Content Organization: Peter_Techub News

On July 4, the on-chain analysis platform Lookonchain detected a significant piece of news: a Bitcoin "OG whale" transferred a total of 20,000 BTC, worth approximately $2.18 billion, from two related addresses after being dormant for 14.3 years. These Bitcoins were originally purchased in April 2011, when each BTC was priced at just $0.78, yielding an astonishing return of 140,000 times. This massive transfer has sparked widespread attention in the market: is such a large-scale movement of dormant funds a precursor to a market crash, or is there a deeper meaning? This article will analyze the potential impact of this event on the cryptocurrency market in conjunction with the latest market conditions.

Whale Awakens: The Astonishing Transfer of 20,000 BTC

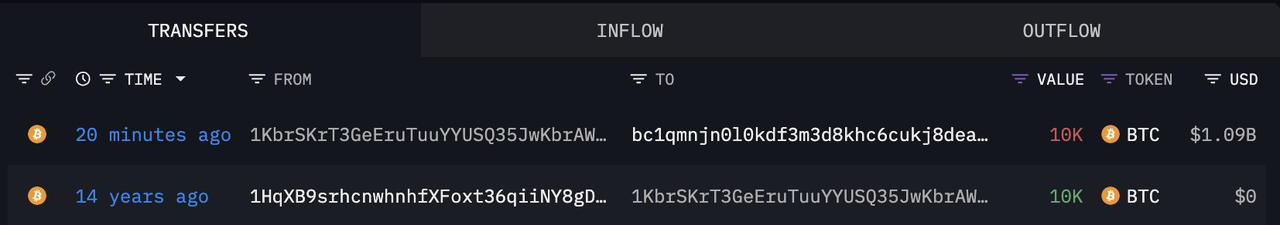

According to Lookonchain data, this Bitcoin OG whale executed two transactions on July 4, transferring 10,000 BTC from two wallets that had been dormant for over 14 years, totaling 20,000 BTC, with a current market value of approximately $2.18 billion. Fourteen years ago, the purchase cost of these Bitcoins was only $15,600 (20,000 BTC × $0.78). Now, the price of BTC has soared to $109,175.02 (according to CoinMarketCap, data from July 4, 2025), yielding a return of 140,000 times. This event is not only a legendary investment case in the history of cryptocurrency but has also raised market concerns about potential selling pressure due to its massive scale.

It is noteworthy that on-chain data shows these BTC have only been transferred to new wallets and have not flowed into exchanges. This indicates that the whale may be restructuring assets, enhancing security measures, or preparing for subsequent operations rather than immediately selling. However, such a large-scale movement of funds has still sparked intense discussions in the crypto community: is this a prelude to the whale cashing out, or a signal that the market is entering a new phase?

Market Background: Bitcoin Price and Macroeconomic Environment

As of July 4, 2025, the price of Bitcoin is $109,175.02, with a total market capitalization of $2.17 trillion, and a 24-hour trading volume down 11.14% to $48.77 billion, maintaining a market share of 64.47% (CoinMarketCap data). Recently, the price of BTC has fluctuated between $105,000 and $110,000, with multiple attempts to break through the historical high of $110,000 failing, indicating some resistance at high levels.

On the macroeconomic front, the Trump administration announced a 10% to 70% tariff on 10 to 12 countries starting August 1, a policy that may exacerbate global trade tensions and increase market uncertainty. Historical experience shows that during trade wars (such as the 2018-2020 US-China trade war), Bitcoin is often viewed as a safe-haven asset, leading to increased price volatility. Additionally, the US Federal Reserve paused interest rate hikes at the end of 2023 and hinted at rate cuts in 2024, injecting liquidity into the market and stimulating the rise of high-risk assets like BTC. However, recent data from Glassnode indicates that whales holding over 10,000 BTC began accumulating at the April low ($75,000) and are now showing signs of distribution, suggesting that some large holders may be taking profits at high levels.

Whale Behavior Analysis: Market Crash or Strategic Adjustment?

Possibility of a Market Crash: Limited Short-Term Selling Pressure

The transfer of large amounts of dormant Bitcoin is often interpreted by the market as a potential signal of selling pressure. Historically, whale sell-offs have often triggered short-term price corrections. For example, on March 30, 2023, a cold wallet on Bitfinex transferred 20,000 BTC after being dormant for 503 days, causing a brief panic in the market. However, the 20,000 BTC from this whale has not yet entered exchanges, indicating no immediate intention to sell. CryptoQuant analyst Dan pointed out that similar transfers of dormant funds, if not directly flowing into exchanges, typically do not trigger immediate selling pressure but may represent asset restructuring or adjustments in long-term holding strategies.

Moreover, the depth of the Bitcoin market has significantly improved in recent years. After the approval of spot Bitcoin ETFs in the US in 2024, institutional inflows have been substantial, with ETFs like BlackRock's IBIT accumulating over $7 billion.

14-Year Dormant Bitcoin Whale Transfers 20,000 BTC: Prelude to a Market Crash or a New Market Signal?

New Market Signal: Strategic Shift in Long-Term Holding

Another possibility is that the transfer by this OG whale reflects an adjustment in their investment strategy rather than a simple intention to sell. On-chain data shows that these 20,000 BTC were transferred to new wallets rather than exchanges, possibly for:

Security Upgrade: With the surge in Bitcoin prices, early wallets may face security risks (such as outdated private key storage methods). Transferring to new addresses may be aimed at adopting more modern storage solutions, such as multi-signature wallets.

Asset Restructuring: The whale may plan to allocate funds to other investment channels, such as DeFi, NFTs, or other emerging crypto assets, to diversify risk or capture new opportunities.

Preparation for Long-Term Holding: The transfer may simply be a repositioning of assets within the current market cycle rather than an immediate cash-out. Glassnode data shows that wallets holding between 1,000 and 10,000 BTC have recently shifted to an accumulation mode, indicating that some whales still see long-term potential in BTC.

It is also noteworthy that this whale conducted multiple small test transactions before the transfer, demonstrating caution and planning. This further reduces the likelihood of a large-scale sell-off in the short term.

Historical Precedents and Market Impact

The activity of dormant whales often draws market attention due to its potential significant impact on liquidity. BitInfoCharts data shows that addresses holding over 1,000 BTC control about 15.4% of the circulating Bitcoin supply. In 2024, the activity of dormant whales significantly increased, for example:

July 14, 2024: A wallet dormant for 11.8 years transferred 1,000 BTC (approximately $6 million), without causing noticeable price fluctuations.

September 20, 2024: A miner's wallet dormant for 15.7 years transferred 50 BTC (approximately $319,000), with a mild market reaction.

March 22, 2025: A wallet dormant for 8 years transferred 3,000 BTC (approximately $250 million), with BTC prices rebounding from $81,000 to $88,000 in the following week.

These cases indicate that the transfer of dormant whales does not always lead to a market crash. On the contrary, if funds do not flow into exchanges, the market can typically absorb short-term fluctuations, especially against a backdrop of strong institutional demand. Since 2024, net inflows into US spot Bitcoin ETFs have approached $7 billion, indicating sustained institutional confidence in BTC.

Market Outlook: Where Will BTC Prices Go?

Combining the current market conditions and whale behavior, here is an analysis of the potential impact on BTC prices:

Bullish Scenario:

Institutional Demand Support: The continued inflow of ETFs like BlackRock provides strong support for the market. Even if the whale sells 20,000 BTC (approximately 0.1% of the circulating supply), the short-term impact may be limited given the current market depth. Analyst Ted Pillows predicts that BTC may break through the historical high of $110,000 within 1-2 weeks, inspired by the breakout of gold prices and the S&P 500 index.

Increased Safe-Haven Demand: Trump's tariff policy may heighten global economic uncertainty, prompting investors to view BTC as a safe-haven asset, similar to its performance during the 2018-2020 US-China trade war. The Coincu research team notes that trade tensions have historically boosted cryptocurrency trading volumes.

Technical Support: The daily chart of BTC shows it has broken through the descending channel formed from March to September, with the MACD indicator in positive territory, indicating bullish momentum. If the $108,000 support level holds firm, BTC may further challenge $110,000.

Bearish Scenario:

Whale Selling Pressure: If these 20,000 BTC eventually flow into exchanges, it could trigger a short-term correction. BeInCrypto analysis suggests that if whales distribute BTC on a large scale, prices could drop to $105,622 or even $102,734. Recently, addresses holding between 1,000 and 10,000 BTC sold over 40,000 BTC (worth $4.3 billion), indicating profit-taking pressure at high levels.

Market Sentiment Volatility: Discussions on platform X indicate that the whale transfer has triggered short-term sentiment fluctuations. If more dormant wallets become active, it could exacerbate market panic.

Macroeconomic Risks: Tariff policies may lead to a stronger dollar, reducing demand for high-risk assets like BTC. Additionally, if the Federal Reserve delays rate cuts, it could further suppress BTC prices.

No Crash Imminent, Cautiously Optimistic

The action of this OG whale transferring 20,000 BTC is more likely to reflect a strategic adjustment rather than an immediate signal of a market crash. On-chain data does not show funds flowing into exchanges, and the market possesses strong resilience supported by institutional funds and bullish technical indicators. However, short-term market sentiment may fluctuate due to whale activity, especially against a backdrop of increasing global trade uncertainty.

For investors, it is advisable to closely monitor on-chain data (such as exchange inflows) and the critical support level of $108,000. If BTC can maintain this level and break through $110,000, it may continue its upward trend; conversely, if whales sell or the macro environment worsens, the risk of a short-term correction will increase. Regardless, this legendary transfer with a 140,000 times return serves as a reminder of the dynamism of the Bitcoin market and the significant influence of whales.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。