Tether has launched its first Layer 1 network "Stable" with USDT as its native Gas, and through a "dual-chain parallel" strategy, it is laying out two public chains, Plasma and Stable, aiming to break free from reliance on platforms like Ethereum and Tron, and to address issues of value spillover and platform risk.

Written by: Luke, Mars Finance

A seemingly ordinary roadmap announcement is stirring a deep undercurrent in the crypto world. In early July, the first Layer 1 network "Stable" with USDT as its native Gas released its three-phase development plan. On the surface, this appears to be just another new project trying to carve out a share in the crowded public chain space. However, as we peel back the layers and connect this clue with Tether's recent series of seemingly unrelated moves—its mysterious development team, another Bitcoin sidechain called "Plasma," and CEO Paolo Ardoino's subtle statements amid regulatory storms—a grand and intricate strategic picture is slowly unfolding.

This is not just a simple product launch, but a fundamental strategic shift for the stablecoin giant Tether. The company, which built a hundred billion empire by issuing "digital dollars" on "foreign territories" like Ethereum and Tron, is quietly initiating an "independence movement." It is no longer satisfied with merely being a "super application" on other blockchains; it aims to step into the arena and create its own financial infrastructure—the world's financial track.

The core question of this grand strategy is: why would a company that captures billions of dollars in profits annually through its existing model choose to disrupt the very framework that made it successful? What internal pressures and external threats are forcing it to transition from a light-asset "application layer" player to a heavy-asset "infrastructure layer" titan? Its meticulously designed "dual-chain parallel" strategy reveals Tether's ultimate ambition to dominate global digital finance.

The trillion-dollar "platform tax"

Tether's motivation stems from the shiny yet exceptionally fragile "Achilles' heel" in its business model. Its success is essentially a parasitic win-win. USDT, as the hard currency of the crypto world, has brought massive trading activity and users to public chains like Ethereum, especially Tron, becoming the cornerstone of their ecological prosperity. However, Tether itself resembles a "tenant" without sovereignty, residing on someone else's land and paying a high "rent" for it.

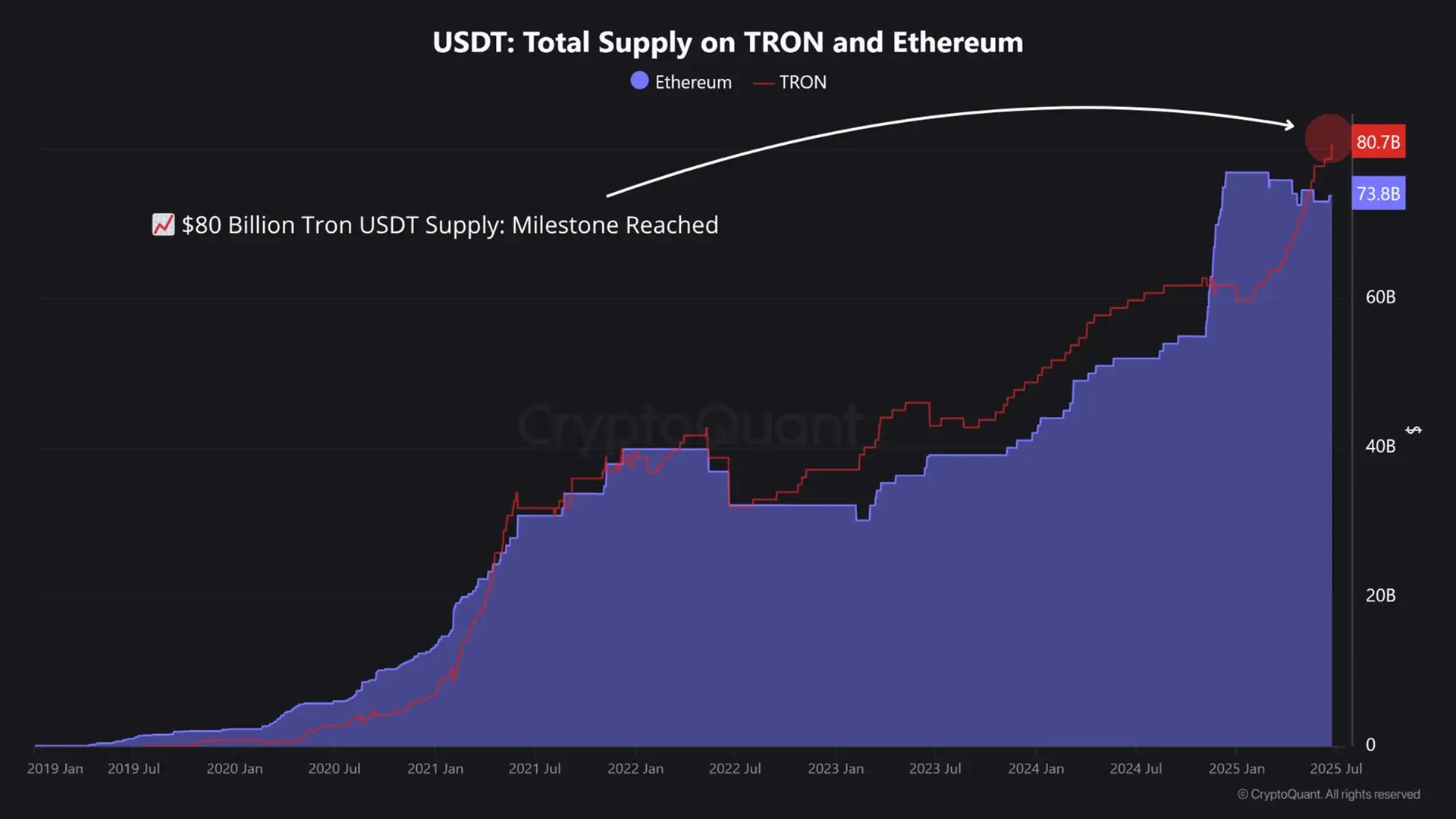

This "rent" is not paid directly but is captured by the platform in a more covert manner—value spillover. The daily settlement volume of USDT exceeds $100 billion, with the vast majority of the traffic carried by Tron. Data shows that the circulation of USDT on the Tron network has surpassed $80 billion, accounting for half of the total supply of USDT, with an average daily transfer amount reaching $21.5 billion. These astronomical trading activities contribute significant transaction fee revenue to the Tron network, but not a single penny flows into Tether's pocket. This is the core dilemma Tether faces: it creates value but cannot capture it. All ecological dividends are "taxed" by the underlying infrastructure platform.

A deeper crisis lies in platform risk. This deep dependency tightly constrains Tether's lifeline by its "landlord." If the platform's policies change, Tether will face the danger of having its foundation pulled out from under it. This concern is not unfounded; there are signs that Tron is attempting to reduce its singular reliance on USDT and is starting to support its own stablecoin USD1, which is linked to the Trump family. This is akin to cultivating a direct competitor within its most important distribution channel. Additionally, the continuous rise in transaction fees on the Tron network is eroding its core advantage as a low-cost settlement network. All of this points to a clear conclusion: Tether's move to build its own infrastructure is less about proactive expansion and more about defensive countermeasures to escape strategic constraints and mitigate survival risks. It must establish its own sovereign territory.

Dual-track counterattack: two public chains, one grand strategy

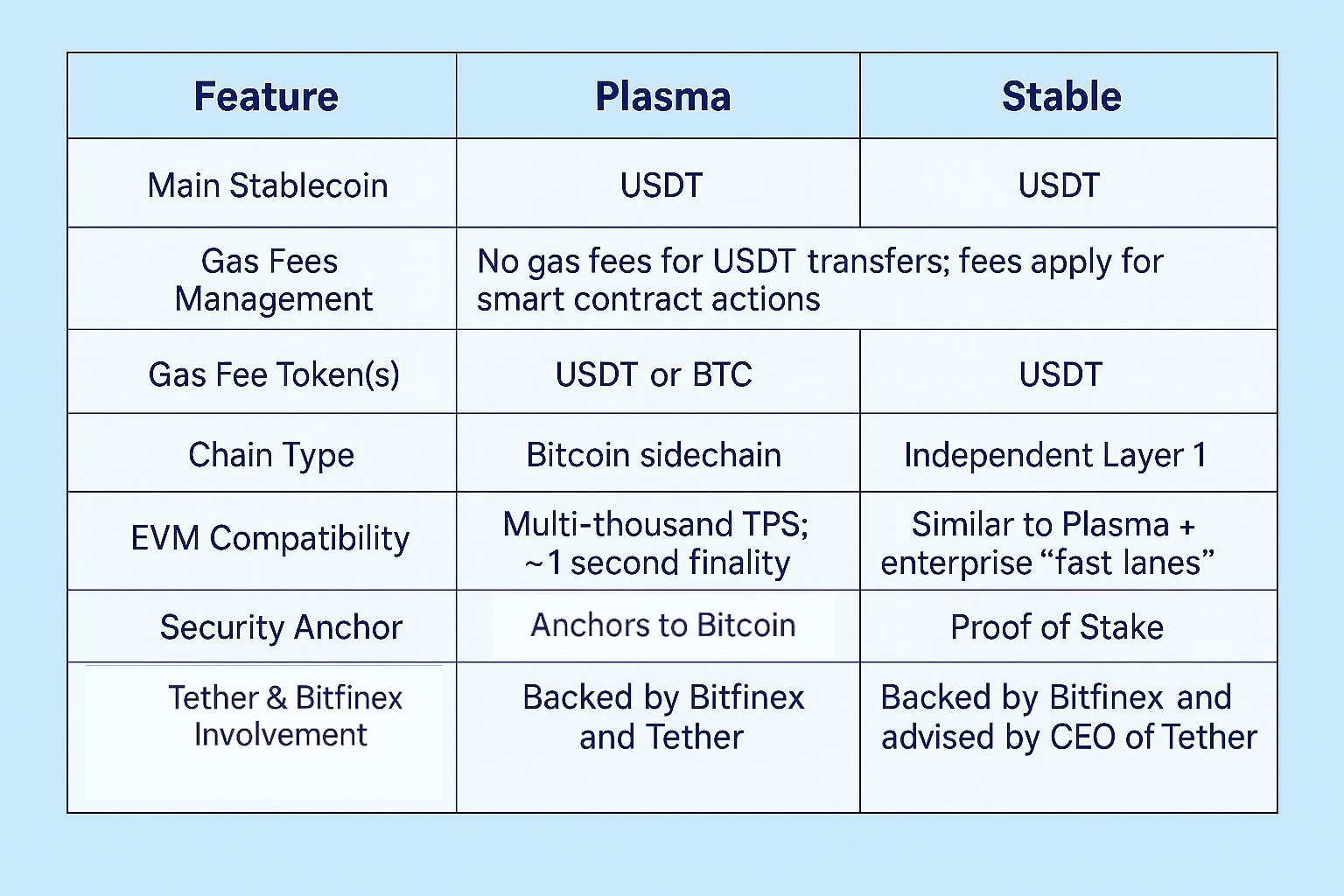

Tether's counterattack is not a gamble but a meticulously calculated "dual-track" strategy. As the "Stable" network emerges, another project called "Plasma" has also received substantial support from Tether's executives and its affiliated company Bitfinex. These two projects may seem independent, but they are actually interrelated, targeting different segments of the institutional market and together forming the left and right arms of Tether's infrastructure landscape.

Plasma: A financial fortress anchored in Bitcoin

Plasma's positioning is extremely clear: a dedicated financial layer born for large-scale, high-security stablecoin settlements. Its core architecture is as a Bitcoin sidechain, periodically anchoring its state roots on the Bitcoin mainnet, thereby inheriting Bitcoin's unparalleled security and finality. This is immensely attractive to traditional financial institutions that prioritize security, such as banks, sovereign funds, and large multinational corporations. Its functional design fully serves the positioning of a "settlement fortress": providing zero-fee USDT peer-to-peer transfers, supporting BTC or USDT for direct Gas payments, and being fully compatible with EVM. Plasma's strategic goal is to precisely capture high-value B2B payments, cross-border remittances, and commodity trade settlements from Tron and Ethereum.

Stable: The highway to future finance

In contrast to Plasma's specialization, the ambition of the "Stable" network is much broader. It is designed as a fully functional, independent Layer 1, aiming to become the "highway" of next-generation on-chain finance. Its grand three-phase roadmap clearly outlines its path to ultimate performance: from a foundational layer with USDT as native Gas achieving sub-second finality, to an experience layer that significantly enhances throughput through "optimistic parallel execution" technology, ultimately upgrading to a consensus mechanism based on Directed Acyclic Graph (DAG) to push speed and resilience to the extreme. The target customers of the "Stable" network are institutions that require high-performance, highly customizable infrastructure, such as DeFi hedge funds and real-world asset (RWA) tokenization platforms.

This "combination punch" strategy reflects Tether's deep insight into the institutional market. It does not naively believe that a single chain can meet everyone's needs. Instead, it provides two different underlying infrastructures with distinct risk-return characteristics and functional focuses, offering tailored solutions for a range of institutions from the most conservative banks to the most aggressive DeFi funds.

The ghost in the machine: unveiling Tether's behind-the-scenes operators

A core contradiction stands before us: Tether's CEO Paolo Ardoino has repeatedly stated in public interviews that "there will be no Tether chain." However, a vast infrastructure ecosystem centered around Tether is rising. Behind this seemingly contradictory situation is a carefully designed organizational structure aimed at achieving "strategic control" and "legal separation."

This structure includes several key roles that together act as "ghosts in the machine," driving the construction of the empire behind the scenes:

Bitfinex: As Tether's sister company, it is the main capital provider and project incubator, leading investments in Plasma and Stable, thereby avoiding direct financial involvement from Tether.

USDT0: This is the technical hub of the entire strategy. Built on LayerZero's OFT standard, it serves as a bridge connecting Tether's existing circulation system with the emerging proprietary public chain through a "lock-mint" mechanism, ensuring liquidity unity.

Everdawn Labs: This mysterious software development company registered in the British Virgin Islands is the actual manager and operator of the USDT0 protocol. It is highly likely to be the actual development team behind the "Stable" network and an important technical partner of Plasma.

This four-party structure composed of "Tether (brand and liquidity) - Bitfinex (capital) - Everdawn Labs (technology) - USDT0 (protocol)" perfectly explains Ardoino's "contradictory" statements. Legally speaking, Tether itself does not directly operate a public chain. However, through this power network composed of affiliated companies and partners, it achieves absolute control and strategic guidance over the entire ecosystem. This is a sophisticated legal and business architecture designed to cope with the complex global regulatory environment.

Deconstructing the engine room: Tether's new financial technology stack

Tether's ambition is not only reflected in its strategic layout but also in its careful selection of underlying technologies. It is not blindly chasing technological trends but, like an experienced chief engineer, selecting the most mature and reliable components from the industry to build a "super engine" optimized for institutional-level finance.

In terms of interoperability, Tether has chosen LayerZero's OFT standard to build its cross-chain USDT (i.e., USDT0). Unlike traditional "wrapped" assets, OFT adopts a "burn-mint" model, ensuring that USDT0 circulating on any chain is standardized and controlled by the issuer, fundamentally solving liquidity fragmentation and the security risks of third-party bridges. This stands in stark contrast to competitor Circle's private protocol CCTP, as Tether aims to create a more open and composable financial track, while Circle resembles a closed "walled garden."

In terms of performance, Tether also demonstrates its "integrated innovation" approach. The "optimistic parallel execution" equipped for "Stable" is a proven effective path for achieving exponential throughput growth, validated by next-generation high-performance public chains like Monad and Sei. The PlasmaBFT consensus protocol equipped for "Plasma" is a customized implementation based on the mature "Fast HotStuff" protocol, providing lower latency and faster finality for payment settlement scenarios. This pragmatic and efficient technology selection strategy significantly shortens the time to market for building reliable infrastructure for institutional clients.

Geopolitical endgame: dancing in the regulatory world

As Tether intensively lays out its infrastructure, the global regulatory landscape is also undergoing dramatic changes. Among them, the "GENIUS Act" being advanced by the U.S. Congress will have a profound impact on the entire stablecoin industry. The core of this act is to establish a strict regulatory framework for stablecoins within the United States, requiring issuers to hold a 1:1 ratio of high-quality liquid assets as reserves, and to undergo rigorous audits and oversight.

In the face of this regulatory storm that could reshape the industry, Paolo Ardoino and Tether have demonstrated remarkable strategic flexibility, executing a textbook-level "combination strategy":

Consolidating offshore dominance: Continuing to position the existing USDT as the core product serving emerging markets and unbanked populations. The newly established Plasma and Stable networks are designed to provide an unprecedentedly efficient and low-cost settlement track for this vast offshore dollar market.

Expanding the onshore market: Ardoino has made it clear that Tether plans to launch a brand new, fully compliant independent stablecoin in the U.S. that meets all the requirements of the "GENIUS Act." This new "U.S. version of Tether" will compete directly with Circle's USDC in the compliance arena within the United States.

This "dual-front strategy" allows Tether to simultaneously meet the needs of different types of institutions. International traders requiring global, high-efficiency settlements can use its offshore USDT and proprietary public chains. Meanwhile, Wall Street asset management firms that need complete compliance and protection under U.S. law can utilize its future onshore stablecoin. Thus, Tether is not passively responding to regulation but actively leveraging it. A regulatory bill that could have posed a survival threat has instead become a strategic catalyst for its global market "pincer attack."

Conclusion: The new foundation of the empire

Looking back at the initial roadmap for the "Stable" network, we can now clearly see that it is not an isolated blueprint but a declaration of the foundation for a vast new empire. Tether is undergoing a profound transformation, evolving from a dependent "application" into a vertically integrated financial infrastructure platform with its own sovereign territory.

By building the two public chains, Plasma and Stable, Tether has simultaneously addressed its long-standing issues of value spillover and platform risk. It is internalizing the hundreds of millions, even billions of dollars in implicit "platform tax" that have flowed to networks like Ethereum and Tron each year back into the value of its own ecosystem. More importantly, it has established a powerful technological and business moat, composed of its multi-billion dollar liquidity, two proprietary public chains, and a sophisticated strategy that dances with global regulation, making it difficult for any competitor to surpass.

The far-reaching effects of this transformation are just beginning to emerge. For Ethereum and Tron, they are about to face the risk of losing their most important "tenant" within their ecosystems. For Circle, it will no longer be contending with a competitor that merely dominates the offshore market, but with a formidable adversary capable of launching attacks on both global compliant and non-compliant battlefields. A private entity is constructing a foundational track that could carry a significant portion of future global value transfers, independent of the traditional banking system. Tether's grand strategy has become evident, and a "Tether economy" with USDT as its native currency is rising on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。