On June 30, the regulatory deadline in Singapore arrives, and cryptocurrency exchanges face a critical "watershed": licensed entities like Coinbase, OKX, and Hashkey ride the wave, while unlicensed ones begin a major retreat!

The Monetary Authority of Singapore (MAS) has made it clear in Part 9 of the Financial Services and Markets Act 2022 (FSMA), effective June 30, 2025, that all entities registered in Singapore providing digital token services to overseas clients must obtain a Digital Token Service Provider (DTSP) license, or they must immediately cease cross-border operations.

The "Twilight Moment" for Unlicensed Exchanges

Singapore, once regarded as a "safe haven" for global Web3 projects and cryptocurrency exchanges, is now leading the way in a new direction for cryptocurrency asset regulation in Asia and globally, with its consistent prudence and decisiveness. The new regulations from the Monetary Authority of Singapore (MAS) regarding Digital Token Service Providers (DTSP) undoubtedly serve as a loud wake-up call in this transformation. Proposed in 2022 and undergoing three years of development, these regulations will be fully implemented on June 30, 2025.

The core provisions of the new regulations are highly "damaging": mandatory licensing, no transition period, regulation of overseas operations, and severe penalties for violators, including hefty fines and potential imprisonment.

MAS's actions are interpreted as a "zero tolerance" approach towards unlicensed exchanges, aimed at maintaining Singapore's reputation as a responsible global financial center and preventing financial crime risks such as money laundering. The release of these regulations has caused significant upheaval in the industry, with many projects and exchanges operating in Singapore but yet to obtain licenses facing tough choices: either expedite compliance applications or be forced to "wander the earth" in search of new footholds. Currently, aside from exchanges like Coinbase SG, OKX SG, and Hashkey that have obtained MAS's Major Payment Institution (MPI) license, some unlicensed cryptocurrency exchanges are considering exiting Singapore, which could lead to hundreds of employees relocating to regions with more lenient regulations, such as Dubai, Kuala Lumpur, or Hong Kong.

In the early stages of the cryptocurrency industry, some exchanges rapidly rose by exploiting regulatory vacuums or gray areas, adopting unlicensed or lightly regulated operational models. While this model may have led to rapid business expansion and lower operational costs initially, its inherent vulnerabilities and unsustainability have become increasingly apparent as global regulatory awareness has awakened and regulatory frameworks have gradually been established.

The lack of effective external regulation and internal auditing is the biggest weakness of unlicensed exchanges. Funds deposited by users on these platforms are easily threatened by misappropriation, mismanagement, internal fraud, or hacking. Once such incidents occur, due to unclear platform liability and lack of regulation, users often find themselves without recourse, and losses are difficult to recover. Such incidents are not uncommon in the history of cryptocurrency development: in 2022, FTX misused user funds, ultimately leading to losses of billions of dollars; in 2025, Bybit suffered a hacking attack, resulting in the theft of approximately $1.5 billion worth of ETH and stETH. These cases point to a fact: on unlicensed platforms lacking regulation and transparency, the security of users' assets hangs like the "Sword of Damocles" above their heads, ready to fall at any moment.

At the same time, unlicensed exchanges are more prone to insider trading, false trading volumes, price manipulation, and other improper behaviors, and due to the failure to strictly enforce or completely lack KYC and AML measures, they can easily become conduits for illegal fund flows, used for money laundering, terrorist financing, and evading sanctions. This not only violates the laws of various countries but also seriously challenges the global financial order. In recent years, the U.S. Financial Crimes Enforcement Network (FinCEN) has been working to strengthen anti-money laundering regulation for cryptocurrency exchanges, wallets, and mixing services, expanding the applicability of the Bank Secrecy Act to the virtual currency sector.

According to incomplete statistics, a considerable number of cryptocurrency exchanges close each year due to mismanagement, security vulnerabilities, regulatory pressure, or outright "running away." Notable examples include: the collapse of MT.Gox in 2014, the closure of FCoin in 2020, and the downfall of FTX in 2022, all of which caused significant losses to users. The "mass retreat" under Singapore's new regulations may reshape the landscape of the cryptocurrency industry in Asia and globally, reducing appeal risks.

Global Regulatory Trendsetter: "Licensed Operations"

Singapore's regulatory actions are not isolated but rather a microcosm of the global transition of the cryptocurrency industry from early "wild growth" to compliant development. Major economies and financial centers around the world are actively exploring and constructing regulatory frameworks that adapt to the cryptocurrency asset ecosystem, striving to encourage financial innovation while effectively preventing risks, protecting user interests, and maintaining financial stability.

Given the inherently cross-border nature of cryptocurrency assets, the regulatory efforts of a single country or region are insufficient to cover all risks, making international cooperation and the establishment of unified standards particularly important. Several international organizations are actively promoting work in this area, aiming to bridge regulatory gaps and enhance the overall robustness of the global cryptocurrency asset ecosystem.

• Financial Action Task Force (FATF): As the global standard-setter for anti-money laundering and counter-terrorist financing (AML/CFT), FATF plays a core role in the regulation of cryptocurrency assets. FATF has issued guidance for virtual assets (VAs) and virtual asset service providers (VASPs).

• Financial Stability Board (FSB): FSB focuses on the potential impact of cryptocurrency assets on global financial stability, particularly in areas such as stablecoins and DeFi. The organization has issued high-level recommendations to promote comprehensive, consistent regulation, supervision, and monitoring of cryptocurrency activities, markets, and VASPs to address potential systemic risks.

• International Organization of Securities Commissions (IOSCO): IOSCO is dedicated to establishing international standards for the regulation of cryptocurrency markets, with a focus on investor protection and market integrity. The organization has issued policy recommendations for cryptocurrency markets and called on member countries to strengthen regulatory cooperation to address cross-border regulatory challenges.

The efforts of these international organizations are gradually forming a multi-layered global governance framework for cryptocurrency assets, promoting national regulatory agencies to formulate and enforce domestic regulations based on common principles, thereby reducing regulatory arbitrage opportunities and enhancing the overall compliance level of the global cryptocurrency market.

The cryptocurrency industry stands at a historic crossroads. The era once filled with rugged heroes and regulatory vacuums is fading away, replaced by a new epoch that increasingly emphasizes rules, order, and responsibility: compliance has become an irreversible fate for cryptocurrency exchanges, and unlicensed operational models are inevitably heading towards their end. As the market matures, users are more inclined to choose regulated, secure licensed platforms, concentrating towards leading licensed institutions.

The "Strategic Divide" of Leading Exchanges

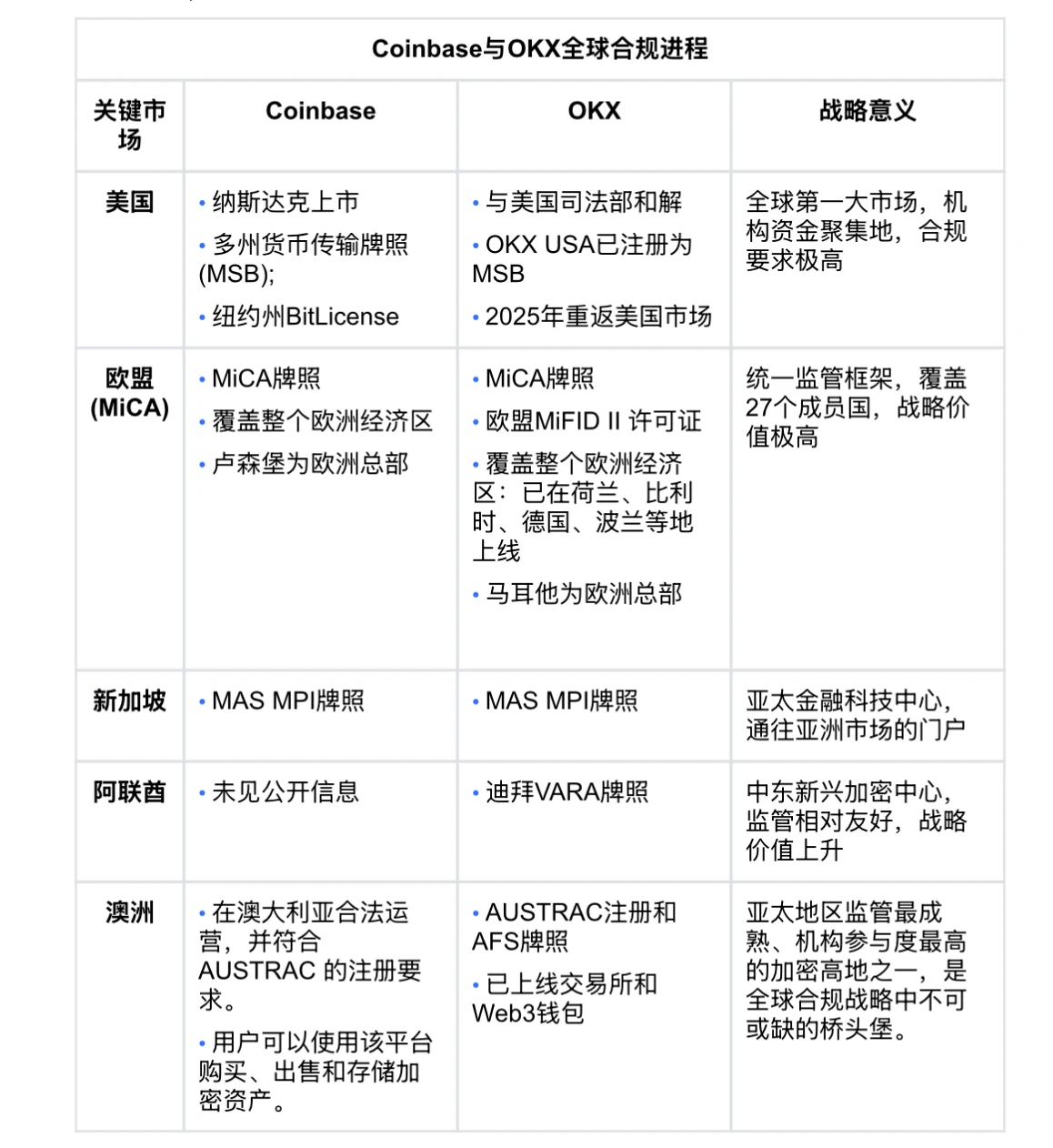

As industry leaders, Coinbase and OKX showcase two distinctly different strategic paths and evolutionary characteristics in their global compliance processes.

Coinbase, as a model of "native compliance," was born in the relatively mature regulatory environment of the United States, integrating compliance into its corporate DNA from the outset, viewing it as a core competitive advantage. Coinbase was the first to obtain licenses in several U.S. states, including the highly regulated New York State Department of Financial Services (NYDFS) virtual currency business license (BitLicense). Subsequently, Coinbase's globalization strategy has been characterized by a gradual outward expansion from the U.S. market, striving to obtain clear local regulatory licenses in key markets such as the EU and Asia-Pacific.

Despite facing ongoing scrutiny and lawsuits from the U.S. Securities and Exchange Commission (SEC) regarding whether certain cryptocurrency assets constitute "securities," Coinbase actively promotes legislative clarity and supports legislative attempts like the "Stablecoin GENIUS Act" aimed at providing clear rules for the industry. Notably, Coinbase was selected for inclusion in the S&P 500 index due to its "high standards of profitability, regulatory compliance, and governance," further confirming its recognition in mainstream financial markets for compliance and governance.

In contrast, OKX represents a benchmark of "adaptability." OKX's early development was more global, with its operations spanning multiple regulatory environments, some of which were even regulatory vacuums, providing opportunities for rapid expansion but also sowing the seeds of compliance risks. In February 2025, OKX's Seychelles subsidiary reached a settlement with the U.S. Department of Justice, paying an $84 million fine and forfeiting approximately $421 million in revenue obtained from U.S. customers during that period. In the same year, OKX announced the official launch of its centralized cryptocurrency exchange and OKX Web3 wallet in the U.S. In recent years, OKX has demonstrated strong adaptability to the global regulatory environment, accelerating its global compliance breakthrough. Through obtaining key market licenses, strengthening internal risk control, and introducing professional talent, it has aligned itself with global mainstream compliance standards.

In terms of global licensing layout, OKX holds high-quality licenses such as the EU MiCA license and Singapore MPI license, and is undergoing MSB registration and compliance reconstruction in the U.S., with its business increasingly concentrating on developed markets, even rivaling Coinbase. Additionally, both exchanges have obtained key licenses in multiple important regions globally, narrowing the gap between them.

These two compliance paths provide valuable references for the industry: Coinbase's early emphasis on compliance can avoid high costs but may limit business expansion speed; OKX's later compliance transformation, while accompanied by greater risks and costs, can still achieve "rebirth through fire." Regardless of the path chosen, compliance has become a necessary condition for cryptocurrency exchanges to gain user trust, attract institutional funds, and achieve sustainable development, with both distinctly different compliance models responding in their own ways to the era's demands for stricter global regulation.

For those unlicensed exchanges still lingering outside regulation and showing no willingness to comply, regardless of their preparedness, the industry's future response may simply be: Bye Bye.

Disclaimer:

This article is for reference only. It represents the author's views and does not reflect the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。