How do these platforms strike a balance between stringent financial regulations, complex technological implementations, and enormous market opportunities?

Written by: Aiying Research

The tokenization of Real-World Assets (RWA) is no longer a self-indulgent futuristic narrative within the blockchain community, but a financial reality that is unfolding. Particularly with the tokenization of stocks, as financial technology giants like Kraken and Robinhood enter the fray, this blockchain-driven structural transformation has already begun. For the first time, global investors have the opportunity to trade "digital stocks" of companies like Apple and Tesla in a nearly frictionless manner, 24/7. However, beneath the market's clamor, deeper questions urgently need answers. Following the previous report "From Retail Paradise to Financial Disruptor: A Deep Dive into Robinhood's Business Landscape and Future Strategy," Aiying aims to penetrate the surface of market hotspots and deeply analyze the underlying logic of current mainstream stock tokenization products. We will no longer stay at the level of "what is," but focus on "how to achieve" and "where the risks lie," providing our clients, investors, developers, and regulators with a reference map that combines depth and practical value.

Aiying will conduct a deep comparative analysis using two typical cases—xStocks, representing the "open DeFi" path (issued by Backed Finance and traded on exchanges like Kraken), and Robinhood, representing the "compliance walled garden" path—supplemented by the practices of key industry participants like Hashnote and Securitize, to explore a core question:

How do these platforms balance stringent financial regulations, complex technological implementations, and enormous market opportunities? What paths have they chosen, and what fundamental differences exist in their underlying logic and compliance design? This is the core that this report aims to reveal.

I. Core Analysis (I): Compliance's "Tightening Spell" and "Amulet"—The Underlying Logic of Two Mainstream Models

The primary challenge of stock tokenization is not technology, but compliance. Any attempt to "move" traditional securities onto the blockchain must confront the complex global financial regulations. In the long-term game with regulators, the market has quietly differentiated into two distinctly different compliance paths: 1:1 asset-backed security tokens and derivative contract tokens. The underlying legal structures and operational logics of these two models are vastly different, determining their product forms, user rights, and risk characteristics. Below, we will break them down one by one.

Model One: xStocks—Embracing the Open Path of DeFi

Core Definition: The tokens held by users (for example, TSLAX representing Tesla stock) legally represent ownership or rights to real stocks (TSLA) either directly or indirectly. This is a "true" stock's mapping on the blockchain, pursuing asset authenticity and transparency.

Legal Structure and Market Performance

Aiying believes that xStocks' compliance design is sophisticated, with its core being to maximize legal risk avoidance through multiple layers of legal entities and a clear regulatory framework while embracing the openness of blockchain.

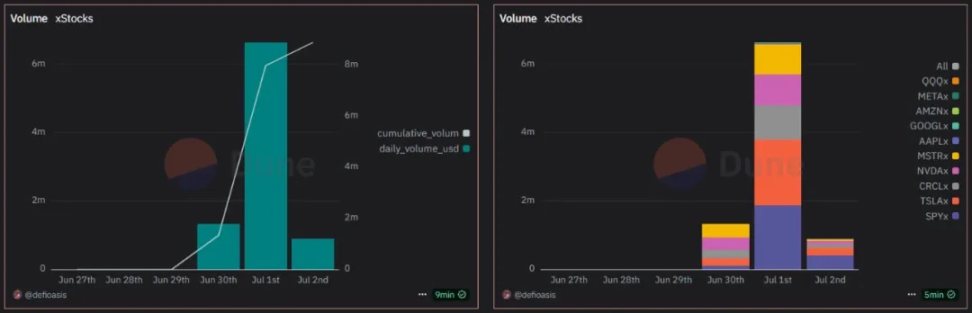

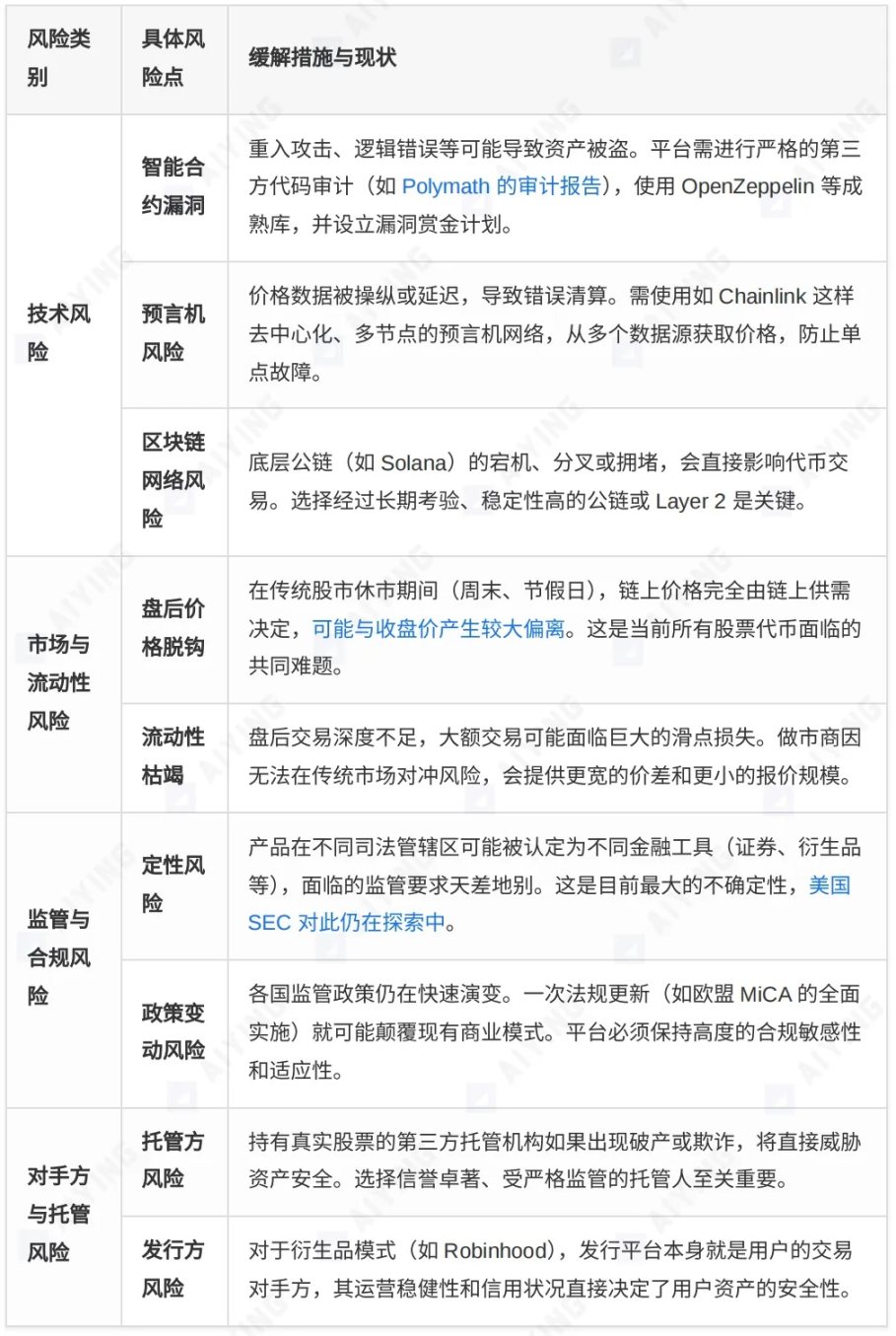

Currently, xStocks supports 61 stocks and ETFs, with 10 having generated on-chain transactions, showing initial market vitality. After being supported by Bybit and Kraken, its trading volume has seen explosive growth, reaching $6.641 million in daily trading volume as of July 1, with over 6,500 trading users and more than 17,800 transactions.

Issuing Entity and Regulatory Framework:

xStocks is issued by the Swiss company Backed Finance, and its operations comply with the Swiss DLT (Distributed Ledger Technology) Act. Switzerland was chosen as the legal base due to its relatively clear and friendly regulatory environment for digital assets and blockchain innovation.

Special Purpose Vehicle (SPV):

This is the cornerstone of the entire structure. Backed Finance has established a special purpose vehicle (SPV) in the stable legal and tax environment of Liechtenstein. This SPV acts like an "asset vault," with the sole function of holding real stocks. This design achieves critical risk isolation: even if the platform where users trade (like Kraken or Bybit) or the issuer encounters operational issues, the underlying assets held in the SPV remain safe and independent.

Asset Support and Liquidity Strategy

To ensure the value and credibility of on-chain tokens, xStocks has established a transparent asset support and dual-track liquidity system.

1:1 Pegging (1 Coin = 1 Share):

Each xStock token circulating on-chain strictly corresponds to one real stock held in a third-party custodian. This 1:1 pegging relationship is the core of its value proposition. Currently, the total number of stock tokens for NVIDIA, Circle, and Tesla has exceeded 10,000.

Issuance Process:

Qualified professional investors can apply for a Backed Account to purchase stocks through Backed. Backed acts as a primary investor, buying stocks from brokers, which are then held by a third-party custodian. Finally, xStocks mints the corresponding number of tokens based on the number of stocks purchased and returns them to the primary investors. These primary investors can issue and redeem stock tokens at any time.

Proof of Reserve:

Transparency is the cornerstone of trust. xStocks integrates with the industry-leading oracle network Chainlink PoR. This means anyone can query and verify Backed Finance's reserve vault on-chain in real-time and independently, ensuring that the number of real stocks held is sufficient to support all issued tokens.

Dual-Track Liquidity Strategy:

- Centralized Exchange (CEX) Market Makers:

On mainstream exchanges like Kraken and Bybit, professional market makers provide liquidity, ensuring users can buy and sell xStocks as conveniently as trading ordinary cryptocurrencies.

- Decentralized Finance (DeFi) Protocols:

xStocks tokens are open, allowing users to deposit them into DeFi protocols on the Solana chain (such as lending platforms and DEX liquidity pools), providing liquidity themselves and earning returns. Currently, xStocks has partnered with DEX aggregator Jupiter and lending protocol Kamino to fully leverage DeFi's composability, creating additional value for assets. For example, the SP500 (SPY) token, which has the highest trading volume, has reached $1 million in USDC-based liquidity on-chain.

The xStocks ecosystem is composed of the issuer Backed, trading platforms Bybit and Kraken, and the underlying blockchain Solana.

Model Two: Robinhood—Compliance-First "Walled Garden"

Core Definition: Completely different from xStocks, the stock tokens purchased on the Robinhood platform do not legally represent stock ownership but are financial derivative contracts tracking the price of specific stocks signed between the user and Robinhood Europe. Their legal essence is over-the-counter (OTC) derivatives, and the on-chain tokens are merely digital certificates of the rights to this contract.

1. Legal Structure and Technical Implementation

Aiying's team finds that Robinhood's model is a very pragmatic form of "regulatory arbitrage," cleverly packaging the product as an existing financial tool with a clear regulatory framework and deploying it rapidly at a very low cost.

Issuing Entity and Regulatory Framework:

These tokens are issued by Robinhood Europe UAB, an investment company registered in Lithuania and regulated by its central bank. Its products are regulated under the EU's MiFID II (Markets in Financial Instruments Directive II) framework. According to MiFID II, these tokens are classified as derivatives, thus circumventing more complex securities issuance regulations.

Low-Cost Rapid Deployment:

Robinhood has deployed 213 stock tokens on the Arbitrum chain at a total cost of only $5.35 (on-chain gas fees), demonstrating the high efficiency of utilizing Layer 2 technology. Among these, 79 tokens have set up metadata, preparing for subsequent trading.

Pioneering Attempts:

Robinhood boldly made the first attempt at tokenizing stocks of unlisted companies, launching tokens for OpenAI and SpaceX, aiming to seize opportunities in the high-value private equity sector. Currently, Robinhood has minted 2,309 OpenAI (o) tokens. (The OpenAI token will provide investors with an indirect investment opportunity in OpenAI through Robinhood's ownership in the SPV, linking the price of the OpenAI token to the value of the OpenAI shares held by the SPV.)

2. "Walled Garden" Style Technology and Compliance Design

Robinhood's technical implementation is closely tied to its compliance strategy, together constructing a closed but compliant ecosystem.

On-Chain KYC and Whitelisting:

Through reverse analysis of Robinhood's stock token smart contracts, community developers discovered that its contracts embed strict permission controls. Every token transfer operation triggers a check to verify whether the receiving address is registered in Robinhood's maintained "approved wallet" registry. This means that only EU users who have passed Robinhood's KYC/AML can hold and trade these tokens, thus forming a "walled garden."

Limited DeFi Composability:

The direct consequence of this "walled garden" model is that its stock tokens can hardly interact with the vast, permissionless DeFi protocols. The on-chain value of the assets is firmly locked within Robinhood's ecosystem.

Future Plans (Robinhood Chain):

To better serve its RWA strategy, Robinhood plans to develop its own Layer 2 network—Robinhood Chain—based on the Arbitrum technology stack, demonstrating its ambition to control the underlying technology.

Although Robinhood's model has found a compliance path within the EU framework, it has also sparked considerable controversy and potential risks.

"Fake Equity" Controversy:

The most representative incident is the launch of its OpenAI and SpaceX tokens. Shortly after, OpenAI officially stated that it had no partnership with Robinhood and clearly pointed out that these tokens do not represent company equity. This incident exposed the significant risks of the derivative model in terms of information disclosure and user perception.

Centralization Risks:

The security of users' assets and the execution of trades entirely depend on the operational status and credit of Robinhood Europe. If issues arise on the platform, users will face counterparty risks.

3. Summary of the Two Models

Through the above analysis, we can clearly see the fundamental differences between the two models. The xStocks model is closer to the open spirit of Crypto Native and DeFi, while the Robinhood model seeks a "shortcut" within the existing regulatory framework.

Key Points

The path of xStocks is "asset on-chain," attempting to authentically and transparently map the value of traditional assets into the blockchain world, embracing open finance. In contrast, Robinhood's path is "business on-chain," using blockchain as a technological tool to package and deliver its traditional derivative business. Aiying understands this as essentially a "CeFi" (centralized finance) blockchain upgrade.

II. Core Analysis (II): The "Game of Ice and Fire" in Technical Architecture—Open DeFi vs. Walled Garden

Under the compliance framework, the technical architecture serves as the skeleton for realizing product vision. Aiying believes that the differences in technology selection and component design between xStocks and Robinhood also reflect their two different philosophies of "openness" and "closure."

1. Choice of Underlying Public Chain: The Triangle Game of Performance, Ecology, and Security

Choosing which public chain to use as the "soil" for asset issuance is a strategic decision concerning performance, cost, security, and ecology.

xStocks Chooses Solana:

Its core motivation is to pursue extreme performance. Solana is known for its high throughput (theoretical TPS of tens of thousands), low transaction costs (usually below $0.01), and sub-second transaction confirmation speeds. This is crucial for stock tokens that need to support high-frequency trading and real-time interaction with complex DeFi protocols. However, historical network outages have also exposed its challenges in stability, which is a risk that comes with choosing Solana.

Robinhood Chooses Arbitrum:

Arbitrum is an Ethereum Layer 2 scaling solution, and the logic behind its choice is "standing on the shoulders of giants." By adopting Arbitrum, Robinhood not only gains higher performance and lower costs than the Ethereum mainnet but also inherits Ethereum's unparalleled security, large developer community, and mature infrastructure. Additionally, Robinhood has announced plans to migrate to its own Layer 2 network based on Arbitrum technology, specifically optimized for RWA, showcasing its long-term strategic ambitions.

Comparative Analysis: This is not simply a question of "who is better," but a reflection of strategic paths. Solana is a monolithic chain pursuing "integrated high performance," while Arbitrum represents a "modular" path that inherits Ethereum's security. The former is more aggressive, while the latter is more stable.

2. Core Technology Component Analysis

In addition to the underlying public chain, several key technology components together constitute the core functions of stock tokenization products.

Smart Contract Design:

- xStocks (SPL Token):

As a standard token (SPL) on Solana, its smart contract design allows for free transfer, similar to ERC-20 on Ethereum. This open design is the technical foundation that enables seamless integration with DeFi protocols (such as being used as collateral on the Kamino lending platform).

- Robinhood (Permissioned Token):

As mentioned earlier, its contract embeds transfer restriction logic. Every transaction calls an internal whitelist registry for verification, which is the technical core of its "walled garden" model and the fundamental reason for its isolation from open DeFi protocols.

The Key Role of Oracles (Using Chainlink as an Example):

- Price Information:

The value of stock tokens needs to remain synchronized with real-world stock prices. Oracles (such as Chainlink Price Feeds) act as data bridges, securely and decentralizedly feeding stock prices from multiple reliable data sources to smart contracts, which is vital for maintaining price anchoring, executing trades, and performing settlements.

- Proof of Reserve (PoR):

This is crucial for products like xStocks that are 1:1 pegged. Through Chainlink PoR, smart contracts can automatically and periodically prove the sufficiency of their off-chain reserve assets to the outside world, solving the trust issue at the code level, which is far more timely and persuasive than traditional audit reports.

Cross-Chain Interoperability (Using Chainlink CCIP as an Example):

- Value:

As a multi-chain landscape forms, the cross-chain capability of assets becomes crucial. Cross-chain interoperability protocols (CCIP) allow assets like xStocks to be securely transferred between different blockchains (e.g., from Solana to Ethereum). This can break down inter-chain silos, greatly expanding the liquidity pool and application scenarios of assets, and is a key technology for realizing the vision of "one token, universal across chains." Backed Finance has mentioned using Chainlink CCIP in its products to achieve cross-chain bridging.

3. Detailed Explanation of Asset On-Chain and SPV Operations

For asset-backed tokens, the SPV is the key hub connecting real-world assets and the blockchain world. Its operational process is rigorous and interconnected, ensuring the security and compliance of assets.

- Asset Isolation:

The issuer (such as Backed Finance) first purchases real stocks in a compliant financial market (such as the NYSE). These stocks are not placed on the issuer's balance sheet but are stored in an independent, regulated special purpose vehicle (SPV) and held by a third-party licensed custodian (such as a bank).

- Token Minting:

After the SPV and custodian confirm the deposit of real assets, they send a verified instruction to the smart contract on-chain, authorizing the minting of an equivalent number of tokens on the target blockchain (e.g., minting 100 TSLAX tokens for depositing 100 shares of TSLA).

- Token Distribution:

The minted tokens are distributed through compliant exchanges (such as Kraken) or directly sold to qualified investors who have passed KYC/AML checks.

- Lifecycle Management:

During the token's existence, the issuer must handle corporate actions through smart contracts and oracles. For example, when Tesla distributes dividends, the SPV receives the dividends, triggering the smart contract to distribute equivalent stablecoins or tokens to on-chain holders. If there is a stock split, the smart contract automatically adjusts the number of tokens held by all holders.

- Redemption & Burning:

When qualified investors wish to redeem, they send the on-chain tokens to a designated burn address. After verification by the smart contract, the SPV is notified. The SPV then sells the corresponding number of real stocks in the traditional market and returns the cash obtained to the investors. Meanwhile, the on-chain tokens are permanently destroyed, ensuring that the on-chain circulation and off-chain reserves always maintain a 1:1 balance.

III. Core Analysis (III): Business Models and Risk Assessment—The "Hidden Reefs" Behind Opportunities

Behind the complex compliance and technical architecture lies a clear business logic. Stock tokenization platforms not only create unprecedented value for users but also open new profit channels for themselves. However, opportunities and risks always go hand in hand.

1. Business Models and Sources of Profit

Although both provide stock token trading, the profit models of different platforms have their own focuses.

Robinhood's Sources of Revenue:

- Clear Revenue:

According to its official statement, Robinhood primarily charges a 0.1% foreign exchange (FX) conversion fee for trades by non-Eurozone users. This fee is incurred when users purchase dollar-denominated tokens using euros.

- Potential Revenue:

While currently emphasizing "zero commission" to attract users, its business model has scalability. In the future, it may introduce profit methods similar to its traditional U.S. stock business, such as payment for order flow (PFOF, although strictly regulated in the EU), membership value-added services for high-frequency traders, or earning from the underlying assets held.

- Expanding into Private Equity Markets:

By issuing tokens for non-listed companies like OpenAI and SpaceX, Robinhood has expanded into high-value asset categories, which is not only a powerful user acquisition strategy but may also lead to profits through related value-added services (such as information and trade matching) in the future.

xStocks (Kraken & Backed Finance) Sources of Revenue:

- Trading Fees:

As one of the core trading platforms, Kraken charges a certain percentage of trading fees from both buyers and sellers of xStocks, which is the most traditional profit model for exchanges.

- Minting/Redeeming Fees:

Backed Finance, as the issuer, primarily serves institutional clients. It may charge a service fee for large minting and redeeming operations conducted by institutional users to cover the costs of purchasing, custody, and managing the underlying assets.

- B2B Services:

Backed Finance's core business model is to provide a one-stop asset tokenization (Tokenization-as-a-Service) solution for other financial institutions. xStocks is both its product and a demonstration of its technical strength.

2. Comprehensive Risk Assessment Matrix

While investors enjoy the convenience brought by stock tokenization, they must be acutely aware of the various risks lurking behind it.

III. Market Landscape and Future Outlook: Who Will Dominate the Next Generation of Financial Markets?

Various platforms in the asset tokenization space are competing for market share with different strategic positions. Understanding their differences helps us gain insight into the future direction of the industry.

1. Major Player Matrix Comparison

In the RWA tokenization space, numerous players have emerged, forming a distinctive competitive landscape based on different strategic considerations. We categorize the main players into three major camps for in-depth comparison.

2. Market Trends and Evolution Path

Looking ahead, stock tokenization and the entire RWA space are showing several clear trends:

- From Isolation to Integration:

Early tokenization projects were often isolated attempts within a single platform. Now, the trend is shifting towards deep integration with mainstream financial institutions (such as BlackRock and Franklin Templeton) and the broader DeFi ecosystem. Tokenized assets are becoming a bridge connecting TradFi and DeFi.

- Regulation-Driven Innovation:

Clarification of regulations is the strongest catalyst for market development. The EU's MiCA legislation, Switzerland's DLT law, and Singapore's Monetary Authority's "Guardian Program" are all providing clearer rules for the market, which in turn encourages more compliant innovation. Compliance capability is becoming a core competitive advantage for platforms.

- Institutional Entry and Product Diversification:

As BlackRock brings trillions of dollars from the money market into blockchain through its BUIDL fund, institutional participation will inject unprecedented liquidity and trust into the market. The types of products will also expand from single stocks and bonds to more complex structured products, private equity, and alternative assets.

- Private Equity Tokenization as a New Blue Ocean:

Platforms represented by Robinhood are beginning to explore the tokenization of non-listed company stocks, opening a window into the private equity market, which is typically limited to institutions and high-net-worth individuals. Although facing significant challenges in valuation, information disclosure, and legal aspects, this is undoubtedly a new direction with great potential.

Future Outlook and Reflections

The wave of stock tokenization is unstoppable, but the road ahead is not without obstacles. Several core issues will determine its final form:

Open vs. Closed Debate:

Will the future market be dominated by open, composable models like xStocks, or will the compliant but closed "walled garden" model of Robinhood prevail? More likely, both will coexist in the long term, serving different risk preferences and user needs. Crypto Native users will embrace the open DeFi world, while traditional investors may prefer to experiment within familiar, regulated "gardens."

The Race Between Technology and Law:

Cross-chain technologies (such as CCIP), Layer 2 solutions, and privacy computing (such as ZK-proofs) will continue to evolve to address current technical bottlenecks in scalability, interoperability, and privacy protection. Meanwhile, whether global legal frameworks can keep pace with technological innovation and provide certainty for these innovations will determine the speed and ceiling of the entire industry's development.

Stock tokenization is far more than a simple "on-chain" of financial assets; it is fundamentally reshaping the paradigms of asset issuance, trading, clearing, and ownership. It promises a more efficient, transparent, and inclusive global financial market. Although this path is fraught with "hidden reefs" of technology, market, and regulation, the future direction it points to is undoubtedly irreversible. For all market participants—whether investors, builders, or regulators—the urgent task is to actively and prudently embrace this impending financial revolution based on a profound understanding of its underlying logic and potential risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。