ETF Shift: Bitcoin Funds See First Outflow in Over Two Weeks

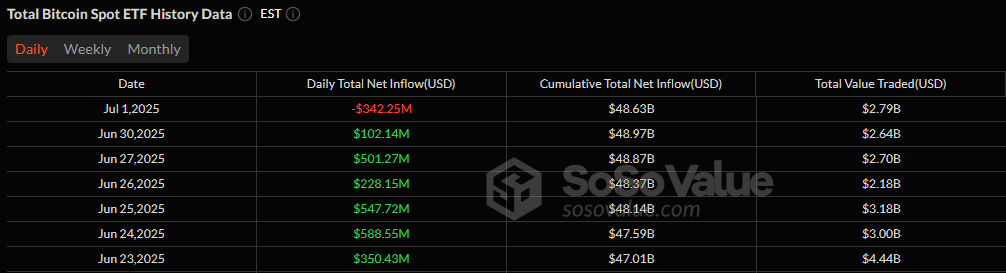

After more than two weeks of steady inflows, bitcoin exchange-traded funds (ETFs) finally hit the brakes. Investors pulled $342.25 million from U.S. spot bitcoin funds on Tuesday, ending a 15-day streak that had brought billions into the asset class.

The outflows were led by Fidelity’s FBTC, which recorded a $172.73 million exit. Grayscale’s GBTC followed with a $119.51 million withdrawal. Ark 21Shares’ ARKB and Bitwise’s BITB also contributed to the red day with outflows of $27.03 million and $22.98 million, respectively. Trading activity remained solid with $2.79 billion in value exchanged, and net assets dipped to $131.30 billion.

Source: Sosovalue

Meanwhile, ether ETFs showed no signs of slowing, marking their third straight day of inflows. Blackrock’s ETHA drove the momentum with a $54.84 million injection, while Grayscale’s ETHE added $9.96 million.

A $24.11 million outflow from Fidelity’s FETH partially offset the gains, but the day still closed in the green with $40.68 million in net inflows. Total value traded reached $385.37 million, and net assets stayed at $9.95 billion.

While bitcoin ETFs took a breather, ether products quietly continued their recovery, signaling a potential rebalancing of institutional interest as July begins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。