Bitcoin and Ether Funds Rack Up $750 Million in Inflows on Strong Institutional Demand

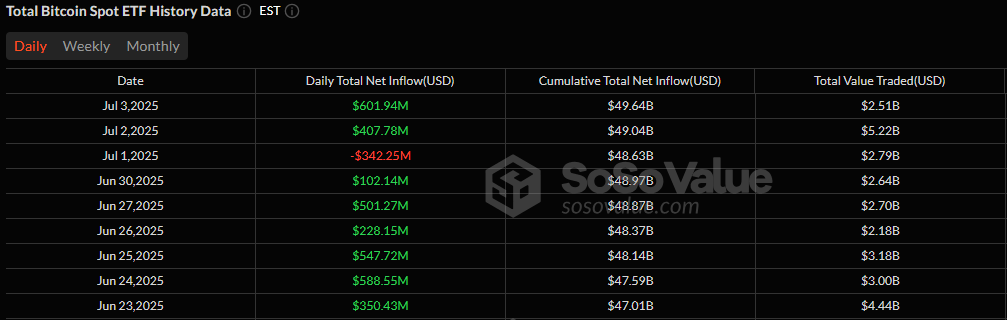

Momentum doesn’t sleep, even ahead of a holiday weekend. U.S. spot bitcoin ETFs piled on another $601.94 million in net inflows on Thursday, July 3, marking yet another day of assertive institutional appetite for digital assets.

Fidelity’s FBTC took the spotlight with a massive $237.13 million inflow, while Blackrock’s IBIT was close behind, attracting $224.53 million. Ark 21Shares’ ARKB held its own with $114.25 million, showing that the buying was broadly spread.

Supporting inflows came from Bitwise’s BITB ($15.53 million), Grayscale’s Bitcoin Mini Trust ($5.84 million), and Vaneck’s HODL ($4.66 million). Total value traded stood at $2.51 billion, and net assets climbed to $137.60 billion, reinforcing the strength of the trend.

Source: Sosovalue

Ether ETFs weren’t left behind either. A solid $148.57 million flowed into the group. Blackrock’s ETHA saw the largest haul with $85.38 million, followed by Fidelity’s FETH with $64.65 million.

Grayscale’s Ether Mini Trust added another $3.90 million. While Grayscale’s ETHE posted a modest $5.35 million outflow, it wasn’t enough to dent the overall bullish tilt. Total ether ETF value traded hit $481.44 million, and net assets closed at $10.83 billion.

As inflows deepen and trading volume holds strong, both bitcoin and ether ETFs appear to be ending the week on a celebratory note, one investors will be watching closely post-holiday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。