The S&P 500 index has reached a new all-time high, but the market "breadth" is collapsing, with only 22 individual stocks at historical highs, far below levels seen in other bull markets.

Written by: Long Yue, Wall Street Insights

As the S&P 500 hits a historic high of 6000 points, market breadth is approaching one of the worst records ever.

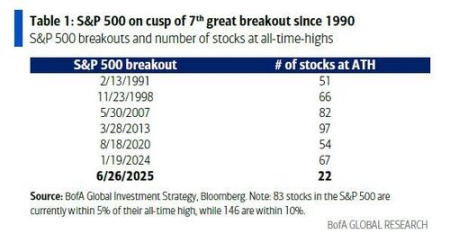

A recent report from Bank of America shows that despite the S&P 500 index continuously reaching new highs, the participation in this breakout is extremely limited, with only 22 S&P 500 constituent stocks hitting historical peaks.

This number is far below other significant breakout periods in history—51 stocks reached new highs in February 1991, 66 in November 1998, 82 in May 2007, 97 in March 2013, 67 in January 2024, and 54 in August 2020, all of which far exceed the current 22.

Bank of America analyst Michael Hartnett pointed out that this is the lowest number of participating stocks in a major breakout since 1990.

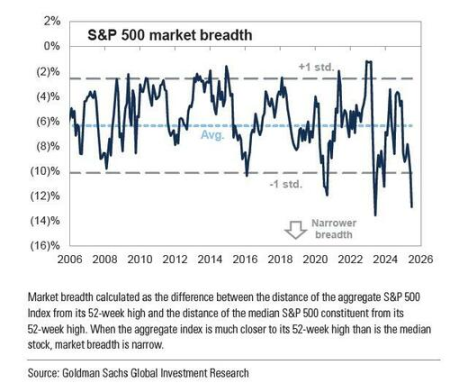

Goldman Sachs' trading team emphasized this unprecedented deterioration in market breadth in a recent report. The bank's U.S. equity strategy chief David Kostin noted in the latest report that "the rebound in the S&P 500 is characterized by extreme narrowness, making it one of the most concentrated rallies in decades."

He warned that the market breadth of the S&P 500 is about to hit a historical low. Data shows that traditional market breadth indicators—measuring the degree of divergence between the index and constituent stock performance—are nearing historical lows.

Extreme Concentration Dominated by Tech Stocks

Tech stocks have once again become the main driving force behind the rise of U.S. stocks, continuing a trend from the past year and highlighting the extreme concentration characteristic of this bull market.

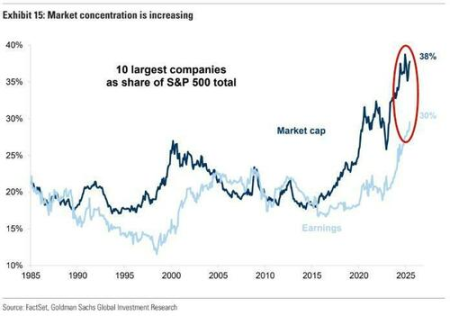

Goldman Sachs strategist Peter Oppenheimer's latest research shows that the top ten companies currently account for 38% of the S&P 500's market value and 30% of its profits, both setting historical records.

This extreme concentration reflects the market's over-reliance on a few tech giants, particularly the so-called "Mag7" (the seven major tech stocks) playing a decisive role in driving index performance.

The performance of the Russell 2000 index further confirms the degree of market divergence. This index is currently down about 11% from its historical high, in stark contrast to the strong performance of large-cap stocks.

Future Gains in U.S. Stocks May Slow

Despite strong technical indicators, Goldman Sachs has a relatively conservative outlook for the next 12 months. Kostin expects the S&P 500 to rise 5% to 6500 points over the next year, which seems quite moderate considering the index has already risen nearly 5% in the past two weeks.

It is worth noting that July has historically been one of the strongest months for the S&P 500, with no negative returns recorded in the past decade and an average return of 1.67%. The Goldman Sachs trading team expects the market may peak around July 17, followed by a pullback, but also acknowledges that "risk events" in July could bring this timing forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。