The next round of wealth migration is already on the way.

I. The macro turning point has arrived: Regulatory warming and policy support resonate

As the third quarter of 2025 begins, the macro landscape has quietly changed. The policy environment that once pushed digital assets to the margins is now transforming into a systemic driving force. With the Federal Reserve ending a two-year interest rate hike cycle, fiscal policy returning to a stimulus track, and the global acceleration of crypto regulation towards a "welcoming framework," the crypto market is on the eve of a structural reassessment.

First, from the perspective of monetary policy, the macro liquidity environment in the United States is entering a critical turning window. Although the Federal Reserve still emphasizes "data dependence" at the official level, the market has already reached a consensus on interest rate cuts within 2025. The divergence between the lagging dot plot and the forward expectations of the futures market is widening. The ongoing pressure from the Trump administration on the Fed has further politicized monetary policy tools, indicating that actual interest rates in the U.S. will gradually decline from high levels between the second half of 2025 and 2026. This expectation gap opens an upward channel for risk assets, especially digital assets. More importantly, with Powell's marginalization in political games and the emergence of a "more compliant Fed chair," easing is not just an expectation but may become a policy reality.

At the same time, fiscal efforts are also unfolding in sync. The fiscal expansion represented by the "Great American Law" is bringing about an unprecedented capital release effect. The Trump administration's significant investments in manufacturing repatriation, AI infrastructure, and energy independence have effectively created a "capital flood channel" spanning traditional industries and emerging tech fields. This not only reshapes the structure of the dollar's internal circulation but also indirectly strengthens the marginal demand for digital assets—especially in the context of capital seeking high-risk premiums. Concurrently, the U.S. Treasury has also adopted a more aggressive strategy in issuing government bonds, signaling a "fearless of debt expansion" stance, making "printing money for growth" once again a consensus on Wall Street.

The fundamental shift in policy signals is also reflected in changes to the regulatory structure. Entering 2025, the SEC's attitude towards the crypto market has undergone a qualitative change. The official approval of the ETH staking ETF marks the first time U.S. regulators have acknowledged that income-generating digital assets can enter the traditional financial system; the promotion of the Solana ETF even provides Solana, once viewed as a "high Beta speculative chain," with a historic opportunity for institutional absorption. More critically, the SEC has begun to establish a unified standard for simplifying token ETF approvals, aiming to create a replicable and mass-producible compliant financial product channel. This represents a fundamental shift in regulatory logic from "firewalls" to "pipeline engineering," with crypto assets being incorporated into financial infrastructure planning for the first time.

This change in regulatory thinking is not unique to the U.S. The compliance race in Asia is heating up, especially in financial hubs like Hong Kong, Singapore, and the UAE, which are scrambling for compliance dividends related to stablecoins, payment licenses, and Web3 innovation projects. Circle has applied for a license in the U.S., Tether is also laying out a Hong Kong dollar-pegged coin, and Chinese giants like JD.com and Ant Group are applying for stablecoin-related qualifications, indicating that the trend of sovereign capital merging with internet giants has begun. This means that in the future, stablecoins will no longer just be trading tools but will become part of payment networks, corporate settlements, and even national financial strategies, driven by systemic demand for on-chain liquidity, security, and infrastructure assets.

Moreover, signs of a recovery in risk appetite in traditional financial markets have also emerged. The S&P 500 reached a historic high in June, tech stocks and emerging assets rebounded in sync, the IPO market warmed up, and user activity on platforms like Robinhood increased, all signaling that risk capital is flowing back. This round of inflow is no longer solely focused on AI and biotech but is beginning to reassess blockchain, crypto finance, and on-chain structural yield assets. This change in capital behavior is more honest than narratives and more forward-looking than policies.

As monetary policy enters an easing channel, fiscal policy fully loosens, the regulatory structure shifts towards "supporting compliance," and overall risk appetite recovers, the overall environment for crypto assets has long since departed from the predicament of late 2022. Under this dual drive of policy and market, it is not difficult to conclude that the brewing of a new bull market is not driven by sentiment but is a value reassessment process driven by institutions. It is not that Bitcoin is about to take off, but that global capital markets are beginning to "pay a premium for certainty assets" again, and the spring of the crypto market is returning in a gentler yet more powerful way.

II. Structural turnover: Enterprises and institutions are leading the next bull market

The most noteworthy structural change in the current crypto market is no longer the violent price fluctuations but the deep logic of chips quietly shifting from retail investors and short-term funds to long-term holders, corporate treasuries, and financial institutions. After two years of clearing and restructuring, the participant structure of the crypto market is undergoing a historic "reshuffle": users centered on speculation are gradually being marginalized, while institutions and enterprises aimed at allocation are becoming the decisive force driving the next bull market.

Bitcoin's performance has already indicated everything. Despite a calm price trend, its circulating chips are accelerating towards "locking up." According to data tracking from institutions like QCP Capital, the cumulative amount of Bitcoin purchased by listed companies in the past three quarters has surpassed the net buying scale of ETFs during the same period. MicroStrategy, NVIDIA supply chain companies, and even some traditional energy and software companies are viewing Bitcoin as a "strategic cash alternative" rather than a short-term asset allocation tool. This behavior pattern reflects a deep understanding of global currency depreciation expectations and a proactive response to the incentive structures of products like ETFs. Compared to ETFs, companies directly purchasing spot Bitcoin have greater flexibility and voting rights, and are less susceptible to market sentiment, possessing stronger holding resilience.

At the same time, financial infrastructure is clearing obstacles for the accelerated inflow of institutional funds. The approval of the Ethereum staking ETF not only expands the boundaries of compliant products but also signifies that institutions are beginning to incorporate "on-chain yield assets" into traditional investment portfolios. The expected approval of the Solana spot ETF further opens up imaginative space; once the staking yield mechanism is packaged and absorbed by the ETF, it will fundamentally change traditional asset managers' perception of crypto assets as "yield-less, purely volatile," and will prompt institutions to shift from risk hedging to yield allocation. Additionally, large crypto funds under Grayscale are applying to convert into ETF forms, marking the breaking down of the "barriers" between traditional fund management mechanisms and blockchain asset management mechanisms.

More importantly, enterprises are directly participating in on-chain financial markets, breaking the traditional isolation between "over-the-counter investment" and the on-chain world. Bitmine directly increased its holdings of ETH through a $20 million private placement, and DeFi Development spent $100 million on acquisitions and platform equity buybacks in the Solana ecosystem, representing that enterprises are actively participating in building a new generation of crypto financial ecology. This is no longer the logic of venture capital participating in startup projects but rather a capital injection characterized by "industrial mergers" and "strategic layouts," aimed at securing core asset rights and revenue distribution rights of new financial infrastructure. The market effects of this behavior are long-tail, stabilizing market sentiment and enhancing the valuation anchoring ability of underlying protocols.

In the derivatives and on-chain liquidity sectors, traditional finance is also actively laying out. The number of open contracts for Solana futures on CME reached a historic high of 1.75 million, and the monthly trading volume of XRP futures also surpassed $500 million for the first time, indicating that traditional trading institutions have included crypto assets in their strategic models. The driving force behind this is the continuous entry of hedge funds, structured product providers, and multi-strategy CTA funds—these players do not pursue short-term profits but are based on volatility arbitrage, capital structure games, and quantitative factor model operations, fundamentally enhancing "liquidity density" and "market depth."

From the perspective of structural turnover, the significant decline in the activity of retail and short-term players further reinforces the aforementioned trend. On-chain data shows that the proportion of short-term holders continues to decline, early whale wallet activity has decreased, and on-chain search and wallet interaction data have stabilized, indicating that the market is in a "turnover sedimentation period." Although price performance during this phase is relatively flat, historical experience shows that it is often during such quiet periods that the largest market movements are born. In other words, the chips are no longer in the hands of retail investors, and institutions are quietly "building a bottom."

Moreover, the "productization capability" of financial institutions is rapidly materializing. From JPMorgan, Fidelity, and BlackRock to emerging retail financial platforms like Robinhood, PayPal, and Revolut, all are expanding the trading, staking, lending, and payment capabilities of crypto assets. This not only enables crypto assets to truly achieve "usability within the fiat currency system" but also provides them with richer financial attributes. In the future, BTC and ETH may no longer just be "volatile digital assets" but will become "configurable asset classes"—with a complete financial ecology that includes derivatives markets, payment scenarios, yield structures, and credit ratings.

Essentially, this round of structural turnover is not a simple rotation of positions but a deep unfolding of the "financial commodification" of crypto assets, a thorough reshaping of the logic of value discovery. The dominant players in the market are no longer the "quick money crowd" driven by sentiment and trends but institutions and enterprises with medium to long-term strategic planning, clear allocation logic, and stable capital structures. A truly institutionalized and structured bull market is quietly brewing, neither ostentatious nor fervent, but it will be more solid, more enduring, and more thorough.

III. The new era of altcoin season: From broad rallies to "selective bull markets"

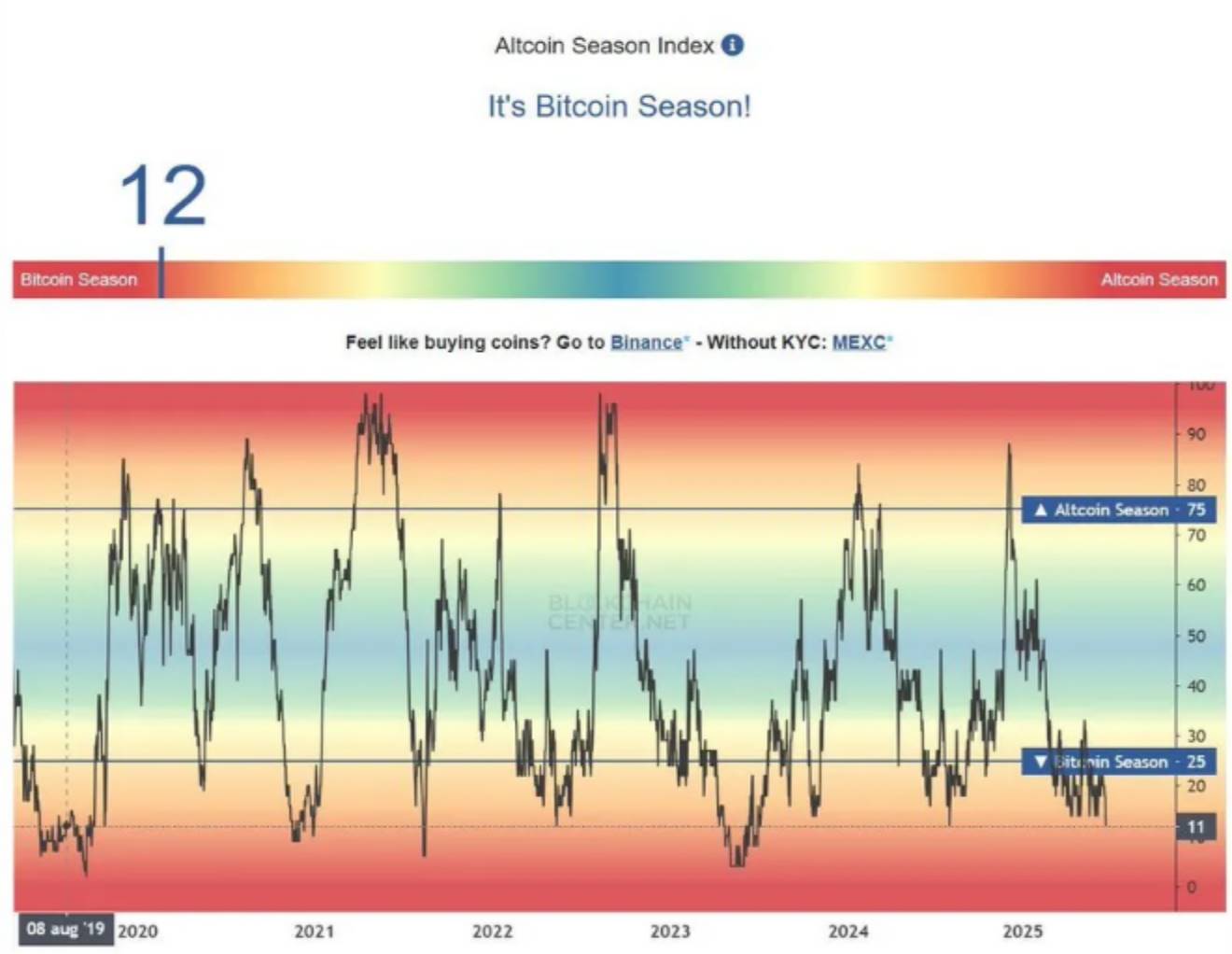

When people mention "altcoin season," what often comes to mind is the comprehensive bloom and frenzy of the market in 2021. However, in 2025, the trajectory of market evolution has quietly changed, and the logic of "altcoin price increases = market-wide surge" no longer holds. The current "altcoin season" is entering a brand new phase: broad rallies are gone, replaced by a "selective bull market" driven by narratives such as ETFs, real yields, and institutional adoption. This is a sign of the crypto market gradually maturing and an inevitable result of the capital selection mechanism returning to rationality.

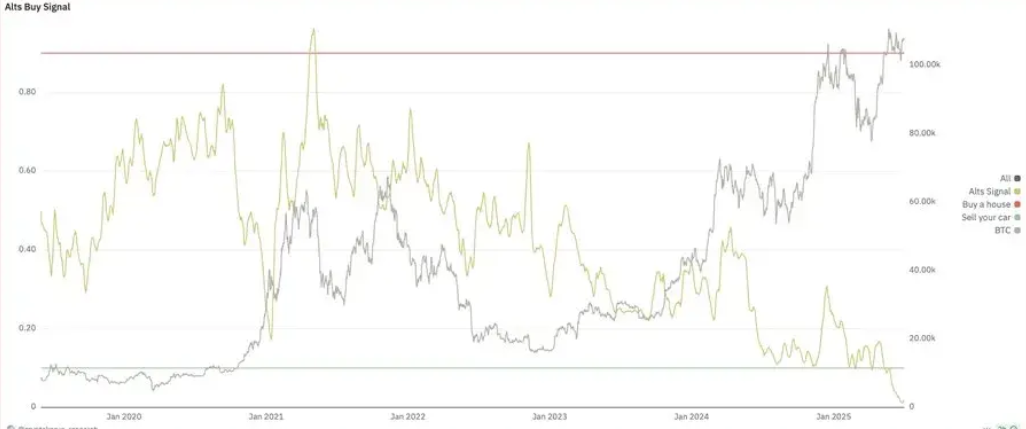

From a structural signal perspective, the chips of mainstream alt assets have completed a new round of sedimentation. The ETH/BTC ratio has seen a strong rebound for the first time after several weeks of decline, whale addresses have accumulated millions of ETH in a very short time, and large on-chain transactions are occurring frequently, indicating that major funds have begun to reprice primary assets like Ethereum. Meanwhile, retail sentiment remains low, with search indices and wallet creation volumes not showing significant rebounds, which instead creates an ideal "low-interference" environment for the next round of market movements: without overheated sentiment and without a surge in retail participation, the market is more easily dominated by institutional rhythms. Historically, it is often during these moments when the market seems to be "rising but not rising, stable but not stable" that the largest trend opportunities are born.

But unlike previous years, this time the altcoin market will not be a "one-size-fits-all" surge, but rather "each flying its own way." ETF applications have become the anchor point for the new round of thematic structures. In particular, the Solana spot ETF is seen as the next "market consensus event." From the launch of the Ethereum staking ETF to whether Solana's on-chain staking yields will be included in the ETF dividend structure, investors have begun to position themselves around staking assets, and the price performance of governance tokens like JTO and MNDE has started to show independent trends. It is foreseeable that in this new narrative cycle, asset performance will revolve around "whether there is ETF potential, whether there is real yield distribution capability, and whether it can attract institutional allocation," rather than a wave of market enthusiasm lifting all tokens. Instead, it will be a differentiated evolution where the strong remain strong and the weak are eliminated.

DeFi is also an important arena in this round of "selective bull market," but its logic has fundamentally changed. Users are shifting from "point airdrop DeFi" to "cash flow DeFi," with protocol revenue, stablecoin yield strategies, and re-staking mechanisms becoming core indicators for assessing asset value. Liquidity providers are no longer blindly chasing high APY bait but are placing greater emphasis on strategy transparency, yield sustainability, and potential risk structures. This shift has led to the emergence of projects like Renzo, Size Credit, and Yield Nest, which do not rely on aggressive marketing or hype but attract continuous capital inflow through structured yield products and fixed-rate vaults.

Capital choices are also quietly becoming more "realistic." On one hand, stablecoin strategies backed by real-world assets (RWA) are gaining favor among institutions, with protocols like Euler Prime attempting to create "sovereign bond-like products" on-chain. On the other hand, cross-chain liquidity integration and user experience unification have become key factors determining the direction of funds. Middle-layer projects like Enso, Wormhole, and T1 Protocol are emerging as new hubs for capital concentration, leveraging seamless bridging and embedded DeFi capabilities. It can be said that in this "selective bull market," it is no longer the L1 public chains themselves that dominate trends, but rather the infrastructure and composable protocols built around them that become the new valuation core.

At the same time, the speculative part of the market is also undergoing a shift. While meme coins still have popularity, the era of "everyone pulling up" is long gone. Instead, a rise of "platform rotation trading" strategies has emerged, where meme contracts listed on Binance often see funding rates quickly turn negative, with the core operational method being to raise prices for offloading, which carries high risks and lacks sustainability. This means that even though speculative hotspots still exist, mainstream capital's interest has clearly shifted. Capital is more inclined to allocate to projects that can provide sustainable yields, have real users, and strong narrative support, preferring to forgo explosive returns in exchange for more certain growth paths.

In summary, the core characteristic of this round of altcoin season lies not in "which public chain will soar," but in "which assets have the potential to be integrated into traditional financial logic." From the structural changes of ETFs, re-staking yield models, cross-chain UX simplification, to the integration of RWA and institutional credit infrastructure, the crypto market is ushering in a deep value reassessment cycle. A selective bull market is not a weakening of the bull market but an upgrade of it. The future will no longer belong to games of speculation but to those who can read the narrative logic in advance, understand financial structures, and are willing to quietly build positions in a "quiet market."

IV. Q3 Investment Framework: From Core Allocation to Event-Driven

The market layout for the third quarter of 2025 is no longer simply betting on "market sentiment warming" or "Bitcoin leading the way," but rather a comprehensive restructuring of asset allocation. In the macro trend of high interest rates nearing their end and continuous inflow of ETF funds, investors must find a balance between "core allocation stability" and "event-driven local explosions." From long-term Bitcoin allocation to thematic trading of Solana ETFs, and to rotation strategies of DeFi real yield protocols and RWA vaults, a layered and adaptive asset allocation framework has become a prerequisite for navigating the volatility of the third quarter.

First, Bitcoin remains the preferred core position. In an environment where ETF inflows have not seen a substantial reversal, corporate treasuries continue to increase their holdings, and the Federal Reserve is signaling a dovish policy, BTC demonstrates strong resilience and a capital siphoning effect. Standard Chartered's latest report has raised its year-end price ceiling to $200,000; although this is a high expectation, the logic behind it is compelling: corporate buying is becoming the largest variable in the market, and the "structural accumulation" characteristic of ETFs has altered the traditional price trajectory of the halving cycle. Even if Bitcoin does not temporarily reach new highs, its chip structure and capital attributes ensure that it remains the most stable foundational asset in the current cycle.

In the rotation logic of mainstream assets, Solana is undoubtedly the most thematic explosive target for Q3. Leading institutions like VanEck, 21Shares, and Bitwise have submitted applications for SOL spot ETFs, with the approval window expected to close around September. As the staking mechanism is likely to be included in the ETF structure, its "quasi-dividend asset" attribute is attracting significant capital pre-positioning. This narrative will not only drive the SOL spot itself but will also impact its staking ecosystem's governance tokens, such as JTO and MNDE. At the current price level of around $150, SOL has strong cost-effectiveness and Beta elasticity. For capital that missed the BTC rally at the beginning of the year, the Solana sector will undoubtedly become a strategic option for "catching up" or even "leading the charge."

At the sector level, the DeFi portfolio still deserves continued reconstruction. Unlike the past phase of "competing for APY," the current focus should be on protocols with stable cash flow, real yield distribution capabilities, and mature governance mechanisms. Configurable projects can refer to SYRUP, LQTY, EUL, FLUID, etc., adopting an equal-weight allocation approach to capture relative returns from individual projects and rotate profits. It is worth emphasizing that these types of protocols often exhibit characteristics of "slow capital return and delayed explosions," so they should be treated with a mid-term allocation mindset to avoid chasing highs and cutting losses. Especially under the premise that Bitcoin's dominance remains high and mainstream sentiment has not fully shifted towards altcoins, DeFi assets are more suitable as structural enhancements rather than tactical speculation.

In terms of speculative position allocation, exposure to meme assets should be strictly controlled. It is recommended to limit it to within 5% of total net asset value and manage positions with an options mindset. Given that meme contracts are currently manipulated by high-frequency capital, they carry high risks but also have small probabilities of high return potential, it is advisable to set clear stop-loss mechanisms, profit-taking rules, and position limits. Particularly for contract targets launched on mainstream exchanges like Binance (e.g., $BANANAS31, $TUT, $SIREN), their short-term surges are often accompanied by high negative funding rates and sharp pullbacks, so a "quick in and out" strategy framework should be established. For investors accustomed to event-driven trading, these assets can serve as emotional replenishment tools, but they must not be misjudged as core trends.

In addition to allocation thinking, another key aspect of Q3 is the timing of event-driven layouts. The current market is transitioning from an "information vacuum" to a "dense release of events." Trump's reaffirmation of his support for the cryptocurrency mining industry and criticism of Fed Chair Powell has accelerated expectations for policy games. The passage of the "Great American Law," Robinhood's entry into Arbitrum Orbit, Circle's application for a U.S. license, and a series of signals indicate that the U.S. regulatory environment is changing rapidly. With the review of the Solana ETF approaching, the market is expected to experience a "policy + capital resonance" rally from mid-August to early September. Layouts for such events should not be entered after "good news is realized," but should be anticipated in advance and gradually built up to avoid chasing high traps.

Additionally, attention should be paid to the volume momentum of structural alternative themes. For example, Robinhood's construction of L2 and promotion of tokenized stock trading may ignite a new narrative of "exchange chains" and RWA integration; projects like $H (Humanity Protocol) and $SAHARA (AI + DePIN integration), supported by verifiable roadmaps and active communities, may become "explosive points" in the marginal sector. For investors capable of deeply analyzing roadmaps, early opportunities in such projects can also be part of a high-volatility strategy, but position control and risk management must be adhered to.

Overall, the investment strategy for Q3 2025 must abandon the "flooding" betting mentality and shift towards a hybrid strategy of "anchoring on the core and flying with events." Bitcoin is the anchor, SOL is the banner, DeFi is the structure, meme is the supplement, and events are the accelerators—each part must correspond to different position weights and trading rhythms. In the new environment where ETF capital bases are continuously expanding, the market is quietly reshaping a new valuation system of "mainstream assets + thematic narratives + real yields," and investors' success will no longer rely on luck but on their ability to understand the capital logic behind this round of changes.

V. Conclusion: The next round of wealth migration is already on the way

Every round of bull and bear cycles is essentially a periodic reshuffling of value reassessment, and true wealth migration often does not occur at the most bustling moments in the market but is quietly completed amidst chaos. At this critical turning point of the current market, although the surface has not yet returned to the stage of "universal frenzy," a selective bull market led by institutions, driven by compliance, and supported by real yields is brewing. In other words, the story has already written its prologue, just waiting for a few who understand it to enter.

Bitcoin's role has fundamentally changed. It is no longer just a symbol of speculation for young people but is gradually becoming a new reserve component in the balance sheets of global enterprises, serving as a national-level inflation hedge. Over the past year, from Tesla and MicroStrategy to Bitmine and Square, more and more companies have included it in their core holdings; at the same time, the inflow of U.S. ETFs has changed the previous "miners-exchanges-retail investors" chip structure, building a foundational capital reservoir. The forces that will most influence Bitcoin's price in the future are not hot posts on X platform but the buying records of institutions in the next quarter's financial reports, the allocation decisions of pension funds and sovereign wealth funds, and the repricing of risk asset valuation systems based on macro policy expectations.

At the same time, the infrastructures and assets representing the next generation of financial paradigms are also slowly but steadily completing their evolution from "narrative bubbles" to "system takeover." Solana, EigenLayer, L2 Rollup, RWA vaults, re-staking bonds… they represent a trend: crypto assets are transitioning from "anarchic capital experiments" to "predictable institutional assets," and these structural opportunities will lead the direction of the next wave of capital tides. Don't get it wrong; this is not a continuation of a get-rich-quick game but a pricing revolution that crosses asset boundaries. What belonged to the PC internet and U.S. stocks in the past will belong to on-chain collaboration and digital property in the future.

The altcoin season has not returned; it has changed. The kind of "comprehensive surge" driven by meme resonance and chain games in 2021 will not be replayed. The next round of market movements will be more deeply tied to the three anchors of real yields, user growth, and institutional access. Protocols that can provide stable yield expectations for institutions, assets that can attract stable capital through ETF channels, and DeFi projects that truly possess RWA mapping capabilities and can connect with real-world volumes will become the "blue-chip stocks" in the new cycle. This is an elite version of "altcoins," a selective bull market that eliminates 99% of pseudo-assets.

For ordinary investors, the challenges and opportunities coexist. The market's surface still appears stagnant—low heat, scattered sectors, weak sentiment, and poor momentum—but this is precisely the golden period for large funds to quietly build positions. When the market begins to ask, "Where is the next breakout point?" what you need to ask is, "Am I standing on the right structure?" It is the reconstruction of position structures, not the randomness of speculative games, that will determine whether you can reap profits from the main upward wave.

Whether it is the institutional takeover of Bitcoin, the ETF narrative of Solana, the reconstruction of the cash flow valuation system in DeFi, or the globalization wave of stablecoins and the establishment of a new order in L2, the third quarter of 2025 will be the prelude to this wealth migration. You may not have sensed it yet, but it is already happening; you may still be waiting, but opportunities never wait for anyone.

The next bull market will not ring a bell for anyone; it will only reward those who think ahead of the market. Now is the time to seriously plan your position structure, information sources, and trading rhythm. Wealth will not be distributed at the peak but will quietly shift before dawn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。