ETF provider Rex Shares and crypto investment firm Osprey Funds have launched the first spot solana ( SOL) ETF in the U.S. with onchain staking rewards. But the approval was a little quirky. The U.S. Securities and Exchange Commission (SEC) essentially allowed the fund to launch on Friday, June 27 by indicating it had “no further comments” regarding the Rex-Osprey application.

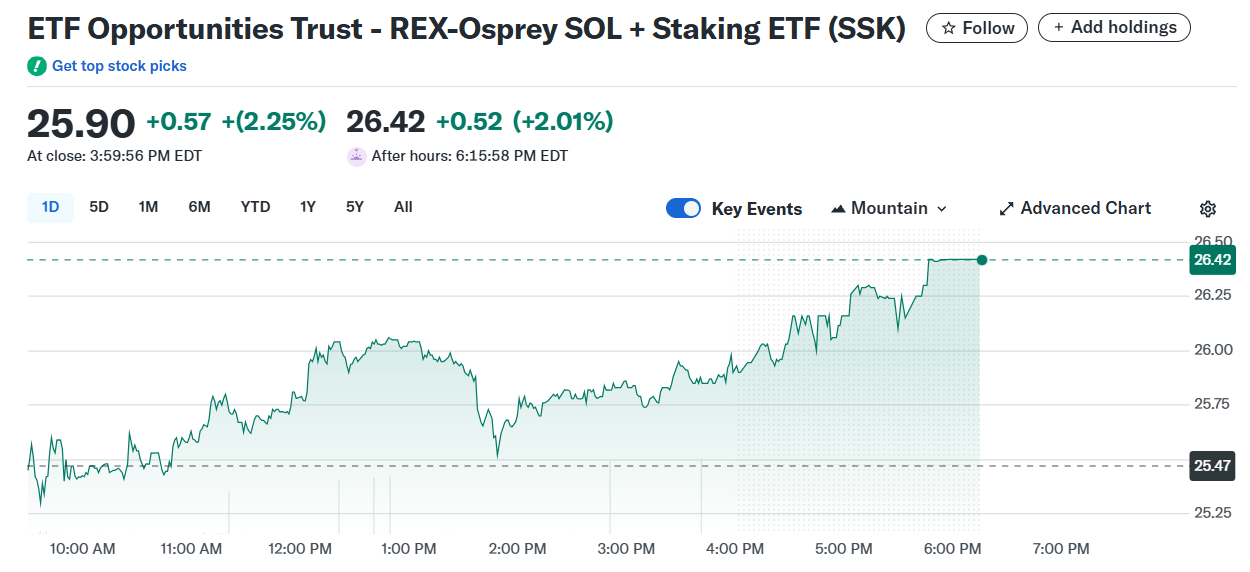

(The Rex-Osprey Solana + Staking ETF (SSK) made its debut in the U.S. on Wednesday / Yahoo Finance)

The Rex-Osprey SOL and Staking ETF (SSK) primarily invests in spot staked solana, but 40% of its assets will be allocated to exchange-traded products that also invest in staked SOL, according to a press release provided to Bitcoin.com. A small allocation will be also be made to solana liquid staking tokens such as JitoSOL. Jito is a Solana liquid staking protocol similar to Ethereum’s Lido, but Jito incorporates maximal extractable value (MEV) which involves validators arranging transactions in the most profitable sequences to increase reward levels.

The curious nature of the SEC’s response is likely because SSK, differs from typical ETFs, and is organized as a “C corporation,” which means it’s taxed separately from its owners and allows staking proceeds to pass through to investors.

“Unlike most ETFs, the Fund will not be taxed as a regulated investment company for U.S. federal income tax purposes because of its limited number of holdings,” the filing documentation states. “Rather it will be taxed as a regular subchapter C corporation which means taxable income generally must be recognized at both the Fund level and shareholder level.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。