On May 27, Cantor Fitzgerald launched its $2 billion Bitcoin collateral loan program for institutional clients, with the first trading partners including crypto companies FalconX Ltd. and Maple Finance. As one of the official underwriters of U.S. Treasury bonds, the entry of this century-old Wall Street institution is seen as a highly symbolic breakthrough.

Bitcoin is transitioning from a store of value to a financial instrument that can influence the credit system.

Just a month later, Bill Pulte, the director of the Federal Housing Finance Agency (FHFA), sent out a significant signal. He has requested that Fannie Mae and Freddie Mac, two pillars of U.S. housing credit, explore the feasibility of incorporating cryptocurrencies like Bitcoin into the mortgage assessment system. This statement triggered a strong market reaction, with Bitcoin's price rising nearly 2.87% within 24 hours, breaking through $108,000 again.

As posed in a Coinbase advertisement: "In 2012, you needed 30,000 Bitcoins to buy a house, and now you only need 5. If house prices have been falling in Bitcoin terms, why have they been rising in dollar terms?" What impact will this Bitcoin mortgage have on the dollar system?

Does Bill Pulte's word count?

Bill Pulte publicly called on Fannie Mae (FNMA) and Freddie Mac (FHLMC) via Twitter to prepare themselves. Fannie Mae (FNMA) and Freddie Mac (FHLMC) are two government-sponsored enterprises in the U.S. Although they do not directly issue loans to homebuyers, they play a core "market-making" role in the secondary mortgage market by purchasing mortgages issued by private institutions, ensuring liquidity and sustainability in the loan market.

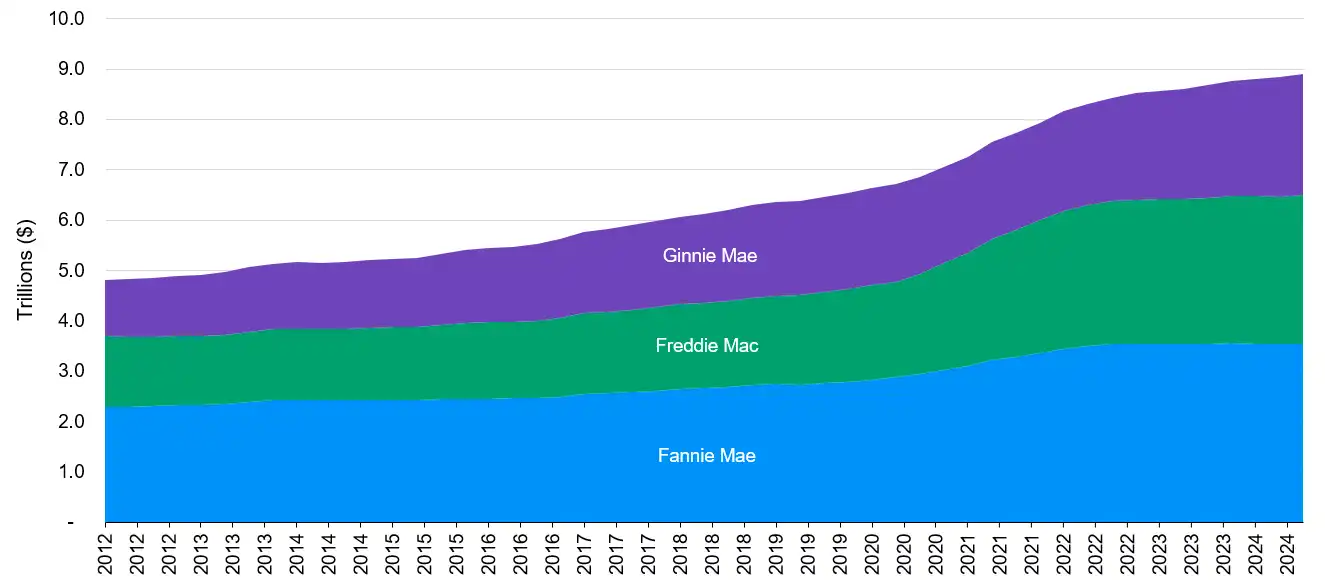

The Federal Housing Finance Agency (FHFA), established after the 2008 subprime mortgage crisis, is responsible for regulating these two institutions. According to a research report by JPMorgan, as of December 2024, Fannie Mae and Freddie Mac had guaranteed a total of $6.6 trillion in agency mortgage-backed securities (MBS), accounting for 50% of all outstanding mortgage debt in the U.S. The Ginnie Mae (directly regulated by HUD) mortgages, which are fully backed by the U.S. government, provide $25 billion to MBS, accounting for 20%.

As of December 2024, the outstanding balance of agency (Ginnie Mae, Fannie Mae, Freddie Mac) mortgage-backed securities, source: jpmorgan

During Trump's first term, stakeholders discussed various GSE (government-sponsored enterprise) reform proposals, but no legislative progress was made. Pulte's use of the term "order" in his tweet is significant because he holds a "supervisory" board position in these two companies as the chairman of the FHFA. After taking office in March 2025, he implemented sweeping personnel and structural reforms, relocating several directors from the two major institutions, appointing himself as board chairman, and firing 14 executives, including Freddie Mac's CEO, for a comprehensive restructuring. This significantly enhanced the FHFA's control over GSEs and led to discussions with the White House and the Treasury Department about a public listing plan based on "implicit guarantees," which has profound implications for the financial system. Now, the FHFA is beginning to explore incorporating crypto assets into the mortgage underwriting assessment system, marking a structural shift in the regulatory attitude towards crypto assets.

Pulte's personal background adds complexity to this news. As the third-generation head of PulteGroup, the third-largest residential construction company in the U.S., he is an heir to a real estate family, just like President Trump. He is also one of the earliest federal officials among Trump's confidants to publicly support cryptocurrencies. As early as 2019, he advocated for the charitable development of crypto assets on social media and disclosed his substantial holdings in Bitcoin and Solana. He has invested in high-volatility assets like GameStop and Marathon Digital, and unlike ordinary politicians, his investments seem to align more with the "Degen" image. Given his previous "crypto history," it appears that he hopes to integrate crypto assets into the U.S. home-buying system is not a spur-of-the-moment idea.

Internal Government Divisions

On the other hand, there are significant divisions within the government. ProPublica reported in March that the U.S. Department of Housing and Urban Development (HUD) is also exploring the use of stablecoins and blockchain technology to track federal housing assistance funds. An HUD official revealed that the proponent of the blockchain plan is Irving Dennis, the new Chief Deputy Financial Officer of HUD, who was previously a partner at the global consulting giant Ernst & Young.

Unlike the "semi-official GSEs" like Fannie Mae and Freddie Mac overseen by the FHFA, Ginnie Mae is a 100% government agency. Therefore, discussions in this area are more rigorous, and the proposal has faced intense internal opposition. Some believe it could trigger a crisis similar to the 2008 subprime mortgage crisis, with some officials even calling it "like using Monopoly money to distribute funds." An internal memo pointed out that HUD does not lack auditing and fund tracking capabilities, and introducing blockchain and crypto payments would only add complexity and could lead to fluctuations in the value of assistance funds and compliance issues.

Currently, platforms like Milo Credit and Figure Technologies are already offering mortgage products backed by Bitcoin. However, they face high loan rates and limited liquidity because they cannot securitize loans to sell to Fannie Mae and Freddie Mac. Once Bitcoin is incorporated into the federal mortgage underwriting system, it could not only lower borrowing rates but also allow holders to leverage their assets, shifting from "HODL" to "building family asset allocation in the U.S."

Of course, risks cannot be ignored. As former SEC official Corey Frayer warned, once unstable crypto assets are introduced into the $1.3 trillion mortgage system backed by the FHA, any event of market value decoupling could lead to systemic shocks. Legal scholar Hilary Allen bluntly stated that using the most vulnerable groups as a testing ground for technological change is extremely dangerous.

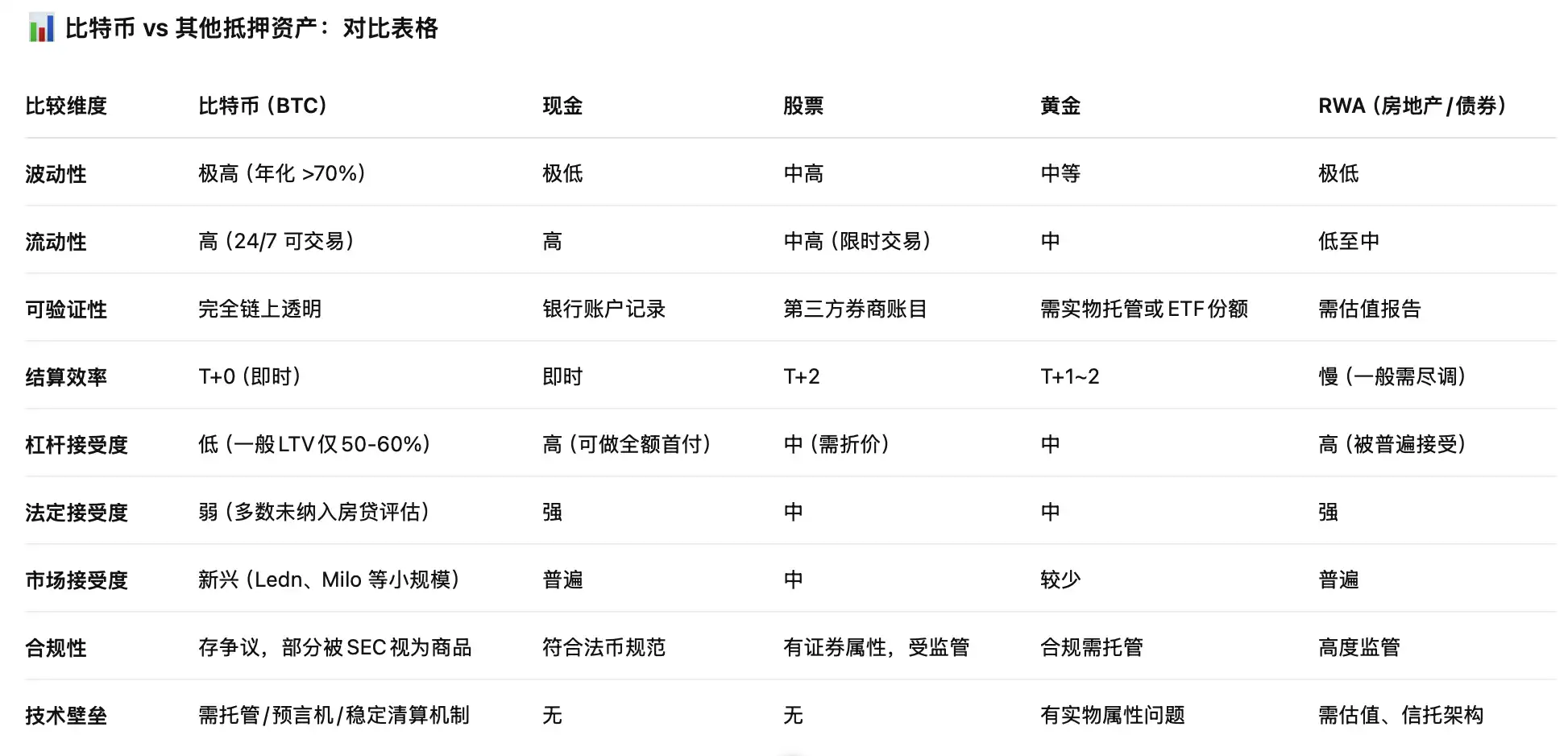

The core of this division lies in whether the U.S. is ready to officially incorporate Bitcoin from "alternative investment" into the public financial system. The FHFA's research direction allows holders to use Bitcoin balances to directly meet down payment or reserve requirements, which has profound significance as it is the first time decentralized assets have been given a "housing leverage" effect. On the other hand, the volatility of crypto assets makes it inherently difficult to assess value and manage risks when used as "reserve assets." If Bitcoin's price fluctuates dramatically, whether it should be allowed for mortgage assessment involves financial regulation, liquidity management, and even systemic stability issues.

What does the new FHFA directive stipulate? How have U.S. residents used cryptocurrencies for loans before this?

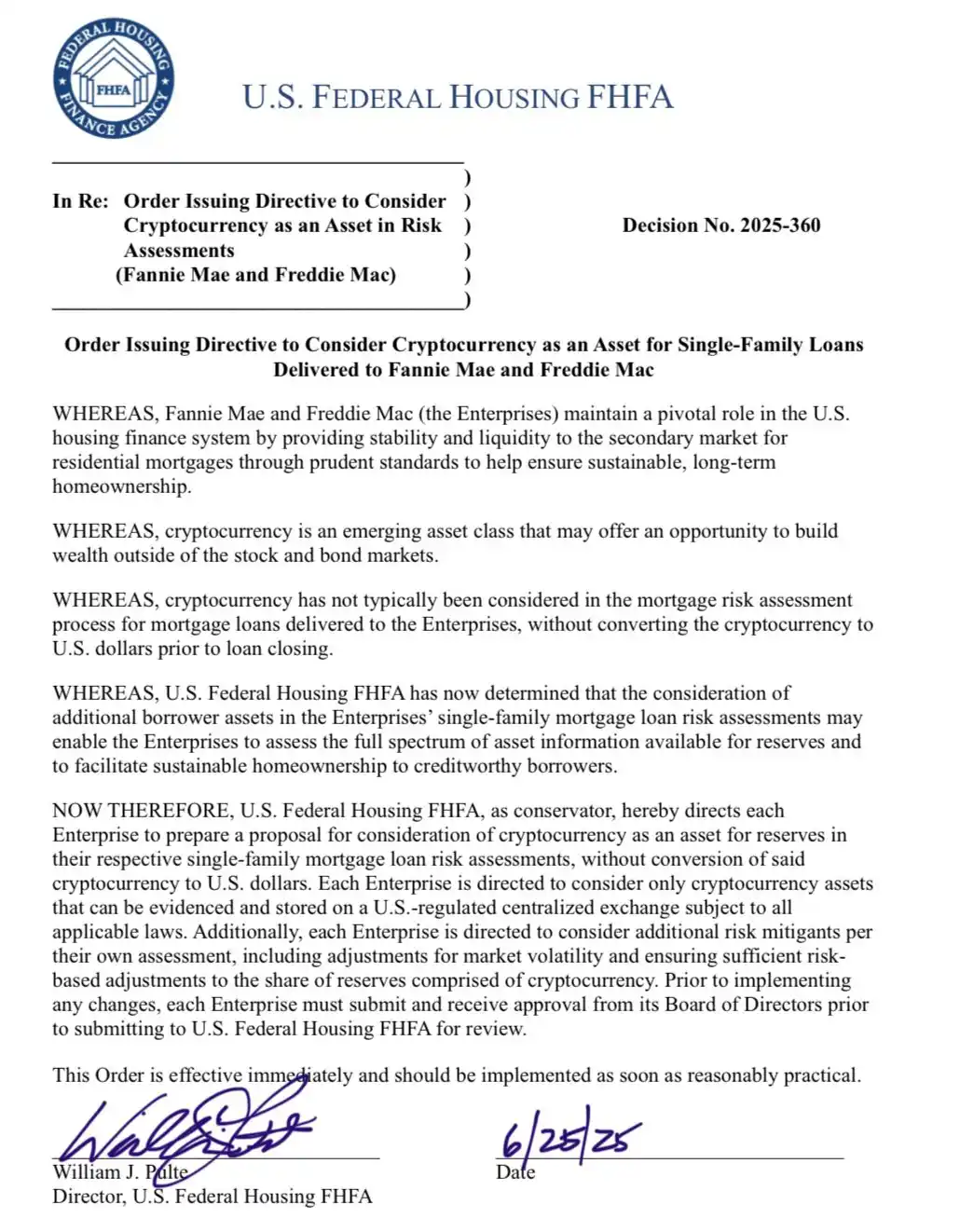

Due to the painful lessons of the 2008 subprime mortgage crisis, current U.S. housing loan assessments have strict compliance restrictions on assets. Borrowers must convert their cryptocurrencies into dollars and keep them in a U.S. regulated bank account for 60 days before they can be considered "mature funds" for assessment. Pulte's proposed direction clearly aims to break through this procedural barrier.

This official order, Decision No. 2025-360, requires the two mortgage giants to consider cryptocurrencies as effective assets for borrowers' wealth diversification. So far, cryptocurrencies have been excluded from mortgage risk assessments because borrowers typically do not convert their digital assets into dollars before the loan ends. The directive requires Fannie Mae and Freddie Mac to develop proposals to include cryptocurrencies in the borrower reserves of their single-family residential mortgage risk assessments. Additionally, the directive stipulates that companies should directly calculate cryptocurrency holdings without needing to convert them into dollars.

The Federal Housing Finance Agency (FHFA) has established clear "guidelines" on which cryptocurrencies qualify for consideration. Only assets issued on U.S. regulated centralized exchanges and fully compliant with relevant laws are eligible. Furthermore, companies must include risk mitigation measures in their assessments, including adjustments based on known cryptocurrency market volatility and appropriate risk reductions based on the proportion of cryptocurrency reserves held by borrowers.

Before implementing any changes, companies must submit their proposals for approval by their respective boards. After board approval, the proposals must be submitted to the FHFA for review and final authorization. The FHFA's decision aligns with the federal government's broader approach to recognizing cryptocurrencies in financial processes and is consistent with Pulte's statement "to respond to President Trump's vision of making the U.S. the world's cryptocurrency capital." The issuance of this directive reflects a commitment to positioning the U.S. as a leading jurisdiction for cryptocurrency development.

What does this mean?

It is well known that the underlying logic of using a highly liquid asset as collateral to exchange for a low liquidity asset is valid, but BTC is at the intersection of multiple interests. When it can truly be certified as an asset for U.S. mortgage loans, its "influence" may rival the power of the "Bitcoin Reserve Act" proposed before Trump's presidency, and this impact will not be limited to a single group; various stakeholders, including the American public, financial institutions, and government departments, will be affected.

How Many Americans Will Use Bitcoin to "Buy a House," and How Much Can They "Save" by Using Bitcoin as an Intermediary?

Daryl Fairweather, chief economist at the American real estate brokerage Redfin, stated, "Due to having ample time and a lack of exciting spending options, many people began trading cryptocurrencies during the pandemic. Some of these investments turned into bubbles, but at the same time, they allowed some individuals to accumulate significant wealth, or at least enough to cover a down payment on a house."

According to the 2025 Cryptocurrency Consumer Report by Security.org, about 28% of American adults (approximately 65 million people) own cryptocurrencies, with a particularly high percentage among Gen Z and millennials, where over half have owned or currently own crypto assets. As millennials and Gen Z continue to occupy a growing share of the U.S. real estate market, the use of crypto assets as a payment method for home purchases may become increasingly popular.

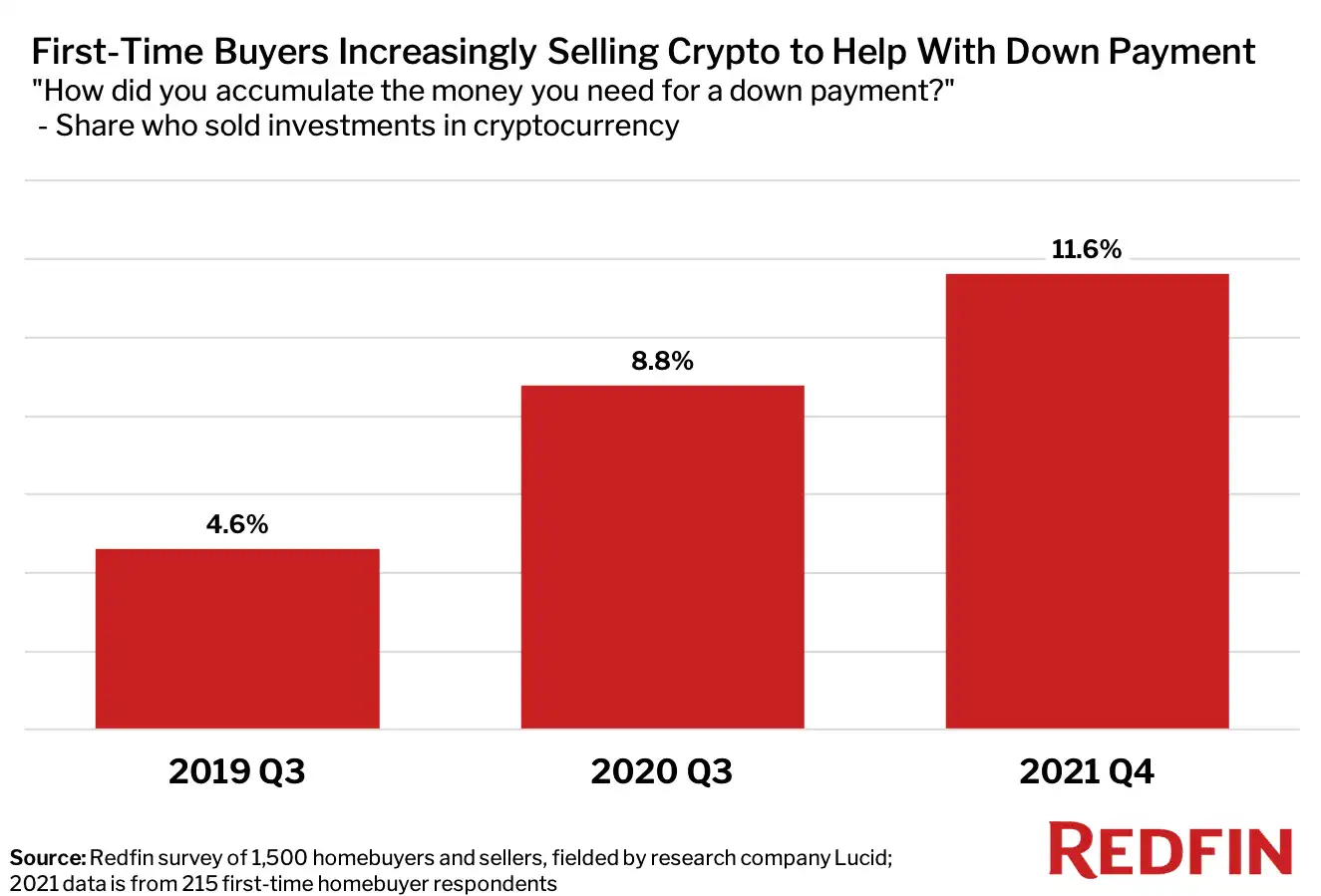

In 2021, Redfin conducted a survey in which they randomly sampled 1,500 first-time homebuyers through the research technology company Lucid. When asked, "How did you accumulate your down payment funds?" the most common response was "from salary" (52%), while less common responses included "cash gifts from family" (12%) and "early withdrawals from retirement funds" (10%). Notably, the percentage of people selling cryptocurrencies to buy homes gradually increased from 2019 to 2021, reaching nearly 12% by the end of 2021. Four years later, with the growing popularity of cryptocurrencies, this percentage may have further increased.

As for how much can be saved, CJK, founder of People's Reserve, shared a small story during a Twitter Space on June 25, hosted by Emmy-nominated producer Terence Michael. He mentioned that in 2017, he sold 100 BTC to buy a house, which is now worth only $500,000, but the BTC he sold is now worth over $10 million. This experience led him to establish People's Reserve, aimed at allowing more people to retain Bitcoin and use it as collateral to buy homes.

This gives rise to a hypothetical scenario: if you purchased Bitcoin worth $50,000 in 2017, by 2025, its value would reach $500,000. Instead of selling your Bitcoin and paying $90,000 in capital gains tax, you could collaborate with a cryptocurrency mortgage institution, pledging $300,000 worth of BTC. You would receive a $300,000 mortgage at an interest rate of 9.25%. The lender would hold your Bitcoin in a custodial account, allowing you to retain ownership of the Bitcoin while only needing to pay around $27,000 in annual interest (which may decrease in the future), thus saving the $90,000 in taxes while still benefiting from the upward price trend of BTC and inflation protection, especially in light of the Inflation Reduction Act raising the U.S. debt ceiling to $5 trillion.

Further Reading: “Trading Crypto to Make $40,000 and Paying $130,000 in Taxes: This is What Musk Criticized About U.S. Tax Law”

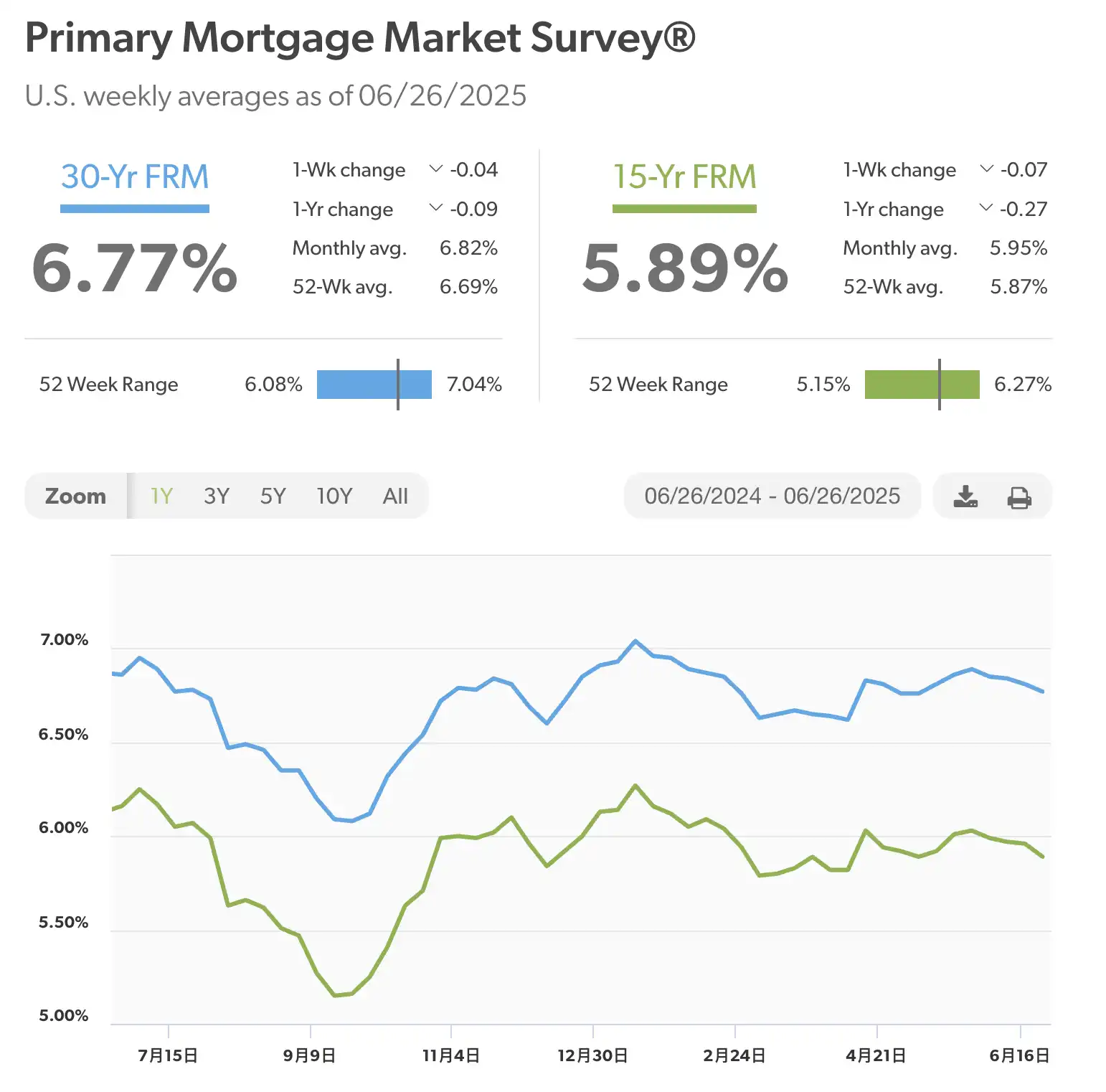

According to data provided by Freddie Mac, the current annual interest rate for a 30-year mortgage in the U.S. generally hovers around 7%, while the 15-year rate is around 6%.

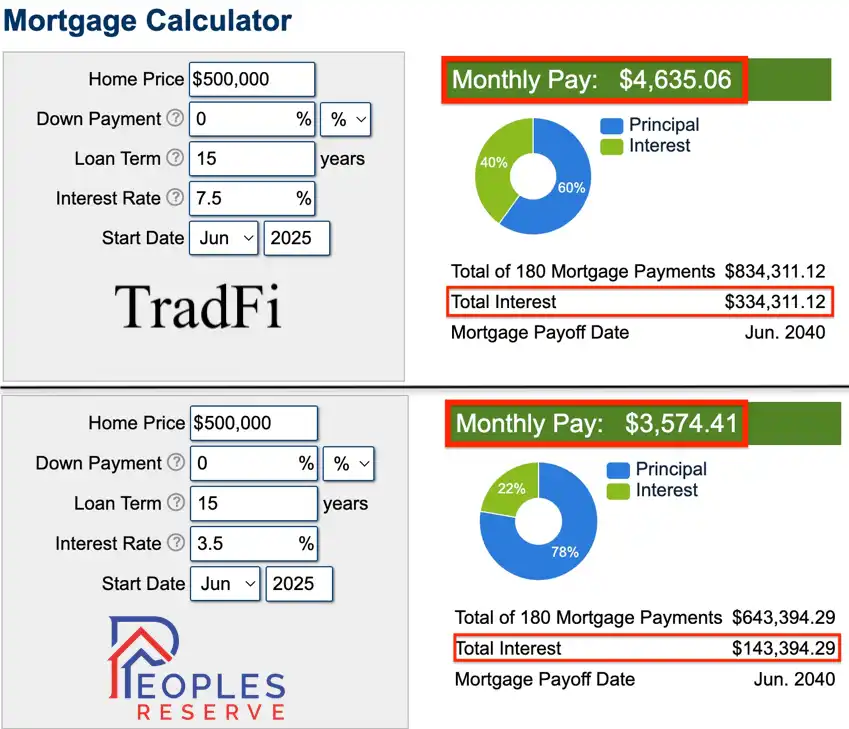

Private institutions like Milo Credit, which have been operating for some time, can now offer Bitcoin loans with an LTV of around 50% at annual interest rates of 9-10%. Platforms like People's Reserve, which are native to the BTC ecosystem, can reduce the annual interest rate to 3.5% (if LTV is 33%). If calculated this way, for a $500,000 15-year mortgage, you could save about $1,000 per month, resulting in a total interest savings of $190,000.

While not all institutions will offer such low rates, the current regulatory environment may lead to rates similar to those of conventional assets among major U.S. lenders, making Bitcoin loans a more prudent choice for Americans today.

Supporting the GSE Privatization Process

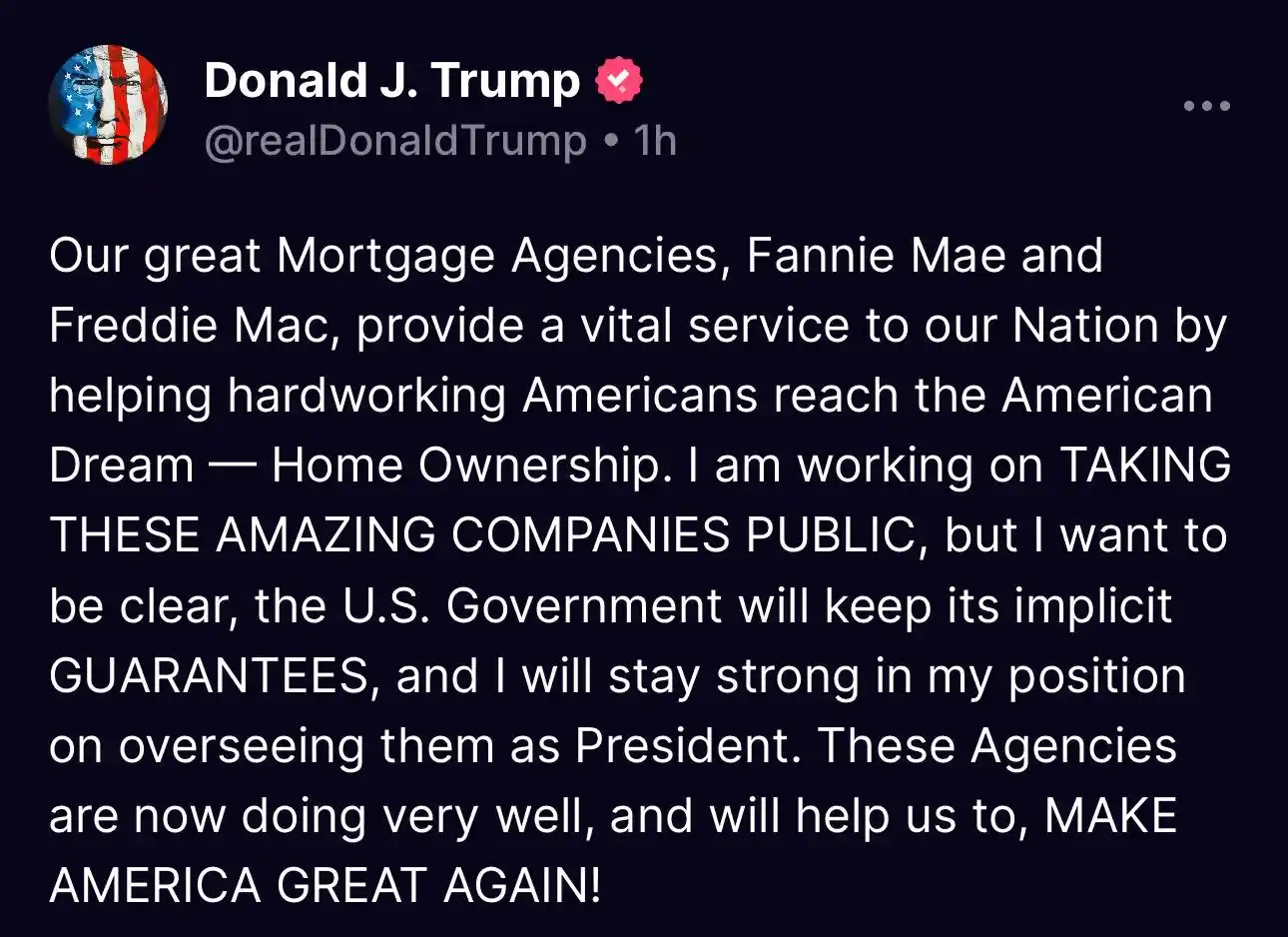

Just a month before the FHFA requested that Fannie Mae and Freddie Mac incorporate Bitcoin and other cryptocurrencies into their mortgage assessment systems, President Trump stated on his social media platform Truth, "I am advancing the work to take these great companies (referring to Freddie Mac and Fannie Mae) public, but I want to make it clear that the U.S. government will continue to retain its implicit guarantees, and I will steadfastly oversee them as President."

The opening of a Bitcoin mortgage mechanism provides an indirect but important support path for GSE privatization. It not only introduces diversified collateral types into the housing finance system but may also create space for the de-governmentalization reforms of Fannie Mae and Freddie Mac from multiple dimensions, including risk transfer, capital formation, regulatory restructuring, and political coordination.

First, in terms of credit risk management, Bitcoin and other crypto asset mortgages are expected to alleviate the pressure on GSEs as "lenders of last resort." For a long time, Fannie Mae and Freddie Mac have had the policy responsibility of providing financing guarantees for a large number of non-traditional borrowers, including those lacking sufficient credit history or income documentation. Opening Bitcoin mortgages would allow "credit-invisible" but "asset-visible" crypto-native investors to enter the mortgage market through new mechanisms, thereby alleviating the unique burden on GSEs to maintain housing affordability. As a decentralized, verifiable, and globally liquid asset, the institutionalization of Bitcoin's collateral capacity equates to building an alternative loan pool "outside the system," leaving more room for structural optimization of the asset pool of GSEs post-privatization.

In terms of capital structure, the Bitcoin mortgage mechanism may also provide financing support for the GSE privatization process through crypto-native asset securitization pathways. One of the biggest obstacles for GSEs is a regulatory capital shortfall of up to $180 billion, which is expected to take over seven years to fill solely through retained earnings. If Bitcoin mortgages can form scalable, rated, and packageable mortgage-backed securities (Crypto-MBS), they are likely to attract new types of capital investors and could serve as potential "off-market supplements" to GSE asset-backed securities. The existence of such assets means that GSEs do not have to rely entirely on congressional funding or taxpayer financing to gradually achieve capital independence, thereby reducing systemic friction during the government's exit process.

At the same time, this mechanism is also forcing an update of the housing finance regulatory model. The traditional GSE assessment system is based on cash flow models such as income verification, debt-to-income ratios, and FICO credit scores, while the widespread use of crypto asset mortgages emphasizes asset capacity, on-chain history, and net worth of crypto wallets as assessment criteria. This shift from "income-oriented" to "asset-oriented" risk control logic not only helps GSEs establish a more flexible and market-oriented credit assessment model post-privatization but also lays the institutional foundation for the integration of new types of mortgage assets. If regulatory agencies can accommodate crypto assets into the assessment model, GSEs will have the opportunity to expand their business boundaries and participate in a broader range of financial asset underwriting, thereby enhancing their market competitiveness.

More importantly, on the political level, the promotion of Bitcoin mortgages helps to construct a discourse space for "technological alternatives," creating a public opinion buffer for the Trump administration's push for GSE privatization. Privatization has historically faced strong resistance from Democrats, housing rights organizations, and some state governments, who worry that de-governmentalization will harm the financing accessibility of low- and middle-income families. The legalization of crypto asset mortgage mechanisms provides another policy option: while the government exits direct guarantees, the market can provide alternative financing support through technology, asset, and risk-sharing mechanisms. This logic not only helps balance public opinion but also provides policymakers with more flexible negotiating chips between reducing government debt and maintaining housing finance stability.

Therefore, although the Bitcoin loan mechanism itself does not constitute a direct tool for GSE privatization, its institutional construction is undoubtedly providing a key "financial buffer" for the privatization process. It expands the collateral asset structure of the housing finance market, releases the policy responsibility space of GSEs, provides alternative capital pathways, and strengthens the market's willingness to accept financial decentralization reforms. In a new political cycle that seeks a "smaller government" and "stronger market," the credit function of crypto assets is gradually becoming an important component driving structural housing finance reform.

How Much "Pressure" Can Bitcoin Release from Mortgages?

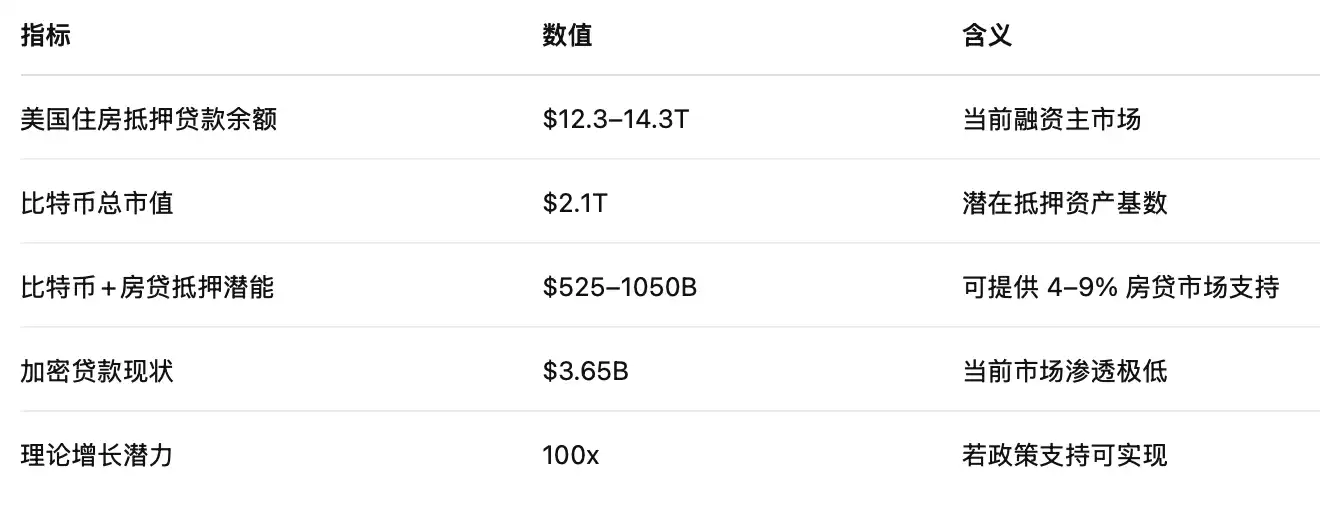

As of now, the total market capitalization of Bitcoin is approximately $2.1 trillion, roughly equivalent to 17% of the U.S. housing mortgage market. If the entire Bitcoin market value were allowed to participate in mortgage collateral support, then the $2.1 trillion BTC market could support $1.05 trillion in loan principal (at a 50% LTV), accounting for about 8-9% of the existing housing loan stock. If only 50% of the acceptable portion is taken as collateral, it could still support $525 billion in loan principal, accounting for 4-5%. Of course, holdings by ETFs, some listed companies, or sovereign nations are not easily included, but these portions likely only account for about 10% of the current total.

Therefore, if Bitcoin mortgages are institutionalized, it will not only have profound implications for the crypto community but also unleash unprecedented asset conversion power to traditional finance, creating a positive feedback loop that can release the purchasing power of BTC without dismantling the existing financial system. This means that if policies are fully implemented, Bitcoin loans could provide hundreds of billions of dollars in new financing power to the housing market, equivalent to over 100 times the current crypto mortgage market.

The "Great and Beautiful Act"

If Bill Pulte's call is a positive signal for Bitcoin mortgage business, the formal signing and implementation of the "Great and Beautiful Act" serves as a strong policy boost for the "American real estate industry." One of the most critical aspects is the permanent increase of the Qualified Business Income (QBI) deduction rate from 20% to 23%, which directly benefits many individuals and entities investing in real estate through limited partnerships, S-corp structures, or REITs, effectively lowering their marginal tax rate to around 28.49%.

For real estate companies focused on rental income on their balance sheets, post-tax cash flow will significantly improve, and capital structures will be further optimized. This reform also indirectly lowers the entry costs for entities holding assets like Bitcoin to purchase properties, providing a more robust compliance framework for bridging "on-chain assets" and "off-chain real estate."

At the same time, the "Great and Beautiful Act" restores and extends the 100% bonus depreciation mechanism and raises the Section 179 immediate deduction limit to $2.5 million, allowing for quicker tax deductions on upfront capital expenditures for real estate projects. This not only encourages concentrated investments in new properties, storage facilities, and productive assets but also helps property developers build a more robust cash flow curve amid increasing interest rate uncertainties. For investors or RWA project parties attempting to leverage Bitcoin assets to purchase properties through DAO, LLC, or SPV models, the restoration of depreciation policies effectively hedges against the lag in rental returns and the long asset realization cycle, facilitating the transformation of digital assets like BTC into more liquid underlying income rights in real estate projects.

Bitcoin + Real Estate seems to be the next big move by Trump.

What Projects Are "Landing" in the Free Market?

Lending Institutions

Milo Credit

Milo Credit is a fintech company based in Florida, USA, that launched the first U.S. housing loan products backed by cryptocurrencies in 2022. Its business model allows users to use digital assets like Bitcoin, Ethereum, or USDC as collateral to obtain loans up to 100% of the property value without a cash down payment. This loan structure does not trigger capital gains tax and does not impose a forced liquidation mechanism, enabling borrowers to retain the potential appreciation of their crypto assets while receiving funding for home purchases.

Milo offers loans up to $5 million, with terms of up to 30 years, and current annual interest rates are approximately in the 9-10% range, with no prepayment penalties. The security of the collateralized assets is managed by third-party custodians such as Coinbase, Gemini, and BitGo. As of early 2025, Milo has issued over $65 million in crypto-backed housing loans.

It is worth noting that previously, such loans typically did not meet U.S. federal housing mortgage standards and could not be packaged and sold to Fannie Mae or Freddie Mac, resulting in higher funding costs and correspondingly higher interest rates. If the bill passes, this system is expected to further lower interest rates. Additionally, due to the extreme volatility of crypto asset prices, Milo still employs a certain degree of over-collateralization to ensure loan security.

Ledn

Ledn, headquartered in Canada, is known for its "Bitcoin-Backed Loans" and is one of the first crypto-native platforms to explore structured products for on-chain asset lending. Ledn's core product allows users to use Bitcoin as collateral to obtain fiat loans (such as USD or USDC), with an LTV typically around 50%, and funds are available instantly, with the shortest loan period calculated weekly. Unlike Milo, Ledn is not directly tied to real estate transactions but serves as a short-term liquidity solution, meeting users' needs for cash without selling Bitcoin. Additionally, Ledn offers savings accounts and compound interest services for Bitcoin and USDC. The platform emphasizes security and compliance, with collateralized assets held in third-party institutions and subject to regular audits, particularly influential in the Canadian and Latin American markets.

Moon Mortgage

Moon Mortgage is a loan platform aimed at crypto-native users, focusing on providing "mortgage Bitcoin to buy a house" services for Web3 entrepreneurs, DAO members, and crypto investors without traditional credit histories. Moon Mortgage's flagship product allows users to apply for traditional structured home loans using BTC or ETH as collateral, with the property serving as a secondary mortgage, addressing the asymmetry between borrowers' assets and income. The platform collaborates with compliant U.S. lenders and custodians to offer users the same interest rate structure and repayment mechanisms as traditional mortgages, while replacing FICO credit scores with a self-developed assessment model that focuses on evaluating users' on-chain asset history and risk tolerance. Moon Mortgage is more vertically positioned, serving crypto-native buyers and emphasizing the concept of "getting in without selling coins," making it one of the few publicly available mortgage projects targeting on-chain identity groups in the U.S. market.

People's Reserve

People's Reserve is a crypto-financial infrastructure project created by CJK Konstantinos, dedicated to building a mortgage and credit system centered around Bitcoin. The project is developing various "Bitcoin-driven" financial products, including self-repaying mortgages and lending tools that exchange home equity for Bitcoin liquidity (HEBLOC, or Home Equity Bitcoin Line of Credit). The core design philosophy of People's Reserve is to release the economic value of users' Bitcoin while ensuring their ownership. These products will not use the pledged Bitcoin for re-hypothecation and will employ a multi-signature custody mechanism to prevent user assets from being controlled by centralized institutions. At the same time, People's Reserve hopes to align its loan interest rates with traditional housing loans, thereby enhancing the mainstream acceptability of crypto finance. Currently, the platform is still in the product development stage and has not officially launched, but it has opened a notification subscription channel on its website, with the first batch of testing services expected to launch on July 4.

Infrastructure

Beeline Title

Beeline Title is not a provider of crypto loans but a blockchain service company dedicated to building property registration and digital custody infrastructure for crypto mortgages. The agency focuses on digitizing the property registration process and integrating it with crypto asset custody mechanisms, enabling fully on-chain, paperless property ownership registration and debt management. According to AInvest, Beeline Title is set to officially launch its national service platform in August 2025, at which point it will assist in completing the first batch of real estate loan transactions backed by Bitcoin. The emergence of Beeline signifies that the connection between crypto assets and real estate is gradually being standardized and regulated, laying the institutional and technical foundation for future large-scale implementation.

In terms of infrastructure, MicroStrategy has also made contributions by developing a BTC credit model, which Pulte directly expressed interest in on social media platform X.

Can Bitcoin Change the "Old Rules"?

From century-old Wall Street brokerages to federal housing finance regulators, from Trump's public statements to the restructuring of capital in the real estate industry, the financial order pivoting on Bitcoin is permeating from the top down. Bitcoin's identity is evolving from "digital cash" to "electronic gold" and is now on the verge of becoming a "credit medium," providing traditional finance with a new way to organize capital. This "decentralized asset + federal-level credit tool" framework is challenging the deepest design logic of mortgages.

In the future, when Fannie Mae and Freddie Mac truly accept Bitcoin as part of their underwriting model, a new financial paradigm and ecosystem may emerge, where Bitcoin represents not just a store of wealth but also a new lever that can leverage housing, taxation, credit, and even national governance.

The institutionalization of Bitcoin mortgages may become the most symbolic "tool" of Trump's "Great and Beautiful" era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。