Author: Luke, Mars Finance

In Washington, seemingly unrelated events often intertwine at a deeper level, sketching a grand strategic picture. At the beginning of July, as public attention focused on the "Independence Day Gift Package" presented by the U.S. House of Representatives to President Trump—a massive fiscal bill dubbed the "One Big Beautiful Bill" (OBBB)—another quieter yet equally profound revolution was quietly brewing on Capitol Hill—a series of legislative proposals targeting digital assets was being brought to the agenda at an unprecedented pace.

These two seemingly parallel trajectories—one of radical fiscal expansion and the other of precise regulatory reshaping—are not coincidental. Together, they form a carefully designed "Washington conspiracy": by creating a massive macroeconomic wave while simultaneously constructing a regulatory moat tailored for the United States, it aims to establish an unshakeable hegemonic position in the global digital asset race. This is not merely about tax cuts or regulation; it is a gamble concerning the future dominance of the financial system.

The Economic Engine and Debt Black Hole of the "One Big Beautiful Bill"

Structurally, the OBBB bill is a meticulously designed duet. On one hand, it introduces unprecedented tax cuts. Critics have labeled the bill as an extreme "robbing the poor to pay the rich": it permanently locks the corporate tax rate at 21% and provides nearly $6,000 in annual tax savings for high-income individuals. On the other hand, the cost of this is borne by brutal cuts to social welfare programs. Approximately 600,000 families will see their food stamps shrink by $100 per month, while the Medicaid program will be directly slashed by $1.2 trillion over the next decade.

The core of the controversy surrounding this game lies in its true fiscal cost. The White House Council of Economic Advisers (CEA) employs a "dynamic scoring" model, insisting that tax cuts will stimulate economic growth, generating enough revenue to offset the costs. However, this optimistic forecast starkly contrasts with the conclusions of nearly all nonpartisan analysis institutions.

The nonpartisan Congressional Budget Office (CBO) predicts that the bill will add a net $3.3 trillion to federal debt over the next decade. Think tanks such as the center-left Brookings Institution and the libertarian Cato Institute have reached similar conclusions, arguing that its impact on GDP is negligible and cannot offset its enormous debt costs. Economists at Goldman Sachs have bluntly stated that any slight growth momentum from the bill will be completely offset by the economic drag caused by the tariffs implemented by the government during the same period.

The academic debate over scoring models actually obscures a more fundamental and undeniable truth: regardless of how it is calculated, the United States has clearly chosen a path of stimulating the economy through large-scale, unfunded fiscal expansion. This is not a mere policy adjustment; it is a paradigm shift in fiscal posture. The underlying economic reality is that a debt-driven super-stimulus cycle has already begun.

Inevitable Rise

Such a scale of fiscal expansion will inevitably reverberate in the monetary realm. A multi-trillion-dollar new national debt hole means that an equal scale of monetary expansion is needed to finance it. This will inevitably lead to the devaluation of fiat currency, creating a powerful and structural long-term benefit for scarce, non-sovereign hard assets like Bitcoin.

This logical chain has been vividly articulated by two thought leaders in the crypto world—Michael Saylor and Arthur Hayes. Michael Saylor, the founder of MicroStrategy, likens currency devaluation to a "leakage of economic energy." In his view, Bitcoin is the engineering solution to this problem, representing "for the first time in human history, you can tightly bind economic energy to individuals… without having to live in fear." Meanwhile, Arthur Hayes, co-founder of BitMEX, believes that government spending and fiat currency creation are the fundamental fuels of the crypto bull market. "Printing money is their only answer," Hayes asserts, predicting that the massive stimulus from the Trump administration will catalyze Bitcoin prices to hit a million dollars.

These views are supported by macro data. There is a significant positive correlation between the global broad money supply (M2) and Bitcoin prices. Historical data shows that when global M2 rises, excess capital flows into "risk assets" like cryptocurrencies. The passage of the OBBB bill effectively heralds the arrival of the "Fiscal Dominance" era. The Federal Reserve's monetary policy will have to serve the fiscal needs of the government by purchasing newly issued bonds to finance it—this is essentially debt monetization, also described by Hayes as "Stealth QE."

Thus, the OBBB bill is not just a tax bill; it is a clear signal: the United States has chosen to manage its heavy debt burden through currency devaluation. This transforms the logic of investing in Bitcoin from a cyclical speculative behavior into a long-term, structural necessity.

Game Rules: A New Regulatory Framework

If the massive macroeconomic wave is the first step of the "conspiracy," then the subsequent regulatory blitzkrieg is the second step. Washington is simultaneously advancing a carefully designed regulatory combination aimed not at stifling but at building a solid "regulatory moat" for the U.S. digital asset ecosystem, thereby attracting capital and talent globally and shaping the industry landscape according to American interests and advantages.

The first pillar of this regulatory reshaping is the GENIUS Act, which aims to create a legal framework tailored for stablecoins. The act establishes a comprehensive federal regulatory framework for "payment stablecoins," strictly limiting the scope of issuers and requiring reserves to be backed 1:1 by high-quality liquid assets such as cash or short-term U.S. Treasury bonds. This not only provides an advantage for traditional banks but, as Arthur Hayes points out, cleverly directs trillions of private savings into the U.S. Treasury market, creating a massive buyer base for the new debt generated by the OBBB bill.

The second pillar is the CLARITY Act, which aims to clarify the regulatory responsibilities between the SEC and CFTC. The act creates a clear path for digital assets to be classified as "digital commodities" once their networks are sufficiently decentralized, thus placing them under CFTC regulation. This paves the way for the compliance of mainstream crypto assets like Ethereum, significantly reducing the legal risks for institutional entry.

The final pillar of the regulatory framework is the Anti-CBDC Surveillance State Act. This act explicitly prohibits the issuance of retail central bank digital currencies (CBDCs), declaring to the world that the U.S. is committed to a private, permissionless financial future rather than a "Chinese-style surveillance tool." This strategic choice aims to compete with China's digital yuan by supporting a privately-led ecosystem based on open and free principles, ensuring that the dollar, in its new digital proxy form, continues to maintain its global dominance.

Market Judgment: Capital Flows and Future Trajectories

As Washington's macro and regulatory blueprint gradually unfolds, the market has begun to vote with real money. However, as many investors are concerned, recent policy benefits seem to have already been realized. After the short-term boost of the OBBB bill on U.S. stocks, the market may face a period of volatile adjustment due to the pressure of massive deficits.

On-chain Data and Market Sentiment Analysis

The current market is digesting a series of complex signals. While surface market sentiment indicators show greed (the fear and greed index has risen to 73), deeper on-chain data reveals a more mature and stable picture. According to Glassnode's analysis, despite the market experiencing significant volatility, its bull market structure remains solid, forming a strong structural support between $93,000 and $100,000.

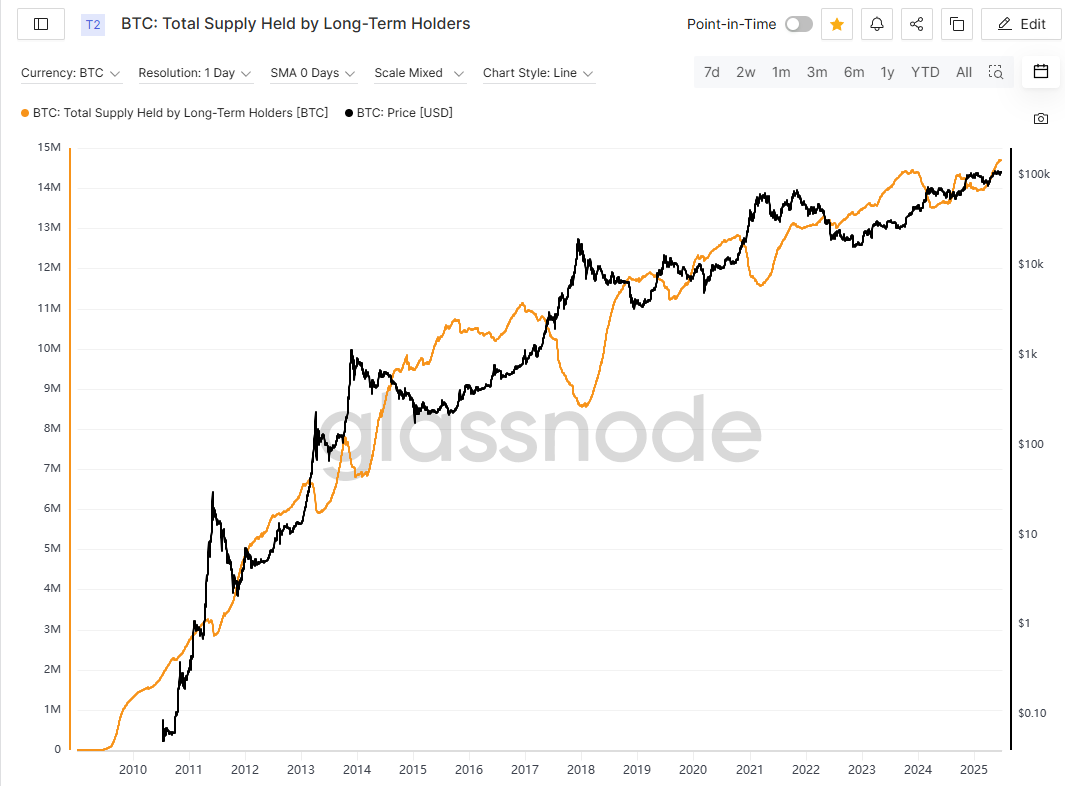

Although the price increase has led to profit-taking, data shows that selling pressure is diminishing, and the behavior of long-term holders (LTH) is shifting back to "HODL" (holding long-term). More notably, the supply of Bitcoin held by long-term holders has reached an all-time high, which is highly unusual in the later stages of a bull market, indicating their strong belief in the future. This divergence between surface sentiment (greed) and underlying data (calmness) is precisely a hallmark of a maturing, institution-driven market. The market is building a strong support base, patiently absorbing selling pressure and waiting for the comprehensive implementation of macro and regulatory policies.

Corporate Balance Sheets 2.0

The "corporate playbook" pioneered by MicroStrategy, which uses publicly traded companies as tools to gain exposure to crypto assets, is now entering version 2.0. With the dual tailwinds of macro and regulatory support, companies are beginning to shift their focus from Bitcoin to other strategically valuable digital commodities, especially Ethereum.

The stock price of crypto mining company Bitmine Immersion (BMNR) surged over 130% in a single day, catalyzed by the company's announcement of completing a $250 million private placement aimed explicitly at purchasing Ethereum as its core inventory reserve asset. Notable crypto bull and Fundstrat founder Tom Lee has taken on the role of the company's new chairman, injecting significant market credibility into this strategy. Coincidentally, Canadian fintech company Mogo Inc. (MOGO) also announced a $50 million Bitcoin inventory reserve authorization, designating Bitcoin as the "company's hurdle rate of return" for all capital allocation decisions.

This creates a perfect positive feedback loop. The CLARITY Act de-risking Ethereum makes BMNR's ETH inventory reserve strategy possible. In turn, BMNR's actions serve as a massive proof of concept, demonstrating the importance of the CLARITY Act. We are witnessing the birth of a new asset class for corporate balance sheets. The market is beginning to distinguish between "Bitcoin as a store of value" and "Ethereum as a decentralized computing platform/settlement layer." Washington's regulatory conspiracy provides a framework for the coexistence and flourishing of both in the portfolios of compliant entities.

Conclusion: Galloping into the New Paradigm of U.S. Crypto

In summary, the inflationary fiscal blitzkrieg, a regulatory framework aimed at legitimizing and guiding the industry, and a strategic rejection of state-controlled currency are not coincidences. This is a well-thought-out "Washington conspiracy" aimed at consolidating the United States' leadership in the next generation of financial and technological revolutions.

The U.S. is choosing to manage its debt through inflation, creating permanent structural demand for hard assets. At the same time, it is building a regulatory moat that incorporates digital assets into its dominant orbit. It provides a clear path to legalization for the broader Web3 ecosystem, ensuring that the next generation of the internet is built on American soil. More importantly, while doing all this, it has clearly chosen the path of economic freedom and individual privacy over state surveillance, giving it a significant advantage over authoritarian rivals in the global ideological competition.

The market has grasped this signal and is responding with mature consolidation and strategic corporate adoption that transcends Bitcoin. For global investors, developers, and builders, the message from Washington is crystal clear: the game has begun, and the U.S. is determined to win. A macro and regulatory environment tailored for digital assets is forming in the U.S., which, while fraught with risks, has a clear goal—to attract global capital, nurture domestic innovation, and ensure that the dollar continues to serve as the undisputed global reserve currency through its new, private, decentralized digital proxy, galloping into the 21st century.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。