Figma is also a Bitcoin fan.

Design software developer Figma has officially launched its IPO process and will be listed on the New York Stock Exchange under the ticker symbol "FIG."

The S-1 filing not only reveals the company's strong operational growth but also exposes its financial strategy of holding nearly $70 million in Bitcoin ETFs for the first time, with plans to reinvest an additional $30 million in USDC to increase its holdings, demonstrating its proactive embrace of crypto assets.

Figma Announces IPO: Challenging Adobe's $20 Billion Valuation

After the breakdown of the $20 billion acquisition deal with Adobe a year and a half ago, Figma announced yesterday that it is launching its IPO in the United States. According to the latest submitted S-1 filing, Figma has not publicly disclosed its expected fundraising amount and valuation range, but the market is optimistic that the company is likely to surpass the exorbitant price offered by Adobe.

Looking back at why the Adobe acquisition fell through, the key issue was concerns from regulatory bodies in the UK and the US regarding competition and monopoly. Now, Figma's choice to go public independently can be seen as stepping out from the shadow of that breakdown. In the 2024 employee stock buyback case, the company's valuation was approximately $12.5 billion, and with the rising tide of AI and the IPO market, investors are hopeful that it can break that number after listing.

Strong Revenue Performance, Aggressive AI Strategy

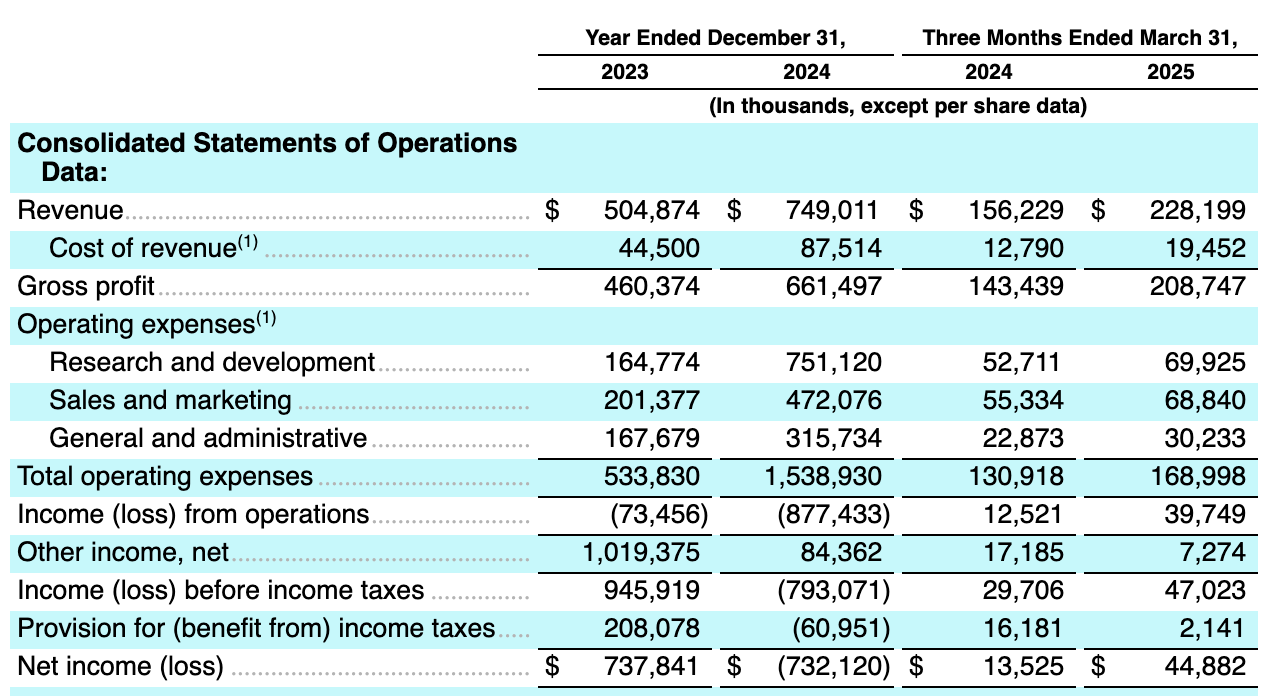

Figma's financial performance is also eye-catching; after a loss in 2024, it reported a net income of $44.88 million in the first quarter of 2025, with quarterly revenue reaching $228 million, a year-on-year increase of 46%. The total revenue for 2024 was $749 million, a 48% year-on-year increase, reflecting the strong momentum of its subscription-based business model.

Figma CEO Dylan Field emphasized in a letter to investors: "AI is at the core of the future design process. We will continue to invest heavily, even though it may lower efficiency in the short term, but this is an indispensable long-term strategy." This also echoes Figma's ambition, with over 200 mentions of AI-related terms in the filing.

Currently, Figma has over 1,000 enterprise customers paying more than $100,000 annually, and over 11,000 medium-sized customers paying over $10,000 annually. Financial data shows that more than half of its revenue comes from markets outside the United States, and it will continue to push for international expansion and acquisitions.

Figma is also a Bitcoin fan: Holding nearly $70 million in Bitcoin spot ETFs

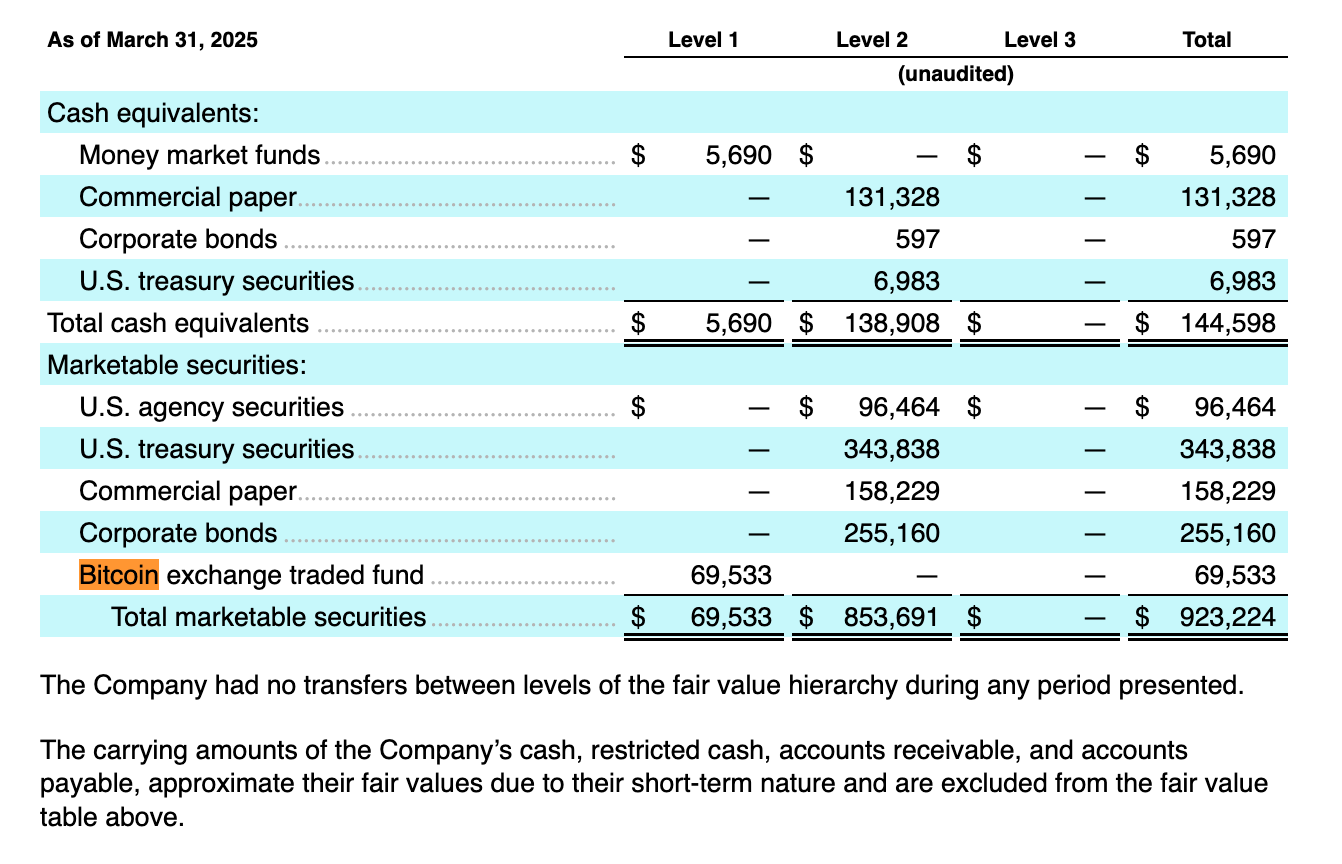

In addition to its impressive operational performance, Figma has also demonstrated a unique vision in its financial strategy. The filing reveals that the company holds approximately $69.53 million in Bitcoin through the Bitwise Bitcoin ETF (BITB), initially investing $55 million, and has currently made a profit of about 26%.

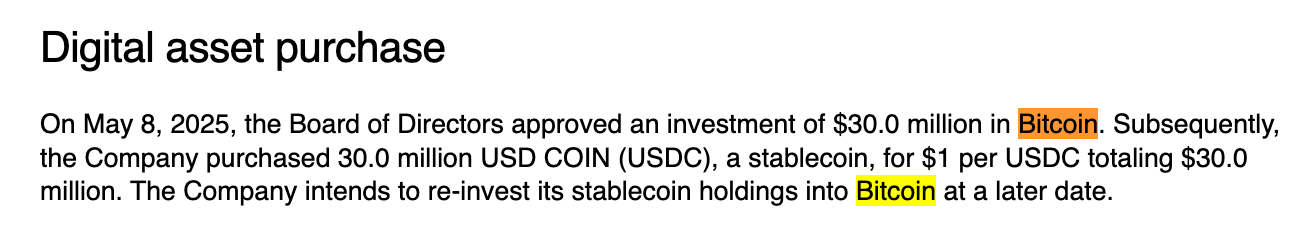

Notably, Figma's board has authorized the purchase of $30 million in USDC this May, allowing for flexible conversion into Bitcoin in the future, thereby maintaining financial flexibility. This indicates that Figma does not view Bitcoin as a speculative asset but clearly incorporates it into its long-term cash and capital management strategy.

This position accounts for about 4% of Figma's existing $1.07 billion in cash and securities, showing its strategic recognition of Bitcoin and resonating with companies like MicroStrategy, representing a new wave of startups that view Bitcoin as a corporate reserve asset.

Founders Continue to Control Figma's Direction: Major Acquisitions Planned

Dylan Field stated that the choice to go public at this moment is not only to enhance brand visibility and gain capital momentum but also to make users and the community a part of the company. Through a special voting rights structure, he will retain over 75% of the company's voting rights, continuing to control the company's direction, and emphasized plans for significant expansion through mergers and acquisitions.

Additionally, the company's internal venture capital arm, Figma Ventures, has already invested in 18 projects, demonstrating its comprehensive approach from product to capital strategy. With the prospectus officially unveiled, Figma joins the ranks of leading startups like Circle in the IPO arena, making a significant impact on the capital financing market in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。