Author: Arthur Hayes, Founder of BitMEX

Translation: Saoirse, Foresight News

Equity investors are like Yellen (Janet Yellen, former Chair of the U.S. Federal Reserve and U.S. Treasury Secretary), chanting: "Stablecoins, stablecoins, stablecoins; Circle, Circle, Circle."

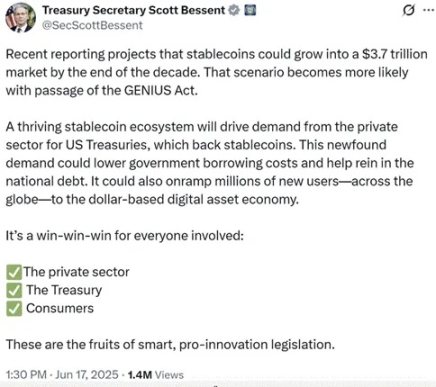

Why are they so bullish? Because The Big Bessent Cock "BBC" (referring to U.S. Treasury Secretary Scott Bessent, with a hint of mockery, hereinafter referred to as BBC) said:

Recent reports predict that the stablecoin market could reach $3.7 trillion by the end of this century. With the passage of the GENIUS Act, this outlook will be even brighter. A thriving stablecoin ecosystem will drive private sector demand for U.S. Treasury bonds, which back stablecoins. This new demand could lower government borrowing costs and help control national debt. It could also attract millions of new users globally into the dollar-based digital asset economy. This is a win-win-win situation for all participants:

1. Private Sector

2. Treasury

3. Consumers

These are the results of wise, innovation-supporting legislation.

But the result is this:

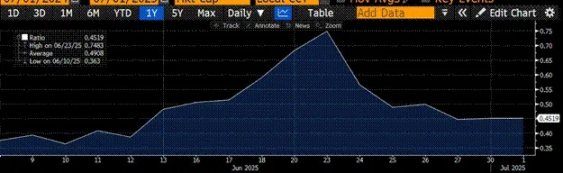

This is a comparison of the market capitalization of Circle and Coinbase. It should be noted that Circle has to give 50% of its net interest income to its "sugar daddy" Coinbase. So how can Circle's market cap reach nearly 45% of Coinbase's? It's truly puzzling…

And then there's this frustrating chart (because I hold Bitcoin, not CRCL):

This chart reflects "Circle Price / Bitcoin Price * 100%." Since its IPO, Circle has outperformed Bitcoin by nearly 472%.

Cryptocurrency enthusiasts should ask themselves: Why is BBC so optimistic about stablecoins? Why does the Genius Act have bipartisan support? Do American politicians really care about financial freedom, or is there something else at play? Perhaps politicians theoretically care about financial freedom, but lofty ideals are not enough to drive action. The 180-degree shift in stablecoin policy must have more pragmatic political reasons. Looking back to 2019, Facebook's attempt to integrate a stablecoin called Libra into its social media empire was thwarted by opposition from politicians and the Federal Reserve. To understand why BBC is so obsessed with stablecoins, we need to examine the main issues that BBC must address.

The main problem facing U.S. Treasury Secretary Scott Bessent (BBC) is similar to that faced by his predecessor Janet Yellen ("Bad Gurl"). Their bosses (the U.S. President and politicians in Congress) like to spend money but do not want to raise taxes, so the Treasury Secretary must find ways to finance the government through borrowing at reasonable costs. It quickly became clear that the market is unwilling to buy long-term government bonds from over-leveraged developed economies at high prices (i.e., low yields). This has been the "doomsday scenario" tug-of-war that BBC and "Bad Gurl" have been watching for the past few years… It's quite a headache:

Above are the 30-year bond yields of these countries: the UK (white), Japan (gold), the U.S. (green), Germany (magenta), and France (red).

If the situation of rising yields isn't bad enough, the actual value of these bonds has plummeted dramatically.

Actual Value = Bond Price ÷ Gold Price

TLT US is an ETF tracking U.S. Treasury bonds with a remaining maturity of over 20 years. The "Fund Price / Gold Price * 100%" shows that the actual value of long-term Treasuries has collapsed by 71% over the past five years.

If past performance isn't bad enough, Yellen and now Bessent face additional constraints. The U.S. Treasury's bond issuance team must devise a plan to achieve the following goals:

1. Fund approximately $2 trillion in federal annual deficits and $3.1 trillion in maturing debt by 2025.

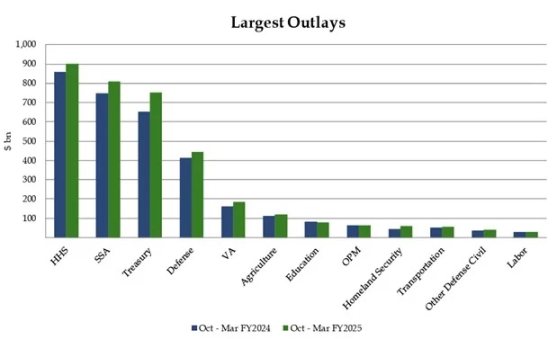

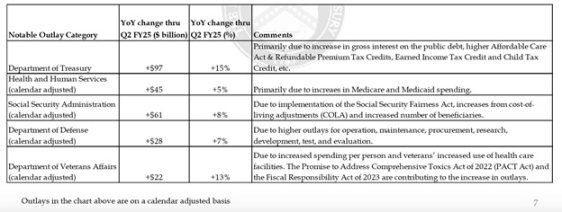

This is a chart detailing the largest expenditures of the U.S. federal government and their year-on-year changes. Note that the growth rate of each major expenditure reaches or exceeds the nominal GDP growth rate of the U.S.

The first two charts show that the weighted average interest rate on outstanding debt is lower than all points on the Treasury yield curve.

- The financial system issues credit collateralized by nominally risk-free Treasury bonds. Therefore, interest must be paid; otherwise, the government would nominally default, which would destroy the entire fiat financial system. Since the entire Treasury yield curve is above the current weighted average interest rate of the debt, maturing debt will be refinanced at higher rates, and interest expenses will continue to rise.

- Given that the U.S. is involved in wars in Ukraine and the Middle East, the defense budget will not decrease.

- By the early 2030s, as the baby boomer generation enters the golden age of receiving medical services from large pharmaceutical companies (with costs covered by the U.S. government), healthcare spending will increase.

2. Sell bonds in a way that keeps the 10-year benchmark Treasury yield below 5%.

- When the 10-year Treasury yield approaches 5%, bond market volatility, as measured by the MOVE index, will spike, leading to a financial crisis.

3. Sell bonds in a way that stimulates the overall financial market.

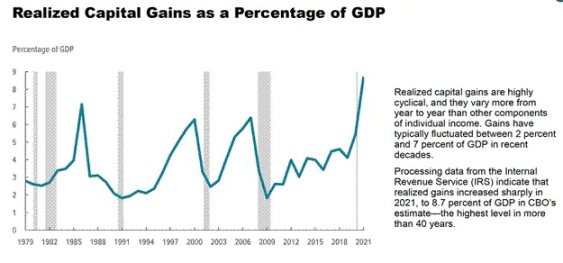

This chart from the U.S. Congressional Budget Office is only updated to 2021, but it clearly shows that after the 2008 global financial crisis, as the U.S. stock market continued to rise, capital gains tax revenues also surged.

- The U.S. government needs to generate tax revenue by taxing the year-on-year increase in the stock market to avoid an incredible fiscal deficit.

- The existence of the U.S. government is to serve the wealthy bourgeoisie. In the past, during the days when "women stayed in the kitchen, blacks worked in the fields, and Indians lived in remote areas," only bourgeois white males were allowed to vote. In modern America, although suffrage has become widespread, power still derives from controlling the wealth of publicly traded companies, leading government policies to continually increase and consolidate the power of that roughly 10% of the population, who control over 90% of the stock market wealth. A prominent example of the government's favoritism towards the bourgeoisie is that during the 2008 global financial crisis, the Federal Reserve printed money to save banks and the entire financial system, yet banks were still allowed to foreclose on people's homes and businesses. This is "socialism for the rich, capitalism for the poor"! With such historical precedents, it's no wonder that New York City mayoral candidate Mamdani is so popular; the poor also want a piece of the "socialist" pie.

When the Federal Reserve implements quantitative easing, the Treasury Secretary's job is relatively easy. The Federal Reserve prints money to buy bonds, allowing the U.S. government to borrow large amounts of low-cost debt and push up the stock market. But now, at least on the surface, the Federal Reserve must show a stance against inflation. This authority cannot lower interest rates or implement quantitative easing, so the Treasury must shoulder the burden alone.

By September 2022, as the market believed that the largest peacetime federal deficit in U.S. history would persist for a long time and the Federal Reserve maintained a hawkish stance, the market began to offload bonds. Within two months, the 10-year Treasury yield nearly doubled, and the stock market fell nearly 20% from its summer peak. It was at this time that "Bad Gurl" Yellen began to take action. In a paper from Hudson Bay Capital, this approach was referred to as "Active Treasury Issuance Strategy (ATI)," where Yellen began to increase the issuance of short-term Treasury bills, exceeding the issuance of coupon bonds [1]. In the following two years, due to the decline in the Federal Reserve's reverse repurchase agreement (RRP) balance, $2.5 trillion was injected into the financial market. If the goal is to achieve the three conditions I listed above, then Yellen's active Treasury issuance strategy can be considered a great success. But times have changed; what should the current BBC do? How will he achieve the same goals in the current environment? With the RRP program nearly depleted, where can he find trillions of dollars in "idle funds" (which are lying on balance sheets) willing to buy Treasury bonds at high prices (i.e., low yields)?

The situation in the third quarter of 2022 was dire. In the chart below, the Nasdaq 100 index (green) and the 10-year Treasury yield (white) show that as yields soared, the stock market plummeted.

The Active Treasury Issuance Strategy (ATI) effectively consumed the balance of the Reverse Repurchase Agreement (RRP, red) while pushing up the prices of financial assets such as the Nasdaq 100 index (green) and Bitcoin (magenta). The 10-year Treasury yield (white) has consistently remained below 5%.

There are two types of funds held by the "Too Big to Fail" (TBTF) large banks, which are willing to use them to purchase trillions of dollars in Treasury bonds as long as there is a considerable profit margin. These two types of funds are demand/time deposits and reserves held at the Federal Reserve [2]. I focus on these eight TBTF banks because their survival and profitability depend on the government's guarantee of their debts, and the regulatory framework is more favorable to them than to other non-banks. Therefore, as long as they can make a small profit, they will act according to the government's requirements. Once BBC asks them to purchase those poorly yielding Treasury bonds, in return, he will provide these banks with risk-free returns.

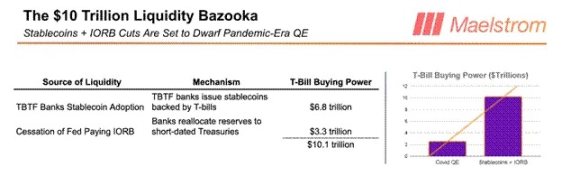

I believe that BBC's enthusiasm for "stablecoins" is due to the fact that TBTF banks can release up to $6.8 trillion in short-term Treasury bill purchasing power through the issuance of stablecoins. These previously idle deposits can then be re-leveraged in the false fiat financial system, thereby pushing up the market. In the next section, I will elaborate on my model: how the issuance of stablecoins facilitates the purchase of short-term Treasury bills and enhances the profitability of TBTF banks.

After discussing the mechanism of stablecoins flowing into short-term Treasury bills, I will briefly explain that if the Federal Reserve stops paying interest on reserves, it will release up to $3.3 trillion in funds for purchasing Treasury bonds. This is another typical example; technically, such a policy is not quantitative easing (QE), but it will have an equally positive impact on fixed-supply monetary assets like Bitcoin.

Next, let's understand BBC's "new favorite," the stablecoin, which is regarded as a "monetary heavyweight."

Flow of Stablecoins

My predictions are based on several key assumptions:

1. Treasury bonds are fully or partially exempt from the Supplementary Leverage Ratio (SLR) regulation

- The so-called exemption means that banks do not need to hold equity capital for their Treasury bond portfolios. A full exemption means that banks can leverage their purchases of Treasury bonds infinitely.

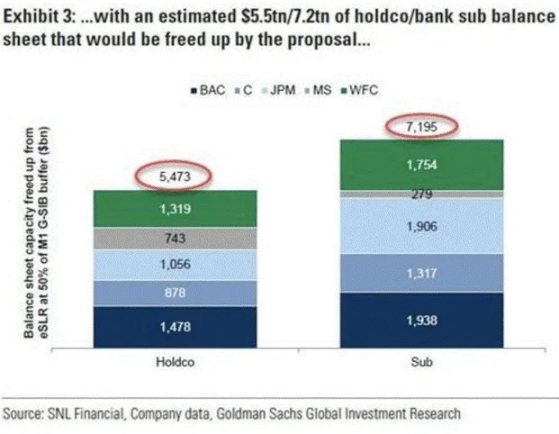

- The Federal Reserve has just voted to lower the capital that banks must hold for Treasury bond holdings; the initial effects of this will become apparent in the next 3 to 6 months. According to the above chart, this plan will release $5.5 trillion in balance sheet capacity for banks to purchase Treasury bonds. Since the market is forward-looking, this purchasing power will be reflected in the Treasury market in advance, pushing yields down under unchanged conditions.

2. Banks are profit-driven institutions that seek to minimize losses

- From 2020 to 2022, the Federal Reserve and the Treasury Department urged banks to significantly increase their holdings of Treasury bonds; banks purchased massive amounts of such bonds due to the higher yields of long-term coupon bonds. By April 2023, due to the fastest increase in policy rates by the Federal Reserve since the early 1980s, the losses from these bonds led to the failure of three banks within a week [3]. Among the TBTF banks, Bank of America had a portfolio of maturing bonds that lost more than its total equity capital; if forced to mark to market, the bank would have been insolvent. To quell the crisis, the Federal Reserve and the Treasury effectively nationalized the entire U.S. banking system through the "Bank Term Funding Program (BTFP)." However, other banks may still incur losses, and if Treasury bond losses lead to insolvency, management will be dismissed, and the bank will be sold at a low price to Jamie Dimon (Chairman and CEO of JPMorgan Chase) or other TBTF banks [4]. Therefore, the chief investment officers of banks are cautious about increasing their long-term Treasury bond holdings, fearing that the Federal Reserve will again "pull the rug out" by raising interest rates.

- Banks will purchase short-term Treasury bills because these bonds are essentially high-yield, cash-like instruments that are almost unaffected by interest rate fluctuations.

- Banks will only purchase short-term Treasury bills with deposits if they can achieve a higher net interest margin (NIM) and do not need to hold or only need to hold minimal capital.

JPMorgan recently announced plans to launch a stablecoin called JPMD. This stablecoin will operate on the Base network, which is operated by Coinbase and built on Ethereum's layer two. As a result, JPMorgan will have two types of deposits. The first type is what I call "regular deposits": these deposits, although in digital form, must interact through the outdated interbank system when circulating within the financial system and rely on extensive manual monitoring; the circulation time for regular deposits is from Monday to Friday, 9:00 AM to 4:30 PM; their yields are negligible. According to the Federal Deposit Insurance Corporation (FDIC), the average yield on regular demand deposits is 0.07%, and one-year time deposits yield 1.62%.

The second type of deposit is the stablecoin (i.e., JPMD). JPMD operates on the Base chain, and customers can use it year-round, 24/7. According to legal regulations, JPMD cannot pay interest, but I speculate that JPMorgan will attract customers to convert regular deposits into JPMD by offering generous cashback benefits. It is currently unclear whether staking rewards (i.e., customers locking JPMD with JPMorgan to earn rewards during the lock-up period) will be allowed.

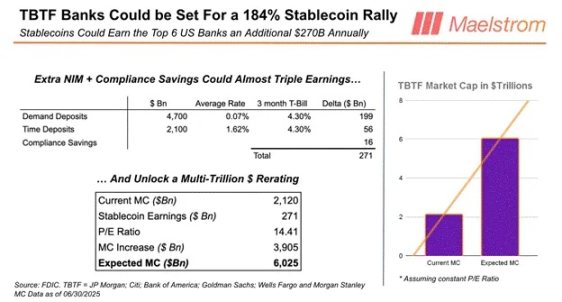

Customers will transfer funds from regular deposits to JPMD because JPMD is more practical, and the bank offers cashback benefits. It is estimated that the total amount of demand and time deposits held by TBTF banks is about $6.8 trillion [5]. Since stablecoins are a superior product, regular deposits will quickly convert into JPMD or similar stablecoins issued by other TBTF banks.

Why is JPMorgan going to the trouble of encouraging customers to switch from regular deposits to JPMD? The first reason is to reduce costs. If all regular deposits are converted to JPMD, JPMorgan can effectively eliminate compliance and operational departments. Allow me to explain why Jamie Dimon would be so excited after understanding how stablecoins actually work.

Broadly speaking, compliance work refers to rules set by regulatory agencies, executed by a group of people using technology from the early 1990s. The rule structure typically follows a "if X happens, then execute Y" format. These "if-then" relationships can be interpreted by senior compliance personnel and encoded into rules that artificial intelligence agents can perfectly follow. Since all public addresses of JPMD are publicly accessible and completely transparent, AI agents trained on relevant compliance regulations can ensure that specific transactions are never approved and can instantly generate any reports required by regulatory agencies. Regulatory agencies can verify the accuracy of the data because all data exists on the public blockchain. Overall, TBTF banks spend $20 billion annually on compliance and the operations and technology required to meet banking regulatory requirements [6]. Once all regular deposits are converted to stablecoins, this cost will be nearly reduced to zero.

The second reason JPMorgan promotes JPMD is that it allows the bank to use the assets under custody (AUC) of stablecoins to purchase billions of dollars in short-term Treasury bills without risk. This is because short-term Treasury bills have almost no interest rate risk, and their actual yields are close to the federal funds rate. Don't forget that under the new Supplementary Leverage Ratio (SLR) rules, TBTF banks have a $5.5 trillion capacity to purchase Treasury bonds. Banks need to find a pool of idle funds to buy these bonds, and the deposits held in their stablecoins are the perfect choice.

Some readers may argue that JPMorgan could already use regular deposits to purchase short-term Treasury bills. My response is that stablecoins are the future. They provide a better customer experience and save TBTF banks $20 billion in costs. This cost saving alone is enough to encourage banks to embrace stablecoins, and the additional net interest margin (NIM) is just icing on the cake.

I know many readers want to invest their hard-earned money in Circle (stock code CRCL) or other emerging stablecoin issuers. But do not overlook the profit potential of TBTF banks in the stablecoin space. If we multiply the average price-to-earnings ratio of TBTF banks, which is 14.41, by the cost savings and the potential net interest margin (NIM) of stablecoins, the result will reach $3.91 trillion. Currently, the total market capitalization of the eight TBTF banks is about $2.1 trillion, which means that stablecoins could drive the average stock price of these banks up by 184%. If there is any non-consensus trade that could allow investors to operate on a large scale, it is to go long on an equal-weighted portfolio of TBTF banks based on this stablecoin logic.

What about competition?

No need to worry; the Genius Act has ensured that stablecoins issued by non-banks cannot form large-scale competition. The act explicitly prohibits tech companies like Meta from issuing stablecoins independently, stating that they must collaborate with banks or fintech companies. Of course, theoretically, anyone can apply for a banking license or acquire an existing bank, but all new owners must obtain regulatory approval. Just consider how long this process takes. Another provision that favors banks in capturing the stablecoin market is the prohibition on paying interest to stablecoin holders. Therefore, fintech companies will find it difficult to attract deposits from banks at low costs. Even successful issuers like Circle will never be able to touch the $6.8 trillion pie of regular deposits held by TBTF banks. Moreover, liabilities of fintech companies like Circle and small banks do not enjoy government guarantees, while TBTF banks do. If my mother were to use a stablecoin, she would definitely choose one issued by a TBTF bank. Baby boomers like her would never use stablecoins from fintech companies or small banks because these institutions lack government guarantees and are hard to trust.

David Sachs, the "cryptocurrency czar" during former President Trump's administration, shares the same view. Many donors in the crypto industry may be quite frustrated. After contributing so much to campaign donations, they find themselves quietly blocked from the lucrative U.S. stablecoin market. Perhaps they should change their strategy and truly advocate for financial freedom, rather than just seeking a small seat at the table of TBTF bank CEOs' "night pots."

In short, the adoption of stablecoins by TBTF banks can eliminate competition from fintech companies for their deposit base, reduce the need for costly and often inefficient compliance personnel, and ultimately increase their stock prices without having to pay interest (thereby boosting net interest margin, NIM). In return for the "gift" of stablecoins from BBC, TBTF banks will purchase up to $6.8 trillion in short-term Treasury bills.

ATI (Active Treasury Issuance Strategy): "Bad Gurl" Yellen; Stablecoins: BBC

Next, I will discuss how BBC can release an additional $3.3 trillion in idle reserves from the Federal Reserve's balance sheet.

Interest on Reserve Balances (IORB)

After the global financial crisis in 2008, the Federal Reserve decided that banks should never fail due to insufficient reserves. The Federal Reserve created idle reserves on its balance sheet by purchasing Treasury bonds and mortgage-backed securities from banks—this operation is known as quantitative easing. Theoretically, banks could convert reserves held at the Federal Reserve into circulating currency for lending, but they refuse to do so because the Federal Reserve prints money to pay them substantial interest. The Federal Reserve conducts offsetting operations on these reserves to prevent inflation from rising further.

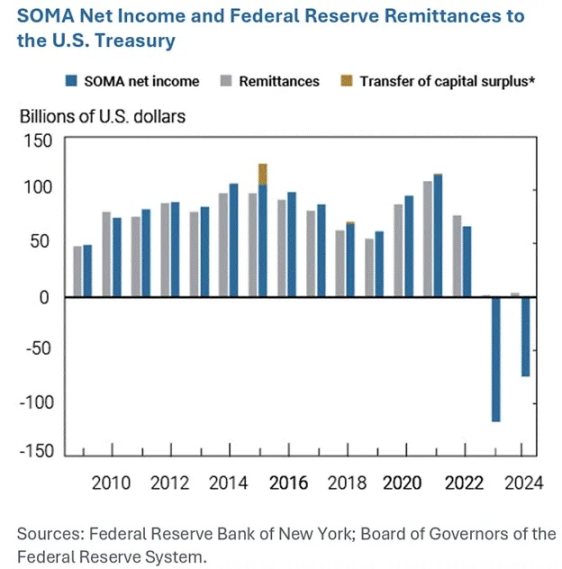

However, the problem for the Federal Reserve is that the interest on reserve balances increases with rising interest rates. This is not a good thing, as the unrealized losses on the Federal Reserve's bond portfolio also expand with rising rates. The result is that the Federal Reserve is now in a state of insolvency, with negative cash flow. However, this negative cash flow situation is purely a result of policy choices and can be changed.

U.S. Senator Ted Cruz recently suggested that perhaps the Federal Reserve should stop paying interest on reserve balances (IORB). This would force banks to convert reserves into Treasury bonds to make up for the loss of interest income. Specifically, I believe banks would choose to purchase short-term Treasury bills due to their high yield and cash-like characteristics.

Senator Ted Cruz has been pressuring his colleagues to end interest payments on reserves to banks, believing this change will play an important role in reducing the deficit.

— Source: Reuters

Why does the Federal Reserve print money to prevent banks from supporting this "empire"? Politicians have no reason to oppose this policy adjustment. Both Democrats and Republicans are keen on fiscal deficits, so why not release $3.3 trillion of purchasing power from banks into the Treasury market, allowing themselves to spend more? Given the Federal Reserve's reluctance to assist the Trump team in financing the "America First" agenda, I believe Republican lawmakers will use their majorities in both the House and Senate to strip the Federal Reserve of its power to pay interest on reserves. Therefore, the next time yields soar, lawmakers will be ready to unleash this massive amount of funds to fund their extravagant spending.

Before concluding this article, I want to discuss the optimistic outlook for increased dollar liquidity during BBC's term. However, before that, I need to mention Maelstrom's cautious positioning strategy from now until the third quarter.

Cautionary Note

Although I hold a strongly bullish view, I believe that dollar liquidity may experience a brief pause after the passage of Trump's "Big and Beautiful Act."

The current content of this act includes raising the debt ceiling. Although politicians will haggle over many terms, Trump will not sign any bill that does not raise the debt ceiling. He needs more borrowing capacity to finance his agenda. There is no indication that Republicans will attempt to force the government to cut spending. The question for traders is: what impact will the Treasury's return to net borrowing have on dollar liquidity?

Since January 1 of this year, the Treasury has primarily financed the government by reducing the balance of its checking account (i.e., the Treasury General Account, TGA). As of June 25, the TGA balance was $364 billion. According to the Treasury's latest quarterly refinancing announcement, if the debt ceiling is raised now, the TGA balance will be replenished to $850 billion through bond issuance, which will result in a contraction of dollar liquidity by $486 billion. The only major dollar liquidity project that could alleviate this negative impact is the outflow of funds from the current $461 billion Reverse Repurchase Agreement (RRP) balance.

One should not conclude that this is an opportunity to short Bitcoin solely based on TGA replenishment; caution is advised. The bull market may experience a brief interruption. I believe that from now until August, before Jerome Powell (current Chair of the Federal Reserve) speaks at the Jackson Hole Fed annual meeting, the market will consolidate sideways or decline slightly. If TGA replenishment indeed leads to a tightening of dollar liquidity, Bitcoin may drop to $90,000 to $95,000; if the replenishment process is uneventful, Bitcoin will oscillate in the $100,000 range, unable to break through the historical high of $112,000. I have a hunch that Powell will announce the end of quantitative tightening and/or other seemingly mundane yet significant banking regulatory adjustments. By early September, the debt ceiling will have been raised, the TGA will be nearly replenished, and Republicans will focus on "delivering benefits" to avoid repeating the "Mamdani-style" mistakes in the November 2026 midterm elections. At that point, the surge in money creation will push the green candlestick K-line through the bearish defense line.

From now until the end of August, Maelstrom will heavily invest in staked USDe (Ethena USD). We have cleared all positions in liquidity junk coins and may further reduce Bitcoin risk exposure based on price trends. Altcoins purchased around April 9 have achieved returns of 2 to 4 times within three months. Without clear liquidity catalysts, the altcoin sector will suffer significant setbacks. After that, we can confidently "pick up the pieces," perhaps achieving returns of 5 to 10 times before fiat liquidity stagnates again at the end of Q4 2025 or early Q1 2026.

Key Takeaways

The adoption of stablecoins by TBTF banks will create up to $6.8 trillion in short-term Treasury bill purchasing power; the Federal Reserve's cessation of interest payments on reserve balances will create up to $3.3 trillion in short-term Treasury bill purchasing power.

Thanks to BBC's policies, $10.1 trillion will eventually flow into the short-term Treasury bill market. If my predictions are correct, this liquidity injection will have an impact on risk assets similar to the $2.5 trillion effect of Bad Gurl Yellen, driving the market into a frenzy!

This is another liquidity "arrow" in BBC's policy toolbox that can be deployed at any time. Once Trump's "Big and Beautiful Act" is passed and the debt ceiling is raised, it will be needed. Because soon, investors will start to worry: how will the Treasury market digest the massive debt about to be issued without collapsing?

Some of you are still waiting for "money Godot" (Godot comes from the absurdist play "Waiting for Godot" by Irish writer Samuel Beckett. In the play, the two protagonists are always waiting for a person named Godot, who never appears, symbolizing the futile wait for something elusive and unattainable), waiting for Federal Reserve Chair Powell to announce a new round of unlimited quantitative easing and interest rate cuts before you dare to sell bonds and buy cryptocurrencies. But that won't happen, at least not until the U.S. confirms a hot war with Russia, China, and Iran, or until a systemically important large financial institution is on the brink of collapse. Even a recession won't bring this Godot. So, stop listening to that fool sitting in the "soft seat" rambling, and listen to what the one holding the "big stick" has to say. (The former refers to Powell, the latter to BBC)

Don't make the same mistake again. Many financial advisors are still urging clients to buy bonds, claiming that yields are expected to decline. I believe global central banks will cut rates and print money to prevent the government bond market from collapsing. Moreover, even if central banks do nothing, the Treasury will step in. This is precisely the point I make in this article: I believe that by supporting stablecoin regulation, exempting the Supplementary Leverage Ratio (SLR), and stopping interest payments on reserves (IORB), BBC can release up to $10.1 trillion in Treasury purchasing power.

But seriously, what does it mean to hold bonds for a 5% or 10% return? You would miss the opportunity for Bitcoin to rise 10 times to $1 million or for the Nasdaq 100 index to soar 5 times to 100,000 points (by 2028).

The real play with stablecoins is not to bet on aging fintech companies like Circle, but to understand that the U.S. government has just handed the launch key of a trillion-dollar "liquidity heavyweight" to TBTF banks, only this heavyweight is cloaked in the guise of "innovation." This is not decentralized finance (DeFi), nor is it financial freedom; it is the debt monetization costume worn by Ethereum.

If you are still waiting for Powell to whisper "unlimited quantitative easing" in your ear before daring to go long on risk assets, then congratulations, you are someone else's "exit liquidity."

So, go long on Bitcoin, go long on JPMorgan Chase, and forget about Circle. This Trojan horse of stablecoins has already breached the fortress; when it opens the city gates, what it carries is not the dreams of libertarians, but liquidity for purchasing short-term Treasury bills, aimed at maintaining the stock market bubble, financing deficits, and keeping the baby boomer generation complacent. Stop waiting on the sidelines for Powell to "bless" the bull market. BBC is already warmed up; it's time for him to water the world with "liquidity juice."

Recommended Reading:

The Battle of Stablecoins: Circle's Rise and the New Forces Entering Traditional Finance

Under the Impact of the GENIUS Act, Can Tether Maintain Its Leading Position?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。