# I. Outlook

## 1. Macroeconomic Summary and Future Predictions

Last week, the three major U.S. stock indices performed steadily, with the S&P 500 index reaching an all-time high. Technology stocks, especially AI-related companies, showed strong performance, driving the Nasdaq index higher. The expectation of a rate cut by the Federal Reserve in July was weakened by strong employment data, with a 75% probability of a rate cut in September. The Fed may continue to take a wait-and-see approach, focusing on the impacts of trade and immigration policies. Although U.S. stocks have reached new highs, valuation risks cannot be ignored, and market volatility may increase in the coming months. Investors need to closely monitor the progress of trade negotiations and the dynamics of Fed policy.

## 2. Market Changes in the Crypto Industry and Warnings

Last week, most altcoins continued to consolidate, with market funds increasingly concentrated in Bitcoin, raising BTC's market dominance to 65%, indicating that investors prefer safe-haven assets. Despite Bitcoin's strong price, the market has entered a consolidation phase, with technical analysis showing that $109,000 is a key resistance level. In the short term, caution is needed regarding the volatility risks brought by technical resistance and the nature of funds, with significant differentiation in altcoin performance, prompting investors to remain cautious.

## 3. Industry and Sector Hotspots

Led by OKX and co-invested by Aptos, Hyperion is a fully on-chain, natively built hybrid Orderbook-AMM DEX that provides a seamless trading experience for both professional and retail users. Co-invested by Google, the AI smart platform Assisterr aims to enhance customer support efficiency and experience by breaking down the barriers of centralized AI training models through an innovative SLM model.

# II. Market Hotspot Sectors and Potential Projects of the Week

## 1. Overview of Potential Projects

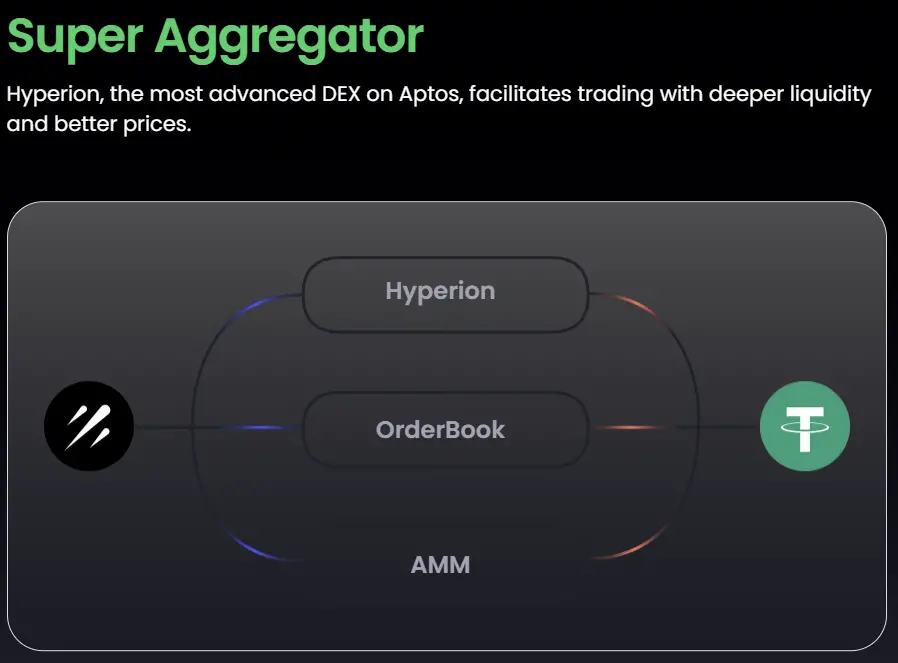

1.1. Analysis of Hyperion, a Fully On-Chain Hybrid Orderbook-AMM DEX Natively Built on Aptos, Led by OKX and Co-Invested by Aptos

Introduction

Hyperion is a fully on-chain hybrid Orderbook-AMM decentralized exchange (DEX) built natively on Aptos, leveraging Aptos's excellent throughput and ultra-low latency to provide a seamless trading experience for both professional and retail users. Hyperion aims to become the foundational trading engine on Aptos, offering competitive liquidity options and an outstanding user experience through its hybrid Orderbook-AMM architecture, serving various types of traders.

Architecture Overview

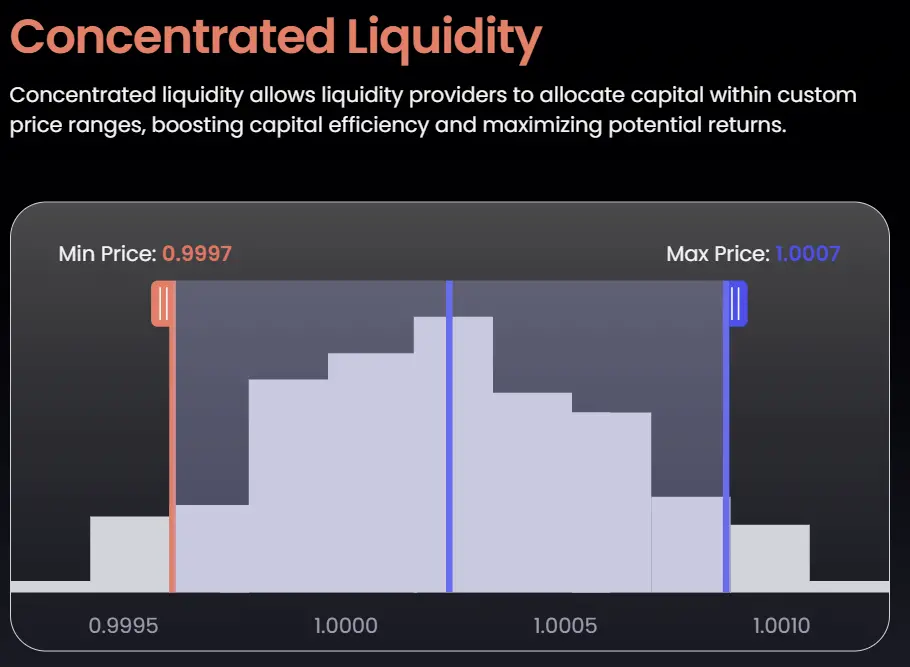

1. Centralized Liquidity

In the automated market maker (AMM) model, prices change continuously, while in centralized liquidity protocols, it is slightly different: prices in centralized liquidity are discrete. The price curve is divided into several "ticks" (price scales), with each tick forming a discrete price space with its adjacent tick. In this price space, for every tick increase or decrease, the price will rise or fall by 0.01% (i.e., one basis point).

Hyperion uses ticks as the boundaries for each liquidity position. When a liquidity position is created, the liquidity provider (LP) sets an upper tick and a lower tick, defining the price range covered by their funds.

As prices fluctuate during trading, the smart contract continuously "consumes" all liquidity within the current tick range until the price moves to the next tick. Upon reaching a new tick, the pool contract immediately switches to that tick and activates all "dormant" liquidity within that price range.

Although each trading pool in a centralized liquidity protocol has the same number of price ticks, in practice, only some ticks are considered "active ticks." The spacing of ticks is related to the fee levels of trading pairs: the lower the fee level, the denser the ticks can be set. In other words, the higher the fee level, the wider the spacing of available price ticks in the pool.

For trading pairs that require higher price precision (such as stablecoin trading pairs), narrower tick spacing is more advantageous. In such trades, a tighter tick distribution helps control price impact, achieving smoother price movements, which is a characteristic needed for stablecoin pools.

2. Fees

Swap Fees in Hyperion's centralized liquidity protocol are proportionally distributed to all active liquidity positions within the current price range. Only those liquidity positions whose set price range includes the current spot price are considered valid liquidity and thus qualify for fee income. If the market price moves outside a position's price range, that position will be converted to inactive status and will no longer earn fees.

Unlike traditional AMM contracts that automatically allocate swap fees to the liquidity pool, centralized liquidity protocols accumulate fees separately, allowing liquidity providers (LPs) to receive their fee income without withdrawing their liquidity.

It is important to emphasize that the Hyperion protocol is entirely composed of a set of automated smart contracts deployed on Aptos, with users directly interacting with the contract functions (such as trading or participating in liquidity pools) to achieve decentralized asset interactions among multiple parties. The protocol's deployers act solely as providers of technical tools and do not offer any securities products or regulated services, nor do they custody user assets, having no further relationship or control over the operation of the protocol itself.

Fee Tiers in Hyperion's centralized liquidity protocol allow for multiple liquidity pools with different fee levels for the same trading token pair. Currently, the protocol allows for the establishment of the following four levels: 0.01%, 0.05%, 0.25%, 1%.

The introduction of a multi-fee rate mechanism helps better meet the actual needs of different types of trading pairs and encourages the market to explore optimal liquidity distribution methods, thereby providing greater flexibility for liquidity providers and traders.

It can generally be expected that different types of token pairs will gradually gravitate towards a certain fee type based on their asset characteristics and the interplay between LPs and traders. For example:

- Low-volatility assets (such as stablecoins) tend to concentrate in the lowest fee pool (0.01%) because these assets have smaller price fluctuations, lower risks for LPs, and most traders prefer their trades to be as close to 1:1 as possible.

- Assets with lower liquidity or high volatility are more likely to cluster in higher fee pools (such as 0.25% or 1%) to compensate for the higher holding risks faced by LPs.

Protocol Fees are extracted from each transaction's swap fees at a default rate of 20% to maintain the healthy operation of the project's economic model and support the long-term sustainable development of the project treasury, used to support the protocol's own development and maintenance.

3. Swaps

In the Hyperion protocol, swap operations support both the automated market maker (AMM) model and the order book (Orderbook) model:

- In the AMM model, swap operations are conducted with passive liquidity pools, and liquidity providers earn fee income based on their provided active liquidity ratio.

- In the order book model, swaps follow the first in, first out (FIFO) principle, where the time of order submission determines the priority of execution.

This dual model provides users with high flexibility, allowing them to freely choose between automated liquidity provision or active order trading based on their trading strategies.

Slippage

To address the uncertainty of price changes, DEXs introduce the concept of slippage tolerance. Users can set their acceptable maximum slippage value, indicating the maximum price change range they are willing to accept. If the final execution price exceeds the user's set slippage tolerance range, the transaction will automatically fail to protect the user's interests.

4. Fee-based Liquidity Mining

In centralized liquidity protocols, only liquidity positions within active price ranges are used for trading, thus generating trading fees. The fee income generated by a liquidity position reflects its effectiveness and actual contribution within the protocol.

Therefore, Hyperion's liquidity mining mechanism has a very unique feature: rewards are distributed based on users' actual fee performance, rather than simply based on the amount of liquidity provided. This means that if a liquidity provider wants to earn more fee income and mining rewards, they need to actively participate and optimize the price range of their liquidity positions.

With the linear release of mining rewards, each time a new trade is executed, the contract will be called to calculate the proportion of fees generated by each liquidity position since the last call in relation to the total pool fees. The released rewards will then be distributed according to the proportion of fees contributed by each position.

This fee performance-based mining mechanism ensures that mining rewards are not diluted by inactive LPs in ineffective price ranges or users who provide "fake liquidity" solely for rewards.

It significantly reduces the costs for protocol parties and third-party projects in incentivizing liquidity and makes Hyperion's TVL (Total Value Locked) more effective and efficient compared to other DEXs.

Commentary

Hyperion's advantages lie in its hybrid Orderbook-AMM decentralized exchange (DEX) architecture natively built on Aptos, combining high throughput and low latency to meet the needs of professional traders for depth and speed while also catering to the usability for retail users; its centralized liquidity design and fee-based mining mechanism effectively enhance capital efficiency and incentive precision; multiple fee tiers and automated income calculations also increase the flexibility of liquidity provision.

On the downside, the complex strategy design and price range management present a higher operational threshold for ordinary users. Additionally, its reliance on the development of the Aptos public chain ecosystem may be limited in the short term by on-chain activity and overall liquidity foundation.

1.2. Interpretation of Assisterr, an AI Smart Platform Co-Invested by Google, Aiming to Enhance Customer Support Efficiency and Experience, and How It Breaks Down the Barriers of Centralized AI Training Models Through Innovative SLM Models

Introduction

AssisterrAI is dedicated to creating a collaborative agent system (Mixture of Agents) centered around SLM and providing no-code development tools, empowering users to build small language models tailored to specific task scenarios. By establishing a decentralized free market focused on peer review, model generation, and data validation, Assisterr forms a self-sustaining, transparent, and sustainable AI gig economy.

Each Assisterr model is governed by a DAO (Decentralized Autonomous Organization) and has independent finances. Once a model is launched in the market, it can obtain datasets, computing power, and task resources through crowdsourcing. The on-chain data source system ensures that the processes of data contribution, validation, and incentivization are traceable and publicly transparent. Ultimately, Assisterr establishes a decentralized SLM factory that powers the vertical AI market.

Architecture Overview

Modular SLM Architectures

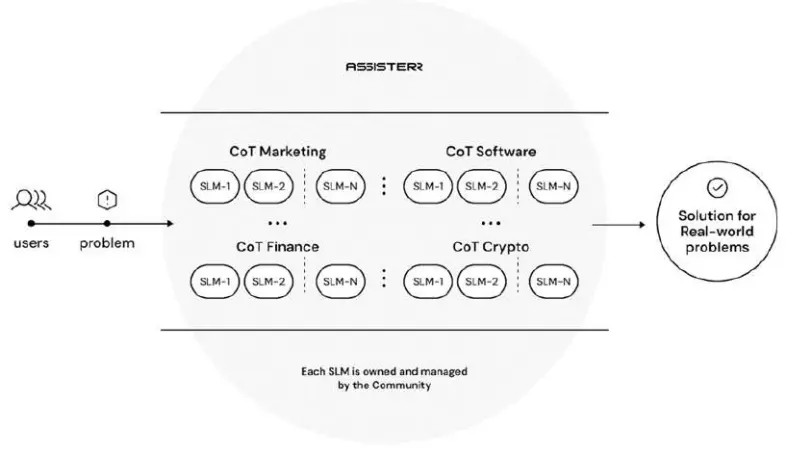

To address the limitations faced by agents based on large language models (LLMs), advanced methods have emerged in recent years, consisting of collaborative agent frameworks made up of multiple small language models (SLMs). By combining SLMs into agentic ensembles, users only need to describe the problem, and the system can analyze, interpret, and ultimately provide the best solution through a series of reasoning processes involving multiple models.

This approach achieves distributed contextual reasoning across multiple mixed, domain-specific models, thereby reducing trade-offs between general reasoning capabilities and deep functional solutions. It provides both breadth (multi-model coverage) and depth (domain focus and efficient execution), allowing the system to selectively call upon multiple participating models.

Thus, this structure is particularly suitable for exploring practical solutions to highly specialized or complex problems.

Currently, two core methods are primarily used in the process of building AI agents from SLM model clusters:

- Mixtures of Experts (MoE)

- Mixtures of Agents (MoA)

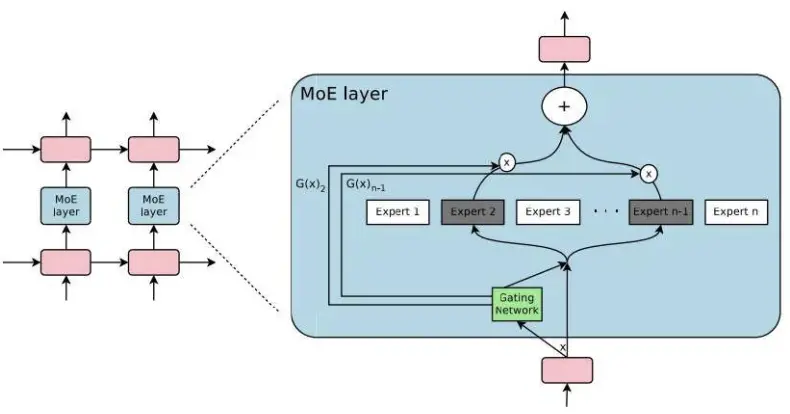

- Mixtures of Experts (MoE)

When small language models are combined in a MoE (Mixture of Experts) structure, the reasoning capabilities of modern SLMs can achieve greater learning flexibility while maintaining functional problem-solving abilities. Through ensemble learning, the system can integrate the reasoning capabilities of multiple small models, each focusing on different contextual domains, to collaboratively solve complex problems.

This structure can produce a hybrid comprehension capability, allowing AI to maintain deep processing abilities. Furthermore, the various "expert layers" of MoE can themselves be composed of multiple MoEs, thereby constructing a hierarchical structure to better address complex contexts and enhance problem-solving capabilities.

A typical MoE architecture includes a sparse gating layer, which dynamically selects several models from multiple parallel networks based on the input, generating the most appropriate response. To achieve more flexible answers, each "expert" model can be fine-tuned for tasks such as code generation, translation, or sentiment analysis.

More complex MoE architectures may contain multiple such MoE layers and be used in combination with other components. Similar to typical language models, the gating layer of MoE also acts on semantic tokens and requires specialized training.

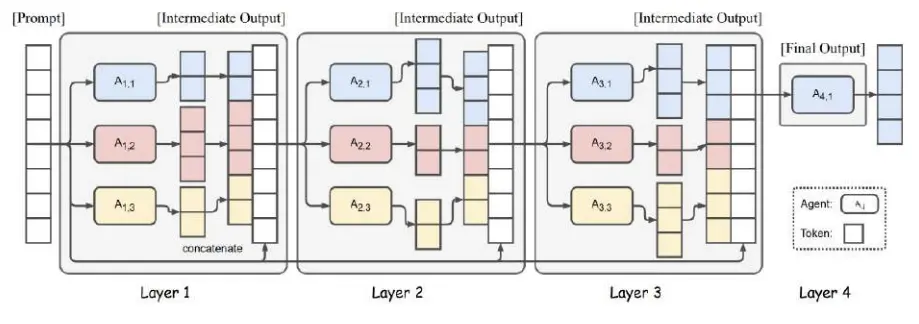

- Mixtures of Agents (MoA)

When SLMs are organized into a MoA (Mixture of Agents) architecture, the model's reasoning capabilities become more diverse and selectable, allowing AI to execute tasks precisely with the desired methodology. Agent models are assembled into a collaborative alliance, enhancing task processing efficiency and the ability to solve complex problems through hierarchical execution protocols, enabling AI to adapt to multi-domain use cases.

A group of agents can collaborate sequentially, iteratively optimizing previous results in each round. The MoA architecture has significantly outperformed large model performance in multiple evaluations. For instance, even among open-source models, MoA's performance exceeded the 57.5% accuracy of GPT-4 Omni on AlpacaEval 2.0.

The Mixture of Agents (MoA) operates at the model output level, rather than at the semantic token level. It does not use a gating layer, but instead sends text prompts in parallel to all agent models for processing.

The output of MoA is not aggregated through weighted summation and normalization, but rather the outputs of multiple agents are directly concatenated, then combined with a synthesize-and-aggregate prompt, and passed to another independent model to generate the final output.

In this architecture, models are divided into two types of roles:

- Proposers: Responsible for generating diverse preliminary outputs

- Aggregators: Responsible for integrating these results and outputting the final answer

Similar to MoE, the MoA architecture can also stack multiple such hierarchical structures. Since MoA does not rely on a gating layer, it becomes an attractive architectural option—it allows multiple small models to be flexibly combined into more complex systems, offering greater modularity and portability.

AssisterrAI: Technology and Ecosystem

AssisterrAI is the product of the fusion of two major trends in the future of AI.

The first trend is: shifting from expensive, general-purpose large language models (LLMs) to smaller, domain-focused small language models (SLMs). As LLMs gradually reach their peak in innovation, SLMs, as their domain-specialized "lightweight" versions, will become the mainstream direction for the future.

The second trend is: decentralization of AI training, reasoning, and data ownership, to build a fair and open AI gig economy system.

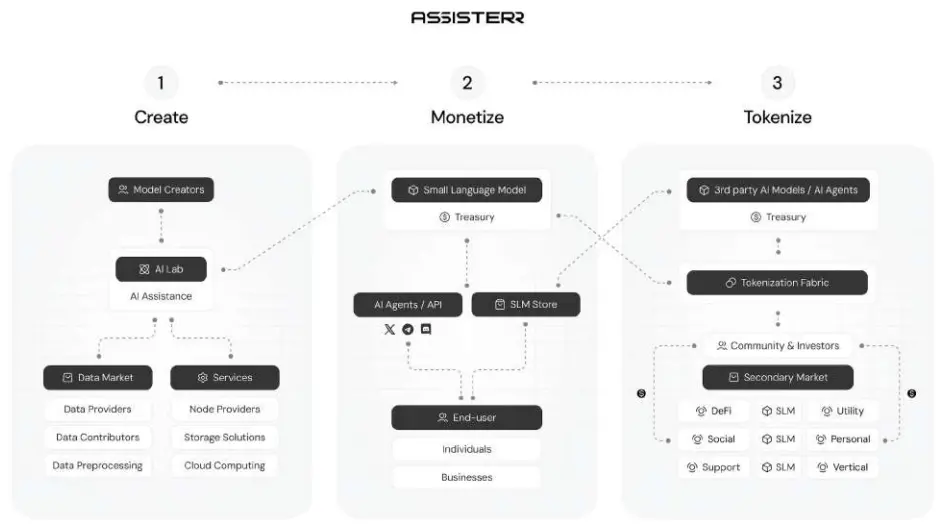

In addition to these two core innovations, the Assisterr ecosystem will also provide a framework to support users in building agentic AI and passive chatbots. The following diagram illustrates the structure of the Assisterr platform, covering the entire process from model creation to its practical application in the decentralized AI economy.

SLM Store

In Assisterr, contributors will be rewarded at every stage of the AI model's lifecycle, from inception to release, including data contribution, model creation, validation, and review processes. This revenue-sharing mechanism will be implemented through an SLM tokenization module.

Assisterr's AI Lab will also effectively connect commercial application scenarios with the required data and expertise.

Once a model is launched in the "SLM Store" tab of the Assisterr interface, any user can query it through the chatbot interface. Currently, the SLM Store supports model agent bots covering multiple verticals, including the Web3 ecosystem, healthcare, software development, and finance.

Each model listed in the SLM Store is equipped with a treasury priced in Assisterr's native token. Each time a user initiates a query, the system deducts a certain amount from their account balance to automatically replenish that model's treasury.

Additionally, users can query models not only through a web user interface connected to a Solana wallet but also via API interfaces, allowing models in the SLM Store to be integrated and called by other applications.

Contributors will be able to create SLMs (small language models) through a no-code interface, assemble them into agent models, and complete deployment. This approach offers creators a rapid market launch cycle and efficient innovation iteration process.

It effectively addresses the challenges faced by independent model developers in distribution and monetization.

As shown in the diagram above, each SLM deployed in the market can participate in the MoA (Mixture of Agents) architecture.

Since these model clusters can integrate reasoning and problem-solving capabilities across multiple models, they bring broader application opportunities. This not only allows models created by contributors to be used as independent solutions but also enables them to become components with specific functions within larger systems.

This mechanism further expands the usage scenarios of models, thereby enhancing contributors' potential to earn rewards.

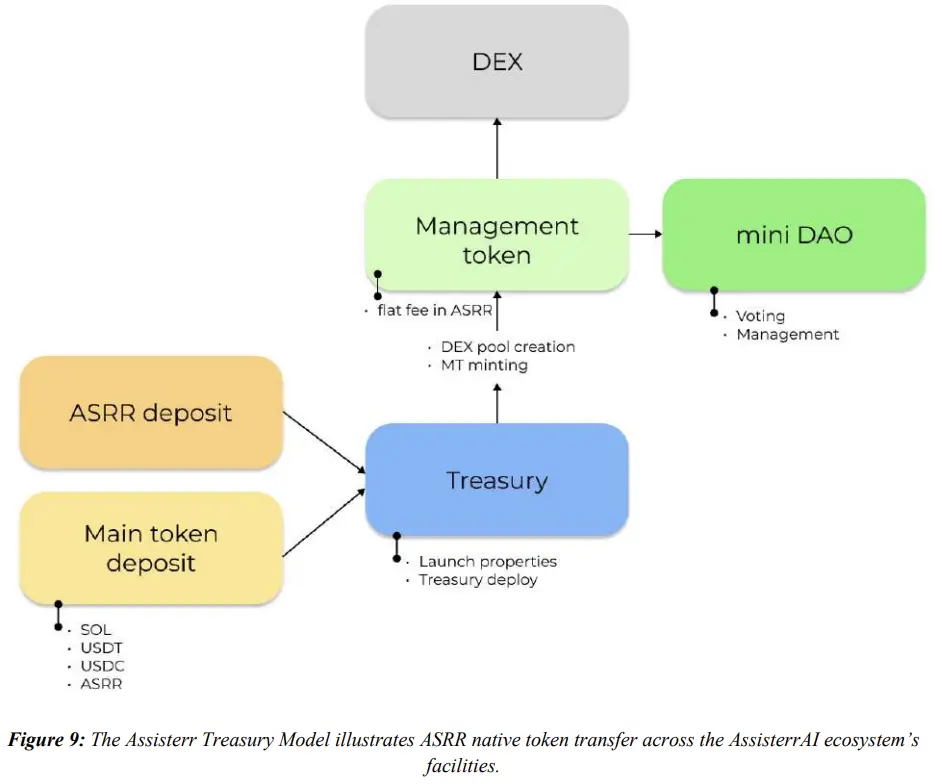

Assisterr Treasury Model

The native token of Assisterr is the core medium supporting the operation of the AssisterrAI ecosystem. At every stage of the SLM development process, this token will be used under smart contract protocols to validate user behavior and serve as the transactional unit for interactions.

By using this token, participants within the ecosystem can access various platform functionalities, such as:

- Using products and services

- Paying related fees

- Participating in the creation, management, and monetization processes of SLMs

The operation of the Assisterr token across the platform's functional modules is based on the Assisterr Treasury Model (ATM), as shown in the diagram. This model has the following characteristics:

- Adaptable to various application scenarios

- Supports flexible governance mechanisms

- Provides an expandable treasury structure

- Achieves a fair incentive distribution system

The execution of this model is divided into three consecutive stages, covering the entire lifecycle management of SLMs.

Summary

Assisterr's advantage lies in its core focus on small language models (SLM), building a decentralized, task-driven AI gig economy system that integrates on-chain verification, modular agent architecture (MoA), data crowdsourcing, and governance DAO, providing an open, transparent, and sustainable collaborative platform for model developers, data contributors, and users. Its no-code tools and token incentive mechanisms significantly lower the barriers to participation, accelerating model iteration and commercial deployment.

On the downside, as the ecosystem is still in its early stages, the platform's model performance and data quality are highly dependent on the community's self-organization effectiveness, and complex mechanisms such as cross-chain operations, MoA architecture, and on-chain verification may present certain understanding and integration challenges for new users or developers.

2. Key Project Details of the Week

2.1. Detailed Explanation of the $20 Million Financing Led by Cyberfund for OneBalance, a Platform Focused on Providing One-Stop APIs for Rapid Development of One-Click Crypto Products

Introduction

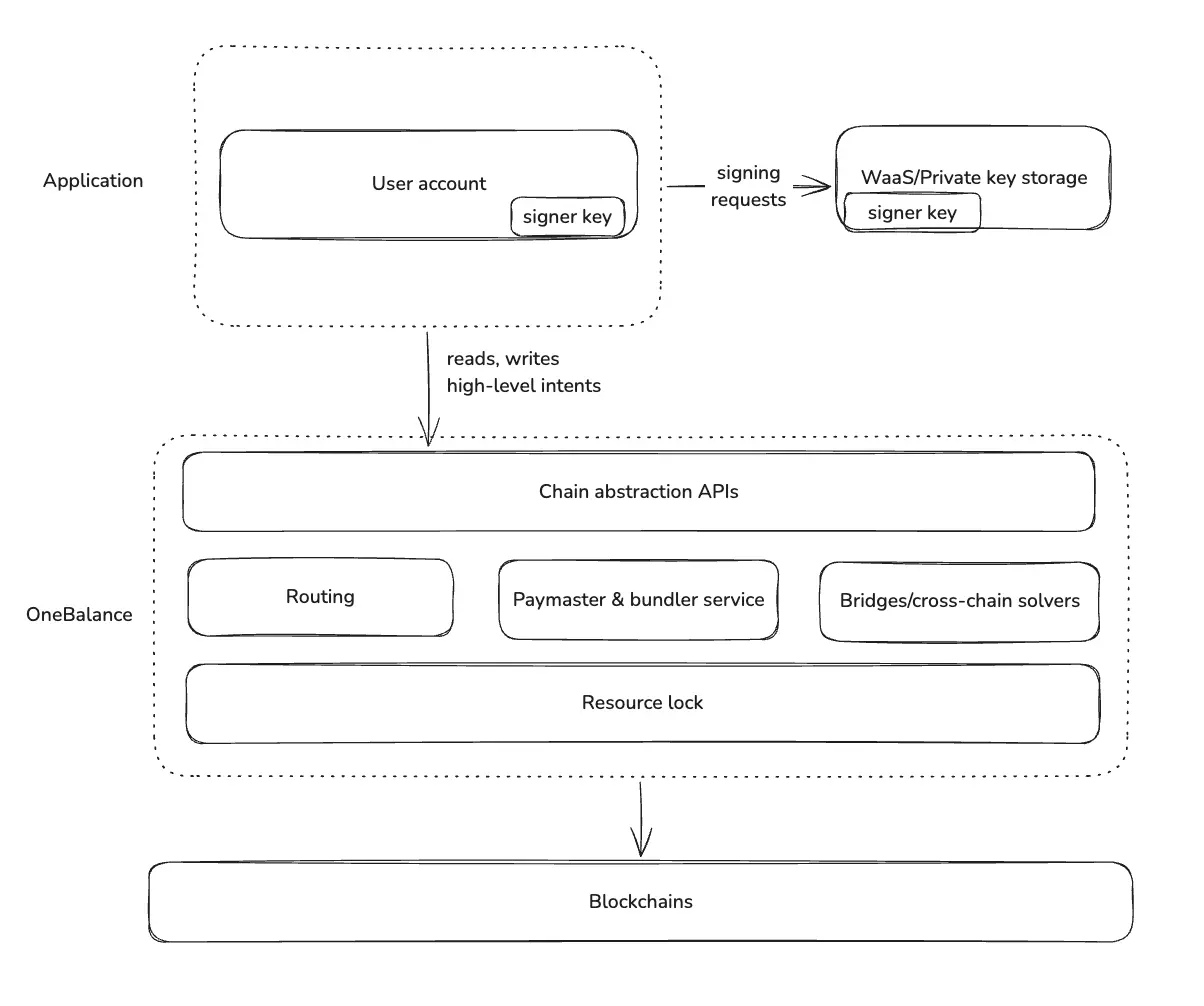

OneBalance is a framework for creating and managing "Credible Accounts." Credible Accounts are an extension of existing account formats (such as externally owned accounts, smart accounts, and stateful accounts) that enable these accounts to make credible commitments without requiring global consensus.

- Feature Analysis

A. Toolkit Integration

In most cases, when using the OneBalance toolkit, applications only need to specify a high-level intent, and the toolkit will convert it into actual transaction payloads for the client to sign. The routing in the chain abstract intent includes:

- Determining the best spending chain based on the user's balance distribution across different chains

- Assessing whether cross-chain bridging is needed to fulfill the intent or if it can be executed on the same chain

- Executing the minimum bridging amount required for the intent

- Identifying which solver/packager can provide the best execution price

- Determining whether a payer is needed or if the user will cover the transaction fees themselves

The OneBalance toolkit is compatible with embedded signature providers (such as Turnkey and Privy) and also supports applications that directly access signing keys (such as Web3 wallets and centralized exchanges).

The toolkit uses gas fee abstract accounts compatible with all chains, so users do not need to worry about paying gas fees. For more information on specific account options, please refer to the relevant sections.

Resource Locks and Fast Paths

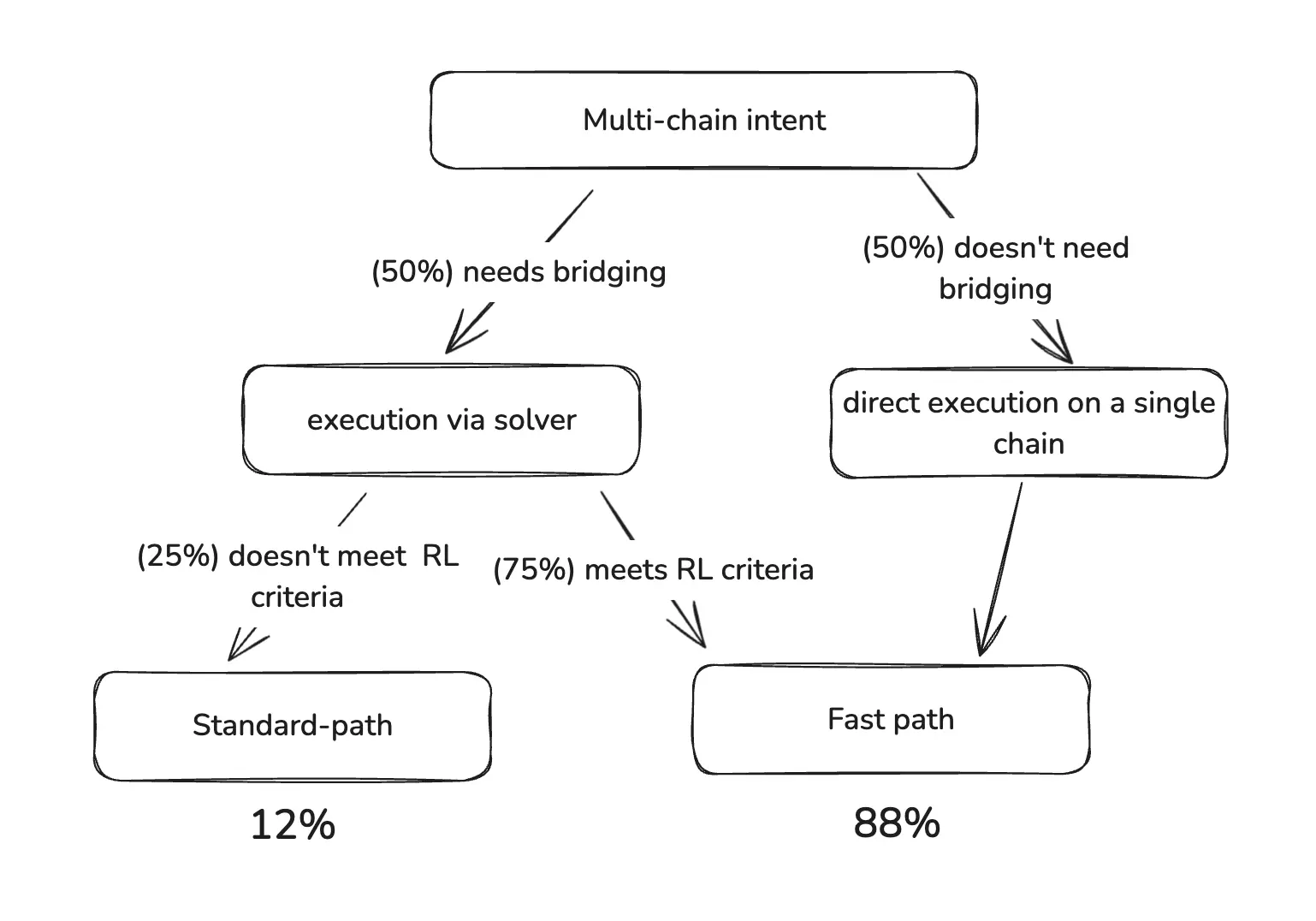

The concept of resource locks introduced by OneBalance in early 2024 significantly enhances multi-chain transaction efficiency.

Specifically, it allows for asynchronous execution of multi-chain intents, separating the completion of intents from settlement, making multi-chain transactions feel like same-chain transactions for users.

Once applications enable resource locks through the toolkit, all user transactions will be co-signed (queued) by OneBalance, preventing double spending during the asynchronous multi-chain execution process.

For detailed workings of resource locks and their impact on cross-chain bridging speed, please refer to the resource lock concept page. Terminology definitions can be found in the glossary.

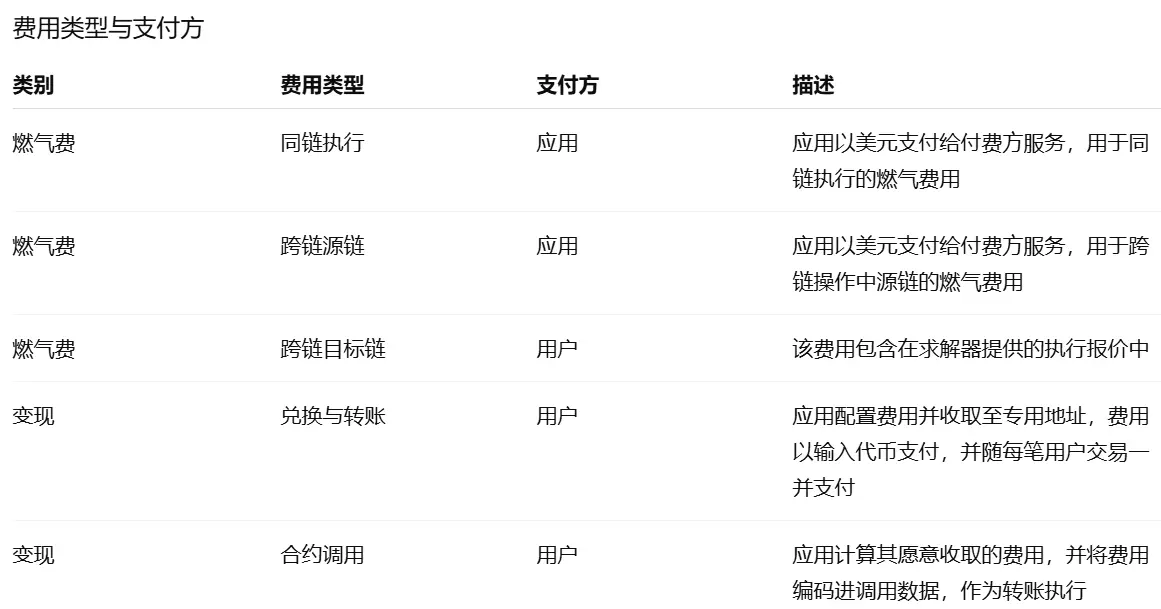

Monetization

From the outset, applications can define flexible user transaction fees, supporting configuration by chain and transaction type. The fees paid by users are used to:

- Offset the gas fees subsidized by the application

- Generate a stable and flexible source of income, with fees settled alongside each user transaction, directly transferred to the application wallet.

- Core Elements

- Transaction Lifecycle

- Transaction Types and Attributes

- Swap and Transfer

Swap and transfer any tokens on any supported chain. - Contract Call

Execute smart contract calls on any chain, using aggregated balances for payment while keeping the sender unchanged. - Fast Path and Standard Path

Fast paths are used for cross-chain execution, eliminating source chain transaction delays.

Standard paths are the basic sequential execution method for cross-chain transactions.

- Swap and Transfer

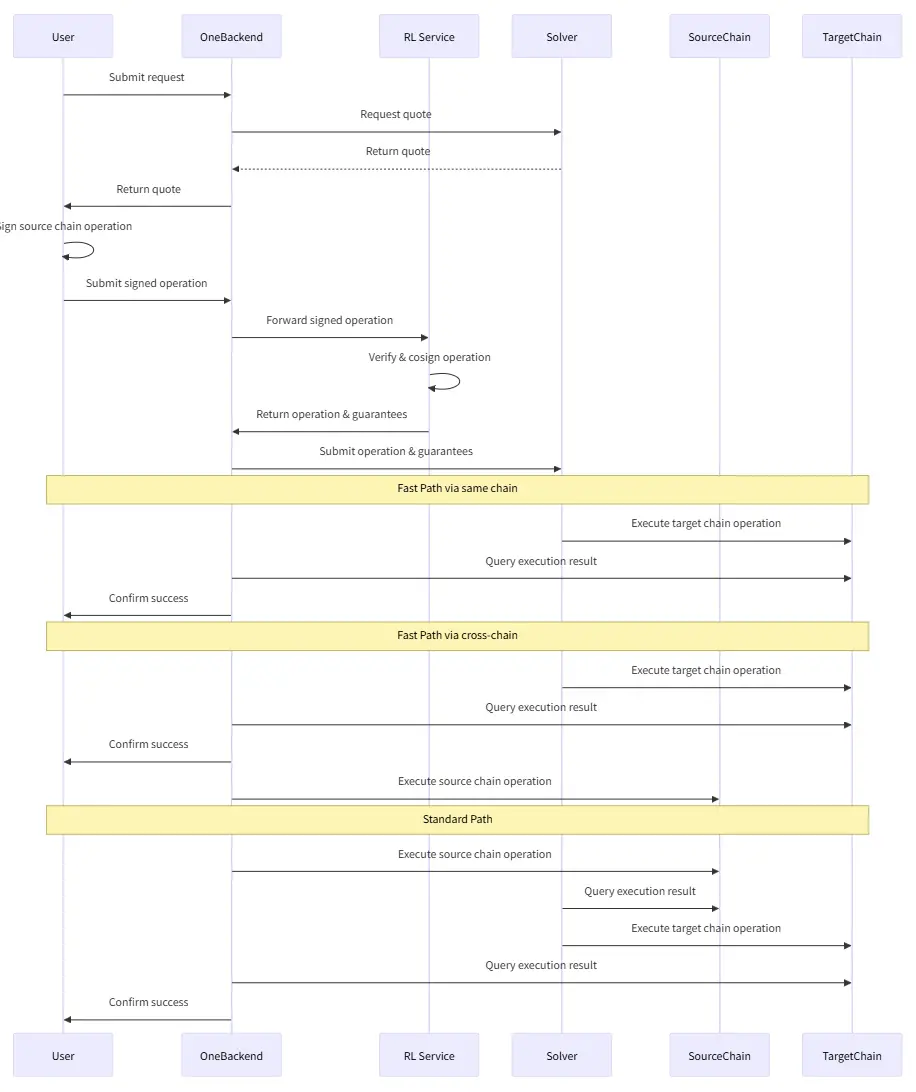

- Execution Process Details

- Initial Request Phase

The user submits an intent (e.g., swapping ETH aggregated across chains for SOL on Solana).

OneBackend processes the request, executing routing and other optimizations.

Note that funds can be spent from multiple chains within the same intent without affecting the process. Our service will assess the available funds on each chain and whether they are suitable for fast path or standard path execution. - Providing Quotes

The solving system provides a quote that includes prices covering gas fees and swap fees.

After receiving the quote, the user decides whether to proceed.

The user signs the operation with their session key and returns it to OneBackend. - Verification and Security Phase

OneBackend forwards the signed operation to our Resource Lock (RL) service.

The RL service verifies the user request and provides a security proof.

Based on the security status, the transaction will follow one of the following paths:

Fast Path: Same-chain execution

Fast Path: Cross-chain execution (instant execution with security guarantee)

Standard Path: (executed after hosted transaction confirmation)

Execution Phase

OneBackend submits the operation and security guarantee to the solver, and the execution process will follow one of the three paths:

Fast Path (Same-chain)

Fast Path (Cross-chain)

Standard Path

The standard path follows traditional sequential execution and is used when fast path conditions are not met. Since it requires waiting for the final confirmation from the source chain, the standard path is typically at least twice as slow as the fast path.

The execution process is as follows:

- OneBackend executes the operation on the source chain

- The solver verifies the execution result on the source chain

- The solver executes the operation on the target chain

- OneBackend verifies the execution result and confirms success to the user

Fast Path Execution Conditions

Multi-chain intents can use the fast path if they meet any of the following conditions:

- Routing is on the same chain, or

- All of the following conditions are met simultaneously:

- The user has sufficient confirmed and unapproved on-chain balance (cross-chain aggregation), and that balance has not been locked (spent but not settled)

- There are no source chain swaps in the execution process

- The Resource Lock (RL) service, according to risk policies, has not exceeded the total unsettled position limit

b. Resource Locks

Resource locks are OneBalance's innovative solution that enables fast cross-chain transactions by eliminating final confirmation wait times and preventing double spending, thus achieving key improvements in speed, reliability, and cost efficiency.

Resource locks allow cross-chain transactions to execute at the speed of the target chain while providing cryptographic guarantees and reducing operational costs through optimized settlement models.

How Resource Locks Work

Resource locks are managed by OneBalance's RL service, responsible for the following four key functions:

- Verification

Validating the user's on-chain balance and locked balance - Joint Signing

Adding signatures to operations to ensure control over account state changes and prevent double spending - Providing Guarantees

Issuing security proofs to the solver for instant delivery, even though settlement may be delayed - Tracking Positions

Ensuring that unsettled balances comply with risk policies, maintaining system integrity

This system supports asynchronous execution, separating the fulfillment of intents from settlement, significantly enhancing user experience.

Key Advantages

- Speed: Near-instant execution

Traditional cross-chain transactions require waiting for final confirmation from the source chain (which typically exceeds 12 minutes on Ethereum). Resource locks provide instant execution guarantees through cryptographic joint signing, eliminating this wait. - Reliability: Guaranteed settlement

Unlike intent-based systems that may fail due to solver unavailability or market conditions, resource locks ensure that operations can be successfully completed with mathematical certainty. - Cost Efficiency: Optimized Economics

Resource locks support transaction batching and optimal routing decisions, significantly reducing the total costs for users and applications conducting cross-chain operations.

Types of Resource Locks

Resource locks are mainly divided into two categories:

- Account-based locks — Implementing locks at the account level, seamlessly compatible with existing user processes and wallets.

- Custodial locks — Not locking accounts but implementing through custodial smart contracts, where users deposit tokens into the contract to support cross-chain operations.

Currently, OneBalance primarily uses account-based locks to achieve the best user experience and compatibility.

Once resource locks are enabled, transactions can only be sent through the OneBalance Toolkit; otherwise, double spending cannot be prevented in an asynchronous execution environment.

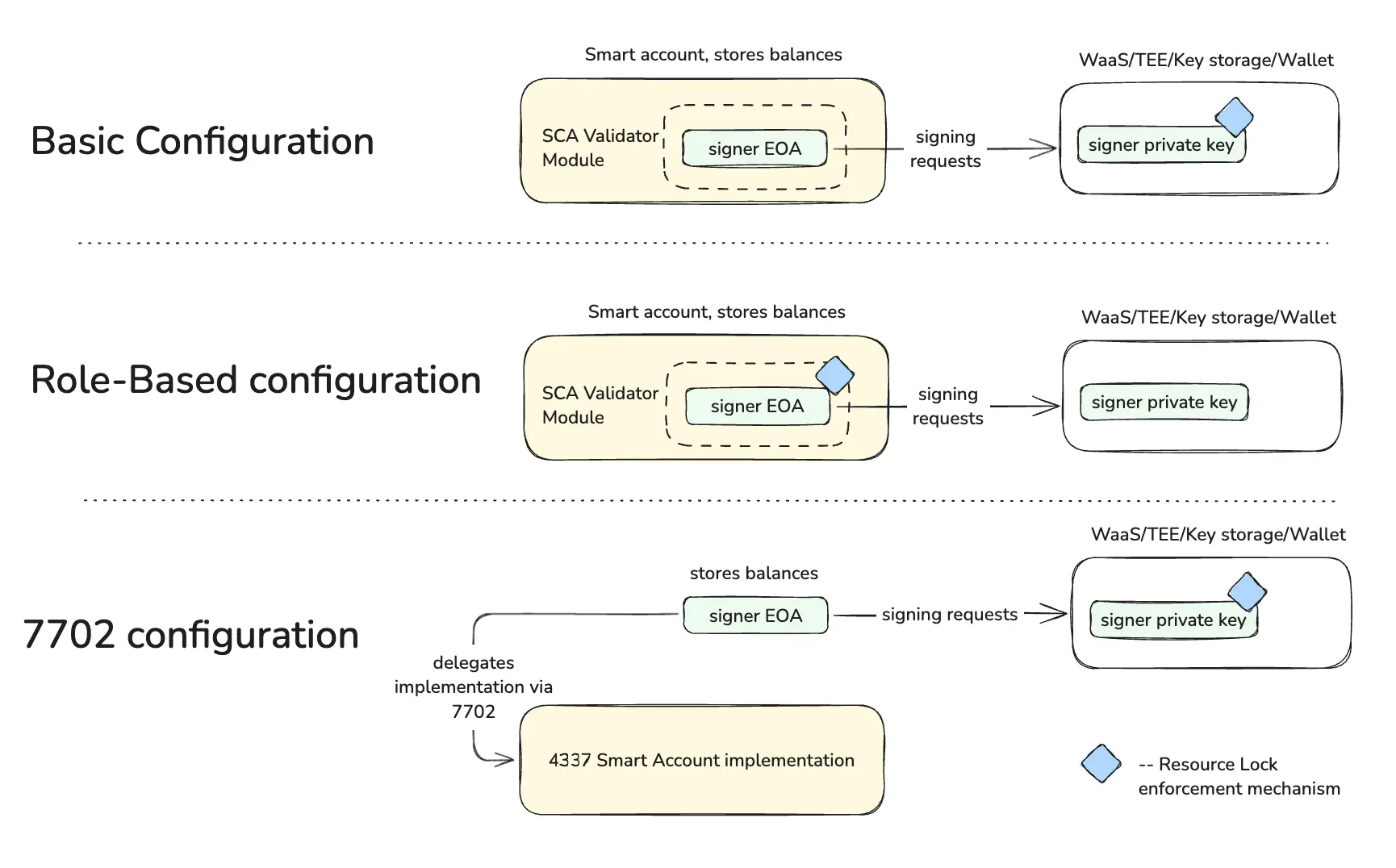

c. Account Model

Understanding OneBalance's account model and its functionalities.

EVM-Compatible Configurations (See Table Below)

OneBalance supports a modular architecture designed to be compatible with various account types. It is also willing to support other account versions based on demand or recommend the most suitable account type for your application.

d. Account Component Description

The OneBalance account system consists of several key components that can be used in different combinations:

- Validators are responsible for identity verification, access control, and permission management.

Validators are a module of smart accounts. - Account Versions are optimized for different deployment methods in smart contract implementation.

- Deployment Type refers to how accounts are initialized, directly affecting user deposit (account) addresses.

- Resource Lock supports fast path cross-chain execution, requiring gating at the account/signature level.

Supported Validator Types

Validators are responsible for validating transactions and managing account access permissions:

- ECDSAValidator (default) uses the standard Elliptic Curve Digital Signature Algorithm (ECDSA) for authentication, compatible with most existing wallet infrastructures.

- RoleBasedValidator allows the establishment of a user_admin role (similar to a user cold wallet), coexisting with the signer role for key rotation and executing trustless "rage quit" (quick exit) in emergencies.

Supported Smart Account Versions

- Kernel 3.1 compatible with: ECDSAValidator and RoleBasedValidator

A multifunctional version supporting various validator types, widely compatible with different configurations. - Kernel 3.3 optimized for: EIP-7702 deployment using ECDSAValidator

A dedicated version designed to improve gas efficiency by leveraging the latest EIP-7702 standard.

e. Fees and Monetization

OneBalance enables applications to monetize services through a transparent and flexible fee structure. This page explains how fees work, who pays them, and how to configure fees for your application.

Users pay a consolidated fee to the application, and the Toolkit helps the application handle the underlying gas fees and paymaster costs.

f. Aggregated Assets

Aggregated assets are OneBalance's solution for representing a single unified asset across multiple blockchain networks for the same token. Instead of managing USDC on Ethereum, USDC on Polygon, and USDC on Arbitrum separately, you can directly use one aggregated asset, ds:usdc.

How Aggregated Assets Work

When you operate with an aggregated asset (like ds:usdc), OneBalance automatically:

- Aggregates your balances of that token across all supported chains

- Optimizes routing to spend from the chain with the highest transaction efficiency

- Automatically handles bridging when cross-chain operations are needed

- Provides unified pricing and fiat value calculations

Supported Aggregated Assets

Each aggregated asset includes:

- Unique ID: such as ds:usdc or ds:eth

- Symbol and Name: identifiers for easy recognition

- Decimal Places: the precision of the aggregated asset

- Constituent Assets: specific on-chain tokens that make up the aggregated asset

Summary

OneBalance's advantages lie in its cross-chain aggregated asset management and unified account system, greatly enhancing user convenience and efficiency, supporting automatic aggregation and optimized routing of multi-chain assets, and reducing the complexity and cost of cross-chain operations. Its innovative resource lock mechanism enables fast and secure cross-chain transactions, preventing double spending and improving user experience and system reliability. Additionally, the flexible account model and transparent fee structure provide highly customizable support and profitability for applications.

On the downside, OneBalance's complex technical architecture presents a high integration and understanding threshold, and some features are still under development, which may affect short-term stability and applicability.

### Industry Data Analysis

1. Overall Market Performance

As of November 1 (Eastern Time), the total net outflow of Ethereum spot ETFs was $10,925,600.

1.1. Spot BTC vs ETH Price Trends

BTC

Analysis

This week's support levels: $108,300 (first line), $107,300 (second line), $105,200 (third line).

This week's resistance levels: $110,400 (first line), $112,000 (second line).

ETH

Analysis

This week's support levels: $2,530 (first line), $2,470 (second line), $2,380 (third line).

This week's resistance levels: $2,630 (first line), $2,680 (second line).

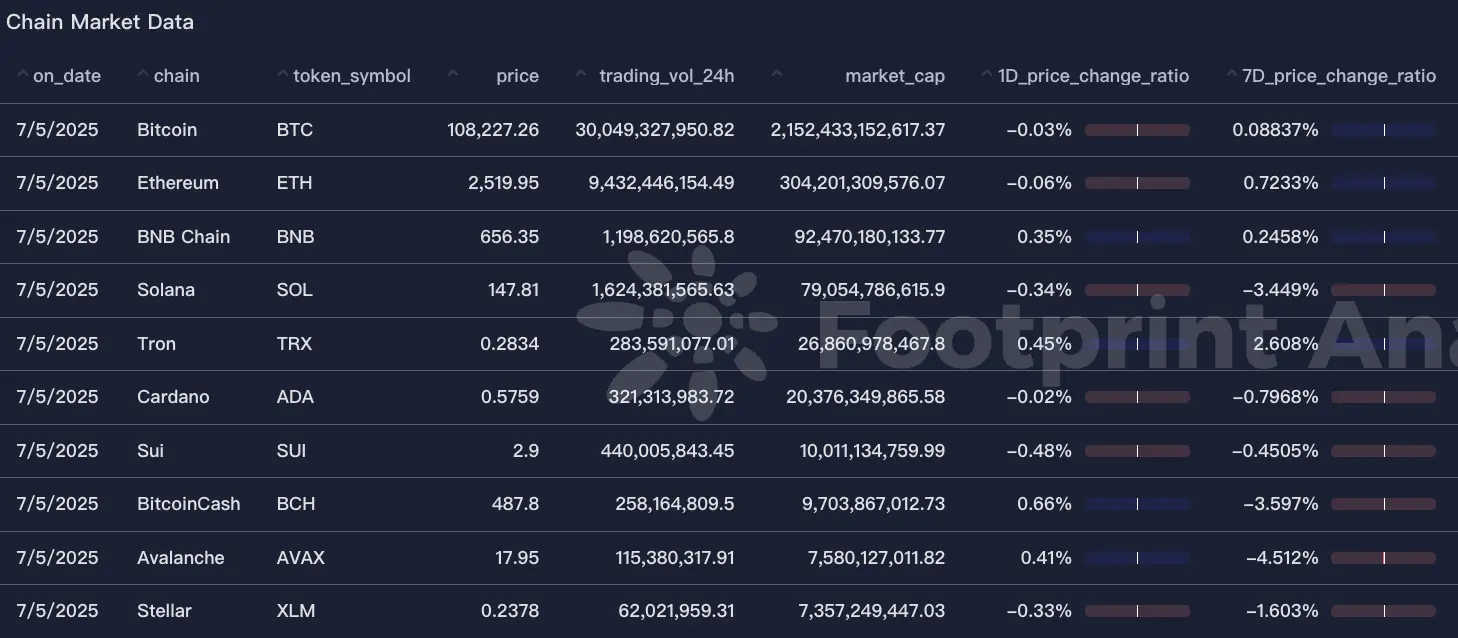

2. Public Chain Data

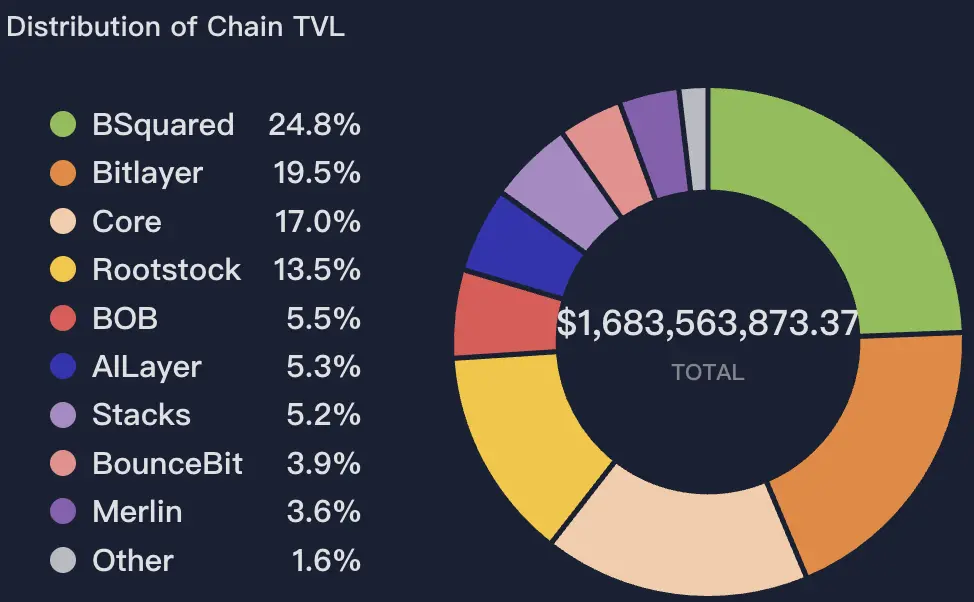

2.1. BTC Layer 2 Summary

Analysis

- Botanix Mainnet Officially Launched

- Botanix Labs launched its Bitcoin Layer-2 network mainnet on July 1, reducing Bitcoin's block confirmation time from about 10 minutes to 5 seconds and achieving EVM-equivalent smart contract support for the first time.

- The network is managed by a decentralized consortium of 16 node operators, including Galaxy Digital and Fireblocks, aimed at ensuring highly decentralized governance from the start.

- The mainnet launch coincided with the simultaneous release of several DeFi applications, such as the decentralized lending trading protocol Dolomite, the perpetual contract platform GMX, and BTC-backed stablecoin Palladium and DEX Bitzy.

- This release is significant for three reasons: it introduces the "BTCFi" concept (supporting DeFi on BTC), significantly enhances transaction efficiency, and provides a comprehensive EVM-compatible experience.

- Bitcoin Hyper Pre-sale Launched

- A new Bitcoin Layer-2 solution called Bitcoin Hyper is currently in pre-sale, raising approximately $2 million to build a Layer-2 network that supports speed enhancements and smart contracts.

- Current project information is not comprehensive, and interested users should carefully evaluate its white paper and team background.

- Interoperable Bridge Technology Research: Union Bridge

- A recent research paper introduced a trust-minimized bridging protocol called Union Bridge suitable for Rootstock, achieving secure asset flow from BTC to Layer 2 through improved BitVMX optimistic proof mechanisms.

- Key innovations include: reusable secure binding design, participant management mechanisms, lightweight client support frameworks, and efficient timelock mechanisms, significantly improving the capital efficiency and security of bridging solutions.

2.2. EVM & Non-EVM Layer 1 Summary

Analysis

EVM Layer 1

- Injective Launches Native EVM Testnet

Injective announced that its native EVM testnet will go live on July 3, allowing developers to run Ethereum-compatible dApps directly on the chain without relying on external bridging layers. - Cosmos Launches EVM Upgrade

The Cosmos network released its EVM module on the mainnet this week, enhancing cross-chain interoperability and further solidifying its position in the multi-chain ecosystem. - Shardeum Officially Launches Mainnet

The community-driven EVM sharded chain Shardeum announced its mainnet launch, adopting a linearly scalable architecture, promising low fees and no MEV, emphasizing its decentralization and high performance.

Non-EVM Layer 1

- Aave Expands to Aptos (First Non-EVM Deployment)

Aave DAO voted to deploy Aave V3 on Aptos (Move language chain), with initial supported assets including APT, USDC, USDT, and sUSDe, marking its first foray into the non-EVM ecosystem. - Sui Network Developer Growth Strong

The Move language chain Sui reported a 54% increase in developers over the past two years, making it one of the strongest growth performers among top Layer-1 projects, currently ranking in the top five for developer activity. - Algorand Non-EVM Asset Native Ecosystem Steadily Developing

Algorand continues to solidify its position as a non-EVM Layer-1, with its native ASA asset standard supporting efficient asset issuance and management, particularly suitable for institutional and compliance scenarios.

2.3. EVM Layer 2 Summary

Analysis

- Bitcoin eSports Level L2 — Botanix Mainnet Launch

Botanix is an EVM-compatible Layer-2 network built specifically for Bitcoin, and its mainnet has officially launched. This network reduces BTC's block time from 10 minutes to 5 seconds while being compatible with Ethereum smart contracts. This development marks a new era for the Bitcoin ecosystem as it moves towards DeFi applications.

- XRPL Launches EVM Sidechain Mainnet

Ripple has launched an EVM-compatible sidechain mainnet based on the XRP Ledger, allowing developers to deploy Ethereum dApps on this network. The sidechain achieves cross-chain interoperability through the Axelar bridge and uses XRP as the gas token, expanding the application scenarios of the XRP ecosystem.

- Vitalik Buterin: Decentralization Cannot Just Be a Slogan

Ethereum co-founder Vitalik stated at this week's Ethereum Community Conference that Layer-2 networks and DeFi protocols must prioritize the security of user assets. He emphasized that if a project relies on an "instant upgrade button" or opaque mechanisms, the so-called "decentralization" will become an empty promise.

- MEV Behavior in Optimistic Rollups Raises Concerns

Recent academic research reveals a significant amount of MEV (Maximum Extractable Value) activity in Layer-2 networks such as Arbitrum, Base, and Optimism. These transactions consume over half of the gas but contribute less than a quarter of the fees, exposing potential issues of resource allocation inequity and efficiency.

### Macroeconomic Data Review and Key Data Release Points for Next Week

The U.S. economy has shown some resilience, with 147,000 non-farm jobs added in June, exceeding expectations, and the unemployment rate dropping to 4.1%, indicating a strong labor market. Overall, the June employment data was stronger than expected, showing that the U.S. labor market remains resilient, which has nearly eliminated market expectations for a Fed rate cut in July.

Important macroeconomic data points for this week (July 7 - July 11) include:

July 9: U.S. EIA crude oil inventories for the week ending July 4

July 10: U.S. initial jobless claims for the week ending July 5

### Regulatory Policies

United States

- The upcoming "Crypto Week" from July 14–18 will review the CLARITY Act (clarifying asset classification and exchange responsibilities), the Anti-CBDC Surveillance State Act (opposing central bank digital currency privacy infringements), and the GENIUS Act (establishing a federal regulatory framework for stablecoins to ensure one-to-one asset backing and transparent disclosure).

- Congress plans to introduce regulatory bills for digital assets and stablecoins within two weeks to clarify the legal framework and market structure.

- The Senate has passed the GENIUS Act, requiring stablecoin issuers to back their tokens with highly liquid assets and disclose reserves regularly.

- Coinbase's acquisition of Liquifi is seen as a strategic move in anticipation of the U.S. easing regulations on token issuance.

Europe and the UK

- While the EU is reviewing the postponement of MiCA II, it plans to introduce regulations on transparency and security for DeFi by 2026.

- Spain has introduced new regulations requiring virtual asset service providers (VASPs) to report transaction and holding data of Spanish users, allowing tax authorities to seize non-compliant assets.

Asia and Africa

- Hong Kong plans to implement a stablecoin licensing mechanism on August 1 to prevent fraudulent activities.

- Japan is undergoing regulatory reforms aimed at standardizing cryptocurrency taxation and promoting the legalization of Bitcoin ETFs to enhance market friendliness.

- Several African countries have introduced cryptocurrency regulatory frameworks aimed at attracting international institutions and regulating local markets.

U.S. States

- The California Assembly is discussing whether to allow cryptocurrency payments and has initiated research on related regulatory frameworks.

- Connecticut state agencies have prohibited the holding, trading, or investing in cryptocurrency assets.

Trends in Other Regions

- The Swedish Minister of Justice announced that over $8.3 million in cryptocurrency assets related to cases have been confiscated since 2024.

- The Cook Islands plan to empower authorities to trace suspicious cryptocurrency assets through new legislation, raising concerns about excessive surveillance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。