Futarchy transforms the subjective differences in DAO decision-making into ownership exchanges based on the collective decisions of market participants.

Written by: Zack Pokorny

Translated by: AididiaoJP, Foresight News

Introduction

The cryptocurrency industry has always been a coexistence of innovation and risk, where even the most whimsical projects can find support. However, over the past 12 months, as the industry has begun to focus on sustainability and real growth, the core contradictions of the industry have become particularly prominent:

For teams: How to build early consensus among loyal token holders? These groups genuinely care about the project's development rather than immediately selling off during market fluctuations, which results in the project losing development time and funding. In the fast-changing landscape of the cryptocurrency industry, how to maintain agility and information sensitivity to make the right decisions quickly?

For investors: How to value early projects that have no revenue or user base? Traditional tools such as discounted cash flow (DCF), revenue multiples, and price-to-earnings ratios are difficult to apply here. Valuation resembles venture capital, relying on subjective judgments about the product, team, and market potential.

These challenges are not unique to cryptocurrency companies, but the decentralized nature of blockchain provides new ideas for solving these problems. When applied to decentralized autonomous organizations (DAOs), the market-based governance model known as Futarchy can bring the following advantages:

Provides builders with clear market consensus, reducing the emotional volatility of token holders during the decision-making process;

Limits information asymmetry, promoting the decentralization of DAO decision-making;

Forms a belief-weighted equity structure shaped by the market that naturally aligns with DAO decisions;

Investors can directly express their approval of specific DAO decisions by adjusting their holdings, acting on market signals generated from proposal votes.

This report will delve into how Futarchy fundamentally improves the investment and decision-making landscape for early cryptocurrency companies, which are highly subjective, have freely tradable ownership, and aim for breakthroughs from zero to one. Currently, the MetaDAO series of experimental DAOs in the Solana ecosystem and Optimism's grant distribution program have begun to experiment with Futarchy, but this article focuses on the foundational principles of Futarchy and DAO governance rather than specific implementation details.

Overview of Futarchy Governance Mechanism

Economist Robin Hanson first proposed the idea of governance through market and economic signals in his 2000 working paper "Shall We Vote on Values, But Bet on Beliefs?" He named this alternative system "Futarchy," combining "future" with the Greek suffix "-archy" (rule), meaning "ruled by the future market." Futarchy aligns with the goals of traditional token voting in DAO governance, which is to guide strategic decisions, but the paths to achieve this are different: it separates the goal-setting process from the evaluation of means to achieve those goals.

In traditional DAO governance, voters typically express their values and beliefs through token-weighted voting (one token, one vote) that is "risk-free" (voting does not carry financial risk). For example, when voters choose a proposal outcome, it may reflect their values or be based on their belief in the proposal's feasibility. The path that receives the most token-weighted votes will be adopted.

Futarchy differs: individuals vote based on their values to choose goals, while prediction markets are used to assess the best means to achieve those goals, effectively separating goal-setting from predictive execution. The core advantage of Futarchy lies in utilizing the predictive capabilities of financial markets (asset prices and trading) to guide decisions, requiring participants to invest real money in their predictions. This market-driven approach promotes accurate predictions and rigorous analysis through economic incentives, which ordinary voting typically cannot achieve due to a lack of vested interest.

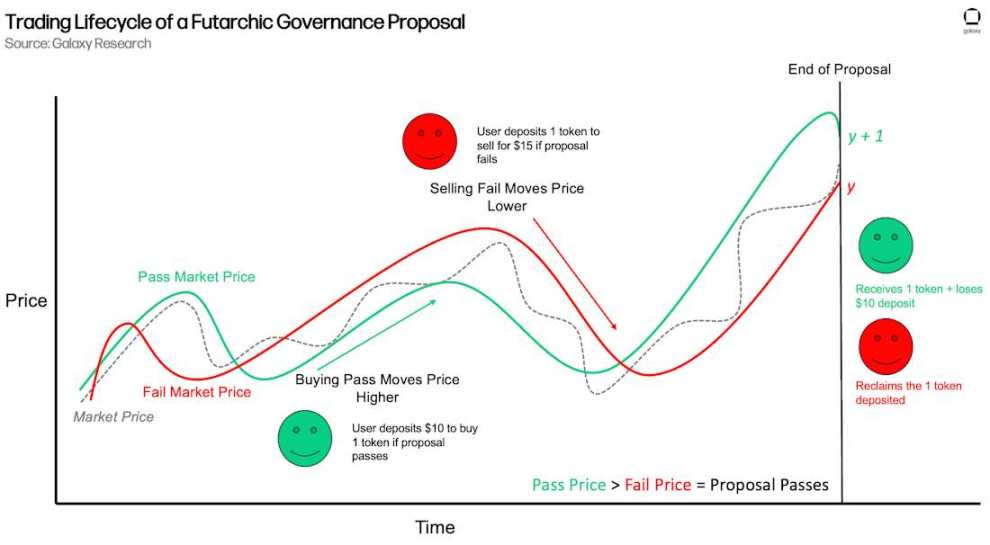

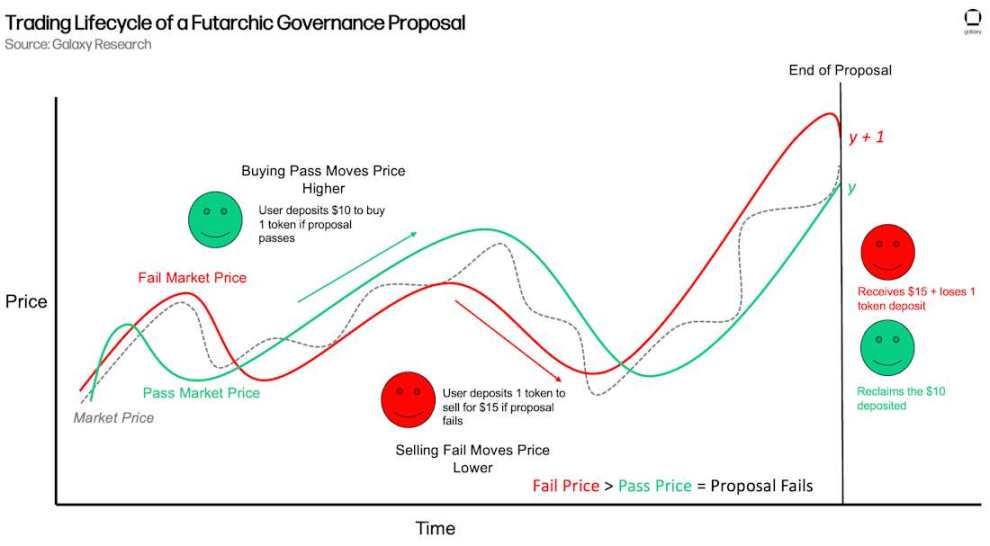

In practice, DAO proposals will establish two temporary conditional token markets: a "pass" market and a "fail" market, both priced in USD stablecoins. These two markets operate during the voting period, parallel to normal trading in the main market. Special-purpose automated market makers (AMMs) "pass AMM" and "fail AMM" support the markets. Voters can buy and sell tokens in either market, driving synthetic proposal price fluctuations. Anyone can participate in these markets, regardless of whether they hold DAO tokens. For example, users holding stablecoins but not DAO tokens can purchase tokens through the proposal's "pass" or "fail" market.

At the end of the voting period, the system records the time-weighted average price (TWAP) of each market, with the higher price determining the proposal's outcome. For instance, if the community proposes to launch a certain protocol feature, and the token price in the "pass" market is higher than in the "fail" market at the end of voting, it indicates that the market collectively believes the feature is beneficial for the DAO, and the proposal passes; conversely, it is rejected. The trading in the proposal market is conditional: if a user buys tokens in the "pass" market, they only actually receive the tokens if the proposal passes; otherwise, the stablecoins are returned; similarly, selling tokens in the "fail" market is executed only if the proposal fails, otherwise the tokens are returned.

Since ownership transfer is only settled when the corresponding outcome occurs, each transaction carries real economic risk. Suppose a proposal passes:

Traders who buy in the pass market increase their token exposure; if the proposal appreciates, they profit more, but if the proposal passes without appreciation (or harms the DAO), they incur greater losses;

Traders who sell in the pass market reduce their exposure and forfeit potential gains, but if the proposal is harmful, they avoid losses.

Thus, the market price reflects not just abstract opinions but real judgments tied to vested interests. The following diagram illustrates the trading lifecycle of a Futarchy governance proposal:

The dynamics when the proposal market fails are similar:

Futarchy governance voting is not just a decision-making tool but an effective information market. By requiring participants to "vote with their money," Futarchy aggregates market opinions and sentiments into economic signals, theoretically producing more robust decisions than "risk-free" voting. This market-driven feedback provides builders with direct insights into the collective perception of a proposal's value. For investors, Futarchy creates unique opportunities for them to express their subjective views on DAO decisions directly and adjust their exposure based on what the market collectively deems the optimal path. This is particularly important for early DAOs, whose valuations are highly subjective and primarily depend on decision-making and product trajectories. Futarchy also allows every participant in the equity table to adjust their holdings to reflect their approval of specific decisions, achieving continuous alignment between financial interests and strategic direction. This mechanism naturally drives projects to form belief-weighted equity structures: participants whose insights consistently align with market decisions will be reinforced, while all holders can maintain belief-weighted exposure consistent with the DAO's strategic direction.

Characteristics of Startups and Early Companies

Understanding the key characteristics of early companies helps recognize the value of Futarchy governance for their builders and investors:

Perceived Valuation: Early startups often have no revenue and are frequently developing innovative products. Their value depends on the quality of the product and team, as well as the market's belief in their future demand through current decisions. Unlike mature companies, startups lack historical data and comparable benchmarks, and valuation primarily relies on interpreting and believing in "invisible" input signals.

Inference-Driven Decision Making: Information asymmetry forces founders and investors to piece together partial data, and builders focused on construction often overlook signals from adjacent ecosystems and competitors. Decisions often rely on probabilities rather than conclusive evidence.

Investor Beliefs: Early investors with long-term faith in the team's vision form a patient, aligned holding group that provides stability during market fluctuations, allowing space for project execution. Conversely, speculative or low-belief investors may sell off during initial volatility, exacerbating fluctuations and forcing the team to divert attention to market management rather than product development.

In summary, founders and investors must continuously guess and invest in the correct narrative, acting accordingly. Futarchy does not eliminate this subjectivity but transforms individual beliefs into aggregated market signals that serve as the basis for DAO actions by allowing anyone to trade tokens on the "pass/fail" outcomes of DAO decisions. This process converts dispersed intuitions into unified, financially-weighted predictions, concentrating ownership among the groups with the clearest and most enduring beliefs. By requiring participants to support their beliefs with real capital, Futarchy turns the vulnerabilities of startups into mechanisms that strengthen governance, providing less arbitrary development paths.

The Value of Futarchy for Startups

Futarchy's dual value for early DAOs lies in:

1) Providing market signals;

2) Offering a dynamic equity structure-building mechanism that directly links the DAO's strategic path with the interests of the holding group.

Market Signals

Futarchy provides feedback on the creative feasibility of the market and directly highlights the economic sentiment of token holders regarding decisions.

Decision-Making in Market Economics

Futarchy governance operates on a logic similar to prediction markets: just as predictions in market economies are more accurate, decisions in market economies should yield more favorable outcomes because participants have vested interests. This outcome correlation reduces redundancy from random and low-quality decisions, incentivizing voters to present more robust and professional opinions. The system also rewards the most accurate predictors, allowing them to adjust their holdings as needed and potentially profit, further aligning individual incentives with the collective interests of the DAO.

By allowing anyone to vote, Futarchy transforms voting into a market, limiting information asymmetry and capturing perspectives outside the DAO holding group. Anyone willing to bear capital risk can assess DAO decisions. This market-driven system also increases the difficulty of manipulation, as any attempts to control voting may be diluted by other market participants. The greater the effort manipulators exert to push the token prices in the "pass" or "fail" markets away from the main market, the stronger the motivation for others to counteract and arbitrage. Moreover, manipulation requires sacrificing real funds to influence outcomes, potentially leading to direct economic losses. The level of decentralization under this structure is difficult to achieve with token-weighted voting.

Separation of Voting and Ownership

In traditional governance systems, there may be a disconnect between people's voting behavior and capital allocation. Someone may oppose a proposal but still increase their token holdings; another person may support a proposal but quietly reduce their holdings, fearing execution risks. This creates a disconnection between stated preferences in governance and displayed preferences in the market, making it difficult for builders to distinguish stakeholders' true views on specific decisions from their overall support for the project. This blind spot can lead to suboptimal decisions.

In Futarchy, voting behavior is closely integrated with market activity, where buying and selling tokens is the act of voting itself. When a proposal is put forward, the market expresses support or opposition through the direct buying and selling of tokens tied to the proposal. This is in stark contrast to traditional governance, where market reactions are completely independent of voting, making it difficult to discern the true motivations behind specific governance decisions. This integrated approach reduces the ambiguity of holder sentiment information and its connection to optimal decisions, ensuring that genuine opinions and beliefs are directly reflected in the voting mechanism, keeping the DAO consistently aligned with the economic views of its holding group. In traditional systems, supporters may act inconsistently, while Futarchy merges market behavior with outcomes. The key to this relationship is that at the end of the voting, tokens flow directly from non-believers in the decision to believers. This process not only clarifies market sentiment and applies it to decision outcomes but also realigns ownership with the most informed and confident participants regarding the decision, allowing the DAO to dynamically balance its equity structure according to decisions.

Belief-Weighted Equity Outcomes

Having a loyal holding group is one of the most challenging tasks for launching early crypto projects. Most teams struggle to distinguish between genuine supporters and speculators, leading to token price volatility, forcing founders to divert their attention to managing market dynamics rather than focusing on the product.

A mainstream strategy for attracting early users is airdrops, incentivizing users to use the product by distributing tokens for free. While this can boost activity and metrics in the short term, it can cause long-term harm:

Speculative behavior: Airdrop recipients typically engage in minimal, non-sustained activities to meet reward conditions, selling off tokens immediately after acquisition, forming a speculative holding group that lacks belief in the project's future.

Blurred product-market fit signals: When users primarily use the product for economic gain, the feedback teams receive can mislead their understanding of product quality and market demand. With rewards, people may use any product, making it difficult to judge whether the core product addresses real problems.

Returning to square one: After the airdrop ends and speculators exit, the project returns to its original state, lacking an active community. The brief spike in activity fails to provide a sustainable foundation for growth.

This contradiction puts early projects in a dilemma: they need users to prove attractiveness, but the methods used to attract users often introduce participants that harm long-term development.

How Futarchy Addresses the Belief Problem of Token Holders

Futarchy creates a natural selection mechanism for holders through market governance. In successive proposals, the token supply gradually concentrates among the most accurate and high-belief voters, while correct but low-belief or incorrect holders (i.e., those whose trades contradict market outcomes) gradually decrease their token share. This process is gradual but continues over time. When combined with a more organic token distribution mechanism, Futarchy can help DAOs find a more loyal holding group.

Futarchy transforms the subjective differences in DAO decision-making into voluntary conditional ownership exchanges based on the collective perceptions of market participants. This can gradually concentrate token ownership in the hands of the most accurate predictors in the market and the most steadfast supporters of the DAO's development path.

For example, a proposal suggests adding a new feature to the protocol. Three holders have different views:

Alice wants to buy 1 token if the proposal fails, believing the feature is detrimental to the DAO. If the proposal does not pass, she wants to increase her exposure.

Bob wants to sell 1 token if the proposal fails, believing the feature is beneficial for the application. If the proposal does not pass, he wants to reduce his exposure.

Eve wants to buy 1 token if the proposal passes, believing the feature has value. If the proposal passes, she wants to increase her exposure.

If the market collectively decides that the proposal should fail (fail price > pass price), Alice effectively acquires Bob's 1 token through the synthetic proposal market. Both Alice and Bob's trades align with the final market outcome: Alice buys under failure conditions, and Bob sells the token he does not wish to hold under failure conditions. Alice gains exposure, Bob exits, and both get what they want. Eve, however, does not directly experience a token transfer due to her conditional purchase relying on the proposal passing, but her relative influence in equity is diminished by Alice.

This results in three outcomes:

Alice (high belief, trade aligns with market outcome): gains tokens and equity share.

Bob (low belief, trade aligns with market outcome): loses tokens and exits.

Eve (did not bet on the passing outcome): maintains absolute holdings but is diluted in relative equity by Alice.

This process is automatically completed through market mechanisms: ownership naturally flows to participants whose judgments consistently align with the collective wisdom of the market. Futarchy ensures that influence is concentrated among participants who have belief in the decision and whose predictions are trusted by the market. The result is that over time, tokens flow increasingly to holders who repeatedly support their views with capital and have faith in the project's direction.

Limitations of Futarchy

Futarchy cannot guarantee success; it is a tool for optimizing decision-making and holder structure, not an ultimate goal. Teams still need to execute the insights generated by Futarchy governance, the underlying product concept must be reasonable, and the product itself must meet real demand.

Moreover, introducing market mechanisms into the decision-making process does not guarantee that the DAO will achieve the best outcomes every time. The idea behind Futarchy is to reinforce opinions through economic consequences, creating an environment conducive to optimal decision-making. People may still act irrationally, and the market may still misprice decisions. However, compared to "risk-free" token voting, holders can still influence the DAO's strategic direction without vested interests, and Futarchy provides an incentive-compatible decision-making mechanism.

The core value of Futarchy does not lie in ensuring that decisions drive prices up and adoption; no governance system can achieve that. But compared to traditional solutions, Futarchy can offer DAOs a higher probability of success.

Conclusion

Futarchy provides a powerful framework for early startups, supporting market-driven decision-making that allows investors to directly align their financial exposure with the direction chosen by the DAO. This mechanism is particularly beneficial for startups, providing a stronger cold-start mechanism for building applications and loyal holding groups. While mature DAOs can also benefit from Futarchy, this model is most valuable in the early stages where subjectivity prevails and building a high-belief holding group is crucial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。