The information, opinions, and judgments regarding the market, projects, and currencies mentioned in this report are for reference only and do not constitute any investment advice.

This week, BTC opened at $108,386.44 and closed at $109,217.98, up 0.77%, with a high of $110,590 and a low of $105,119.70, resulting in a fluctuation of 5.05%, while trading volume continued to shrink.

The past week was relatively dull, with macro events still being the decisive factors for BTC price movements. However, there were no significant changes beyond market expectations regarding employment data, the "Big and Beautiful Act," or the reciprocal tariff war.

An ancient whale with a holding of over 80,000 BTC that had been silent for more than 14 years began to move assets this week, creating some psychological pressure on the market. As BTC prices approach historical highs again, the trend of long-term holders reducing their positions may reappear.

Some positive changes are also occurring, as the activity of on-site funds has begun to increase after being dormant for over a month. This increase may resonate with off-site funds, driving BTC to initiate the fourth wave of this bull market.

Policy, Macro Finance, and Economic Data

This week, three major macro events intertwined to impact the crypto market.

First, U.S. employment data exceeded expectations. Data released on July 3 showed that the U.S. unemployment rate for June was 4.1%, significantly lower than the expected 4.3% and the previous value of 4.2%. A deeper look into the data reveals that while private employment decreased, state government jobs surged. The number of unemployment claims for the week ending June 28 was reported at 233,000, also below the expected 240,000 and the previous value. The latest employment data alleviated market concerns about a U.S. economic recession and reduced the probability of a rate cut in July to 4.7%. Ultimately, the market impact was relatively neutral.

Second, the U.S. President officially signed the "Big and Beautiful Act" on July 4, marking the largest political achievement of his term so far. The act includes massive tax cuts, significant increases in government budgets, and spending reductions, which may further reduce the credit of the dollar in the long term, increase debt, and decrease government revenue. However, in the short to medium term, it will undoubtedly have a significant stimulating effect on the economy. Therefore, despite considerable public debate, the financial market interpreted it positively overall, directly pushing the S&P 500 index to continue reaching historical highs this week.

Third, the "reciprocal tariff war" has fully entered its third phase—Trump announced on July 5 that he had signed a "tariff letter" to 12 countries, detailing a "flat rate" national tax rate, with the final tax rate range raised to 10%–70%. The letter will be sent out on July 7. This tax rate is likely to take effect on August 1, bringing new uncertainties to global trade, inflation, and market sentiment. Since the maximum extent exceeded the expected 50%, the market reacted negatively, but the impact was relatively small due to adequate pricing.

In our observation framework, the current U.S. economy exhibits characteristics of a soft landing or no landing, with rate cuts expected to start in September. The "Big and Beautiful Act" will bring positive effects to U.S. stocks in the short to medium term, and the impact of reciprocal tariffs is about to pass, leading U.S. stocks to set new historical highs again. In the short to medium term, under the expectation of rate cuts, the upward trend may be maintained. However, the current valuation of U.S. stocks is not low, and close attention should be paid to changes in corporate profitability and the impact of tariffs on economic and employment data.

Crypto Market

Compared to the past few weeks, due to the continuity of macro market information, the BTC market was relatively flat this week, but changes are brewing internally.

On July 2, BTC once again validated the "first upward trend line of the bull market," but for most of the week, it operated around the $108,000 mark and made the third attempt at the historical high of $110,000 in eight months.

The BTC retail market shows significant differentiation, with trading enthusiasm among on-site funds waning, while on-chain activity and new addresses performed moderately. However, the BTC Spot ETF market is active, recording continuous inflows of funds.

Currently, BTC prices and trends are entirely controlled by the funds flowing through the BTC Spot ETF channel, and the correlation between BTC trends and the Nasdaq index has also increased to 0.94.

Some changes may be occurring, as on-site lending rates have rebounded after falling to low levels, and the 30-day average premium rate in the contract market has also begun to rebound after hitting a low. Of course, both need to be monitored for sustainability. In the June monthly report, we judged that the market would step up again in the third quarter. If funds continue to flow into the BTC Spot ETF channel and on-site funds begin to resonate with long positions, the fourth wave of increases may be realized soon.

Fund Inflows and Outflows

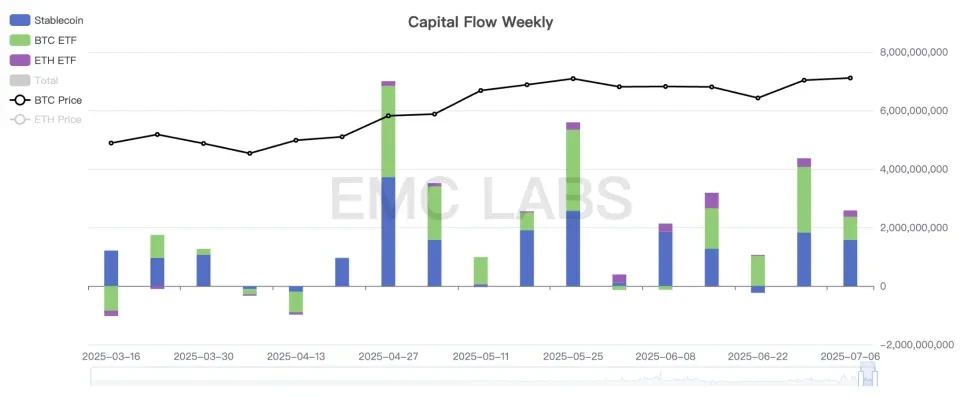

After a significant rebound in April and May, fund inflows have shown differentiation, with stablecoin channel funds beginning to weaken, while BTC Spot ETF channel funds remain relatively strong and stable.

This week, BTC Spot ETF channel funds inflowed $790 million, a noticeable decrease from last week but still maintaining a high level.

Crypto market fund inflow statistics (weekly)

Stablecoin channel inflows were $1.574 billion, close to last week.

Selling Pressure and Liquidation

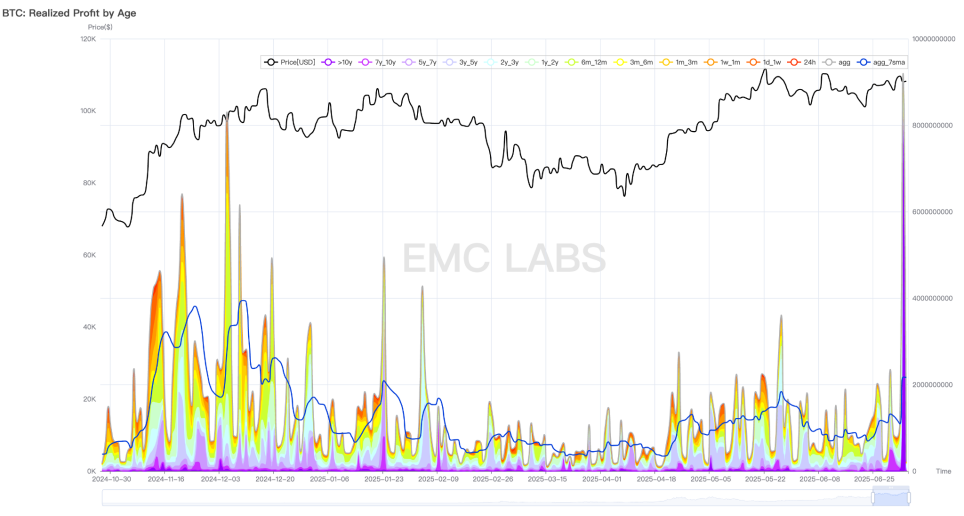

As the price once again challenges $110,000, long-term holders seem to be starting to reduce their positions again.

From the scale of transfers to exchanges, the total selling scale of long and short positions this week is still shrinking, providing strong support for BTC price increases.

However, this week, an ancient wallet holding over 80,000 BTC experienced unusual activity. The significant movement of this wallet, which had been silent for 14 years, caused the on-chain realization value to surge.

On-chain value realization statistics

Based on the current trend, once BTC breaks through $110,000 and initiates the fourth wave of increases, the selling by long-term holders and aged BTC is expected to restart. These sell-offs will work together with buying power to discover a new price for BTC and determine its height.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0.625, indicating an upward phase.

EMC Labs

EMC Labs was established in April 2023 by crypto asset investors and data scientists. It focuses on blockchain industry research and investments in the crypto secondary market, with industry foresight, insights, and data mining as its core competencies. It aims to participate in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。