Authors: Colonel Guo, Director of Economic Research at Asia Weekly, and Li Yongfeng, Founder of Knot Record Company and Blockchain Expert

Abstract:

Financial market infrastructure is the "financial plumbing." Historically, Hong Kong has built financial infrastructure twice—through the linked exchange rate system and RTGS—ultimately shaping its status as an international financial center, once on par with New York and London. Now, with the arrival of digital finance based on stablecoins, a window for institutional and technological innovation has opened. Stablecoins have become standard infrastructure for international financial centers, and Hong Kong should seize the opportunity to become a super financial center driven by both the US dollar and the Chinese yuan.

Introduction

In May 2025, the global financial landscape reached an important turning point as the US Senate and the Hong Kong Legislative Council successively passed legislation regarding stablecoins, marking a key step for digital currencies into the mainstream financial system. These legislative actions not only reflect the increasingly important role of stablecoins in the global financial system but also reveal the attempts of the US and Hong Kong to shape the global digital finance landscape through the regulation of stablecoins.

In addition to the US and Hong Kong, other countries and regions have also accelerated legislation or amendments regarding stablecoins, including the European Union, Singapore, Japan, South Korea, Australia, India, Taiwan, Russia, Thailand, and Argentina. A global currency competition surrounding the future of digital finance has begun, with the US finally acknowledging stablecoins after several iterations, attempting to lead this transformation once again. Financial companies and tech giants from various countries are already gearing up.

Stablecoins are no longer just "trading tools" but have become payment channels for the digital economy and bridges between on-chain assets and fiat currencies. Former Federal Reserve Chairman Ben Bernanke believes that financial market infrastructure is the "financial plumbing," used to support trading, payments, clearing, and settlement, realizing interconnections and interactions among financial institutions.

We believe that since the 1970s and 1980s, Hong Kong has built financial infrastructure twice—through the linked exchange rate system and RTGS—ultimately shaping its status as an international financial center, once on par with New York and London. Now, with the arrival of digital finance based on stablecoins, a window for institutional and technological innovation has opened. Hong Kong should seize the opportunity to become a super financial center driven by both the US dollar and the Chinese yuan.

1. Paradigm Shift in Financial Infrastructure

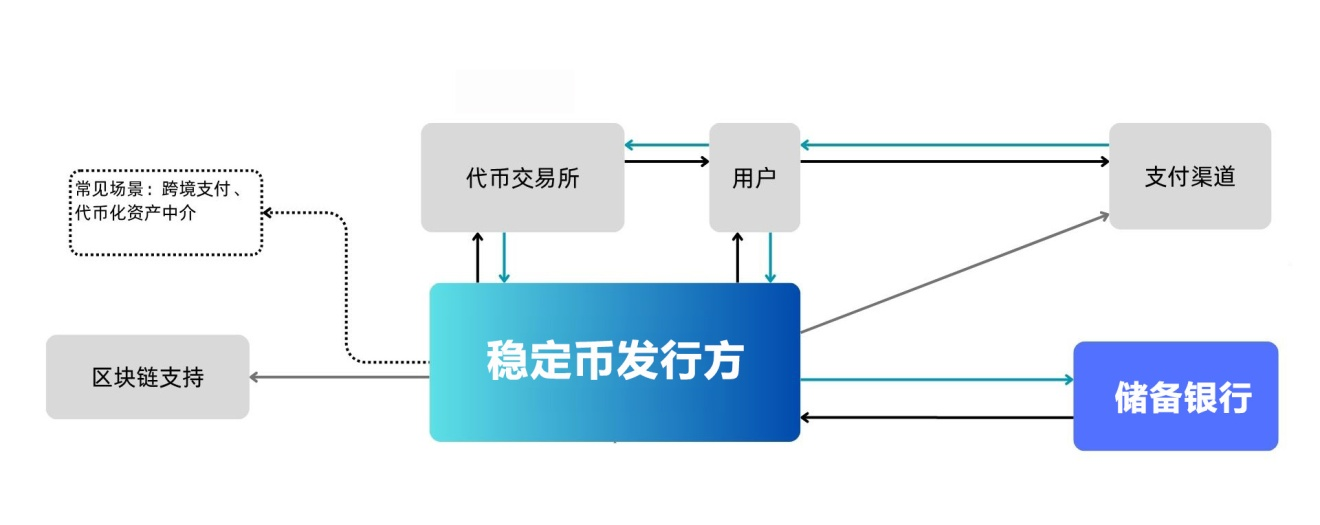

Stablecoins are cryptocurrencies that maintain value stability by being pegged to fiat currencies, gold, or other assets. Thus, stablecoins reduce price volatility through anchoring mechanisms, combining the efficiency of blockchain with the stability of traditional assets. This design makes them a "safe haven" in the crypto market, retaining the convenience and decentralization advantages of cryptocurrencies while avoiding the extreme volatility risks of mainstream cryptocurrencies like Bitcoin.

Unlike highly volatile digital assets like Bitcoin, stablecoins are widely used in cross-border payments, remittances, and decentralized finance (DeFi) due to their stability. According to market data, the total market capitalization of global stablecoins has approached $250 billion, with on-chain transaction volume expected to reach $10 trillion by 2025, demonstrating their core role in the digital economy.

When people talk about stablecoins, the focus often centers on their convenience as payment tools—buying and selling assets in the crypto world or making small cross-border transfers. In reality, the true challenge stablecoins pose to the traditional financial system (TradFi) is not that they create a new form of "money" or currency (as stablecoins pegged 1:1 to fiat assets do not actually issue currency), but that they bring a completely new and disruptive clearing system.

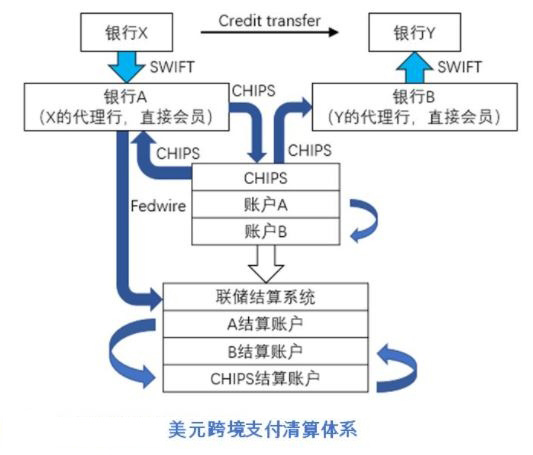

Currently, the global financial trade system mainly relies on a network woven together by bank accounts and SWIFT (Society for Worldwide Interbank Financial Telecommunication). Cross-border remittances send payment instructions via SWIFT, with funds jumping between multiple correspondent banks, each jump adding time delays and costs. The core of this system is not efficiency but a hierarchical trust based on national sovereignty and bank credit. At the top of this pyramid is undeniably the US dollar and its clearing system, CHIPS (Clearing House Interbank Payment System).

In this global payment system, when a transaction occurs, the information flow (such as SWIFT messages) and the funds flow are two independent tracks. The information flow promises that funds will move, but the actual clearing of the funds flow relies on a trust chain composed of multiple intermediary institutions. The inefficiency and high costs of this structure are evident, but its most fatal weakness lies in systemic fragility: any problem at an intermediary stage can lead to transaction failures and significant counterparty risks.

Stablecoins fundamentally solve this problem by integrating the actions of "accounting" and "settlement." In blockchain-based transactions, the transfer of tokens itself constitutes the clearing. The information flow and funds flow are no longer separated; they are encapsulated in the same operation, with the transmission of information (transaction records on-chain) and the transfer of value (change of asset ownership) occurring simultaneously, achieving atomic-level exchanges, hence referred to as "Atomic Settlement." This means that value can flow globally in near real-time, point-to-point, without needing to go through layers of intermediaries for approval and clearing. It no longer requires bank accounts as a prerequisite; a digital wallet is the only key to this new world.

Stablecoin Clearing System

This leads to the most core advantage of stablecoins: finality of transactions. The moment stablecoins reach the recipient's address, the transaction is irrevocably completed. This is not a "pending" or "to be settled" state, but the final state of the transaction. The value has undoubtedly transferred from one party to another, and the creditor-debtor relationship between the two parties is thus concluded. How to handle this asset afterward—whether to convert it into fiat currency or use it for other investments—is entirely up to the recipient's decision, but it has no relation to the finality of the initial transaction. Finality is the solid foundation upon which the new generation of financial infrastructure can build trust and reduce risk. Clearly, this is not just an improvement in efficiency; it is a paradigm shift in financial infrastructure.

Four Core Pillars of Stablecoins Disrupting the Traditional Financial System

- Instant settlement (T + 0, significantly reducing working capital requirements)

- Extremely low transaction costs (especially compared to the SWIFT system)

- Global accessibility (available year-round, requiring only internet connectivity)

- Programmability (currency driven by extended coding logic)

In the traditional financial system, the hegemonic status of the US dollar is closely tied to its role as the world's primary clearing currency. Global trade, commodity pricing, and foreign exchange reserves are almost all denominated in dollars; any country wishing to participate in the global economy cannot bypass the dollar's clearing channels. This grants the US unparalleled economic influence and the ability to impose financial sanctions, known as "dollar hegemony."

However, the emergence of stablecoins provides the world with a "Plan B." Due to their underlying technology being decentralized, any economy can theoretically issue stablecoins pegged to its own fiat currency. If SWIFT and the banking system are the "national highways" and "provincial roads" of the financial world, then the stablecoin clearing system lays down countless direct "air routes" to destinations worldwide. There are no traffic lights, and there is no fear of roadblocks, which provides the possibility to break the financial pattern of the dollar as the sole world currency.

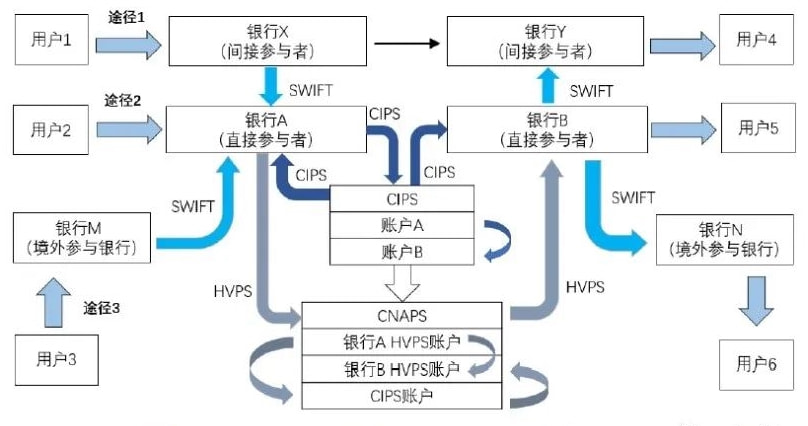

To counter the risks of sanctions from the US and the EU against Russia, the Central Bank of Russia established the SPFS system (System for Transfer of Financial Messages) as an alternative to the SWIFT system. Additionally, China has launched the CIPS (Cross-Border Interbank Payment System) for renminbi payments. These systems, like the US dollar's cross-border payment and settlement system, are very complex and inefficient:

Renminbi Cross-Border Payment System CIPS

In the era of digital finance, competition is no longer about who can print more trustworthy paper money, but about who can establish an efficient, secure, and widely adopted digital currency clearing ecosystem first. This is a race to seize the "ecological niche" of the new financial era. If a country can successfully promote its own stablecoin, it can not only enhance the international influence of its currency but also become a rule-maker for the new generation of digital financial infrastructure, attracting global capital, technology, and talent.

At its core, this competition has never changed; it remains the ongoing struggle for the right to mint currency that has lasted for centuries. From shells to gold, from paper money to digital, the form of currency is changing, but the economic sovereignty and power it represents have never shifted.

Now, the technological revolution has opened Pandora's box, and geopolitical games have followed. A new global currency war has begun, but the battlefield has shifted from the physical world to the intangible realm of blockchain.

2. The "Flywheel Effect" and "Scale Effect" of Stablecoins

The stablecoin clearing system also has advantages such as programmability, traceability, and verifiability, making it not only faster and cheaper but also theoretically more open—its entry threshold is no longer a banking license but the ability to access the network. Clearly, as a new financial infrastructure, stablecoin pioneers have a flywheel effect, and stablecoins of major economies like the US dollar and euro are more likely to achieve scale effects.

2.1 Flywheel Effect

- Flywheel Effect: Refers to a system or business model that requires significant effort to start but, once operational, each component promotes and enhances itself, creating a positive cycle that allows the entire system to grow continuously with increasing efficiency and decreasing costs. Taking the US and US dollar stablecoins as an example, the process of starting and accelerating the flywheel can be broken down into the following interconnected steps:

Step 1: Start the Flywheel - Clear Regulatory Framework

The US GENIUS Act establishes a clear regulatory framework, eliminating legal gray areas. Issuers like Circle (USDC) and PayPal (PYUSD), as well as traditional financial giants like JPMorgan and Goldman Sachs, can confidently invest resources because they know the rules and that their business is legal. Users (whether individuals or institutions) no longer need to worry about issues like issuers running away or opaque reserves. With the backing of US government regulation (such as requiring 1:1 high-quality liquid asset reserves and regular audits), US dollar stablecoins transform from a "risky asset" into a reliable tool akin to "cash."

Step 2: Accelerate the Flywheel - Adoption and Integration

Once trust and legitimacy are established, the flywheel begins to gain initial momentum. Individual users will be more willing to use US dollar stablecoins for payments, savings, and cross-border remittances because they are faster and cheaper than traditional bank wire transfers. Institutional users, such as Wall Street funds, market makers, and corporations, will start to adopt them on a large scale. They can use US dollar stablecoins for instant settlement (T+0), replacing traditional clearing systems and greatly improving capital efficiency. This will lead to ecosystem integration, where compliant US dollar stablecoins become the "king of collateral" and "king of transaction mediums" in the decentralized finance (DeFi) world. All mainstream lending protocols and decentralized exchanges (DEX) will center around them. Payment companies (Visa, Mastercard), tech giants (Apple, Google), and commercial banks will seamlessly integrate them into their payment systems and apps. Imagine paying USDC directly with ApplePay, with an experience and usage almost indistinguishable from fiat currency.

Step 3: The Self-Reinforcing Cycle of the Flywheel

This is the core part of the flywheel effect, where various components begin to drive each other, forming a powerful positive feedback loop. The more people and businesses accept US dollar stablecoins, the greater their value to new users. This will attract more users and businesses to join, creating a classic "network effect" that makes it difficult for stablecoins of other currencies to compete. The enormous trading volume and adoption rates will create unparalleled liquidity. Whether in centralized exchanges or DeFi protocols, US dollar stablecoin trading pairs will have the best depth and lowest slippage. This will attract global traders and capital, further deepening its liquidity and forming a "liquidity black hole" that siphons liquidity from other competitors.

The smartest developers and entrepreneurs globally will build new applications (dApps), financial products, and services around this most mainstream and trusted stablecoin standard. This will create a vast digital economy ecosystem based on US dollar stablecoins. Once users and assets are locked into this ecosystem, the switching costs will be very high. Traditionally, the influence of the dollar has primarily been in international trade, foreign exchange reserves, and the banking system. Now, through stablecoins, the influence of the dollar will permeate every corner of the digital world—from NFT trading to the metaverse economy, and to micropayments between IoT devices.

According to regulatory requirements, for every dollar of stablecoin issued, the issuer must hold one dollar in real reserves (usually cash and short-term US Treasury bonds). This means that the larger the scale of US dollar stablecoins, the greater the demand for US Treasury bonds. This indirectly helps the US government finance at a lower cost and strengthens the global financial system's dependence on US Treasury bonds. Therefore, for the US dollar as a world reserve currency, seizing the initiative in stablecoins can not only slow down the global trend of de-dollarization but also serve as a support for the dollar.

2.2 Scale Effect

- Scale Effect: Also known as economies of scale, refers to the phenomenon where unit costs gradually decrease as output (in this case, the issuance and circulation of stablecoins) increases. In the stablecoin field, this includes not only technical costs but also trust costs, compliance costs, and network construction costs.

For a stablecoin issuer, operating in a country with clear and unified federal laws (such as the US) has far lower compliance costs than operating in dozens of countries or regions with varying rules. Once a compliant regulatory system that meets US standards is established, it can serve a vast global user base. This "one compliance, global service" model itself is a significant scale effect. In a small-scale, unregulated environment, users need to spend considerable time and effort researching whether a stablecoin is trustworthy. However, when the US government sets standards for the entire industry, the cost of trust becomes socialized. Users can "blindly trust" any stablecoin that holds a US license, significantly reducing the overall transaction costs for society.

As the user base expands, the unit costs of building and maintaining blockchain networks, wallets, exchange interfaces, APIs, and other infrastructures will drop sharply. The average cost of processing 100 million transactions is far lower than that of processing 1,000 transactions. Scale brings deep liquidity. For institutions needing to conduct large transactions, this means lower market impact costs (slippage).

In a market with poor liquidity, a $10 million transaction might cause significant price fluctuations, but in a market with liquidity in the tens of billions, this transaction will have almost no impact. This efficiency advantage is something small-scale stablecoins cannot match. Once US dollar stablecoins become market-dominant due to their scale, their technical standards, API interfaces, and compliance practices will become the de facto "global standards." Projects from other countries that wish to interact with this vast US dollar digital economy must be compatible with these standards. This gives the US a strong voice in the future formulation of global digital financial rules. Just like today's TCP/IP protocol of the internet, whoever establishes widely adopted standards first will control the initiative for future development. This is an intangible but extremely powerful scale advantage.

2.3 First-Mover Advantage

In summary, for a large economy like the US, promoting compliant US dollar stablecoins is not merely about "embracing financial innovation." Through the "flywheel effect," the US can leverage its existing monetary credibility and regulatory capacity as initial thrusts to initiate a self-reinforcing cycle. This cycle will continuously expand the application scenarios of the dollar in the digital realm, deepen global dependence on dollar liquidity, and ultimately "copy and paste" the dollar's hegemony from the traditional financial system to the future digital financial world. Through the scale effect, the US can build a solid moat for the US dollar stablecoin ecosystem. By lowering compliance, technical, and trust costs, and establishing global standards, it makes the competition costs for latecomers (such as euro stablecoins and yen stablecoins) extremely high, making it difficult to shake its dominant position.

Therefore, this legislative race for stablecoins is essentially a struggle for leadership in the future digital currency world. First movers, especially those with a strong sovereign currency foundation, will gain enormous, even insurmountable advantages through these two effects. This is why, after years of stablecoins being introduced with little fanfare, countries and economies suddenly became tense after the development of stablecoins began during Trump's second term. Once US dollar stablecoins develop within the US regulatory framework, they will fully unleash the flywheel and scale effects, becoming unstoppable.

In this on-chain war, the time window for the euro and renminbi is running out.

3. How Stablecoins Reshape International Financial Centers

Historically, the rise of international financial centers has essentially been about becoming the "hub port" for global capital flows. Whether it is London, New York, or Hong Kong, their core function is to gather, allocate, and enhance global capital by providing the most outstanding infrastructure—including legal systems, talent networks, and the most efficient trading and clearing systems. However, as value itself begins to digitize, the criteria for measuring whether a "hub port" is advanced must also evolve.

We believe that stablecoins and cryptocurrencies, with their efficiency, trust, and consensus on rules, are becoming key variables in the evolution of international financial centers. They are not just a new asset; they represent the cornerstone of the next generation of financial infrastructure, the standard configuration for financial centers in the digital finance era.

3.1 Trust and Credibility

What is the core competitiveness of an international financial center? It is to solve the issues of trust and credibility in the financial system. Capital is profit-seeking but also risk-averse. A place becomes a financial center precisely because it successfully establishes a mechanism that minimizes uncertainty in transactions, allowing strangers from around the world to entrust their lives and fortunes to it.

The core competitiveness of a financial center ultimately lies in its ability to create, export, and maintain "trust." In the 14th to 16th centuries, Venice provided reliable clearing guarantees and transparent contractual foundations for cross-regional commercial trade through strong national credit backing and the invention of double-entry bookkeeping. In the 17th century, Amsterdam standardized and assetized credit by establishing the world's first central bank (the Bank of Amsterdam) and the first freely traded joint-stock company (the Dutch East India Company), enabling it to circulate on a large scale. In the 18th and 19th centuries, London elevated national credit to a global currency anchor through the powerful central banking functions of the Bank of England and its deep ties to the "empire on which the sun never sets," while ensuring the sanctity of contracts through a mature common law system. Since the 20th century, New York has built the ultimate fortress of contemporary financial credibility through its unmatched economic strength, the dollar's status as a global reserve currency established by the Bretton Woods system, and a capital market that is both deep and broad, subject to strict regulation.

From Venice's national guarantee, to Amsterdam's corporatized and securitized credit, to London's central bank + global currency credit, and finally to New York's hegemonic currency + strong regulation + deep market credit, we can clearly see that the evolution of financial centers is a history of upgrading the "trust" manufacturing mechanism.

Stablecoins elevate "trust" to a new level through institutional design and technological means. The traditional financial system primarily addresses counterparty risk, while the stablecoin system uses blockchain technology to solve the risks inherent in the transaction system itself.

On the other hand, compliant and reputable stablecoins establish consensus and trust between new and old business models. For TradFi, stablecoins serve as the "official passport" for its assets to enter the digital world. When a dollar enters the blockchain through a compliant stablecoin (like USDC), it gains programmability and composability, allowing it to participate in new financial activities such as DeFi lending and automated market making, greatly expanding the utility and yield possibilities of the asset.

For DeFi/Web3, stablecoins are the "value anchor" connecting the real world. They introduce the core asset of the traditional world—the credit of sovereign currency—providing a pricing benchmark and hedging tool for this emerging ecosystem. The future growth of a financial center depends on its ability to become the intersection of the new and old financial worlds. A financial center with a strong stablecoin ecosystem will become the gateway for global TradFi capital to enter Web3 and will be the preferred place for Web3 innovation projects seeking liquidity in the real world.

3.2 Capital Efficiency

Capital flows like water, always seeking the lowest cost, highest efficiency, and least resistance. Since the lifeline of a financial center is to attract and efficiently allocate capital, it must adopt infrastructure that maximizes capital efficiency. In a world where a stablecoin clearing system already exists, continuing to rely on traditional financial infrastructure is akin to insisting on using steam trains in the high-speed rail era.

As mentioned earlier, the stablecoin clearing system can not only address counterparty risk but also offers extremely high efficiency. JD.com founder Liu Qiangdong stated, that through stablecoin licenses, global enterprises can achieve currency exchange, reducing cross-border payment costs by 90% and increasing efficiency to within 10 seconds.

Therefore, to maintain its basic positioning as a "high-efficiency land," a financial center must embrace stablecoins, leveraging the efficiency of stablecoin "atomic settlement" to enable seamless, real-time capital flow across global markets, capturing any fleeting opportunities.

3.3 Rule-Making

Ultimately, the competition among international financial centers is a competition for the power to formulate global financial rules. In the technology sector, whoever's infrastructure is most widely adopted defines the industry standards. Windows defined the operating system for personal computers, and TCP/IP defined the communication protocol for the internet.

Former Federal Reserve Chairman Ben Bernanke once likened financial market infrastructure to "financial plumbing," which supports trading, payments, clearing, and settlement. As a new infrastructure, stablecoins, if unregulated, could disrupt this plumbing. However, their rapid development also brings regulatory challenges, such as systemic risk, consumer protection, and issues related to illegal activities. For instance, insufficient reserves could trigger a "bank run" effect, impacting financial stability. Regulation can ensure that stablecoin issuers provide transparent reporting and regular audits to protect user interests. The cross-border nature of stablecoins necessitates international regulatory coordination. The EU's MiCA legislation and the UK's FCA framework have begun to take action, but further unification of regulations for decentralized stablecoins is needed to avoid regulatory arbitrage. Therefore, how to develop in a compliant and healthy manner is a key focus for various countries.

Li Yongfeng, in "On the Legal Personality of Decentralized Blockchain Communities—An Analysis Based on Corporate Community Theory," explores the theory of legal personality for decentralized blockchain communities, providing important insights for stablecoin regulation. The theory of legal personality helps clarify responsible parties, especially in decentralized stablecoins, where DAOs can be viewed as companies subject to corporate law regulation.

Li Yongfeng argues that decentralized blockchain communities (such as DAOs) should be granted independent legal personality based on communitarian theory. These communities have collective interests and organizational structures similar to traditional companies and should be regarded as legal entities to participate in civil and commercial legal relationships. Stablecoins, especially decentralized stablecoins (like Dai), are often managed by DAOs or similar structures. If DAOs are considered legal entities, it clarifies their responsibilities in the issuance and governance of stablecoins, addressing the issue of unclear responsibilities in decentralized systems. Therefore, decentralized communities should have clear governance mechanisms, which can be applied to stablecoins, requiring transparent decision-making processes and member rights; there is a need to innovate legal frameworks to adapt to blockchain technology, which aligns with the regulatory needs of stablecoins, such as achieving transparency and compliance through smart contracts.

It is evident that infrastructure equals standards, and this principle applies equally in the digital finance era. A stablecoin ecosystem dominated by a specific financial center will subtly become the de facto global standard in terms of technical standards, compliance formats (KYC/AML processes), and API interfaces. For example, if US dollar stablecoins regulated by New York dominate, then global digital asset projects must comply with the rules of the New York Department of Financial Services (NYDFS) to access this largest liquidity pool.

By supporting and regulating its own stablecoin ecosystem, a financial center is not only upgrading its "hardware" but also exporting its "software"—that is, its regulatory concepts and financial rules. This represents a higher-dimensional competitiveness, positioning the financial center in the most core and advantageous position in the competition. From efficient clearing and new trust mechanisms to dominating future rules, stablecoins play an indispensable role on these three levels. They are no longer just a financial product that adds value; they are, like electricity and the internet, the core infrastructure driving the operation of the next generation of financial centers.

4. The Hong Kong Dollar as a Type of US Dollar Stablecoin

From the perspective of the linked exchange rate system, the Hong Kong dollar is a type of US dollar stablecoin, just not implemented through blockchain technology. The core mechanism of the linked exchange rate is that Hong Kong's monetary base (cash in circulation and banks' balances at the Monetary Authority) must be supported by 100% or more in foreign exchange reserves (mainly US dollars). When issuing more Hong Kong dollars, the issuing banks (HSBC, Standard Chartered, Bank of China Hong Kong) must first pay the Monetary Authority an equivalent amount in US dollars at the fixed rate of 7.80 HKD to 1 USD. The reverse is also true.

It is worth considering why the British authorities initially chose to link to the US dollar rather than the British pound. This is because the US dollar can provide the greatest trust foundation for the Hong Kong dollar.

4.1 The Credit of a Hard Peg to the US Dollar

After the collapse of the Bretton Woods system, although the US dollar decoupled from gold, its status as the world's primary reserve currency, pricing currency, and medium of exchange remained unshaken, and was even strengthened by the "petrodollar" system. At that time, the British economy was deeply mired in "stagflation," and the exchange rate of the pound was highly volatile. Linking to a globally stable and liquid currency was a more credible choice for Hong Kong than linking to a relatively declining pound.

By the early 1980s, the US had already replaced the UK as Hong Kong's largest trading partner and primary source of investment. Most of Hong Kong's import and export goods and financial assets were denominated in US dollars. Pegging the Hong Kong dollar to the primary trade and settlement currency was the most rational choice for commercial interests, as it could eliminate the vast majority of trade exchange rate risks. In 1983, negotiations between China and the UK over Hong Kong's future hit a deadlock, triggering an unprecedented crisis of confidence, and the Hong Kong dollar's exchange rate plummeted. The Hong Kong government needed to take the strongest and most rapid measures to stabilize public confidence. Choosing the then most powerful US dollar as the peg was the best "strong medicine" to boost confidence.

The linked exchange rate system means that the Hong Kong government cannot arbitrarily print money to cover fiscal deficits or stimulate the economy. Every dollar issued in Hong Kong dollars is backed by real US dollar reserves. This systemically eliminates the possibility of hyperinflation. This almost "self-binding" monetary discipline sends a very strong signal to global capital: Hong Kong is a place that respects rules, keeps promises, and has rigid protection of property rights. This credibility is invaluable, especially in a region full of uncertainties.

4.2 Efficiency Improvement

Due to the stability of the exchange rate, businesses and investors do not need to purchase expensive financial derivatives (such as forwards and options) to hedge against exchange rate risks, which directly reduces the cost of investing and trading in Hong Kong. In cross-border trade and financial transactions, if one party uses Hong Kong dollars and the other uses US dollars, the settlement process becomes exceptionally simple, as the exchange rate is almost fixed. This greatly improves the efficiency of clearing and settlement. Financial institutions, when conducting large-scale asset allocation and capital dispatch, also do not need to reserve large capital buffers for exchange rate fluctuations, enhancing capital efficiency. Investors can very precisely calculate the US dollar value of their Hong Kong dollar assets because they know the exchange rate will only fluctuate within a very narrow range of 7.75-7.85. This certainty is key to attracting long-term, large-scale capital. Therefore, the linked exchange rate system has become the "stabilizing force" for Hong Kong in attracting international capital.

4.3 The First Leap

Due to the peg of the Hong Kong dollar to the US dollar, Hong Kong has naturally become one of the most important US dollar trading and settlement centers in the Asian time zone. Global banks and enterprises can conveniently exchange Hong Kong dollars and US dollars in Hong Kong, with excellent liquidity and minimal spreads.

The linked exchange rate system is a strategic trade-off made by Hong Kong under specific historical conditions. It sacrifices monetary policy independence in exchange for extreme exchange rate stability and monetary credibility. It has proven that for an outward-oriented, small open economy like Hong Kong, which relies on entrepot trade and international finance, the benefits brought by exchange rate stability (attracting capital, reducing transaction costs, establishing credibility) far outweigh the benefits of retaining monetary policy independence.

The linked exchange rate system is not just a technical exchange rate arrangement; it is a financial infrastructure that underpins Hong Kong's status as an international financial center. From an academic perspective, financial market infrastructure can be defined as the material and technical conditions necessary for the normal operation of financial markets, a series of activities that facilitate the smooth trading of financial assets, and a series of institutional and organizational systems that ensure the smooth operation of financial markets. The core and most valuable commitment provided by the linked exchange rate system to global investors guarantees the stable and efficient conduct of financial transactions in Hong Kong, profoundly shaping Hong Kong's economic structure, financial market ecology, and its unique role in the global financial system, alongside Hong Kong's common law system, propelling Hong Kong from an entrepot trade center to a regional international financial center in the 1970s and 1980s.

5. The National Treasure RTGS

Although Hong Kong has become an international financial center in the Asia-Pacific since the 1980s, compared to established international financial centers like London and New York, Hong Kong's time as an international financial center is relatively short, and there are significant gaps and deficiencies in its financial market system construction. New York and London are currently recognized as global international financial centers, and these two financial centers, in terms of market size, completeness, and influence on global capital, are unmatched by other cities.

The second tier includes cities like Hong Kong, Singapore, Tokyo, Frankfurt, Paris, Zurich, and Sydney, which play financial roles in their respective regions and are considered regional international financial centers. Additionally, cities like Shanghai, Toronto, Seoul, Madrid, Dublin, Kuala Lumpur, Mumbai in India, and Johannesburg in South Africa primarily play financial roles within their own countries and are considered national or domestic financial centers.

5.1 Intense Competition in the Asia-Pacific Region

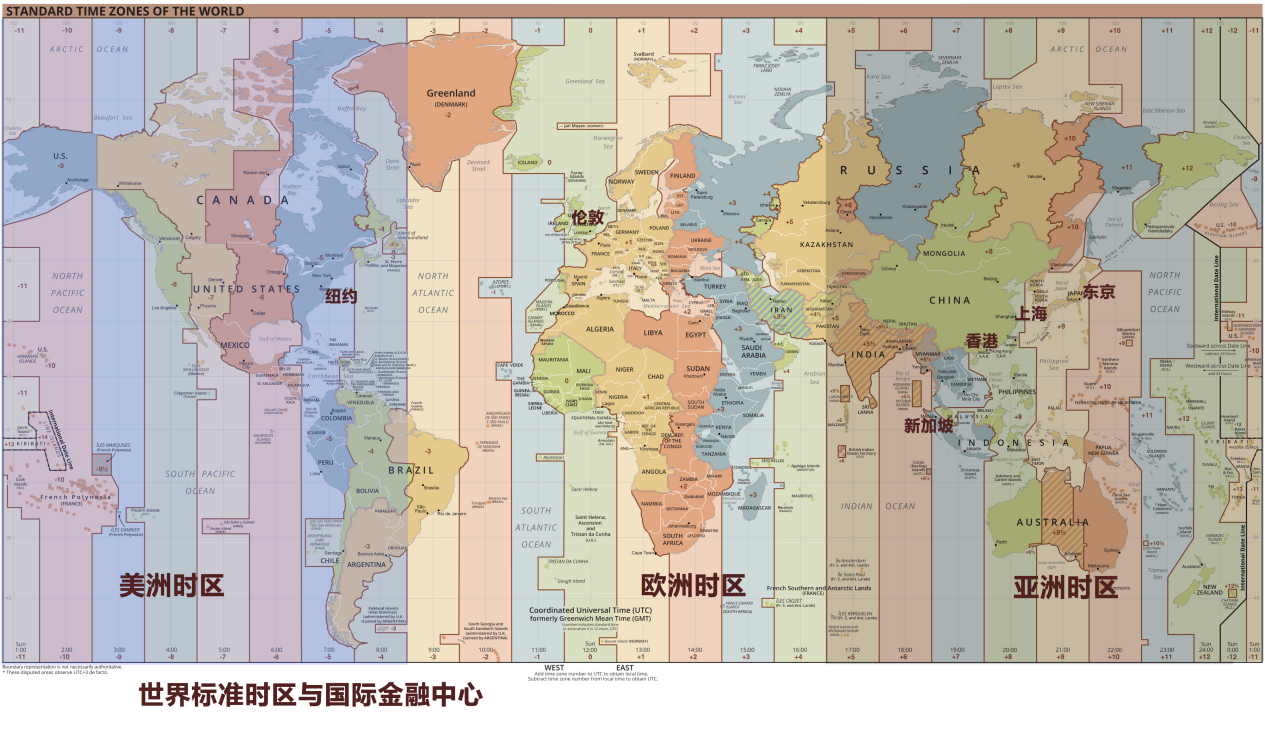

However, the vigorous development of Hong Kong's financial market in the 21st century represents the imminent rise of a super economic power in the Asia-Pacific region. From the perspective of financial globalization, the Asia-Pacific region also needs a global international financial center that can complement New York and London. Furthermore, from the perspective of the efficiency requirements of financial globalization for capital circulation, there should be at least three global financial centers distributed across North America, Europe, and East Asia, so that the global financial system can operate continuously 24 hours a day. Only by mastering real-time information and product pricing rights can a true international financial center be established.

The theory of financial time zones also suggests that regional trading platforms should be established based on human life cycles and habitual needs to better grasp local and product real-time information and pricing rights. Currently, North America has New York (UTC-5), and Europe has London (UTC+0) as two global international financial centers, while East Asia lacks a global-level center, relying instead on three regional centers: Tokyo (UTC+9), Hong Kong (UTC+8), and Singapore (UTC+7). Singapore has set its standard time at UTC+8 to facilitate economic exchanges with Malaysia and China, meaning Singapore time is the same as Hong Kong and Beijing time, with no time difference. From the perspective of the development needs of global international financial centers, Singapore and Hong Kong are the two most favorable competitors, leading to the "New York-London-Hong Kong" versus "New York-London-Singapore" debate in the international community.

5.2 Why Hong Kong Stands Out

At the beginning of the 21st century, although Singapore had a large foreign exchange trading volume, Hong Kong surpassed Singapore to become the world's third-largest US dollar trading center, with foreign exchange trading being deeper and more significant, as its trading volume is more important and critical than that of other currencies. The US dollar, as the world's number one reserve currency, has the best liquidity and risk resistance. How did Hong Kong become the world's third-largest US dollar trading center?

Colonel Guo Zhong in "The National Treasure RTGS—Deeply Revealing the Value of Hong Kong You Don't Know" points out that this is closely related to an important financial infrastructure built before and after Hong Kong's return. The main part of this infrastructure is the RTGS—Real-Time Gross Settlement system. This is also the core of Hong Kong's status as an international financial center.

The former president of the Hong Kong Monetary Authority, who was responsible for the development of RTGS, Chen Delin, pointed out: As an important component of financial market infrastructure, the interbank large-value payment settlement system is a cornerstone of any thriving financial center. Many people liken it to the "pipes" of the financial system, but I prefer to view it as the blood vessels of the human body, as their smoothness directly affects health and even life.

Chen Delin's metaphor vividly illustrates the dangers of inefficient capital circulation, particularly the risks in foreign exchange trading, the most famous of which is the Herstatt Risk. Due to time zone differences in foreign exchange trading, delays in settlement can lead to a series of defaults among banks, affecting a chain of financial institutions. The larger the market scale, the higher the financial risk. To eliminate time zone discrepancies, the core requirement is to achieve synchronization between the two settlement systems, which means real-time gross settlement.

With advanced electronic technology, the United States was the first to launch a comprehensive RTGS system. The Hong Kong Monetary Authority (HKMA) began developing its RTGS system shortly after its establishment in 1993, ultimately launching the Hong Kong dollar RTGS on December 9, 1996, becoming the fourth region in the world to implement an RTGS system, following the United States, Switzerland, and the United Kingdom, with the UK having launched just a few months earlier than Hong Kong.

More importantly, following the launch of the Hong Kong dollar RTGS, the HKMA introduced the US dollar RTGS system in 2000, with HSBC serving as the settlement bank, achieving the world's first synchronized electronic foreign exchange trading settlement, thus ending the Herstatt Risk that plagued foreign exchange trading.

Chen Delin stated that since the launch of the RTGS system in Hong Kong on December 9, 1996, it has kept pace with the times, continuously enhancing its functions, "notably maintaining 100% normal and continuous operation without any incidents of downtime," laying the foundation for the future development of payment and settlement in Hong Kong's banking sector, and serving as a crucial cornerstone for Hong Kong to become Asia's leading international financial center.

5.3 Seizing the Asian Time Zone

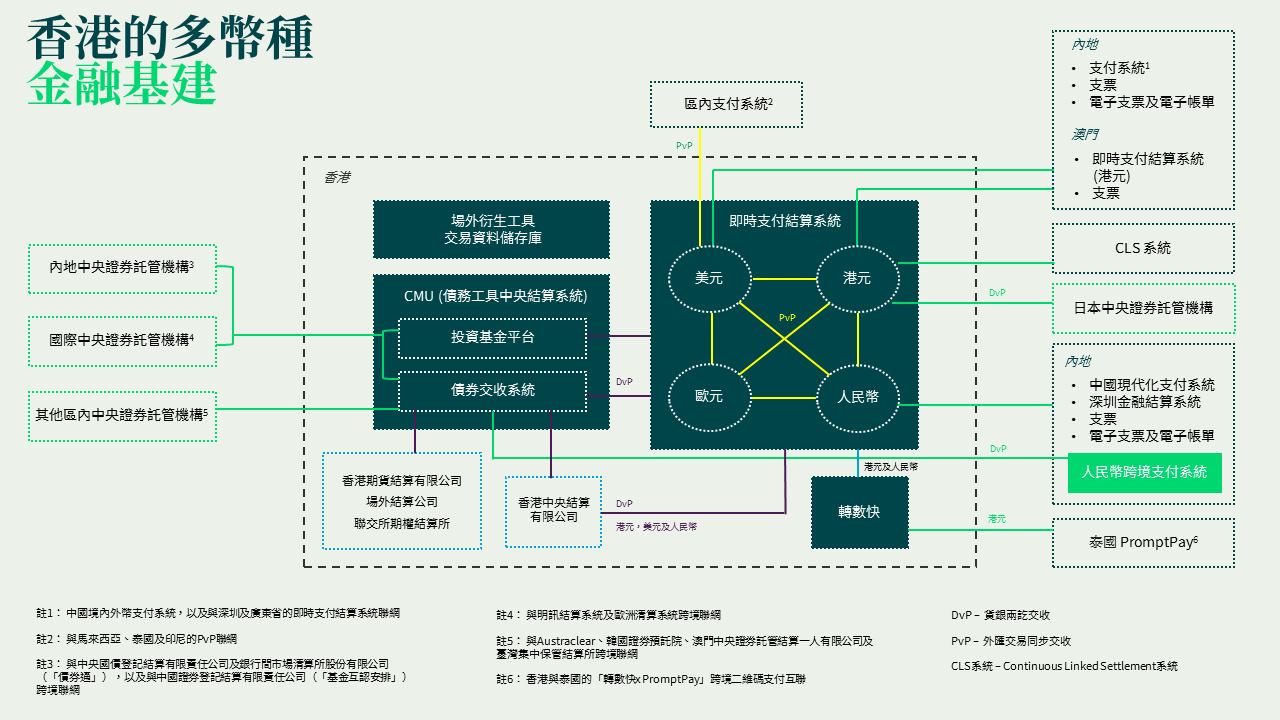

Due to the smooth and effective operation of Hong Kong's US dollar RTGS system, it has gained high recognition in the financial sector. After multiple certifications, Malaysian authorities connected the Malaysian Ringgit RTGS system (RENTAS system) with Hong Kong's US dollar RTGS system in November 2006, allowing for synchronized settlement of Ringgit and US dollar foreign exchange transactions during business hours in both Malaysia and Hong Kong, thereby eliminating settlement risks. That year, Singapore's RTGS system MEPS had just been launched. Following Malaysia, the Indonesian Rupiah RTGS system and the Thai Baht RTGS system were subsequently connected to Hong Kong's US dollar RTGS system. Additionally, in 2003, the Euro RTGS system was launched, with Standard Chartered Bank serving as the settlement bank. With the establishment of the offshore Renminbi center, the HKMA launched the Renminbi RTGS system in 2007, with Bank of China serving as the settlement bank.

This internationally advanced, reliable, secure, and efficient RTGS system processes a large volume of fund transactions within the Hong Kong banking system daily, with Renminbi settlements averaging over 1 trillion yuan each day, strongly supporting Hong Kong as a global hub for offshore Renminbi business. According to statistics from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), approximately 70% of global Renminbi cross-border payments are processed through Hong Kong's payment system.

More importantly, this stable and efficient RTGS system has allowed Hong Kong to seize the initiative in US dollar trading in the Asian time zone, becoming the world's third-largest US dollar trading center. Becoming the US dollar trading center in the Asian time zone is a crucial step toward establishing a third global international financial center. Financial globalization requires uninterrupted foreign exchange trading and settlement around the clock, making the Asian time zone, outside of London and New York, critically important. After its return, Hong Kong quickly filled this gap with its own strength.

In other words, as the infrastructure of the global financial market, the US dollar settlement system of "New York-London-Hong Kong" has formed a stable pattern, jointly supporting the 24-hour operation of financial globalization. The relationship among New York, London, and Hong Kong is not one of competition but of mutual reliance. If any one of the three encounters problems, the impact on global finance would be unimaginable.

5.4 The United States' Caution

The importance of Hong Kong as a US dollar trading center has been highlighted during the recent US-China confrontations. At one point, there were rumors that the US would restrict Hong Kong banks from conducting US dollar settlements, even considering removing Hong Kong banks from the SWIFT system. In response, HKMA President Chen Maobo stated that Hong Kong is the third-largest US dollar settlement center, serving a large number of multinational institutions in the Asian time zone, and that the interconnectedness of financial centers means that any turbulence in the Hong Kong market would inevitably affect the US, shaking the confidence of other investors holding US dollars as foreign exchange reserves. The US is well aware of the importance of the Hong Kong dollar market and ultimately did not take any concrete action. This demonstrates that Hong Kong's financial infrastructure, centered around RTGS, is not only a "national treasure" for China but also an important component of the global financial market.

In this sense, the financial infrastructure centered around the RTGS system since Hong Kong's return has effectively rebuilt Hong Kong as an international financial center, giving it a clear advantage over Singapore and serving as a powerful weapon in the competition between the two. Coupled with the offshore Renminbi center and arrangements for mainland enterprises to list in Hong Kong, this has enabled Hong Kong to upgrade from a regional international financial center to a global financial center. This transformation into a global financial center is one of the most significant achievements of Hong Kong since its return 25 years ago.

Of course, there is a clear understanding of Hong Kong's actual status as a financial center, both internally and among international financial professionals. On one hand, it is believed that Hong Kong's current status as a financial center does not yet reach the heights of New York and London; on the other hand, whether Hong Kong can achieve this critical leap depends on developments in the coming years. For present-day Hong Kong, the urgent task is to consolidate the advantageous position brought by its financial infrastructure and common law, quickly restore confidence in the market, and retain financial institutions and talent. Singapore has also been strengthening its financial infrastructure, particularly in recent years focusing on the application of blockchain in finance, becoming a blockchain center in the Asia-Pacific region. In the long run, Hong Kong also needs to pursue innovative breakthroughs in financial technology to maintain its competitiveness in the financial sector. From the perspective of the development of Hong Kong's financial center, the construction of financial infrastructure is crucial.

Now, with stablecoins as the digital financial infrastructure, how can Hong Kong leverage this opportunity for another leap as a financial center?

We believe that Hong Kong's opportunity lies in the "dual-engine drive"—the "Hong Kong dollar stablecoin" and the "Renminbi stablecoin," these two powerful digital engines.

6. Dual-Engine Drive

The core of Hong Kong's "dual-engine drive" is to allow the "Hong Kong dollar stablecoin" and the "Renminbi stablecoin" to play different but complementary strategic roles on Hong Kong's unique platform.

6.1 Hong Kong Dollar Stablecoin (HKDS)

The Hong Kong dollar stablecoin, due to its linked exchange rate system with the US dollar, is essentially a Hong Kong-regulated, Asia-time-zone-operating, programmable US dollar proxy (USD Proxy). Despite this, it is crucial for financial trade within the region: a large number of traditional financial institutions (banks, funds, family offices) globally wish to enter the digital asset space but struggle with compliance and trust issues. An HKDS backed by the HKMA is a reliable "on-ramp" for them. They can use HKDS to purchase tokenized assets (such as bonds and real estate) and participate in compliant DeFi protocols without directly holding stablecoins like USDC/USDT, which have faced compliance controversies in other jurisdictions.

Domestic e-commerce platforms looking to expand overseas also need an efficient stablecoin settlement system, which can directly address the cross-border payment challenges that have troubled them for years, especially the complex currency exchange processes and high bank fees when targeting emerging markets. Through stablecoins, funds can be settled almost in real-time between platforms, global suppliers, logistics providers, and end consumers, significantly accelerating cash flow turnover. More importantly, this system can uniformly process payments from different countries and regions, aggregating them into a standardized digital asset, thereby simplifying the complexity of financial reconciliation and risk management. This will not only significantly reduce the operational costs of overseas business but also enhance its price competitiveness in the global market, potentially triggering a supply chain revolution.

Hong Kong's RTGS system handles a massive volume of Asian US dollar transactions, and HKDS can upgrade this T+0 or T+1 settlement capability to 24/7, instant, atomic on-chain settlement (T-Now). This represents a revolutionary efficiency improvement for scenarios such as foreign exchange trading, securities settlement, and derivatives clearing, solidifying Hong Kong's position as the Asian US dollar clearing center.

It is clear that HKDS is not intended to disrupt the US dollar system but to embrace and strengthen it. It leverages Hong Kong's regulatory credibility to provide a more efficient and secure digital interface for the US dollar world, reinforcing Hong Kong's position in the existing international financial landscape.

6.2 Offshore Renminbi Stablecoin (CNHS)

Since HKDS will strengthen the US dollar system, what about the Renminbi? The urgent task is for Hong Kong to quickly launch a stablecoin based on offshore Renminbi. Correspondingly, the Renminbi should accelerate its internationalization and adapt to the global financial digitalization trend as soon as possible.

The offshore Renminbi stablecoin is Hong Kong's most unique and disruptive trump card in this competition. Its strategic value lies in creating an entirely new track. One of the biggest obstacles to Renminbi internationalization is the efficiency and cost of cross-border payments and settlements. CNHS can bypass the traditional SWIFT/CIPS system, providing a near-zero-cost, zero-time-difference payment settlement network for "Belt and Road" trade, bulk commodity transactions, and cross-border e-commerce. This represents a "dimensional reduction attack" on the existing system.

International investors looking to invest in Chinese assets face many inconveniences beyond limited channels like the Shanghai-Hong Kong Stock Connect. A liquid CNHS can serve as a "gateway" for global investors to access offshore Renminbi bonds, funds, and other financial products. They can use CNHS to purchase tokenized assets denominated in Renminbi from anywhere in the world, greatly expanding the investor base for Renminbi assets.

Hong Kong's practical strategy is to launch the Renminbi stablecoin as soon as possible after the Hong Kong dollar stablecoin is introduced, making Hong Kong the only place in the world where "US dollar ↔ Hong Kong dollar stablecoin ↔ Renminbi stablecoin" exchanges can be conducted legally, compliantly, and on a large scale. It is evident that for China, CNHS leverages Hong Kong's unique advantage as the largest offshore Renminbi center, providing the most critical infrastructure for the global narrative of Renminbi internationalization, securing an irreplaceable strategic position for Hong Kong in the new global financial landscape.

——Hong Kong will no longer be merely a center for stocks or foreign exchange but will become the global liquidity center for digital value. Capital from the US dollar world and capital from the Renminbi world will converge, collide, and merge here, creating unprecedented financial products and opportunities.

——Based on this dual-currency stablecoin infrastructure, Hong Kong can attract high-quality global assets (from real estate to private equity, from art to carbon credits) for tokenized issuance. Issuers can freely choose to price in HKDS or CNHS, attracting investors from different sources.

——Hong Kong will become a unique "regulatory sandbox," where two different financial philosophies and technological paths from the East and West can be tested and integrated. For example, the cross-border application testing of e-CNY can be fully developed through interactions with CNHS in Hong Kong.

Conclusion

From a regional international financial center to a global international financial center, from a traditional financial system to a digital financial system, Hong Kong stands at a historical crossroads. Its advantages of the "one country, two systems" policy, the linked exchange rate system, its status as the Asian dollar center, the largest offshore Renminbi center in the world, and its leading global regulatory framework for stablecoins form the foundation for Hong Kong's transition into the digital financial era. By simultaneously developing the Hong Kong dollar stablecoin (connecting the world) and the Renminbi stablecoin (looking to the future), Hong Kong has the opportunity to transform from a traditional international financial center into a "super financial hub" that bridges the physical and digital worlds, as well as the US dollar and Renminbi systems. Correspondingly, the Renminbi should accelerate its internationalization and digitization efforts to adapt to the global digital financial development trend.

This is not only a transformation and upgrade for Hong Kong itself but may also provide a key balancing point and intersection for the evolution of the global financial landscape in the coming decades. Whether Hong Kong can seize this opportunity will determine its global position in the second half of the 21st century.

References:

Marvin Barth: Stablecoins Are a Monetary Revolution in the Making, 2025, Thematic Markets

Rashad Ahmed Inaki Aldasoro: Stablecoins and Safe Asset Prices, May 2025, BIS

Zhao Xiaobin: A Century of Competition Among Global Financial Centers: Factors Determining the Success or Failure of Financial Centers and the Rise of China's Financial Center, "World Geography Research," June 2010

Shen Jianguang: Opportunities and Challenges of Stablecoins for the International Status of the US Dollar, June 2025, Chief Economist Forum

Wang Yang, Bai Liang, Zhang Xueyi: Stablecoins as a Double-Edged Sword for US Dollar Hegemony, June 2025, FT Chinese Network

Liu Yu: Building a New Generation Global Payment Network Using Compliant Stablecoins, 2024, Wanxiang Blockchain

Cai Xiaozhen: Analysis of the Competitive Landscape Between Hong Kong and Singapore as International Financial Centers, 1980-2005, Master's Thesis, East China Normal University, May 2007

Li Yongfeng: On the Legal Personality of Decentralized Blockchain Communities—An Analysis Based on Corporate Community Theory, 2021, Collection of Master's Theses, Renmin University of China

Guo Zhongxiao: The Lesser-Known Value of Hong Kong 2—New York-London-Hong Kong or New York-London-Po? 2022, Demonstration Finance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。