Bitcoin Whale Movement Sparks Speculation in Crypto Markets

Coinbase, Head of Director, Conor Grogan, stated that there's a small possibility that billions of dollars worth of long-held Bitcoin whale movement were moved earlier on July 4, as a result of a private key hack.

Before this massive move, one of the associated wallets made a small transaction on Cash (BCH)

The BTC in question had been sitting untouched since 2011, only to be moved in full to eight new addresses on July 4– an unusual and highly coordinated action.

Could this be The Biggest Crypto Theft Ever

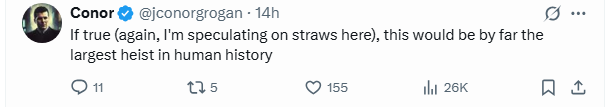

Conor Grogan, Head of Product at Coinbase , believes there’s a slim but serious possibility that this $8.6 billion Bitcoin whale movement was triggered to compromise private keys. In a post on X, Grogan speculated that if it was a hack, this would qualify as the largest theft in human history.

Source: X

Could It be A Security Test?

Grogan speculated that the BCH transaction may have been a way to quietly test access to the wallet’s private key, as BCH movements typically don’t attract much attention from tracking tools.

However, he also pointed out an odd detail– the other BCH wallets weren't touched raising more questions.

For now, the blockchain community is left guessing: Was this just a rechecking control, or the early signs of a record-breaking crypto breach?

A Test Transaction Raises Red Flags

What adds to the suspicion is a Bitcoin Cash (BCH) test transaction that occurred roughly 14 hours before the major Bitcoin whale movement transfer.

Grogan tracked a 10,000 BCH test sent from one of the old BTC wallet clusters. Just one hour later, the actual BTC began to move.

This leads to a plausible theory: the user would have tested their private key access via BCH, which is rarely monitored by whale trackers– possibly to avoid early detection.

Are Bitcoin whale movement Preparing to Exit the Market?

A recent move of 80,009 BTC from long-dormant wallets has stirred up speculation across the crypto space. Although none of the funds have been transferred to exchanges yet, the sudden activation to these old wallets has raised eyebrows– and questions.

So, are these early Bitcoin holders planning to cash out?

At this point, there’s no definitive answer. Experts argue that because the BTC hasn’t hit any trading platforms, the move doesn't necessarily indicate a bearish trend– at least not yet.

However, if these wallet activations are being used to shift liquidity into other digital assets, it could signal a broader shift in market sentiment.

Some analysts believe the whales might simply be enhancing wallet security or relocating assets under new storage setups. On the flip side, others fear this could be early stages of a large-scale liquidation– especially given the uncertain global economic landscape.

Final Thoughts

Whether the $8.6 Billion Bitcoin whale movement was a deliberate security reallocation, a quiet whale move, or high-stakes breach, it’s a major event in crypto history. With the funds now dormant in new wallets, all eyes remain on-chain, waiting for the next move.

Also read: Unlock Big Rewards with the $BOOM Airdrop Listing Date 2025免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。