Demand for U.S. Treasury bonds will not significantly increase in the short term due to the growth of stablecoins, and the relative growth of non-U.S. stablecoins will become an important indicator of the de-dollarization trend.

Written by: Xu Chao, Wall Street Insights

Will demand for U.S. Treasury bonds significantly increase in the short term due to the growth of stablecoins?

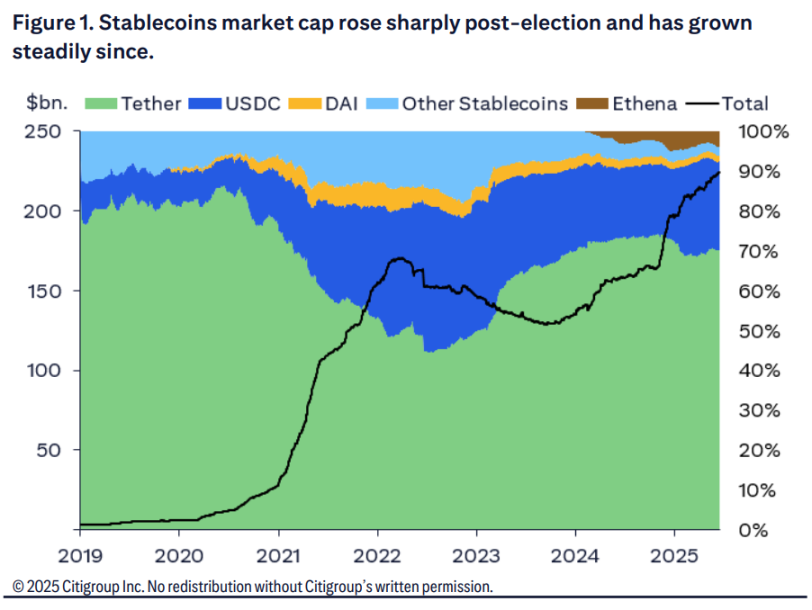

According to information from the Wind Trading Desk, Citigroup stated in a report on June 20 that the rise of U.S. dollar stablecoins is more a reflection of the dollar's reserve status rather than a driving factor. Demand for U.S. Treasury bonds will not significantly increase in the short term due to the growth of stablecoins, and the relative growth of non-U.S. stablecoins will become an important indicator of the de-dollarization trend.

Growth of stablecoins is unlikely to materially drive demand for U.S. Treasuries

The GENIUS stablecoin bill has passed in the Senate, and the House's STABLE bill has also come out of committee. Citigroup believes this is an important step in providing regulatory clarity for U.S. digital assets, which is beneficial for the entire industry. The passage of legislation is a key milestone in improving the regulatory framework for digital assets and will help accelerate the widespread adoption of stablecoins.

The market is generally focused on whether stablecoins will become a new growth point for demand for U.S. Treasury bonds (enhancing the dollar's status).

Citigroup's analysis suggests that the answer to this question is conditional: "both yes and no." The key lies in the source of funds: if newly issued stablecoins come from the transfer of existing bank deposits or money market funds, it will not actually create net new demand for U.S. Treasuries.

Currently, Tether and Circle mainly hold U.S. Treasuries and support their assets through repurchase transactions.

Citigroup believes that in the short term, before the widespread adoption of stablecoins, their growth will not significantly increase demand for U.S. Treasuries. The current growth of stablecoins may divert bank deposits (reducing banks' demand for U.S. Treasuries) and/or money market funds (directly reducing demand for U.S. Treasuries). If stablecoins begin to earn interest, it may lead to larger-scale growth, but this will also divert some funds from existing holders.

The source of growth for stablecoins is crucial. If the growth comes from the transfer of funds from other U.S. Treasury holding instruments like money market funds (MMFs), it does not constitute net new demand.

Citigroup estimates that under the baseline scenario, the potential long-term (by 2030) size of the stablecoin market will reach $1.6 trillion. Among this, $240 billion will come from the reallocation of U.S. cash, $109 billion from the reallocation of global M0, and $273 billion from the reallocation of deposits held by foreigners, which will constitute the true incremental demand for U.S. Treasuries.

Non-U.S. stablecoins become an important indicator of de-dollarization

Citigroup believes that the dominant position of the dollar as a reserve currency will continue to exist, regardless of stablecoins. In terms of reserve diversification, the euro is the only potential long-term competitor.

Based on current trends, Citigroup expects the dollar to maintain its dominant reserve currency status until 2070. Even under aggressive assumptions (a 12.5% annual decline in the dollar's share and a 5% annual increase in the euro), this status will continue until 2046.

Citigroup emphasizes that the relative issuance trend of stablecoins will become an interesting indicator to track changes in the dollar's dominance. Since the launch of euro stablecoins under the European MiCA legislation, their market capitalization has increased, coinciding with the weakening of the dollar and cracks in the narrative of "American exceptionalism."

Currently, euro stablecoins account for only a tiny portion of dollar stablecoins, even though the dollar's share in foreign exchange reserves is about 50% and nearly 80% in foreign exchange transactions. This indicates that the adoption of stablecoins may represent both an opportunity and a threat to the dollar's dominance.

Analysts expect that the dollar's dominance will remain in the foreseeable future. The existing reserve status and network effects of the dollar mean that dollar-based stablecoins are likely to continue to dominate the market. The relative popularity and issuance volume of non-U.S. stablecoins will be interesting indicators to track the trend of de-dollarization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。