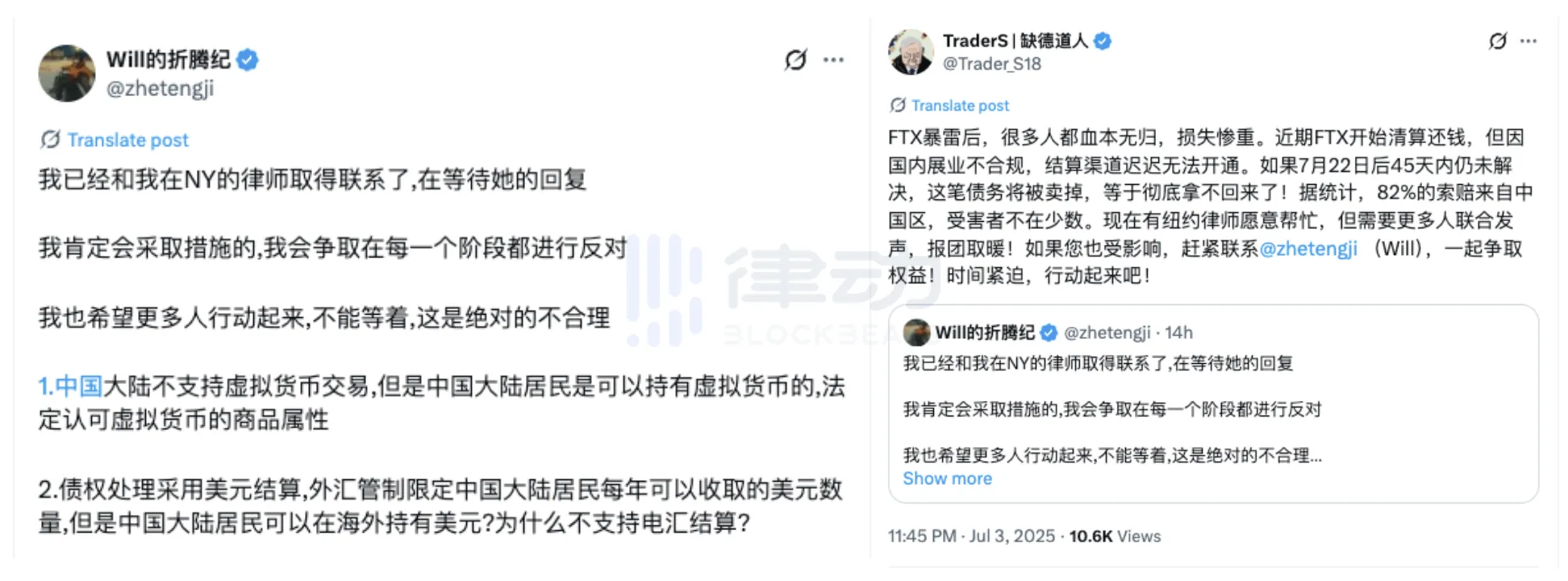

On July 4, 2025, Sunil, a representative of FTX creditors, posted a screenshot of a document regarding FTX's bankruptcy liquidation on social media. The document indicated that FTX would seek legal advice, and if users belonged to restricted foreign jurisdictions, their claim funds could be confiscated.

Sunil also revealed a piece of data: 82% of the claim funds from "restricted countries" came from Chinese users.

However, due to the prohibition of cryptocurrency trading in China, these users might be classified as "illegal," leading to the confiscation of their claim eligibility. This means that not only would these users be unable to recover their losses, but their assets could also be "legally confiscated."

The community erupted in outrage, questioning whether the compliance reasons provided by the liquidation team were merely excuses to evade responsibility. Some referred to FTX's decision as "American-style robbery," lamenting that "the people are worse than dogs," expressing deep disappointment and helplessness. Some believed that despite China's strict restrictions on cryptocurrency trading, user funds should not be directly confiscated, and that FTX's decision lacked clear legal basis.

In light of this statement, which could rewrite the global creditors' rights perception, the public's primary concern was not just whether FTX was "acting lawfully," but who was making the decisions, based on what standards, and who the ultimate beneficiaries were.

Who is in charge?

Taking over this wreckage is a bankruptcy restructuring team from Wall Street: led by restructuring veteran John J. Ray III as CEO, and spearheaded by the prestigious law firm Sullivan & Cromwell (hereinafter referred to as S&C), forming the liquidation team.

John J. Ray is a seasoned professional in handling corporate bankruptcies. He previously took over the Enron bankruptcy case, bringing nearly $700 million in revenue to S&C during that "trial of the century."

This time, he brought the same law firm team to take over FTX.

High salaries are not an issue; the question is how high they are. According to public documents, S&C partners charge up to $2,000 per hour, while John Ray himself demands $1,300 per hour. According to Bloomberg data, by early 2025, the legal service fees claimed by S&C in the FTX Chapter 11 bankruptcy proceedings had reached a staggering $249 million.

Assets that should belong to all creditors are being sliced away by this "professional team." This is why FTX creditors have consistently accused them of "repeating the Enron script."

Another ironic aspect is the speed at which FTX announced its bankruptcy. It wasn't until SBF's complete testimony draft was leaked that we learned how he was "hunted" just two days before the bankruptcy filing.

A draft of testimony prepared by SBF (Sam Bankman-Fried) for Congress revealed that FTX.US's General Counsel, Ryne Miller, also from S&C, had closely collaborated with the liquidation team to force SBF and his management to swiftly enter Chapter 11 bankruptcy.

SBF wrote in his testimony: "The people from Sullivan & Cromwell and Ryne Miller sent me a lot of threats; they even harassed my friends and family… Some came to me in tears."

But he had no chance to turn back. The five emails he sent were never replied to by John Ray.

He was merely the previous protagonist in this elaborate plunder.

That bankruptcy filing was pressed amid a night of bombardment, panic, and isolation. He had intended to continue fundraising, trying to save the situation, but was preemptively kicked off the stage by the legal advisors he had hired.

And the real game—about who takes over this company and who divides its legacy—was just beginning.

Who is dividing FTX's legacy?

The way this bankruptcy liquidation team is handling FTX's historical investment portfolio is both infuriating and perplexing.

These portfolios were once crucial pieces in SBF's "effective altruism" dream and were considered valuable reserves for FTX's potential resurgence, but they were almost "liquidated" in a wholesale manner by John Ray's team, with most selling prices far below their true value.

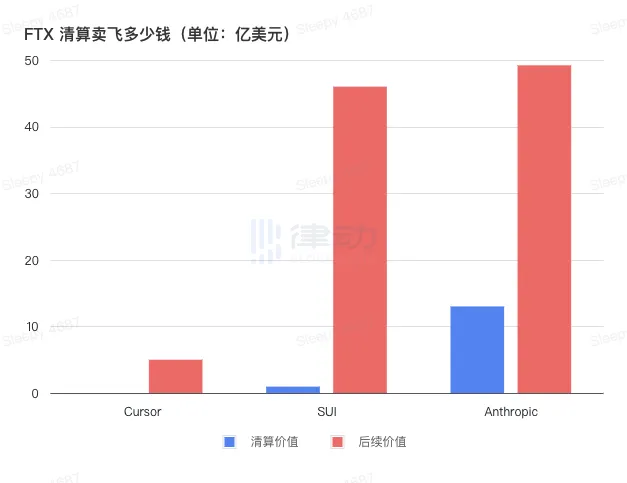

The three most glaring transactions reveal the absurdity of the entire liquidation:

1) Cursor: $200,000 for a $500 million sigh

Cursor, hailed in the AI community as the "Vibe coding tool," received a $200,000 seed round investment from FTX, which was sold at its original price during liquidation. On the surface, it seems like no loss, but considering that Cursor has been reported by authoritative media like TechCrunch and Bloomberg to be valued at $9 billion, this selling price is outrageous.

Conservatively calculated, FTX could have recovered at least $500 million in equity returns, but under the lawyers' operations, it was handed over. There was even industry sarcasm suggesting it was "faster to make money than Trump," directly pointing to the "particularly shady" sale of this asset.

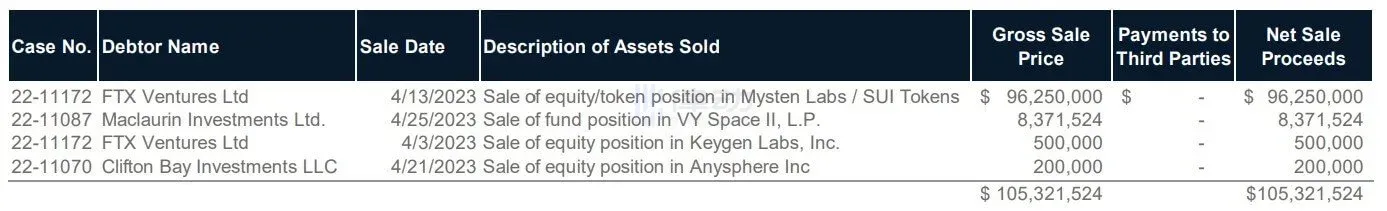

2) Mysten Labs / SUI: $96 million for a $4.6 billion public chain dream

Mysten Labs and its developed SUI chain are considered the next Solana, possessing extremely high public chain scalability.

In 2022, FTX exchanged about $100 million for equity in Mysten and the right to subscribe for 890 million SUI tokens, but the liquidation team disposed of this asset for $96 million in 2023, citing "quick capital recovery."

At its peak, this batch of SUI was valued at over $4.6 billion, meaning that the $96 million at that time was only equivalent to 2% of its future value.

The community once joked that if SBF saw the SUI market while in prison, he would probably be so furious he would vomit blood.

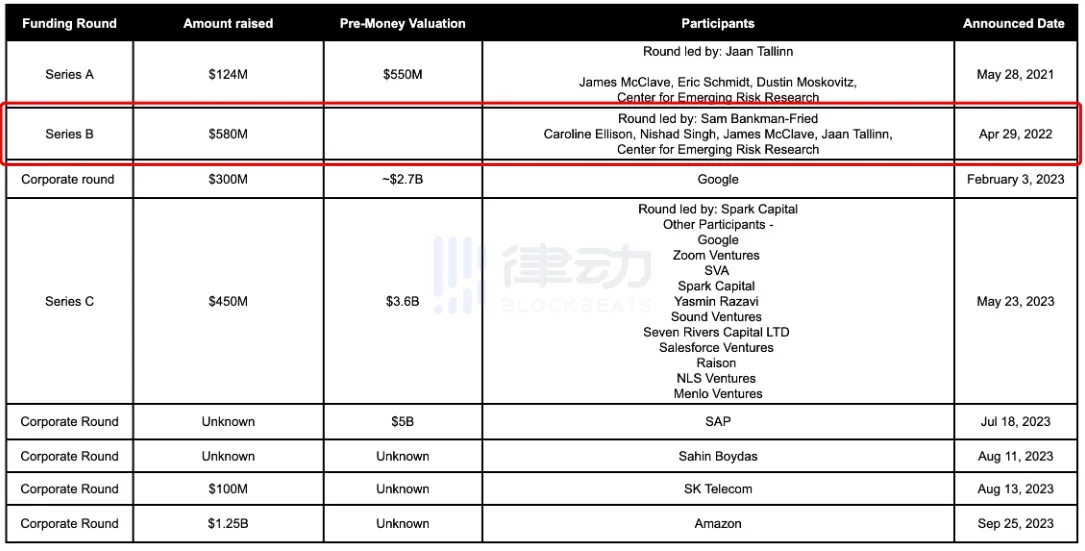

3) Anthropic: $1.3 billion for a $61.5 billion giant

Anthropic, founded by former OpenAI executives, focuses on AI safety, with SBF personally investing $500 million for about 8% equity.

The liquidation team sold all shares in two transactions in 2024, totaling $1.3 billion, which was initially considered a decent monetization result. However, less than a year later, Anthropic's valuation soared to $61.5 billion, meaning that FTX's 8% stake was worth nearly $5 billion.

In other words, the bankruptcy liquidation team missed at least $3.7 billion in additional returns.

FTX's investment vision was correct; almost no one would deny that. They fired their shots just before the windfall, betting on these companies at their most overlooked moments and securing core shares.

But after FTX's collapse, these bets were treated as scrap metal.

In addition to these three typical cases, the FTX liquidation team has faced significant controversy over transactions involving LedgerX, Blockfolio, and bulk sales of SOL tokens, consistently executing operations that "sold off" these assets.

For instance, during the 2024 liquidation auction of SOL tokens, institutions like Galaxy Trading and Pantera Capital bought them at low prices, and subsequently, the SOL price skyrocketed, yielding astonishing profits, while the original creditors could only watch the opportunity slip away. According to reports from the Financial Times and Cointelegraph, FTX is believed to have missed at least tens of billions of dollars in potential appreciation in the disposal of quality assets.

Why did this concentrated and rapid "liquidation sell-off" occur? John Ray's explanation was "to lock in funds promptly and avoid volatility risks," but industry analysts pointed out that such reasoning fails to explain why large-scale discounts were only targeted at familiar institutional friends, and many assets doubled in value in less than six months.

Thus, conspiracy theories emerged, suggesting that the liquidation team sold off valuable assets to familiar funds in a very short time, allowing themselves to collect exorbitant legal fees and quickly close cases, ultimately profiting significantly. Assets that originally belonged to creditors were transferred at low prices to those closer to the centers of power under the guise of being "reasonable and compliant."

The value of those shares, tokens, and options that were sold at bargain prices continues to grow; while those who should have held onto this growth can only watch the future being seized by others through publicly available PDFs.

Bankruptcy liquidation or "legal plunder"?

No industry is better at forgetting than the cryptocurrency industry. The market has now fallen back into a chase for AI, stablecoins, and RWAs, as if the crisis of 2022 has passed, but this liquidation process is far from over.

Over the past three years, FTX's assets have been sliced, packaged, and auctioned, stripping away all future prospects of a platform, leaving only an empty shell.

The scale and complexity of FTX's bankruptcy liquidation are enough to be recorded in the annals of global cryptocurrency history, but what truly deserves to be written into textbooks is the collective disillusionment of creditors regarding the legal trust system.

On one hand, the liquidation lawyers represented by John Ray and S&C have legally charged exorbitant fees, making it almost impossible to hold them accountable in court. On the other hand, they have shielded themselves with indemnity clauses, meaning they would not have to bear responsibility even if they were later questioned about "malicious liquidation."

For the tens of thousands of retail investors who were plundered by FTX's collapse, this is not redemption but a second injury. You may miss the market, but being deprived of a fair chance to recover is the most brutal.

Currently, FTX's bankruptcy assets are expected to be globally liquidated and distributed for a total of $14.5 billion to $16.3 billion, but if users from regions like China ultimately cannot claim their funds smoothly, it will mean another unresolved tragedy: some are completely excluded from the legal system, while the funds that originally belonged to them are consumed by the cumbersome legal processes and the gray areas of bankruptcy lawyers.

Moreover, in the new proposal submitted by the FTX team to the bankruptcy court, hidden clauses for advisor indemnity have been embedded, making it nearly impossible for creditors to sue or appeal.

Perhaps for the industry, FTX's collapse is just another cycle's bottom, but for those trapped within it, especially the tens of thousands of Chinese retail investors, this is not only the loss of funds but also the end of hope.

That group of lawyers and advisors, hailed as the "professional liquidation team," can decide the fate of billions of dollars in assets with just a few lines of text, yet no one is left to provide these ordinary investors with any chance of a comeback.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。