Who is taming desire? Who is releasing volatility? Who is returning to humanity?

Author: danny

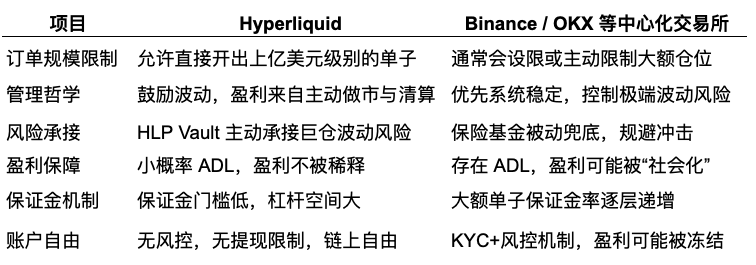

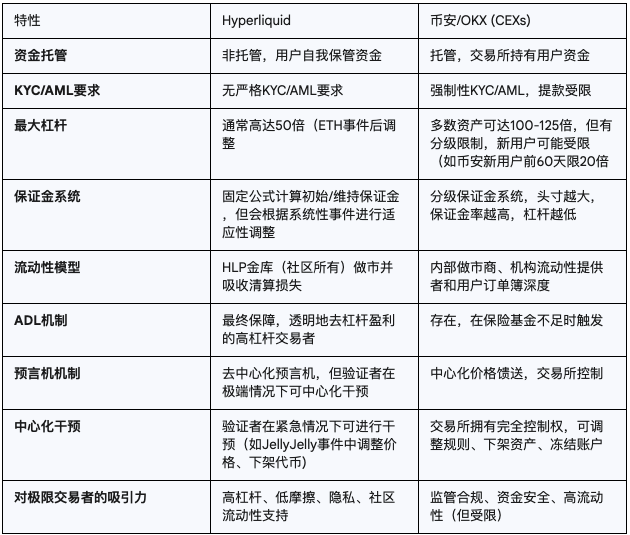

Navigating the landscape of crypto derivatives: Why can Hyperliquid facilitate massive trades while centralized exchanges impose stricter restrictions? The conflict between freedom and order is not merely a regulatory and technological issue, but a matter of the value return of the trading system.

Overview

Extreme trading (i.e., "ultra-high leverage + ultra-large positions") frequently occurs on the decentralized platform Hyperliquid, and this is no coincidence. This is due to its underlying design philosophy and mechanisms being inherently more compatible with high-risk, high-elasticity trading styles, especially for strategy traders who "bet small to win big." Hyperliquid offers six key advantages:

Hyperliquid is more like an "arena" for extreme traders, creating an ecosystem that allows for extreme risk exposure, supports high-frequency trading strategies, and protects user rights with a non-custodial fund structure. In contrast, Binance and OKX resemble "gatekeepers of the financial system," limiting the scope for individual extreme strategies while pursuing stability and compliance.

There is no absolute superiority between the two; only different choices of risk preference and strategy style.

Overview of Functionality and Feature Comparison

For a detailed introduction to Hyperliquid's mechanisms and background, I have provided a comprehensive overview in this article:

https://x.com/agintender/status/1938445355118649745

This article will start with the HLP vault—discussing Hyperliquid's "innate whale body" from this "core mechanism."

The Main Body (Without) Highlights

1. Liquidity Model: Hyperliquid HLP Vault Operation Mechanism

The HLP (Hyperliquid Liquidity Provider) vault is a core component of Hyperliquid, enabling the platform to operate efficiently as a market maker and liquidator. The HLP vault is not just a passive liquidity pool; it actively participates in market making and liquidation. Its rapid growth to over $500 million in Total Value Locked (TVL) indicates its success in attracting capital, which directly translates into the deep liquidity required for large trades. Additionally, its risk-adjusted performance is strong, with a Sharpe ratio of 2.89 (compared to Bitcoin's 1.80), and it has a -9.6% negative correlation with Bitcoin.

The role of HLP in "absorbing losses" during significant liquidation events is a key feature, providing support for extreme traders to take large positions by offering protection against potential losses that may spread through the market. The "democratization" characteristic of HLP means a broader and potentially more elastic base of liquidity providers, contrasting with the reliance on a few large institutional market makers.

Market Maker and Liquidator Role vs. Insurance Fund

The HLP vault acts as the default market maker on the platform. This means it continuously provides buy and sell quotes, offering liquidity for all trading pairs. When users trade, a significant portion of orders is matched with the HLP vault.

In addition to market making, the HLP vault plays a critical role in the liquidation process. When a trader's margin is insufficient to maintain their position, the HLP vault intervenes to liquidate these positions, preventing the accumulation of bad debts and ensuring the platform's stability.

Centralized exchanges (CEXs) rely on centralized insurance funds to cover bad debt losses resulting from insufficient liquidation. While these insurance funds are typically large, their capacity is limited. When extreme market volatility occurs, and large-scale liquidations lead to losses exceeding the insurance fund's capacity, CEXs may need to initiate Auto-Deleveraging (ADL) or other forced measures.

The capacity of the insurance fund limits the exchange's ability to withstand single or multiple massive liquidation events. If a super-large position's liquidation results in excessive losses, even with an insurance fund, it may not be sufficient to cover them.

When extreme traders' large positions are liquidated, it can place immense pressure on the CEX's insurance fund, triggering ADL, leading to the forced liquidation of profitable positions, and even causing distrust among other traders.

Community Ownership and Profit Distribution

A unique aspect of the HLP vault is its community ownership. Users can mint HLP tokens by staking USDC, thereby becoming owners of the vault. This means that the profits of the vault are directly distributed to HLP token holders.

Profits primarily come from the following sources:

Trading fees: The HLP vault collects trading fees from trades matched with it.

Funding rates: As a market maker, the HLP vault charges or pays funding rates depending on market conditions. When the market is in contango (perpetual contract prices are higher than spot prices), the HLP vault collects funding rates; conversely, it pays funding rates.

Liquidation fees: The HLP vault charges a certain liquidation fee when liquidating positions.

These profits are distributed regularly (usually weekly) to HLP token holders or used to repurchase Hyperliquid tokens (executed every 10 minutes).

Diversifying Risk to Support Large Positions

The HLP vault diversifies risk through the following mechanisms, thereby supporting the absorption and liquidation of large positions:

Diverse liquidity providers: The HLP vault is composed of numerous independent stakers rather than a single entity. This decentralized liquidity means that risk is spread across a large number of participants, reducing the risk of failure of any single entity.

Automated hedging and rebalancing: The HLP vault's algorithms continuously monitor the market and automatically adjust its hedging strategies to manage its risk exposure. For example, when the vault holds a large position in one direction, it may hedge in the external market or adjust its quotes to reduce risk.

Intelligent risk management: The HLP vault is designed to absorb large orders and effectively manage the risks associated with these positions through its internal hedging and liquidation mechanisms. This allows Hyperliquid to support larger individual positions than many centralized exchanges (CEXs).

HLP is one of the core mechanisms of Hyperliquid, and its Oracle price design (3-second updates, funding rate algorithms, and even leverage limits) operates around HLP. They are not separate links but a whole, interlocking. The funding rate algorithm gives HLP a certain dealer advantage, and the Oracle price provides confidence to HLP participants, allowing HLP's scale to continuously grow, thereby absorbing larger positions and withstanding higher volatility.

2. Dealer Advantage: Hyperliquid Funding Rate Algorithm

The funding rate algorithm of Hyperliquid is designed to tightly anchor perpetual contract prices to the spot prices of the underlying assets, providing traders with a controllable cost and risk funding fee while also offering HLP a corresponding "dealer advantage."

Components

The funding rate consists of two parts:

Premium Index: This reflects the deviation between the market price of perpetual contracts and the oracle spot price. When the perpetual contract price is higher than the oracle price, the premium index is positive; conversely, it is negative.

Interest Rate: This is a fixed benchmark interest rate, usually intended to compensate for the financing costs of holding contracts. Hyperliquid's interest rate is typically set at 0.3% (higher than Binance).

Characteristics Based on Oracle Price

The funding rate of Hyperliquid is calculated based on the oracle price rather than the internal spot price of Hyperliquid. This ensures that the funding rate accurately reflects the fair price of the external market, avoiding distortions caused by internal market manipulation. This characteristic greatly instills confidence in "HLP participants," leading to an increasingly larger HLP pool (because Hyperliquid itself "cannot" manipulate prices).

High-frequency collection and extreme rates

High-frequency collection: Hyperliquid's funding rate is collected 1/8 times per hour. This means the funding rate is calculated and collected every 8 hours. This high-frequency collection mechanism allows the funding rate to respond more quickly to market changes and encourages perpetual contract prices to more effectively revert to spot prices.

Extreme rates: Hyperliquid allows extreme funding rates, up to 4% per hour. This high cap means that under extreme market conditions, the funding rate can quickly become very high, rapidly correcting the deviation between perpetual contracts and spot prices.

Risk Cost Expectations for Large Positions and Market Price Reversion Mechanism

These characteristics collectively provide risk cost expectations and market price reversion mechanisms for large positions:

Predictable risk costs: Although the funding rate fluctuates, its algorithm is publicly transparent and based on observable oracle prices. This allows traders to relatively accurately predict the potential funding costs of holding large positions. For extreme traders, they can factor in the high funding rates before entering positions, thereby managing their risks.

Rapid market price reversion: The combination of high-frequency collection and extreme rates means that when there is a significant deviation between perpetual contract prices and oracle prices, the funding rate will quickly rise (or fall), creating strong incentives for traders to align their position direction with the market consensus direction. This helps pull perpetual contract prices back to align with spot prices, effectively preventing price decoupling. This is especially important for large positions, as it means that even in the event of significant deviations, the market will have a strong self-correcting mechanism (relieving the pressure on HLP's positions).

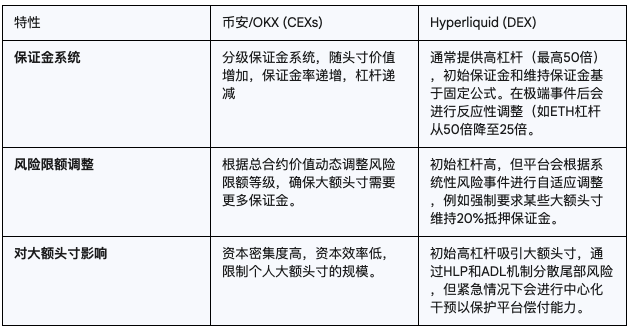

3. Cost of Capital Advantage: Comparison of Hyperliquid Contract Margin Requirements

Regarding the initial margin and maintenance margin requirements for large Bitcoin perpetual contracts, Hyperliquid exhibits significant differences from the tiered margin systems of Binance and OKX. This is primarily due to the presence of HLP, which makes the platform more "inclined" to accept volatility.

Margin Requirements of Hyperliquid

Hyperliquid adopts fixed and relatively flat margin requirements, typically applying the same margin rate to positions of all sizes (e.g., initial margin of 1%, maintenance margin of 0.5%). This means that even extremely large positions are subject to the same low margin rates.

Binance and OKX's Tiered Margin System

Both Binance and OKX adopt a tiered margin system, which means that as the size of the position increases, the required initial margin and maintenance margin ratios gradually rise. The core idea is that larger positions bring greater risks, thus requiring higher margins to cover potential losses. For example, holding a Bitcoin contract worth $10 million may only allow for 20x leverage, while holding a $100 million contract may limit leverage to 5x or even lower.

This mechanism is designed to protect the exchanges themselves. If a massive position is liquidated, the resulting losses may exceed the capacity of their insurance funds, threatening the stability of the entire platform. By limiting the leverage on large positions, CEXs reduce single-point risk.

This directly restricts extreme traders' ability to establish ultra-large positions on CEXs. They need to invest more of their own capital as margin or are forced to spread their positions across multiple accounts or platforms, increasing operational complexity.

Taking Bitcoin perpetual contracts as an example:

Binance: For smaller positions, it may offer leverage of up to 125x (initial margin of 0.8%). However, as the nominal value increases, the available leverage gradually decreases, meaning the margin rate correspondingly increases. For example, for positions exceeding a certain amount, leverage may be limited to 50x (initial margin of 2%) or even lower.

OKX: Similar to Binance, OKX also has detailed tiered risk limits. For instance, the leverage for Bitcoin perpetual contracts is tiered based on the nominal value of the position, starting from a maximum of 100x and gradually decreasing. This means that as the value of the Bitcoin contracts you hold increases, the required margin ratio also increases.

Assessing Whether Hyperliquid Offers a Lower Margin Threshold

Hyperliquid provides a relatively low margin threshold for large positions at specific leverage levels.

For small positions: Hyperliquid's margin rate may be comparable to the highest leverage tier of CEXs (i.e., the lowest margin rate).

For large positions: The tiered margin system of Binance and OKX means that once a position exceeds a certain threshold, the required margin rate significantly increases. In contrast, Hyperliquid maintains a low and fixed margin rate, allowing extreme traders to establish extremely large positions at relatively low capital costs.

For example:

Suppose you want to establish a long perpetual contract position in Bitcoin worth $100 million.

On Binance or OKX, due to the tiered margin system, you may not be able to use 100x or even 50x leverage. For instance, you might only be able to use 10x or 20x leverage, meaning you would need an initial margin of $10 million or $5 million.

On Hyperliquid, if its uniform margin rate is 1%, you would only need an initial margin of $1 million.

Therefore, for traders looking to establish massive positions, the low and consistent margin requirements offered by Hyperliquid indeed represent a significant advantage.

### Profit Withdrawal: Investigation of Hyperliquid's Withdrawal Policy

Non-Custodial Platform Characteristics

Hyperliquid is a non-custodial platform. This means that users have relatively more control over their funds, which are stored directly in the users' EVM-compatible wallets. The platform itself does not directly hold users' crypto assets.

Withdrawal Restrictions and Profit Withdrawal Barriers

Due to its non-custodial nature, Hyperliquid does not have daily withdrawal limits or profit withdrawal barriers like centralized exchanges (CEXs).

No daily withdrawal limits: Users can withdraw all or part of their funds on Hyperliquid at any time and from anywhere, as long as the on-chain network allows. There are no daily or per-transaction withdrawal limits set by CEXs for compliance, risk management, or internal liquidity management.

No profit withdrawal barriers: Hyperliquid does not restrict withdrawals based on user profits. Whether in profit or loss, users have absolute control over their funds.

For compliance (AML/KYC), risk control, and internal liquidity management reasons, CEXs typically set daily or per-transaction withdrawal limits. In some cases, when users experience significant profits, withdrawals may be subject to stricter scrutiny or delays. Withdrawal restrictions reflect the custodial power that CEXs have over users' funds. They need to ensure that their reserves are sufficient and comply with regulatory requirements to prevent illegal fund flows.

For traders like James Wynn, who wish to quickly withdraw funds after making significant profits or need to flexibly mobilize large amounts of capital, CEX withdrawal limits are a serious obstacle. They cannot freely control their funds as they can on Hyperliquid. Hyperliquid's non-custodial model avoids these issues, providing users with greater financial freedom (at least on the surface).

### Profit Guarantee: Hyperliquid's Liquidation Mechanism and Auto-Deleveraging (ADL)

Hyperliquid's Liquidation Mechanism

Hyperliquid's liquidation mechanism is based on margin rates. When a trader's maintenance margin rate falls below a specific threshold (usually 0.5%), their position will be triggered for liquidation. The HLP vault of Hyperliquid acts as the liquidator, taking over and closing these positions to prevent bad debts from occurring. Therefore, the more sufficient the funds in the HLP vault, the lower the probability of ADL being triggered.

Both Binance and OKX include an Auto-Deleveraging (ADL) feature. When the insurance fund is insufficient to cover liquidation losses, ADL will forcibly close profitable traders' positions based on the size of their profits and leverage levels. ADL is the last line of defense for CEXs to protect themselves and maintain market order under extreme market conditions. It distributes a portion of the liquidation losses to profitable traders to avoid bankruptcy or systemic risk.

For extreme traders holding large profitable positions, ADL is a significant uncertainty factor. Even if they successfully predict market direction and achieve substantial unrealized gains, they may be forced to liquidate their profitable positions due to the losses of others, thus losing part of their potential profits. This uncertainty regarding profits is something extreme traders are unwilling to face.

Differences in Hyperliquid's Handling of Profitable Positions

The main difference between Hyperliquid and CEXs in handling profitable positions is that it does not include the ADL feature. This means:

Profitable positions are not threatened: Even in extreme market volatility leading to large-scale liquidations, profitable traders do not need to worry about their positions being automatically reduced by the system. This provides extreme traders with greater certainty and security, as their profits will not be used to cover the losses of other traders.

HLP vault bears the losses: If the liquidation process results in bad debts, these losses will be borne by the HLP vault, rather than being distributed to profitable traders through ADL. This is thanks to the ample liquidity and risk management capabilities of the HLP vault.

This difference makes Hyperliquid more favorable to profitable positions under extreme market conditions, allowing extreme traders to hold large profitable positions with greater peace of mind.

### How HLP Vault and Funding Rate Algorithm Work Together to Attract Extreme Traders

The unique design of the HLP vault and the funding rate algorithm work in synergy, enabling Hyperliquid to attract and support extreme traders like James Wynn in executing massive trades, specifically reflected in the following aspects:

1. (Near) Infinite Liquidity and Depth (HLP Vault):

Capacity to Absorb Large Orders: The HLP vault, as the platform's primary market maker, can provide significant depth with its large capital pool and automated market-making algorithms, thus absorbing ultra-large orders. For traders like James Wynn, who wish to establish positions worth tens of millions or even hundreds of millions in a single trade, this is a fundamental requirement. Traditional CEXs may experience excessive slippage or even be unable to fully execute such large single orders.

Low Slippage Trading: Because the HLP vault provides continuous liquidity, traders can enjoy low slippage even when executing large trades, ensuring that their trades can be executed at prices close to the market best price, which is crucial for high-frequency and extreme trading.

2. Predictable Risk Costs and Market Calibration (Funding Rate):

Skewed Dealer Advantage: Encourages more investors to place their funds in the HLP vault to provide more liquidity and earn more fees, creating a flywheel effect.

Clear Funding Cost Expectations: The transparency of the funding rate algorithm and its high-frequency collection characteristics allow traders to relatively accurately predict the funding costs of holding large positions. Although the funding rate may be high, it is transparent and calculable, allowing traders to incorporate it into their risk models. For extreme traders, this means they do not take risks under unknown costs.

Price Anchoring and Arbitrage Opportunities: The existence of the funding rate and its high cap ensure that perpetual contract prices can quickly revert to spot prices. This means that even with significant price deviations, the market will have a strong self-correcting mechanism. This provides extreme traders with arbitrage opportunities, allowing them to profit from the price differences with the spot market by bearing the funding rate or quickly establishing positions when prices deviate, anticipating a return to normal.

3. Fund Security and Freedom (Non-Custodial & No ADL):

Freedom of Fund Control: Hyperliquid's non-custodial nature ensures that traders like James have complete control over their substantial funds, allowing them to withdraw at any time without worrying about platform restrictions or potential fund freezes. This provides significant psychological security against the backdrop of frequent withdrawal issues or fund freezes on centralized platforms.

Profits Are Not Threatened (No ADL): Hyperliquid does not adopt the ADL mechanism, meaning that even during extreme market volatility leading to large-scale liquidations, James's profitable positions will not be automatically reduced by the system. This allows extreme traders to hold profitable positions with greater peace of mind, without worrying that their profits will be used to cover the losses of other traders, thus maximizing the protection of their potential gains.

In summary, the HLP vault provides unparalleled liquidity and trading depth, while the funding rate algorithm offers transparent and effective risk cost management and market price calibration mechanisms. Coupled with the freedom of funds provided by the non-custodial model and the absence of ADL, these factors create a unique trading environment that allows Hyperliquid to meet the needs of extreme traders like James Wynn, who pursue high leverage, large positions, and value fund security and profit protection.

### In Closing

The rise of Hyperliquid indicates that the market is evolving. High-performance (real yield) decentralized exchanges, despite having some centralized elements in practice, are carving out a significant niche by offering functionalities that traditional CEXs cannot meet or restrict (such as high leverage, low friction, and community liquidity).

This suggests that future derivatives trading may become more fragmented and specialized, with different platforms providing varying services based on traders' diverse needs, risk preferences, and acceptance of decentralization.

Between the two, there is no right or wrong, only different choices of risk preference and strategy style.

The way out for leverage, the return of contracts.

Who is taming desire? Who is releasing volatility? Who is returning to humanity?

May we always maintain a sense of reverence for the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。