The U.S. Treasury's inclination to increase the issuance of short-term bonds is substantially undermining the independence of the Federal Reserve.

Written by: Bao Yilong, Wall Street Insights

The U.S. Treasury's strategy to increase the issuance of short-term bonds is significantly weakening the independence of the Federal Reserve, effectively shifting the authority of monetary policy-making to the Treasury Department.

This week, U.S. Treasury Secretary Yellen clearly stated a preference for relying more on short-term debt financing, contrasting with her previous criticism of her predecessor's excessive reliance on short-term government bonds. This strategy is essentially equivalent to a fiscal version of quantitative easing.

In the short term, the Treasury's shift towards issuing more short-term government bonds will stimulate risk asset prices to further deviate from their long-term fair value and structurally push up inflation levels.

The more profound impact is that this will severely limit the Federal Reserve's ability to independently formulate anti-inflation monetary policy, creating a fiscally dominated landscape. The actual independence of the Federal Reserve has been eroded in recent years, and the surge in short-term government bond issuance will further deprive the central bank of the space to freely formulate monetary policy.

Why Short-Term Bonds Are an "Inflation Catalyst"

In the coming years, rising inflation seems inevitable, and the U.S. Treasury's decision to increase the issuance of short-term bonds is likely to become a structural factor driving inflation.

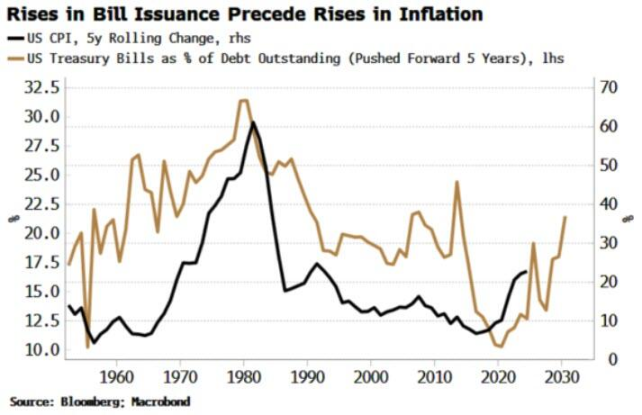

Treasury bills, as debt instruments with maturities of less than one year, are more "monetary" than long-term bonds. Historical data shows that fluctuations in the proportion of Treasury bills in the total outstanding debt often precede long-term inflation trends, resembling a causal relationship rather than a simple correlation.

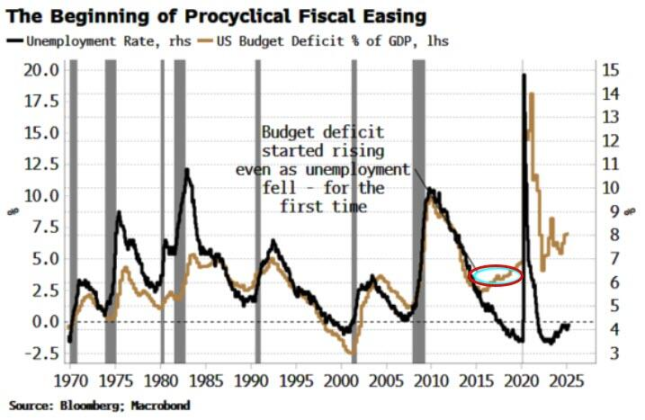

The onset of the current inflation cycle was foreshadowed by the rebound in Treasury bill issuance that began in the mid-2010s, when the U.S. fiscal deficit first experienced pro-cyclical growth.

Additionally, the explosive growth of the repurchase market in recent years has amplified the impact of short-term bonds. Due to improvements in the clearing mechanism and increased liquidity, repurchase transactions themselves have become more like money.

Treasury bills typically achieve zero haircut in repurchase transactions, allowing for higher leverage. These Treasury securities activated through repos are no longer dormant assets on balance sheets but are transformed into "quasi-money" that can push up asset prices.

Moreover, the choice of issuance strategy has distinctly different effects on market liquidity.

A striking example is that when the annual net bond issuance relative to the fiscal deficit is too high, the stock market often encounters trouble. The 2022 bear market is a case in point, which prompted then-Treasury Secretary Yellen to release a large amount of Treasury bills in 2023. This move successfully guided money market funds to utilize the Federal Reserve's reverse repurchase agreement (RRP) tool to purchase these short-term bonds, injecting liquidity into the market and driving a stock market recovery.

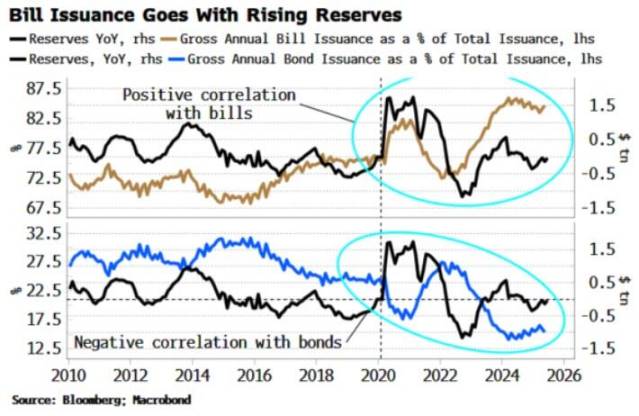

Furthermore, observations show that the issuance of short-term Treasury bills is usually positively correlated with the growth of Federal Reserve reserves, especially post-pandemic; while the issuance of long-term bonds is negatively correlated with reserves. In short, issuing more long-term bonds squeezes liquidity, while issuing more short-term bonds increases liquidity.

Issuing short-term bonds provides the market with a "sweet stimulus," but when the stock market is already at historical highs, with crowded investor positions and extremely high valuations, the effectiveness of this stimulus may be difficult to sustain.

The Era of "Fiscal Dominance" Arrives, Federal Reserve in a Dilemma

For the Federal Reserve, the irrational exuberance of asset prices combined with high consumer inflation and a large amount of outstanding short-term debt creates a tricky policy dilemma.

Traditionally, the central bank should respond to this situation with tightening policies.

However, in an economy burdened with a large amount of short-term debt, raising interest rates will almost immediately translate into fiscal tightening, as the government's borrowing costs will soar.

At that point, both the Federal Reserve and the Treasury will face immense pressure to ease policies to offset the impact. Ultimately, the winner will be inflation.

As the outstanding balance of short-term government bonds rises, the Federal Reserve will find itself constrained in raising interest rates, increasingly unable to fulfill its complete mandate. Instead, the government's massive deficit and its issuance plans will substantially dominate monetary policy, creating a fiscally dominated scenario.

The market's accustomed independence of monetary policy will be significantly undermined, and this is still the situation before the next Federal Reserve chair takes office, who is likely to lean towards the White House's ultra-dovish stance.

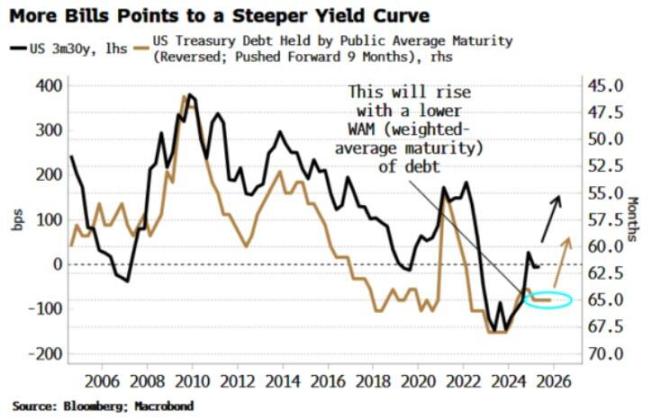

It is noteworthy that this shift will have profound long-term implications for the market. First, the dollar will become a casualty. Second, as the weighted average maturity of government debt shortens, the yield curve will tend to steepen, meaning that long-term financing costs will become more expensive.

The likelihood of reactivating policy tools such as quantitative easing, yield curve control (YCC), and financial repression to artificially suppress long-term yields will significantly increase. Ultimately, this could become a "victory" for the Treasury.

If inflation is sufficiently high and the government can manage to control its underlying budget deficit, the debt-to-GDP ratio could indeed decline. However, for the Federal Reserve, this is undoubtedly a painful loss, as its hard-won independence will suffer severe erosion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。