Following Alex's perspective, we delve into the path of large-scale adoption of stablecoins in the cross-border payment scenario, as well as the immense potential of stablecoins as the future "Internet currency layer."

Written by: Deep Tide TechFlow

From the U.S. "GENIUS Act" to Hong Kong's "Stablecoin Regulation," stablecoins are ushering in an unprecedented window of opportunity under a new compliance cycle.

With Circle's tremendous success, stablecoins have become the Canaan land flowing with milk and honey in the Bible, not only capturing the attention of Web3 investors but also attracting traditional Web2 giants like JD.com, Ant Group, and Walmart to enter the fray.

In this hotly contested arena, how can one quickly and accurately find their position?

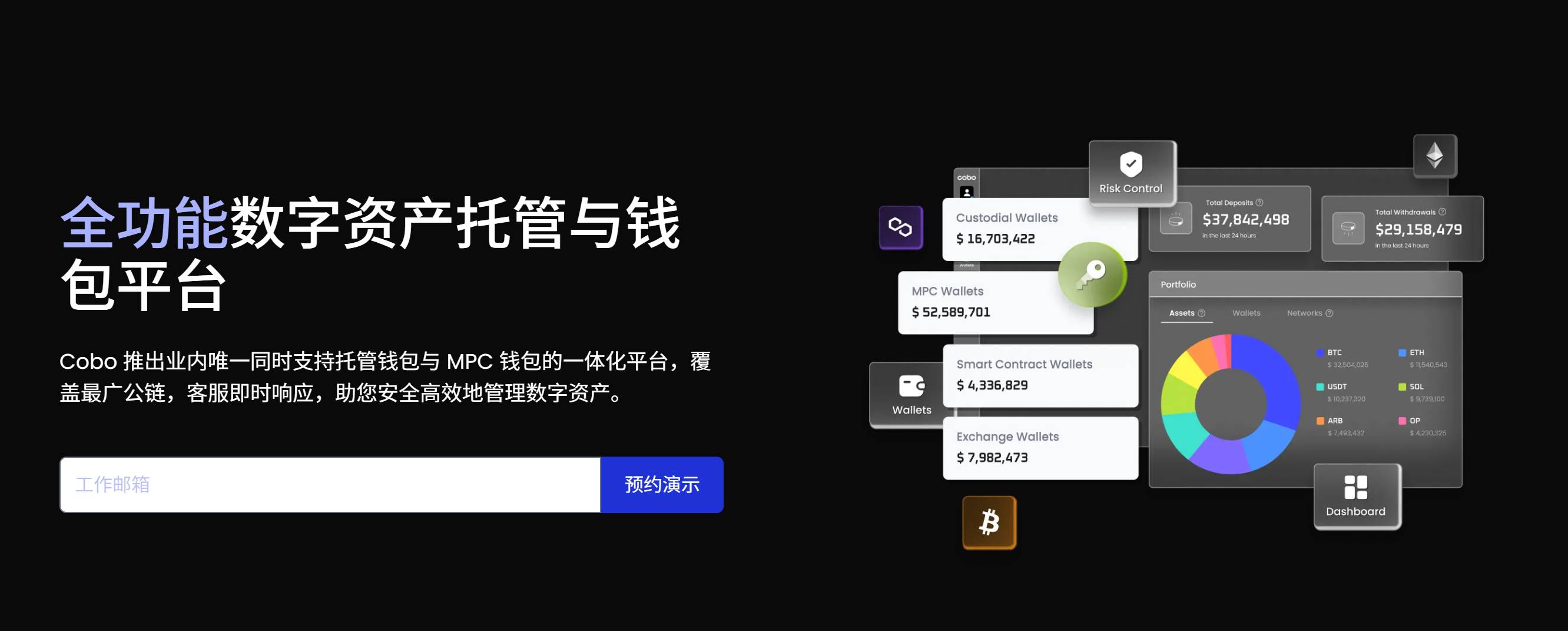

We note that as a full-featured digital asset custody and wallet platform, Cobo launched its stablecoin solution as early as last year. The forward-thinking insights cultivated over years in the industry have equipped Cobo with valuable experience in addressing this issue.

In a conversation with Cobo's Senior Vice President and Head of Payment Business, Alex Zuo, the challenges of stablecoins were succinctly dissected:

The stablecoin-related business heavily relies on interdisciplinary collaboration, requiring solid knowledge reserves in Finance, Technology, and Crypto. However, it is currently challenging to find a team that excels in all three areas.

Discussing Cobo's role in the financial infrastructure transformation led by stablecoins, Alex elaborated:

Cobo has always focused on building underlying infrastructure. For stablecoin clients, Cobo can provide comprehensive technical support and possesses strong compliance advantages. Additionally, we have rich experience in serving publicly listed companies. At the same time, Cobo has robust distribution capabilities, enabling stablecoin issuers to quickly establish circulation scenarios for stablecoins.

Regarding the opportunities for entrepreneurs in the wave of stablecoins, Alex stated:

As stablecoins move towards large-scale adoption, new demands, tools, and functions will emerge in various scenarios, which are worth contemplating and exploring.

In this issue, let us follow Alex's perspective into the path of large-scale adoption of stablecoins in the cross-border payment scenario, as well as the immense potential of stablecoins as the future "Internet currency layer."

Cross-Border Payment Clients Actively Seek Cobo, Initiating the Evolution of Cobo's Stablecoin Payment Products

Deep Tide TechFlow: Thank you for your time. First, could you please introduce yourself?

Alex:

Hello everyone, I am Alex Zuo, Senior Vice President and Head of Payment Business at Cobo.

My earliest professional experience was in the VC field. About a decade ago, I worked at PreAngel, where our partner, Wang Lijie, started looking into Crypto early on. Then, I joined Formation 8's Asian fund, where one of the fund's owners came from the Korean LG Family and invested in Coinone, one of Korea's top three exchanges, around 2016. It was during this period that I began to delve deeper into Crypto. In 2018, I started my own venture, co-founding a rating company called TokenInsight with several friends, including project parties previously invested by PreAngel. I served as the co-founder and COO, mainly responsible for the company's business and commercial aspects. I joined Cobo in 2019.

I have been with Cobo for nearly six years. Initially, I worked on investment-related tasks, including institutional lending and Cobo Venture. After the FTX collapse, the company decided to scale back its investment line and focus on business, so I began overseeing all BD Sales and domestic marketing efforts. Currently, I am responsible for the entire payment and stablecoin-related business.

Deep Tide TechFlow: Many may not be familiar with Cobo's business in payments and stablecoins. Could you please introduce Cobo's current stablecoin solution and its role in the overall payment scenario?

Alex:

We have always focused on building the underlying infrastructure of the industry, especially wallet-related infrastructure. Five or six years ago, when exchanges were booming, our clients were mainly trading platforms. As the industry gradually became compliant, asset management platforms, mining companies, and miners became our primary service targets. Last year, we shifted our focus to BTCFi, believing it to be an important area.

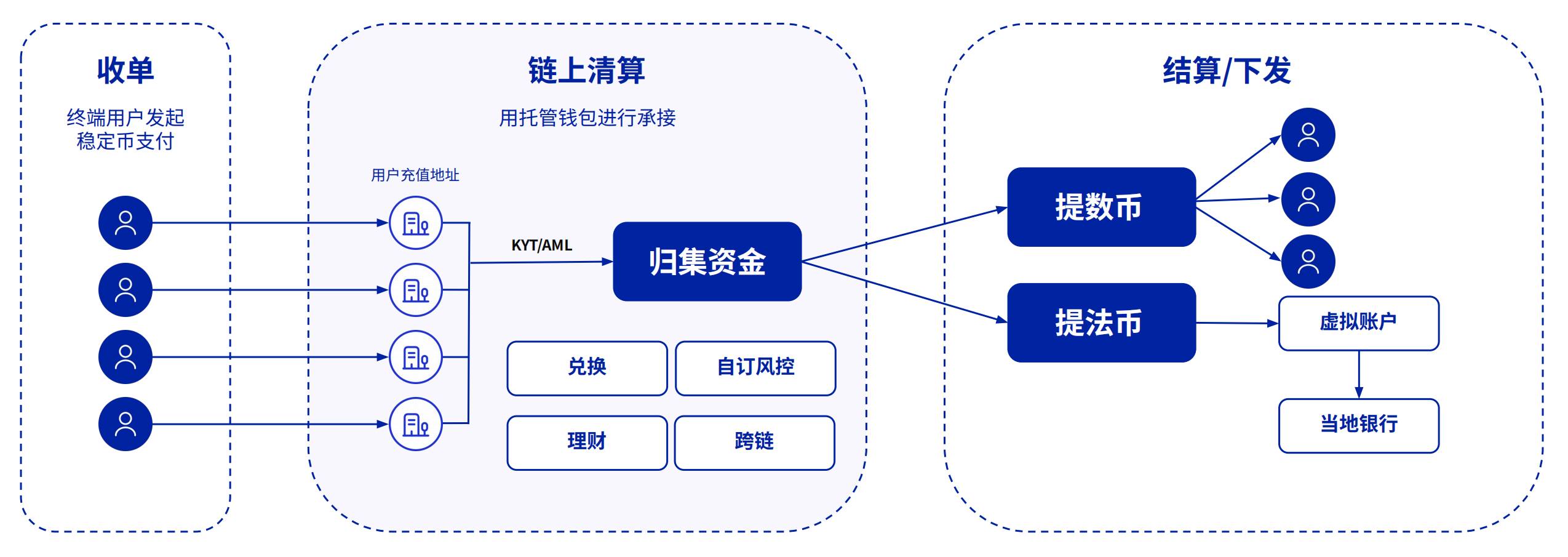

Since last year, more and more cross-border payment clients have approached us. These companies, whether actively or passively, hold some U in their hands due to their upstream or downstream clients, leading to payment issues such as receiving or remitting funds. In this process, they hope we can provide wallet functionalities, prompting us to conduct deeper research and development in the payment field.

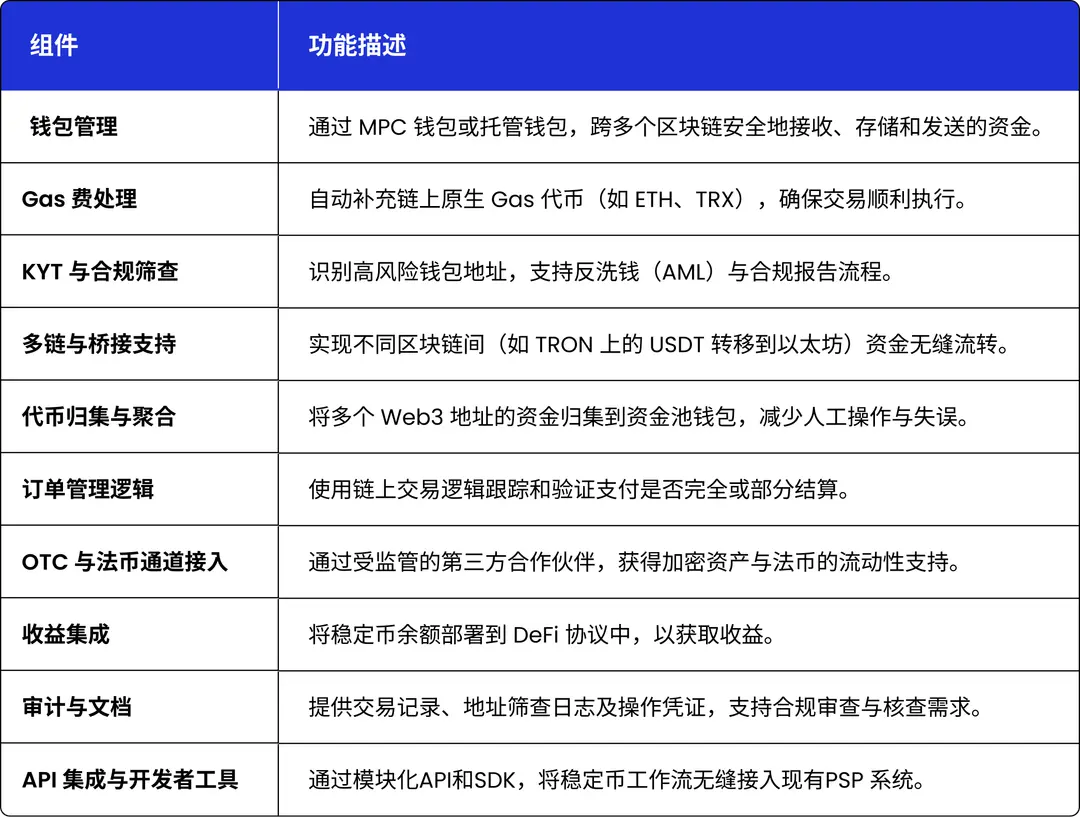

Payment clients differ significantly from Crypto-native clients; they have a weaker understanding of security and the blockchain but have higher expectations regarding compliance, product scalability, and long-term business development, even considering future licensing issues. We found it challenging to provide better services to clients based on the previous underlying infrastructure and custody framework, so we undertook deeper optimizations, mainly reflected in the following aspects:

First, we implemented a lot of so-called chain abstraction, allowing clients to use products with lower barriers. For example, transferring U in the crypto space incurs Gas fees, which is a natural thing, but for traditional Web2 companies, the conceptual understanding and specific operations present high barriers. Therefore, we use chain abstraction to facilitate transfers and payments in U, further lowering the threshold.

Second, anti-money laundering and compliance capabilities. Payment clients are very wary of encountering on-chain dirty money and are highly concerned about the compliance of on-chain funds. Thus, our product has undergone deeper simplification and barrier reduction. Cobo's greatest advantage is that we are the only company globally that offers both centralized custody and MPC self-custody. Many clients now primarily use MPC, and Cobo can combine the advantages of centralized custody with MPC self-custody to provide our centralized custody compliance capabilities to MPC clients, effectively offering on-chain anti-money laundering services and helping them further mitigate risks.

Additionally, the entire cross-border payment involves three levels: the first level is the wallet receiving stablecoins; the second level is acceptance; and the third level is the bank account. Payment companies may be strong in acceptance and bank accounts, but they still feel apprehensive about entering the unfamiliar territory of digital currencies. We will introduce our partners to connect with these traditional payment institutions. We are also a licensed institution in Hong Kong, with a licensed trust account to help clients solve problems.

Cobo's advantage lies in wallets and infrastructure. We hope to build a complete service network around wallet capabilities, lowering the barriers for everyone to use stablecoins. Ultimately, we aim to promote the widespread adoption of stablecoins in a compliant manner, allowing more clients to cross the "last mile" without obstacles.

Cobo's Unique Value: Technology, Compliance, Distribution, and Experience

Deep Tide TechFlow: Cobo's path seems different from other stablecoin projects. Cobo first leverages its own advantages and then gradually develops its products based on client needs, so can I understand it as clients can use your products directly after you finish developing them?

Alex:

Because we may be more focused on the underlying aspects, our current main client base is divided into two categories.

One category is clients engaged in cross-border payments. These clients may not necessarily issue their own stablecoins, but their upstream and downstream clients have begun to have business needs for stablecoins or digital currency transactions. Therefore, they come to Cobo, or they look for an acquirer, and initially, they might even seek exchanges to resolve transaction-related matters. However, as these cross-border payment companies expand their business scale, previous solutions become inadequate, and they will need wallet providers like us to help them generate and manage a series of addresses to connect with multiple acquirers, finding the cheapest way to conduct transactions between fiat and digital currencies in a router-like manner. This is what we do in the context of cross-border payment scenarios or PSP (Payment Service Provider) scenarios.

Another significant scenario is the issuance and circulation of stablecoins. Many of our clients, including large internet companies, did not feel an urgent need a few months ago to apply for stablecoin licenses or to see how others were doing. However, recently, influenced by Circle's stock performance and JD.com's proactive stance, everyone has begun to see this as a very worthwhile business and has started to push related work.

In this process, clients need support from law firms, consulting companies, and technical service providers. On one hand, Cobo can provide technical support, such as Minting and Burning stablecoins and more functionalities like freezing and blacklisting. On the other hand, clients highly value collaboration with Cobo due to our strong distribution capabilities. We have also connected with many PSPs, and our existing clients already handle transaction volumes reaching hundreds of billions of dollars. Stablecoin clients hope their stablecoins can be quickly distributed, and our client network can help stablecoin issuers rapidly expand their business scope and establish circulation scenarios for stablecoins, which is also one of our core values.

Deep Tide TechFlow: Many traditional banks claim they can help clients with cryptocurrency settlements. Are they also looking for the PSPs you mentioned? And does Cobo collaborate with many banks?

Alex:

We define PSPs as those who already bring a lot of scenario traffic and have upstream and downstream clients, which is the type of client we value most now.

In the past, when crypto-friendly banks wanted to help clients with cryptocurrency settlements, they generally chose OTC services due to their lack of licenses and capabilities. The core of OTC services is the final exchange.

Cobo aims to help clients gradually build a Crypto system, or the entire payment and receipt system. We believe that serving such clients has higher added value.

Deep Tide TechFlow: You mentioned that Cobo is the only company globally that offers both centralized custody and MPC self-custody. What specific advantages does this have? Because for some clients, they might choose to collaborate with two companies (one self-custody company and one MPC company)?

Alex:

Now, more clients are choosing the MPC technology system. This self-custody model can later apply for licenses, and future business can be more expansive. The number of clients opting for centralized custody is indeed decreasing, but clients within the MPC system encounter many issues, such as private key management and compliance problems. At this point, Cobo's advantage of offering both centralized custody and MPC self-custody becomes evident.

First, in some applicable legal systems, clients may need to utilize Cobo's centralized custody, allowing us to directly empower clients with our licensing capabilities. Secondly, in some legal regions, if clients wish to apply for licenses themselves, they can choose Cobo's MPC solution. Additionally, for clients in the early stages who have not yet established compliance teams, opting for Cobo's MPC solution allows them to benefit from Cobo's centralized custody's risk control and anti-money laundering capabilities, further lowering their risk control and compliance thresholds.

Moreover, Cobo has grown in this industry for a long time, and our technical reserves are quite robust. Over the years, we have developed various wallets and different types of underlying wallet solutions. During the payment process, we found that some wallet solutions are no longer as popular, such as smart contract wallets, or the market has yet to find specific application directions for these wallet solutions. However, as we scale up, there will still be significant demand for these wallet solutions.

Deep Tide TechFlow: What do you think are the main obstacles to stablecoins?

Alex:

I believe that stablecoin-related business heavily tests interdisciplinary collaboration, requiring solid knowledge reserves in Finance, Technology, and Crypto, and these three areas have different specific demands.

In the Finance field, the focus is on compliance and a deep understanding of the financial system and various financial practices. In the Technology aspect, attention needs to be paid to product design and how to integrate blockchain technology. In the Crypto dimension, once you truly possess stablecoins, if you only provide exchange services, the profit margins have dropped from the past 0.04% and 0.02% to now 0.005%, leaving almost no room for profit. Therefore, the key lies in how to help users manage assets, appreciate value, swap, etc., through Crypto, which requires in-depth Crypto Native knowledge.

From my experience, especially in the stablecoin field, it is challenging to find a team that excels in Finance, Technology, and Crypto all at once. Many companies have obvious shortcomings. Therefore, when assessing whether a project can succeed, I believe the core factor is the team's capabilities and overall quality.

Deep Tide TechFlow: Recently, Circle's stock price has soared, and with JD.com and Ant Group's high-profile announcements about entering the stablecoin space, how does Cobo define its role in the stablecoin race?

Alex:

From what I understand, stablecoin licenses in Hong Kong are still quite scarce. You can count them on one hand; currently, over 40 companies have submitted applications, and there are dozens of law firms indicating intentions to apply, making the competition very fierce. The competitors are primarily China's largest financial institutions and internet companies, and many small and medium-sized institutions do not even qualify to submit applications.

From the perspective of stablecoin issuance, Cobo is currently providing technical support to some large clients, who are very important partners for us. Of course, we hope they can succeed in Hong Kong, but even if they do not achieve that, these clients have generally expressed a tendency to obtain licenses globally, such as in Singapore, the Middle East, or Switzerland. For companies determined to delve into this field, business expansion will not be limited to Hong Kong alone.

In helping clients, we not only provide issuance tools but also assist in building a foundational wallet system that connects issuers and merchants, similar to how Circle has a merchant system that facilitates connections between acquirers and merchants, where acquirers perform Mint and Burn functions. From a broader perspective, our goal is to become a distribution channel for stablecoins.

Based on my observations, there are currently three main distribution models for stablecoins:

The first is a centralized, financially robust model, represented by companies like Stripe, which builds a global network through its own banks and licenses, centering everything around itself, with clients relying entirely on its system for all interactions.

The second is a decentralized model like Circle, where the Circle Payment Network uses a network of certified vendors, and parties conduct mutual transfers through a whitelist system. Circle itself does not directly provide real exchange bank accounts but achieves compliance and information transfer through partners.

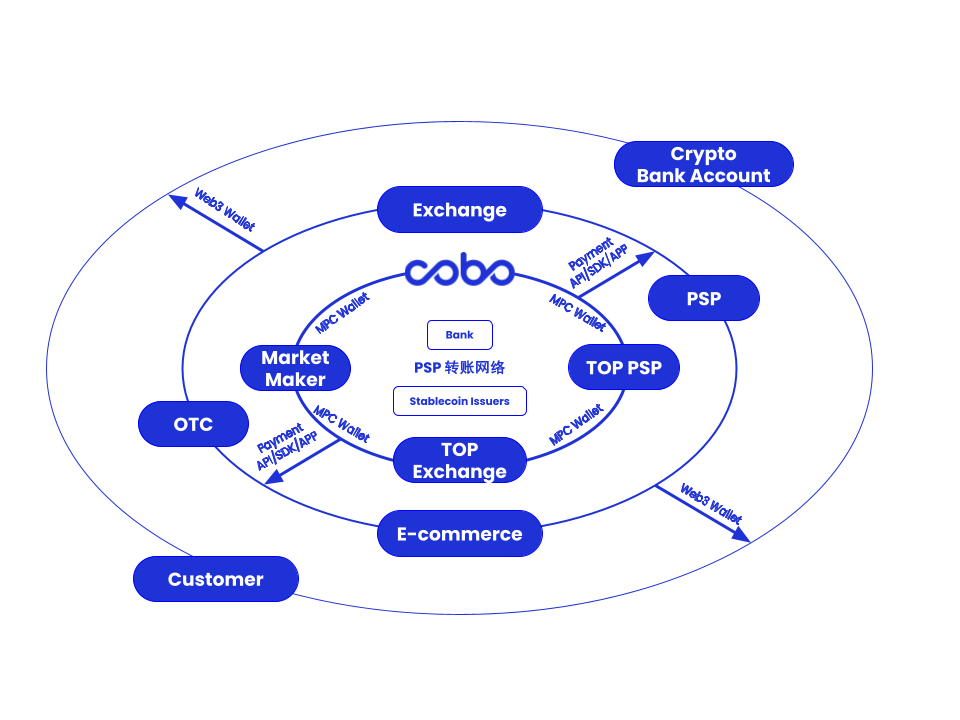

Cobo represents the third model, which is a more intermediate approach: We build a large PSP transfer network at the core, connecting exchanges, OTC merchants, and Cobo, relying on deeply cooperative banks and top market makers to combine on-chain transfers with off-chain bank rapid settlements. For example, after completing a transfer of 1 million USDT on-chain, funds can be quickly settled off-chain through crypto-friendly banks within a minute. The next layer consists of small and medium-sized PSPs and exchanges, which use the core layer's super market makers for acceptance. The outermost layer includes small merchants and retail clients.

In this system: the outermost layer of clients requires self-custody wallets due to regulatory reasons, making it difficult to entrust funds to the core layer; the middle layer of clients needs more payment tool support, such as chain abstraction and anti-money laundering functions; while core layer clients rely on an MPC-based transfer system. This way, if a large number of clients use Cobo's system, transfers between clients will be faster, safer, and more compliant. This model is similar to the CeDeFi concept proposed by AAVE a few years ago, where institutions have a dedicated pool in DeFi, filtering participants through compliant custodians or wallet providers to ensure the safety and traceability of funds.

Our goal is to help clients quickly increase transaction volumes through this network. Cobo currently handles transaction volumes of about 300 to 400 billion dollars, while many stablecoin issuers in Hong Kong may only have issuance volumes of several billion or even hundreds of millions of dollars. If we can provide them with a strong circulation network, significantly enhance their distribution capabilities, and connect stablecoin issuers and clients through the Cobo wallet system, on one hand, issuers can attract users through incentive subsidies, and on the other hand, clients can provide issuers with more application scenarios, ultimately achieving mutual benefits for both parties.

Deep Tide TechFlow: Regarding the distribution network, what changes do you foresee in the future? Or, having discussed the existing distribution systems, what new distribution systems do you think may emerge in the future?

Alex:

The Cobo distribution network we are currently promoting relies on banks and top market makers to gradually distribute stablecoins through a layered logic, which we believe is an effective approach. How this network will evolve in the future is still uncertain.

In the past, the distribution of stablecoins mainly relied on exchanges; for example, half of Circle's revenue goes to Coinbase. However, in the future, which scenarios can truly support large-scale stablecoin circulation remains uncertain. Many people are optimistic that some countries with weaker banking systems (such as those in Latin America and Africa) may be overtaken by stablecoins, including using stablecoins as equivalents in cross-border payments, even without final acceptance. However, as stablecoins gradually become compliant, whether these scenarios truly hold significant potential is still debatable.

Additionally, during a recent internal team discussion, we also talked about the possibility of fundamental changes in the banking system in the future. Previously, cross-border bank transfers relied on the Federal Reserve's account system, but in the future, it may shift towards a token system issued by banks themselves. This model could break existing limitations and even allow certain commercial banks to surpass the Federal Reserve in some aspects. This is a very promising direction for future development. Of course, there are also views that AI-driven payment agents (AI Agents) may become the next trend, but the specific architecture and implementation methods remain unknown.

Deep Tide TechFlow: Earlier, we discussed many companies already applying for licenses in Hong Kong. In your view, what barriers do traditional companies face when venturing into stablecoins, whether applying for licenses themselves or establishing related cryptocurrency reserves? And regarding compliance, what specific advantages does Cobo have?

Alex:

Currently, the two types of businesses that are most suitable for publicly listed companies are one is to hoard coins like MicroStrategy, which many Hong Kong-listed companies are doing, and the other direction is stablecoin licenses.

From the perspective of hoarding coins, the business threshold is not high, and it is relatively simple to operate, especially under the current relatively relaxed regulatory environment. However, the key issues in hoarding coins are twofold: first, when to sell; second, when more and more companies start hoarding coins, this business no longer possesses scarcity, and the market will not particularly favor your stock. Therefore, to stand out in this field, one must achieve a leading position or explore a deep connection between coins and stocks. So I think the difficulty in this direction lies in how to operate it later.

As for stablecoin licenses, many small companies claim they want to enter this field, but more often, it is for short-term stock price speculation. We have encountered many such companies that may have shown no interest in this field six months ago, even issuing announcements without in-depth communication. These companies typically use this to attract market attention but do not have genuine execution capabilities or opportunities to obtain licenses.

In the business systems related to Hong Kong and publicly listed companies, Cobo's advantages mainly lie in two aspects:

First, we have rich experience in serving publicly listed companies. Several mining companies listed on NASDAQ and the Hong Kong Stock Exchange are served by us, and we have accumulated experience in collaborating with auditing firms, including how to conduct audits and statistics of crypto assets, as well as providing full-process services in conjunction with consulting firms.

Additionally, in terms of stablecoin licenses and technical solutions, Cobo's advantages lie not only in technical capabilities but also in the completeness of our solutions. We not only provide issuance but also support distribution, encompassing the entire process from Mint and Burn to merchant wallet management, helping clients quickly get started. This comprehensiveness is a significant advantage that distinguishes us from other providers.

Wallets are the truly missing link for stablecoins, and we are optimistic about stablecoin exchanges.

Deep Tide TechFlow: When it comes to large-scale adoption, if we only look at the large-scale adoption of stablecoins, what key infrastructures do you think still need to be developed? Or which infrastructures can form a strong synergy in promoting the large-scale adoption of stablecoins?

Alex:

First, I believe our wallet can create synergy. From Stripe's recent acquisition direction and actions, they hope that merchants and even individual users can directly use self-custody wallets through Privy. These wallets can generate addresses via email for immediate use, and they link this system with the acquiring services based on Bridge to enable quick transfers and management between wallets. From our observations, Stripe is leveraging blockchain technology to rapidly reconstruct the core functions of Alipay from back in the day, and they are currently filling the gap in the wallet space through acquisitions.

Similarly, this year, many clients have approached us realizing that wallets are the truly missing link in their business, or a segment that is difficult to quickly fill in the short term. Therefore, I am very confident in our track.

As for other infrastructures, such as in the payment sector, compliance remains a core issue, including on-chain KYB and KYC, and how to deeply integrate with real Web2 data is a common pain point for many clients. For example, when you complete a transfer, you need to protect user privacy while ensuring user reliability; currently, there are no particularly mature solutions for these issues.

Additionally, how to expand into asset management in a compliant and legal manner after payments is also a direction worth exploring. In the past, whether centralized or decentralized asset management companies, there is still a need for further optimization in how to better serve traditional clients.

Finally, I personally have high hopes for the exchange between stablecoins. According to current trends, whether it’s large tech companies in the US and Europe or regions like South Korea, a large number of stablecoin issuances may emerge. The exchange between these stablecoins may no longer rely on the previous Curve model. How to build an efficient exchange system will be a huge opportunity and is a key focus within our company.

Now is a critical juncture for stablecoins to achieve large-scale adoption.

Deep Tide TechFlow: How large do you think the market space is for the entire stablecoin sector? What market share do you think Cobo will occupy in the future?

Alex:

Based on the centralized custody wallets and our internal statistics on the total amount of MPC transfers, we currently occupy about 5% of the market share.

In the future, I believe our basic market share should not diminish. With more Chinese individuals, large Chinese payment companies, and Web2 payment giants entering the space, along with the rapid transfer system that Cobo is building, we should be able to do much more than we currently do, and our share may expand to around 10% - 15%.

This is an estimate from the perspective of transfer volume, but it is difficult to judge how large the stablecoin sector will be. On one hand, it depends on whether future regulatory trends remain favorable; on the other hand, it also depends on whether scenarios involving AI Agents can truly materialize. If there are indeed hundreds of millions of AI agents transferring in the future, the scale could be larger than the current internet. In the short term, we first see scenarios in cross-border payments, and in the future, a large number of online, on-chain, and even inter-agent transactions may evolve to settle in stablecoins, making that volume very hard to estimate.

Deep Tide TechFlow: Hong Kong, Singapore, Dubai—who do you think is most likely to become a breeding ground for the rapid growth of stablecoins?

Alex:

From our perspective, there are some differences in different regions. For example, from the custody perspective: the EU is applying for the MiCA license; Singapore has the MAS's DTSP license, followed by a Digital Payment Token (DPT) license under the Major Payment Institution License (MPI); Hong Kong does not yet have clear regulations; the US has New York's BitLicense, which is purely a custody license; and Dubai in the Middle East has the VARA license.

From the issuance perspective: the US has low requirements for issuers, but issuers must use compliant custody or have high requirements for the commercial banks they use; I think Switzerland's Crypto Valley is relatively friendly, but the issue in Europe is that it requires offline asset reserves to be held in European commercial banks, which historically have faced many bankruptcies, leading many to see this as a significant risk; the Middle East is relatively friendly, but especially in Dubai, the biggest issue is the low global recognition of its banking system; Hong Kong's biggest problem is the scarcity of licenses and strict reviews; although Singapore was the first to issue a stablecoin bill, many details are vague and uncertain.

So, in summary, we would recommend trying for licenses in regions like Switzerland, Singapore, and Dubai, but the ability to apply for licenses depends on one's own strength. As long as your scenario is large enough, regulation will be more lenient. Regulators are mainly concerned with a few issues: first, whether the scenario is compliant and legal; second, whether the license will be sold off after two years; and third, whether the circulation volume is too small to provide value for the license.

Deep Tide TechFlow: In the broader financial market beyond payments, stablecoins are seen as the next generation of "internet currency layer." How do you view this perspective? What significant effects/impacts do you think stablecoins will unleash? What preparations will Cobo make?

Alex:

I believe that in the short term, stablecoins will squeeze the fiscal autonomy of small countries' currencies, such as Nigeria, where the local currency is very unstable. In the medium to long term, USD stablecoins will have a huge impact on local currencies, especially in standardized online services and transaction scenarios, where USD-denominated stablecoins become mainstream, severely affecting the currency systems of small countries.

From the perspective of the banking system, it is foreseeable that many small and medium-sized banks will have poorer medium to long-term competitiveness, especially among the younger generation. Once everyone starts circulating with each other, and accounts are designed to be based on stablecoins, there may be less need to convert money into banks, and thus less need for bank cards.

For centralized exchanges and banks, their core role in the future may focus on compliance, meaning that when there is a need to convert cryptocurrencies to fiat, these institutions provide compliance guarantees to reduce counterparty risk. You cannot say they are meaningless, but their value will be diminished.

Cobo is making multi-layered preparations in this trend, such as fully compliant centralized custody, fully client-compliant self-custody, building various wallet systems, and optimizing more product functions. Additionally, we will apply for the necessary licenses in various regions to meet the needs of licensed institutions that rely on our services. Besides, we have also discussed whether we should eventually buy a bank, but the conclusion is that it is still a bit premature at this stage.

Overall, many things will indeed migrate on-chain. Coinbase has created its own Base chain, capturing and storing that value within itself, and we are more committed to becoming a bridge into the chain starting from wallets.

Deep Tide TechFlow: Many people say that stablecoins are an institutional game. How do you view this perspective? In your opinion, how can ordinary users better seize the opportunities presented by stablecoins?

Alex:

First, at this stage, I believe that A-share companies should remain cautious. Through communication and contact, some people genuinely want to engage but lack the capability, while others are purely looking to speculate in the short term.

As for whether stablecoins are an institutional game, I think from the perspective of issuance, this sector will definitely be led by very centralized large institutions, but for entrepreneurs, if you believe in large-scale adoption and think that 20% - 30% of future traffic will be settled in stablecoins, then many new demands, tools, and functions will emerge in different scenarios that are worth considering and exploring.

I believe we are at a critical juncture for true large-scale adoption, which also brings a lot of new entrepreneurial opportunities. In the past, the industry was more about rebuilding traditional financial functions on-chain, but the current trend is to migrate on-chain innovations into models that traditional finance can accept while balancing compliance and on-chain flexibility.

For example, many people think U-cards are a bad business, but the core issue with U-cards, aside from compliance, is poor user experience. Most existing U-cards are debit cards, where you can only use what you deposit. If we can truly solve the issue of on-chain credit or the on-chainization of traditional credit, it will bring a huge breakthrough in the user experience of U-cards. Additionally, there is significant exploratory space for the evolution of traditional trust structures and insurance systems on-chain.

I am actually more optimistic about the current market than many others. In the past, many projects simply issued tokens and created prototypes, but the old model of issuing tokens and listing on exchanges is no longer viable. At this point in time, real customers have entered the market, and products need to be more mature and aligned with actual needs. For instance, if Coinbase's account system can truly integrate with Shopify, Amazon, Walmart, etc., and everyone has their own on-chain wallet and assets, then products must be simplified and made more accessible; this is a whole new starting point.

Finally, I believe CeDeFi is a direction worth delving into. In the past, Ce referred to centralized exchanges, but now Ce leans more towards technology platforms. The key lies in how to balance liquidity and compliance, meeting regulatory requirements while serving a broader user base, which contains enormous entrepreneurial opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。