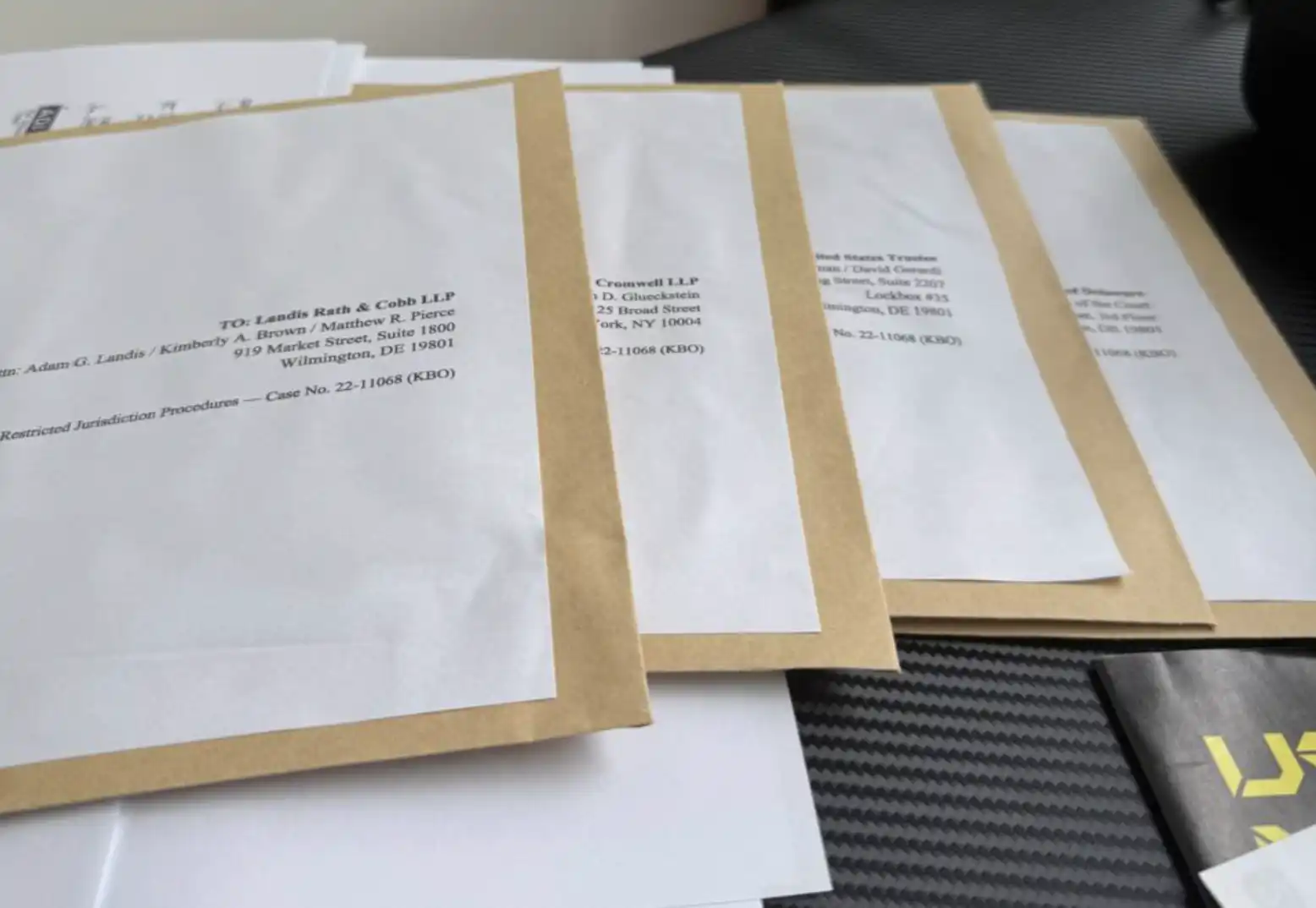

The second way is to submit it yourself, meaning you complete the entire process in your personal capacity. However, it is important to note that self-submission is a relatively complex and strictly regulated process, requiring you to notify at least four relevant parties by mailing letters separately.

Specifically, these four parties include:

The presiding judge of the bankruptcy case: Currently, the judge responsible for the FTX case is Judge Owens, and you need to mail a physical letter to him, which is the court-recognized formal notification method. If you do not have a lawyer, you must send the letter yourself; if you have a lawyer, you can submit it directly through the court system, saving the mailing process.

The legal team of the FTX Recovery Trust: They are divided into two parts, one being the New York law firm responsible for the main case, and the other being the local law firm handling the case in the bankruptcy court's jurisdiction. Both must receive notification.

If submitted through the lawyer system, the system will automatically copy them; if submitted personally, you will need to send physical letters to them separately or, in urgent cases, send emails. However, whether the emails are formally accepted and recognized is not up to us to decide.

- The U.S. Trustee's Office (UST): This is the agency under the U.S. Department of Justice responsible for overseeing bankruptcy procedures, essentially the regulatory body for this case. Given that this motion has already shown procedural and fairness biases, I believe it is necessary to copy our objections to the UST so that the regulatory body can also see them. Currently, when I encourage other creditors to write letters of opposition, I also suggest they copy the UST. The UST accepts both physical letters and emails, but the formal process still recommends mailing physical letters.

In summary, the process for opposing the motion has two paths:

One is to submit through a lawyer who fully represents you, which is smoother and easier to comply with;

The other is to submit physical letters in your personal capacity, ensuring that all four parties mentioned above receive them.

Finally, I want to emphasize that the deadline for opposing the motion is July 15, meaning that regardless of which method you choose, the relevant materials must be submitted and delivered before this date. This timeline is crucial; missing it means you cannot intervene in the current process.

Regarding sending the objection letter, I can share my practical experience.

I am currently in Singapore, and this is actually the second time I have sent a letter in the past few days. Today is July 7, and I used DHL for international express delivery, which is expected to arrive at the U.S. court by July 9. This method is relatively secure, and the timing is more controllable.

However, for friends in mainland China, the delivery time will be slightly longer, usually taking 3 to 4 days, and it may even reach 4 to 5 days. Therefore, to ensure that the letter can be received by the court before the July 15 deadline, it is best to send the letter out before July 9. If you wait until July 10 or later to send it, there is a significant risk that it may be considered overdue, rendering the objection invalid.

Regarding the content that needs to be included in the objection letter itself, there are mainly two parts:

A formal letter to the judge: This letter expresses your position against the motion, explaining your reasons and basis for disagreement. This is the core part and needs to clearly articulate your objections.

Certification of Service: This is a document that proves you not only sent the letter to the court but also sent it to several other parties simultaneously. This step is crucial as it demonstrates that you have followed the complete service process, and the judge will use this to determine whether your opinion is compliant and valid.

Currently, I have established a coordination group on Telegram for opposing the motion, and there are now over 400 creditors joined, nearing 500. In the group, I shared a letter template I wrote myself and detailed the operational process for everyone's reference. I also recorded a video showing the materials included in the four letters I sent and what the format looks like, helping everyone to understand the entire process more intuitively.

Will's template for the rights protection letter

BlockBeats: Did you not collaborate with other creditors to send the letters together?

Will: At first, I did consider whether to submit the objection in a "joint voice" manner, organizing a group of people to co-sign and initiate together. I even collected some information in the group, such as everyone's claim IDs and account information on FTX, with the intention of gathering more voices to enhance representation.

However, after communicating with some legal professionals around me and consulting a few lawyers familiar with U.S. bankruptcy procedures, I received important feedback: the effectiveness of the objection letter does not necessarily correlate with the number of signatories. In other words, even if more people co-sign, it does not automatically enhance the legal validity of the letter; rather, it may lower the judge's or lawyers' recognition of its professionalism due to differing opinions and mixed content.

So I began to shift my strategy, emphasizing "diversity" rather than "centralized unity." I also observed that in the discussions within the group, some viewpoints I found reasonable might not persuade others; conversely, some perspectives I did not fully agree with resonated with other members in the group. This diversity of voices is actually an advantage.

Therefore, I now encourage members in the group to write their letters independently and express their thoughts and positions—everyone can voice their opinions as long as they do not make obvious procedural errors. This approach is more effective in terms of breadth and representation.

As of the time of your interview with me, I roughly counted that there are about 15 creditors I am aware of who have completed sending their letters. Although their positions and expressions vary, and there have even been debates and disagreements in the group, I think that is fine. As long as everyone can clearly express their viewpoints, this multi-point effort strategy is actually more beneficial for the entire Chinese creditor community.

BlockBeats: What do you think the chances of success are?

Will: I am relatively optimistic; I always believe there is a chance for success in this matter. But to be honest, seeing how this motion has developed to such an outrageous extent today, it is actually hard to predict what direction it may take in the future. While I still hold hope, I must admit that anything could happen. All we can do is our best, and let the process determine the outcome.

BlockBeats: When will the final result be announced?

Will: Theoretically, it will be on July 22.

BlockBeats: Have there been any cases where a community proposed an objection motion that was accepted by the judge?

Will: I have not systematically studied all similar cases, so I am hesitant to give a particularly definitive judgment. But I know that there are many creditor communities overseas, not just Chinese users who are paying attention to this matter. For example, there is a French creditor in our group who has already received compensation, but he still believes this motion is very unfair. Out of a pursuit for fairness, he has been continuously following up and actively helping others in the group with suggestions, even assisting other creditors in modifying materials and providing substantial help.

He has previously proposed many motions covering various aspects. Another creditor representative I know is currently a very influential figure in the FTX creditor community, and he is very active on Twitter. He has consistently opposed the use of "dollarized" settlements in the FTX liquidation plan, advocating for compensation based on the original asset. He has united a group of people and submitted motions multiple times to protest, continuously pushing for the right to speak.

From what I currently understand, it seems that FTX has begun to be willing to communicate with him. This also indicates that as long as we take continuous action, it is possible to receive a response.

So for us, this action is not just a simple opposition to this one motion. We will also proactively propose more motions in the future, such as demanding that FTX immediately pay eligible claims; if they continue to delay, they must compensate for the waiting period, such as providing additional compensation or calculating interest.

The losses incurred during this blank period are essentially caused by the liquidators, so they should bear the responsibility. While I am not sure about the acceptance rate of previous motions, our future strategy is very clear: we will continue to propose more well-founded motions to fight for our rightful rights.

In fact, the way we are proposing motions now is not the most forceful approach. The most powerful way should be to have a seat on the creditors' committee. In fact, I considered this issue early on when the incident first occurred—because at that time, I was relatively one of the larger creditors and had attempted to run for a seat on the creditors' committee.

At that time, we had a group with several creditors who had even larger claims, some of whom were ranked in the top 30 or top 20, all very important participants. But their initial attitude was very clear: they were unwilling to reveal their identities or show up. So during the election, everyone chose to take a step back. Instead, my lawyer encouraged me to step forward, so I signed up and entered the subsequent phone interview stage. However, I was ultimately not selected.

After that, I did not actively participate anymore, but I have always kept this matter in mind. About a year later, a member of the creditors' committee exited because they no longer held claims. According to the rules, committee members must continuously hold their claims and cannot transfer or sell them; otherwise, they lose the qualification to represent other creditors. I guess they might have thought the recovery price at that time was decent, so they chose to exit.

Later, they sent me an email asking if I would like to be placed on the waiting list. I immediately replied that I was willing. I have always believed that there should be someone among us creditors to voice our concerns, not out of any noble intention, but out of self-interest. I hope this process can be well supervised to ensure that the entire compensation process proceeds smoothly and that I can ultimately get back my rightful share.

However, I was not selected in the end, and I did not continue to follow up. But my mindset is actually the same as many of the friends in the group now—since the asset recovery has made significant progress and repayment is on the agenda, there is no reason to deviate from the course. Everyone is actually waiting for the process to complete and to get back their rightful share of money. In fact, being too frequently concerned can easily lead to emotional setbacks.

It was precisely because of this that when I saw this motion, I was really shocked and had to stand up.

Why is the FTX debt so popular?

BlockBeats: Can you share some current situations in the creditor community you are in with the readers?

Will: Actually, most of the friends do not have legal assistance. I have always had a legal team following up; I have a long-term cooperating lawyer in New York, and he also brought in a lawyer who specializes in bankruptcy matters to help me with related issues. As soon as I received the motion documents, I immediately contacted them. However, it coincided with a U.S. holiday, and they replied that they needed time to study the case and would contact me after the holiday.

But I felt that just waiting was not a solution, so I decided to take action myself. This morning, I have already sent out the objection letter to the judge and the other four relevant parties. At the same time, I also wrote them an email expressing my desire to arrange a phone meeting as soon as possible. I told them that I hope to communicate at the earliest opportunity—on one hand, I want them to help me formally submit the objection motion in the system to ensure the process is complete; on the other hand, I also want to hear their more professional opinions to assess the direction of this matter.

In addition, there are one or two friends in our group who are in North America, one in California and two in Canada, and they have also been trying to contact lawyers recently. But I think their chances of catching up this time are slim. Because you first need to find a suitable lawyer, then sign a contract, and let the other party spend time studying the case. If they are not specifically lawyers who handle such cases, it will be very tight for them to complete these preparations before July 15.

BlockBeats: Some creditors suggest selling their claims to compliant addresses. What do you think of this claim transfer proposal? Is it a better choice for these small creditors?

Will: First of all, I have no prejudice against the buying and selling of claims. On the contrary, I think that to some extent, this actually provides an exit channel for those creditors who urgently need money, which has its positive significance.

However, what I find unacceptable are some so-called "claim agents" or intermediaries, especially a considerable number of them are from our country, who play a very negative role in this process. They continuously sell anxiety to the community, creating panic through various means, thereby driving down the claim prices. In such an environment, many already anxious friends are forced to sell their claims at low prices, which I find very unethical.

I am just an ordinary person, and I am doing my best to hope that things can move in a reasonable and fair direction. But if one day I find that the situation has really gone off track, what I might do is sell my claims.

But the problem is that the current situation has become very unfair. Why can't we, the original creditors, receive the final compensation? And those who bought claims at a discount can receive full or even higher compensation? Why should the arbitrage opportunities be left to them instead of allowing us original creditors to maximize our interests?

What makes me feel even more unfair is that there is a very key but easily overlooked clause in this motion—it states in very small print: if a third-party institution buys your claim, your original country of holding will no longer be considered when determining compensation eligibility. In other words, once this motion is passed, it will artificially create an arbitrage space. Chinese creditors are like being driven away, with no choice but to sell their claims. If someone buys, you have to sell, while the buyer may enjoy compensation eligibility due to policy arrangements.

BlockBeats: How big is this arbitrage space?

Will: A conservative estimate might be between 20% to 30%. In the FTX bankruptcy liquidation, claims are calculated with an annual interest accumulation of 9%, so how much can ultimately be recovered will also depend on the time dimension and the scale of the assets recovered. Additionally, FTX still has multiple lawsuits that have not yet concluded, and the funds recovered in the future are also likely to be redistributed to creditors.

So, for me, this entire arrangement seems extremely unfair. The arbitrage space is transferred to those who "take over midway," while the original creditors not only face pressure to sell but may also lose the rights that should belong to them.

BlockBeats: If what you say is true, if this motion unfortunately passes, is there still a possibility for Chinese creditors to recover funds through some "off-the-books" method, such as transferring claims to overseas individuals who can then claim compensation on their behalf? Is this path operationally feasible?

Will: I have heard that there are indeed some similar custodial schemes now, where creditors can entrust their claims to a third party, who will then handle the asset recovery operations on their behalf. Of course, the custodian will charge a certain percentage as a fee for their services.

If it really comes to the point of having to sell the claims, I actually considered selling when the claim price was still at 80% and communicated with several claim institutions. However, the communication process at that time was not smooth, and I judged that there were some potential risks, so I ultimately did not proceed.

I personally believe that if one really has to choose to sell their claims, it is best to seek mature and trustworthy institutions to handle it. In fact, there are not many truly powerful buyers or mature claim institutions in this market; their communication with the court and trustees is also smoother. If it comes to that, including the friends in the group asking me today, my advice would be to sell, but also to unite as much as possible to negotiate a relatively reasonable price or find a suitable channel and partner to ensure this step is taken smoothly.

BlockBeats: Can creditors now sell their claims for more than 100% of the claim value?

Will: It has always been over 100%, even reaching 120% to 130%.

BlockBeats: In that case, wouldn't that be more suitable than direct compensation?

Will: Direct compensation would definitely yield more, which is why there is this space. I can give you a simple calculation to clarify this logic.

Assuming the principal is 100%, according to the current compensation plan, creditors can not only recover the full principal but also receive interest at an annualized rate of 9%. Based on the timeline, it has been nearly three years since the event occurred, and at a 9% annualized rate, the interest over three years would be approximately 27%—meaning a total recovery of around 127%.

If the compensation period continues to extend, the interest will continue to accumulate, and this does not even consider the potential additional assets that may be recovered and redistributed. In other words, this is an almost certain, relatively stable income path—9% annualized returns in the traditional financial system are already a very attractive product.

This is also why so many professional securities firms and institutions are willing to buy FTX claims at a discount. They are not only looking at the current recovery ratio but also the potential for additional returns in the future.

For these claim institutions, there is already a huge information gap between them and ordinary creditors. Early on, I was actually continuously following this matter and could feel that they were indeed getting a lot of internal information much earlier in the process of acquiring claims.

For example, at that time, the quotes for claims in the market were constantly changing, with some buying at 40% or 50%, while others offered over 80%. This indicates that these institutions had already begun large-scale layouts from very early on. From what I understand, some of the largest credit-related financial institutions may have invested hundreds of millions of dollars, expecting to recover around $2 billion in assets.

Moreover, they have more complex financial operation paths. For instance, if they can ultimately achieve a 9% annual return, they can package these claims into financial products and sell them to users or institutional investors at a 5% yield. For them, this creates a stable and low-risk arbitrage space.

It is precisely because of the existence of this structural arbitrage space that the FTX claims market appears particularly "attractive." The key is that the base amount of these claims is very large. In the traditional financial market, it is indeed possible to achieve a stable return of around 5% through purchasing U.S. Treasury bonds, but finding an investment target that is both high-yielding and stable, and can accommodate hundreds of millions of dollars, is extremely rare.

BlockBeats: Looking back on this rights protection process, what do you think the biggest challenge has been? What costs and resources have you invested in this rights protection effort?

Will: From the perspective of financial investment, the cost of this matter itself is not high. I have always had lawyers handling related affairs to ensure that the entire process can proceed smoothly. So although everyone sees me speaking out front, it is not out of a motive of "I want to represent everyone," but because my own core interests are deeply tied to this.

Currently, the main investments are legal fees and related expenses for preparing materials, but this part of the cost is relatively controllable and not large. The real investment has been in time and energy.

In the past few days, I have been working on this matter almost day and night. First, I must get the message out, so I started actively contacting the media, and some KOL friends helped with sharing. I need to frequently release information, respond to everyone, and maintain continuous public attention, which has taken up a lot of my time and energy.

Second, I need to maintain the normal operation of our community. New members join every day, and I have almost become a customer service representative, constantly educating them about relevant knowledge. Because the entire motion process is relatively complex, many new friends initially feel very confused, especially some creditors who are in the country and have limited English proficiency; they struggle to understand the English materials we prepared and may even back off because of it.

At this time, we not only have to play the role of "information guides" but also act as "psychological supporters." On one hand, we need to let them know that we are ready, and the process is not complicated; on the other hand, we need to soothe their emotions, encourage them to move forward, and make them realize that they are not fighting alone.

For me personally, this period should have been relatively relaxed; I had originally planned to take a vacation, travel, or exercise to relax. But now I am almost sitting in front of the computer all day, constantly preparing materials, answering questions, and maintaining communication, which has indeed required a lot of time and energy.

BlockBeats: If the court maintains the restrictions after the hearing on July 22, what are your next plans?

Will: If this motion is ultimately passed, there are actually two more stages we can respond to.

The first is a 45-day objection period. During this time, creditors can still intervene through lawyers, including attending hearings, submitting materials, or taking other legal actions.

At the same time, we can also pay attention to whether the liquidators will appoint lawyers specifically handling Chinese affairs during this period. This "regional lawyer" plays a very critical role—if we can contact this lawyer and communicate his views and judgments through video or other means, we can assess whether his opinions align with the current reality and whether there is an opportunity to seek compensation within the existing framework.

So after the hearing on July 22, I believe the next actions should mainly focus on three points:

First, we need to quickly get lawyers involved to prepare possible responses;

Second, closely monitor the other party's movements, especially whether they will announce further operational details or appoint a legal team representing Chinese creditors;

Third, if the situation further deteriorates, such as the hope for compensation basically vanishing, we need to start preparing for "loss mitigation," such as considering claim transfers or discounted sales. This is like in the market; if you judge that a certain coin is about to plummet, you can only choose to sell in time.

BlockBeats: What advice do you have for those Chinese creditors who have not yet taken action?

Will: I believe that submitting materials before July 9 is still feasible. The next actions can be divided into two paths: first, if possible, try to seek professional legal assistance; second, if it is temporarily impossible to hire a lawyer, you can also choose to submit an objection letter in your personal name. The cost of sending a letter is not high; even if sent from within the country, it only costs a few hundred yuan. The key is to act quickly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。