JD.com and Ant Group are promoting a renminbi-backed stablecoin.

The initiative aims to promote the internationalization of the renminbi.

Senior executives have not made any public statements.

JD.com and Ant Group have taken a significant step by engaging with the People's Bank of China on July 4, 2025, proposing the approval for the issuance of a renminbi-backed stablecoin. This move aims to strengthen the global position of the renminbi through offshore transactions.

Given the dominance of the US dollar in global trade, this proposal is crucial. The initiative seeks to address current limitations by issuing these stablecoins in Hong Kong. Company leaders have yet to make any official statements.

Renminbi-backed stablecoin proposal challenges the dominance of the US dollar

Both JD.com and Ant Group expressed an urgent need for offshore renminbi stablecoins during their meeting with the central bank of China, with the primary goal of using these stablecoins to promote the internationalization of the renminbi and facilitate cross-border payments.

This proposal could serve as a countermeasure against the dominance of US dollar-backed stablecoins in the market. The Hong Kong SAR government plans to launch renminbi-backed alternative currencies in Hong Kong, which, if successful, could further expand in scale.

If the efficiency of renminbi cross-border payments remains lower than that of US dollar-pegged stablecoins operating around the clock on the blockchain, it will pose a strategic risk to China. — Wang Yongli, former vice president of the Bank of China

The crypto community is closely monitoring regulatory and market responses.

Historical context, price data, and expert insights

Did you know? Although the renminbi has launched a digital renminbi pilot domestically, its share in global trade has not exceeded 3%.

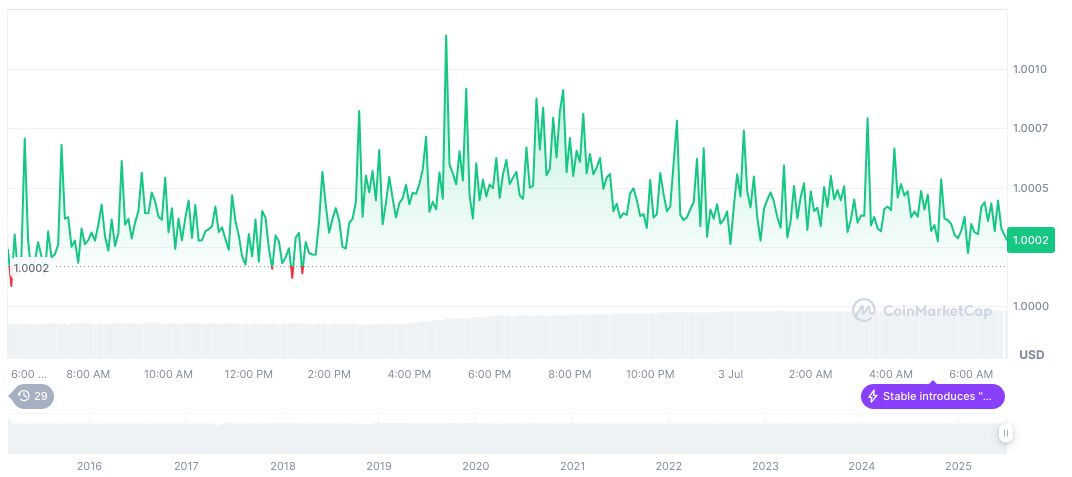

CoinMarketCap data shows that despite a 15.60% drop in the 24-hour trading volume of Tether USDt, its price remains stable at $1.00, with a market capitalization of $158.48 billion. Although the price of Tether USDt increased by 1.01% in 24 hours, it has decreased by 2.85% over the past 30 days.

Tether USDt (USDT), daily chart, CoinMarketCap screenshot, UTC time July 4, 2025, 02:49. Source: CoinMarketCap

Experts point out that a successful renminbi stablecoin could change the financial landscape and reshape global payment infrastructure. Despite ongoing regulatory hurdles, approval could set a precedent for the integration of traditional currencies with blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。