Currently, there exists a bubble and speculation chain: "Stablecoin compliance → Funds enter crypto → Speculative trading of unregulated derivatives or air coins."

Written by: Sima Cong AI Channel

Fundamental Purpose

First of all, I must say that most of the information you see about tokenized stocks is inaccurate, and it doesn't clearly explain what tokenized stocks are.

I will answer all your concerns at once.

Currently, there exists a bubble and speculation chain: "Stablecoin compliance → Funds enter crypto → Speculative trading of unregulated derivatives or air coins."

I want to remind you that customers are betting against Robinhood on stock price trends, rather than participating in public market trading.

Is the Future Here or Overhyped?

On June 30, American online brokerage Robinhood announced the launch of U.S. stock tokenization services on the same day as well-known crypto trading platforms Bybit and Kraken, providing users with a 24/7 uninterrupted stock trading experience.

According to Reuters, Robinhood announced the launch of stock token trading services for EU users based on the Arbitrum network, supporting trading of over 200 U.S. stocks and ETFs, including Nvidia, Apple, and Microsoft. On the same day, Bybit and Kraken launched the "xStocks" (stock tokenization) product provided by the Swiss compliant asset tokenization platform Backed Finance, covering about 60 stocks and ETF tokens.

Driven by this news, Robinhood's stock price hit an all-time high, rising nearly 10%. Company executives also stated plans to launch tokens linked to private company stocks, starting with Sam Altman's OpenAI and Musk's SpaceX.

Is it about to open a "crypto IPO" market that bypasses traditional securities markets?

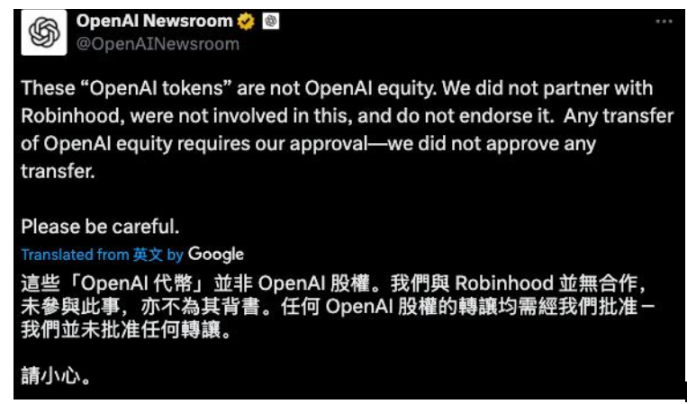

On July 3, OpenAI issued an urgent announcement stating that these "OpenAI tokens" are not equity in OpenAI. "We have not partnered with Robinhood, nor have we participated in this matter, and we do not endorse it. Any transfer of OpenAI equity requires our approval, and we have not approved any transfer."

A trade association representing financial companies is urging the U.S. Securities and Exchange Commission (SEC) to reject the opportunity for digital asset companies to offer tokenized stocks through specific exemptions, advocating for a more transparent approach.

In a letter sent this week to the SEC's crypto working group, the Securities Industry and Financial Markets Association (SIFMA) stated that its members "have been closely reading" reports indicating that digital asset companies are seeking to offer tokenized stocks and have submitted no-action or exemption relief requests to the agency. No-action relief means that if the company launches these products, SEC staff will not recommend enforcement action against the company.

"Therefore, SIFMA urges the SEC to reject these companies' requests for no-action or exemption relief and instead provide a robust public process to allow meaningful public feedback before making any decisions regarding the introduction of new trading and issuance models, as well as other issues that may arise in response to the SEC's consideration of RFI [Request for Information] policy actions," the association said.

First, understand what it is

l Assume that the total circulating shares of a stock are the entire cake; Robinhood buys a portion from the securities market, which is considered one piece of the cake, then digitizes the price trend of this piece of cake and puts it on the blockchain, lowering the entry threshold for buyers (minimum 1 euro). Essentially, it dresses up the expectation of the price increase or decrease of this piece of cake as a token on the blockchain, which is then bought and sold.

l The benefit for Robinhood is an increase in the number of users, and an increase in users means a possibility of revenue growth and the construction of its own financial product service ecosystem.

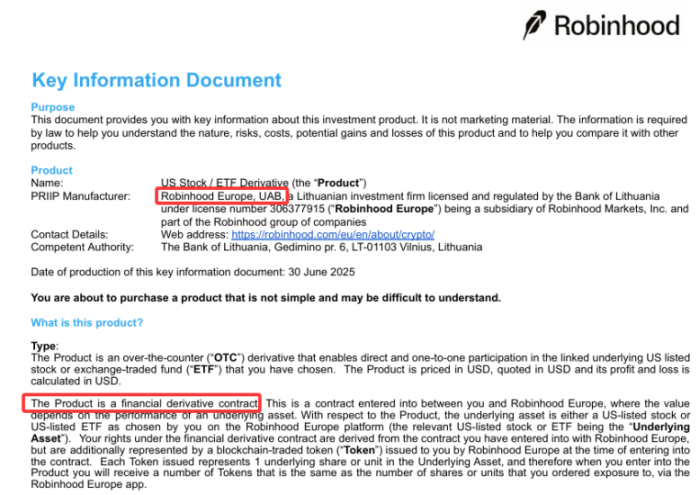

According to the key information document provided by Robinhood before customer registration:

The price of this product is dynamically adjusted based on the real-time value of the underlying asset provided by NASDAQ.

Holding this product does not mean you own any shares or units, or have the right to obtain shares or units of the underlying asset. This product does not allow you to redeem it for shares or units of the underlying asset, or in any other way, and does not provide you with the rights you would have when directly purchasing shares or units of the underlying asset (e.g., voting rights at shareholder meetings).

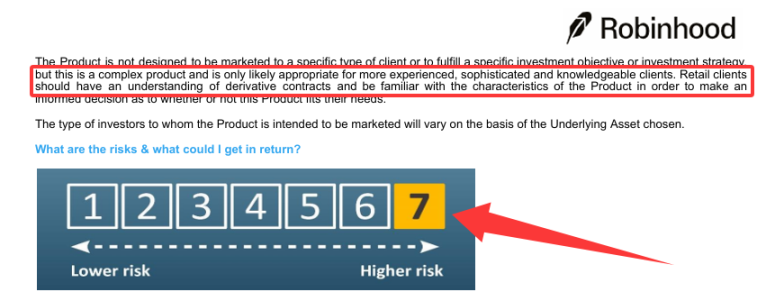

And this is a financial derivative product with a maximum risk level of 7.

This product is not subject to investor compensation or deposit insurance schemes. Robinhood Europe is the sole counterparty for payment claims related to the product among all underlying assets.

Robinhood Europe may suspend closing product positions in specific circumstances, such as unexpected market volatility, requests made outside U.S. trading hours, temporary announcements, or other situations that make pricing more difficult.

Using limit orders to hedge orders, the price is within a range of 0.5% above or below the last reported trading price of the underlying asset on the NASDAQ exchange (i.e., NASDAQ stock market, NASDAQ OMX BX, or NASDAQ OMX PHLX), as well as within a range of 0.5% above or below the foreign exchange rate.

Perpetual contracts use limit orders to restrict orders, with prices potentially exceeding the last reported trading price of the applicable perpetual contract exchange by more than 1% above or below.

Refer to the official introduction on Robinhood's official website for specifics.

Buying and Selling Stock Tokens

Before You Buy Stock Tokens

Before you purchase your first stock token, you need to register and get approved for trading. This includes:

Providing necessary information, such as your Tax Identification Number (TIN). If you have multiple TINs, the system may require you to add all TINs.

Answering questions about your investor profile to help assess your financial situation and investment goals.

Completing a knowledge check questionnaire to ensure you understand stock tokens and the associated risks.

Reviewing and agreeing to the required agreements, including terms of use.

Searching for Stock Tokens

You can find available stock tokens in Explore (magnifying glass). You can use the search bar to look for stock tokens by stock code or name.

Placing Your Buy Order

After finding the stock token you want to purchase, click on it to go to the Stock Token Detail Page (STDP).

On the STDP, select Buy.

We currently support buy orders using quantity or euro value, including whole tokens and fractions.

Review estimated prices and FX details. All stock tokens are displayed in USD, and you will purchase them in euros. When you trade, the foreign exchange conversion occurs automatically, and Robinhood does not add a spread, only a 0.10% foreign exchange fee.

After confirmation, your buy order will be placed.

Selling Stock Tokens

After finding the stock token you want to sell, click on it to go to the Stock Token Detail Page (STDP).

On the STDP, select Sell.

We currently support sell orders using quantity or euro value, including whole tokens and fractions.

Review order details on the confirmation screen and confirm. After confirmation, your sell order will be placed.

Review and Confirm

After entering your order details, please carefully review the information on the confirmation screen. If the market is closed, the order confirmation screen will indicate that your order is queued for the next market opening.

Using Your Funds After Selling

When your sell order is executed, the sale proceeds will be immediately credited to your account, but there are some important details about how to use them:

Funds can be traded immediately. This means you can immediately use the cash from the euros (€) sold to purchase other stock tokens or supported assets.

Withdrawals are paused until the next business day (T+1). While you can immediately use these funds for trading, you cannot withdraw the euro proceeds to your bank account until the next business day after the sale settles.

This withdrawal pause specifically applies to the euro proceeds from selling stock tokens.

The withdrawal pause status will be automatically lifted on the next business day.

If you make multiple sales on different dates, the proceeds from each sale will be available for withdrawal on the next business day after that specific sale.

You can check the status of your funds in Transfer → Withdrawable and see the current withdrawable funds versus the balance awaiting settlement.

Important Trading Details

Trading Hours: You can trade stock tokens from Monday 2 AM CET/CEST to Saturday 2 AM. You can also queue buy or sell orders outside of these times, which will be placed when the market reopens. The order confirmation screen will confirm whether your order has been successfully queued.

Corporate Actions: Corporate actions on the underlying stock (such as splits or mergers) will affect your stock tokens. Trading may be paused during the processing of corporate actions. Banners and/or notifications in the app will inform you about corporate actions and trading pauses. Check corporate actions for stock tokens for more details.

Market Data: Charts and fundamentals are displayed in USD.

Costs

Foreign Exchange Fees: We use the current exchange rate to convert your euros, plus a small additional foreign exchange fee of 0.10%.

Estimated Total Costs: This includes:

l The converted token price (in euros)

l 0.1% foreign exchange fee

l A small buffer considering volatility

To help prevent severe price fluctuations while processing your order, the execution price of buy orders may be equal to or lower than:

0.5% above the last trading price of the stock, and 0.5% above the current euro/USD exchange rate.

Similarly, the execution price of sell orders may be equal to or higher than:

0.5% below the last trading price, and 0.5% below the current euro/USD exchange rate.

Trading Not Allowed During Corporate Actions

During the time the corporate actions team works to process these changes, we will temporarily block you from trading the affected stock tokens.

During the processing of corporate actions, new orders are typically not allowed. In most cases, trading becomes unavailable from the effective date at around 2 AM CET/CEST and resumes after processing is completed, usually at the start of the U.S. market day (around 3:30 PM CET/CEST).

During corporate actions, all pending orders for the stock token will be canceled.

In rare cases, such as during delisting or liquidation, we only allow you to place sell orders for that specific stock token. Buy orders are not permitted, and any pending orders will be canceled.

How Do Stock Tokens Differ from Traditional Stocks?

Stock tokens offer many of the same benefits as traditional stocks, but since you do not own the underlying stock, you will not have certain shareholder rights, such as voting. Additionally, unlike stocks, when you purchase stock tokens, you are entering into a derivative contract with Robinhood Europe.

How Do Stock Tokens Work?

When you purchase stock tokens, you are not buying actual stocks—you are buying tokenized contracts that track the price of the underlying asset, recorded on the blockchain.

You can buy, sell, or hold stock tokens, but currently, you cannot send them to other wallets or platforms.

What Are the Benefits of Trading Robinhood Stock Tokens?

There are several potential benefits to trading stock tokens on Robinhood:

l No commission or additional spreads: Just a 0.1% foreign exchange fee covers everything. There are never hidden fees.

l Start from 1 euro: Enter the market on your terms—and earn dividends when eligible.

l 24-hour market access: Buy and sell stock tokens anytime from Monday to Friday.

l Peace of mind investing: Robinhood stock tokens are offered as derivatives under MiFID II. The underlying assets are securely held by U.S.-licensed institutions.

In a nutshell, the current state of tokenized stocks:

A derivative contract that requires KYC/AML (providing a tax code is itself KYC), lacking the fundamental shareholder rights of traditional stocks (for example, no voting rights with Robinhood, and not even holding the underlying stock itself), cannot be freely transferred or circulated to other wallets or platforms (only buy and sell within the Robinhood token stock app), traded with limit orders (within 0.5%), and settles T+1. Most importantly, tokenized stocks cannot be traded during sensitive periods of the listed company's information (such as during major disclosures).

This is a derivative product disguised as a stock.

What Is a Stock?

A stock (also known as "shares" or "equity") is a financial instrument that grants shareholders rights to participate in the equity of a company.

It is a type of security through which a corporation allocates ownership. Because corporations need to raise long-term funds, they issue stocks to investors as partial ownership certificates of the company's capital, allowing shareholders to earn dividends (stock dividends) and/or cash dividends, and share in the profits from the company's growth or market fluctuations; however, they also share the risks associated with operational failures of the company.

The world's first stock was issued in the 17th century by the Dutch East India Company.

The essence of a stock is to represent a share of ownership in a company. By purchasing stocks, investors effectively become shareholders, sharing in the company's profits and risks.

What Is a Derivative Contract?

A derivative contract is a financial agreement between two parties whose value is based on (or "derived from") the price of something else—such as stocks, bonds, commodities, currencies, interest rates, or even market indices. You do not own the actual item (like a barrel of oil or company stock), but rather you are betting on how its price will change.

These contracts bind Robinhood as the counterparty to pay customers based on the performance of U.S. stocks or ETFs. If the value of the U.S. stock or ETF increases from the start to the end of the contract, Robinhood will pay the customer the resulting profit. Conversely, if the value decreases, Robinhood will retain the difference. In cases of stock splits and buybacks, the derivative contracts will be adjusted, and the tokens will be recalibrated.

What Is Tokenization?

When a new U.S. stock derivative contract is signed, Robinhood simultaneously issues (mints) a new fungible token on the blockchain. This token represents the customer's rights to the U.S. stock derivative. The token is non-transferable.

When the U.S. stock derivative is closed, Robinhood will remove the tokenized U.S. stock derivative contract from the blockchain. The blockchain will update in real-time, and the token will no longer be valid and cannot be part of any wallet or blockchain transaction.

U.S. stock derivatives are considered complex financial instruments. They are not traded on regulated markets or other multilateral trading facilities. Additionally, although Robinhood hedges its obligations by purchasing U.S. stocks or ETFs at a 1:1 ratio for the U.S. stock derivatives it issues, customers should understand the inherent counterparty risk of U.S. stock derivatives and assess Robinhood's creditworthiness before trading.

What Is a Perpetual Futures Contract?

A futures contract is a derivative contract that obligates the buyer and seller to exchange an asset at a fixed price on a specific future date, regardless of the market value on that date. A perpetual futures contract, or perpetual contract, is a futures contract without an expiration date. Because there is no expiration date, there is no need for actual delivery of the commodity; the sole purpose of perpetual futures contracts is to speculate on the price of the asset. These contracts can be used to speculate that future prices will be lower than the current price (known as a short position) or higher than the current price (known as a long position).

What Are Crypto Perpetual Futures Contracts (or Crypto Perpetual Contracts)?

Crypto perpetual contracts refer to perpetual futures contracts that reference crypto assets. The crypto perpetual contracts offered by Robinhood refer to the crypto assets listed in this key information document.

It Is Not Even Tokenized Stocks, But Tokenized Financial Derivative Contracts

The tokenized stocks issued by Robinhood Europe are essentially not true stock ownership but rather a derivative, specifically: Robinhood explicitly states, "You do not own the underlying stock and cannot redeem it for stock." What you are trading is a private contract between Robinhood and you, not a stock registration mapped on the blockchain. This is essentially a new packaging of a Contract for Difference (CFD), not tokenized securities.

What Robinhood issues is merely a representation of the rights to CFD/contract trading, packaged as a visible token on the blockchain, but: it is non-transferable, can only be closed internally within Robinhood, and is merely a "trading certificate" on-chain, not a stock equity on-chain.

Typically, one of the core advantages of tokenized assets is transferability (on-chain). "Non-transferable" means this token is just a record in Robinhood's internal system, not a blockchain asset that can circulate freely and trade in a decentralized manner. It is merely a digital certificate to track your "rights," and this certificate cannot leave Robinhood's ecosystem.

Traditional securities trading is strictly regulated by the SEC, ESMA, and FINRA; Robinhood, which operates in Europe, only offers complex financial products, falling under a "looser" regulatory framework, even directly circumventing the compliance framework of the securities market;

The bubble chain: "Stablecoin compliance → Funds enter crypto → Speculative trading of unregulated derivatives or air coins."

Robinhood's business model is a part of this chain of "speculative trading."

The safety of funds entirely relies on the solvency and creditworthiness of Robinhood Europe. If Robinhood Europe encounters financial issues, your investment could be lost entirely, and there is no investor compensation mechanism under the usual bankruptcy protections of financial institutions. This is a fundamental difference from strictly regulated stock exchanges and brokerages.

The role of blockchain: In this case, the blockchain acts more like an internal ledger and a technical gimmick for issuing non-transferable tokens to track customers' derivative positions, rather than endowing assets with decentralized, transparent, and freely circulating characteristics. It has not truly realized the vision of "tokenized stocks" that promotes disintermediation, increased liquidity, lowered barriers, and enables free trading on-chain.

John Krebriat, General Manager of Robinhood's crypto business, stated: "We want to address historic investment inequality—now everyone can buy these companies."

This is a straightforward and blatant misleading promotional slogan.

Why Does Robinhood Buy the Underlying Stocks at a 1:1 Ratio?

The answer: To hedge its market risk as a market maker (counterparty).

Robinhood is essentially "the counterparty you trade with"—you profit, they lose; you lose, they profit. This is similar to the relationship between a casino dealer and players.

What Two Risks Are Being Hedged?

A. Market Price Risk

If not hedged, an increase in the underlying stock price would cause Robinhood to lose money (because it owes customers the increase).

By purchasing the stock, Robinhood uses the profits from the rising stock price to hedge its losses in the contract.

B. Currency Risk (for some products)

If the token is priced in euros while the stock is priced in dollars, then it also needs to hedge against risks from currency fluctuations.

But the core risk is the first one: market price risk.

This is a centralized "trading closed loop" designed by Robinhood, where users do not own stocks but rather have a liability contract with Robinhood, which hedges its market risk through the stock spot market, while users still bear Robinhood's credit risk.

Robinhood Europe is not a traditional exchange; it is not a platform that matches buyers and sellers. It is more like an Over-the-Counter (OTC) market maker.

As the sole counterparty, Robinhood Europe theoretically may have motives that conflict with customer interests. For example, it may manipulate its quotes under certain market conditions or make decisions during settlement that are unfavorable to customers. While compliant companies typically have internal regulations to constrain such behavior, risks still exist.

This Is Regulatory Arbitrage

l Since there is already a mature securities market, why is there a need for tokenized stocks? What is the significance?

l If tokenized stocks are anchored to real stocks and the underlying assets are publicly listed companies, should they be subject to the same regulations?

l The current regulation of cryptocurrencies/DeFi is clearly more lenient than that of traditional securities markets. Is there a possibility of "regulatory arbitrage"?

l Does this model belong to a bubble? Will it burst as regulations tighten with stablecoin legislation and others?

Based on the principle of "same assets, same risks, same regulations," Robinhood is essentially engaging in regulatory arbitrage.

Traditional stocks are regulated by the SEC and FINRA, while tokenized stocks on the Robinhood platform are not bound by these regulations, relying instead on European regulations (such as MiFID II), creating a situation of regulatory arbitrage. Although the 2025 GENIUS Act regulates stablecoins, it has not yet clarified the status of tokenized derivatives, leaving a gray area.

The 24/7 trading and low entry barriers of tokenized stocks attract speculators, but the lack of investor protection found in traditional markets (such as SIPC insurance) may be seen as unfair competition.

With the same underlying assets but different legal structures and regulatory intensities, this creates unfair competition; it is a typical case of regulatory arbitrage, not technology-driven financial innovation, but speculation-driven arbitrage innovation.

l The underlying assets are shares of publicly listed companies, and the inherent risks are consistent with traditional securities;

l Investors face the same price volatility, corporate governance risks, and information asymmetry;

l If regulation is not unified, regulatory arbitrage may occur: the same asset may enjoy different regulatory treatments on different platforms.

What Impact Does This Have on Altcoins?

First, it must be noted that over the past century, U.S. securities regulation has generally been viewed as successful—markets are deeper, valuations are more reasonable, and fraud is less common, all due to mandatory disclosures by publicly listed companies.

Some market perspectives suggest that tokenized traditional quality assets, supported by clear business models, compliant regulatory frameworks, and stable actual returns, are becoming the new favorites for on-chain capital, creating a siphoning effect on the altcoin market. In particular, tokens that lack actual revenue models, have immature products, and rely solely on narratives to support their market capitalization are facing liquidity exhaustion and survival pressure.

There are also views that altcoins may not necessarily disappear but will find it increasingly difficult to survive. In the crypto market, each new quality asset is a blow to those price assets maintained by consensus. The only way forward for altcoins is to generate actual application value, and it must be value that can bring in real income. All tokens that cannot materialize and survive solely on narratives will gradually enter a death spiral. There may still be altcoin seasons, but the days of widespread price increases across thousands of coins are over; simple models should be a thing of the past.

First, let’s define what altcoins are:

Altcoins refer to any cryptocurrency issued after Bitcoin. The name of these coins is derived from the phrase "alternative coins" or "altcoins." In simple terms, it is a term that describes all digital assets that are alternatives to Bitcoin.

The term "altcoin" comes from the Chinese term "山寨货," which carries a mocking connotation of imitation goods. Since Bitcoin is the first cryptocurrency globally, many coins that mimic Bitcoin's technology have been launched subsequently, leading to the term altcoin.

However, in the real cryptocurrency market, altcoins refer to:

l Lacking technological originality or practical application scenarios

l Lacking a clear business model or real demand support

l Cryptographic assets aimed at short-term speculation, pump and dump schemes

They typically mimic the technical architecture of mainstream cryptocurrencies (such as Bitcoin and Ethereum) but do not offer substantial innovation or value support.

These projects often tout "decentralization," "blockchain finance," and "Web 3.0 revolution," but in reality, they are just new speculative tools that change the packaging without changing the substance.

They provide a seemingly possible chance of "getting rich overnight," attracting countless gambler-like speculators.

The end result is that a few early participants cash out and leave a large number of retail investors holding the bag at high prices, ultimately losing everything.

The allure of altcoins, air coins, or meme coins to countless speculators lies in their apparent promise of overnight wealth. Investors rush in like gamblers to chase a minuscule chance, but ultimately they may lose everything, leaving behind unverifiable legends of sudden wealth that continue to attract speculators.

The "wealth myths" in the market (such as the explosive rise of "Dogecoin" and "Shiba Inu Coin") are amplified and spread endlessly, while countless loss cases are selectively ignored. This information asymmetry, combined with the inherent gambler psychology and FOMO (fear of missing out) emotions, leads investors to enter the market like they would a casino, with a mindset of seeking large returns from small probabilities, ultimately falling into losses.

However, speculators tend to selectively ignore risks, and their memories are short; getting rich overnight is their only focus and pursuit.

Thus, the conclusion is clear:

Regardless of the inherent regulation requiring KYC for tokenized stocks, their design structure, which anchors to real stocks, does not meet the demands of altcoin speculators. Altcoins and even meme coins will continue to attract speculative interest.

Are the so-called "tokenized stocks" part of a new bubble?

From multiple perspectives, they indeed are:

Regulation is not yet clear

Stablecoin legislation, MiCA, and other regulations have not fully materialized and remain in a gray area;

Limited technological innovation

Blockchain is only used for recording and settlement, without bringing true financial efficiency improvements;

Market sentiment drives

Investors are chasing the "blockchain finance" concept while ignoring the essence of the product;

Strong speculative atmosphere

Low barriers to entry, small units, and easy trading characteristics attract a large number of retail participants;

Potential systemic risks

If Robinhood or similar platforms default, it could affect a large number of retail investors.

Against the backdrop of stablecoin legislation gradually being implemented, the market's focus on "compliance" and "tokenization" is extremely high. Robinhood may leverage this market sentiment to package its high-risk derivative products as the popular concept of "tokenized stocks," attracting investors who wish to participate in crypto concepts within a compliant framework.

Robinhood's tokenized stocks are essentially price betting agreements and also serve as a tool catering to speculators.

After launching on July 1, 2025, trading volume surged by 200%, indicating a clear speculative sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。