Tom Lee Ethereum Play: From Bitcoin Mining to ETH Staking

Tom Lee Ethereum Vision: Building the MicroStrategy of ETH

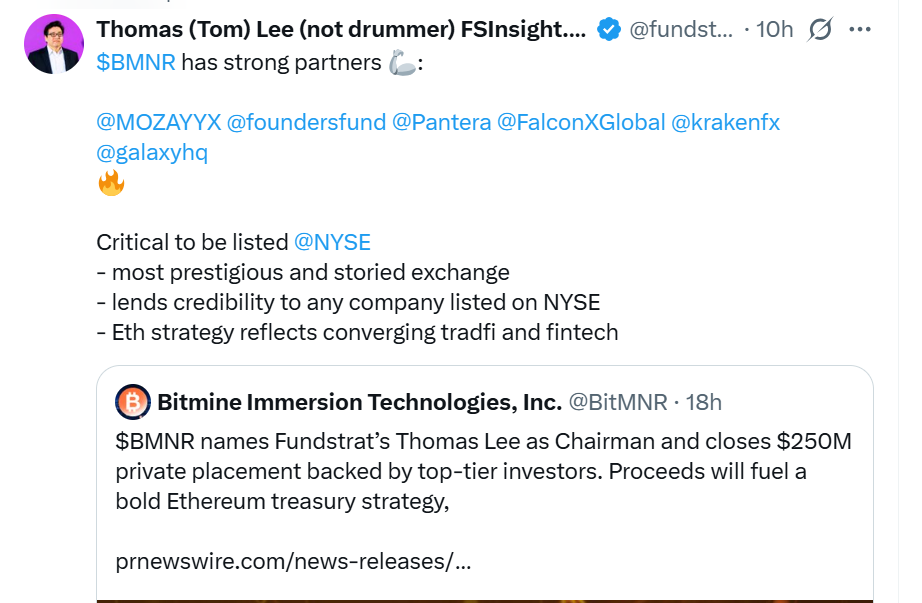

BitMine announced a $250 million private placement to implement a buying strategy around ether, which it aims to make as its primary treasury reserve asset. The stock of BitMine Immersion Technologies soared 400% on Monday on the company's announcement that it would be changing course to introduce another ETH treasury play, this time involving a well-known Wall Street figure.

Tom Appointed as Chairman to Drive Ethereum Focus

As part of its treasury strategy, BitMine announced a $250 million private placement to stack ether and the appointment of Tom Lee from Fundstrat as Chairman.

Participants in the raise included Pantera Capital and Galaxy Digital, two cryptocurrency companies that have taken part in past publicly traded treasury bets. "This transaction accurately reflects the rapid and ongoing convergence of traditional financial services and crypto, as it involves the highest quality investors across TradFi and crypto venture capital," he said in a statement.

Tom Lee Ethereum Call: Will ETH Become the Next Bitcoin? Are You Holding Enough?

Tom Lee's Ethereum stock surged 700% in one day, indicating a strong bullish trend in the cryptocurrency market. He believes that this cryptocoin is the backbone of blockchain and is the largest L1 in crypto, with around 60% of crypto built on it. As traditional finance shifts to blockchain, Lee continues to believe that this may be a major benefit. In particular, there may be more activity on the chain and a higher demand for L1 coin if more dollars enter the system as stablecoins. As coin gains traction, .eth domains are solidifying their place in the digital identity landscape. They're not just addresses; they're a statement of presence in the Web3 ecosystem.

Goal is to buy Ethereum due to rising interest in stablecoins.

His appointment comes amid growing interest in stablecoins , following the successful IPO of Circle and potential legislation pushing through Congress. He believes the financial services industry and crypto are converging, with stablecoins being the ChatGPT of crypto due to viral adoption by consumers, banks, and even Visa. He emphasizes the importance of creating a project that accumulates this L1 token to protect and influence the stablecoin network.

Why is Tom Lee converting a bitcoin mining company to an ETH treasury and staking company?

The discussion around Ethereum's evolving role in the digital asset ecosystem is indeed compelling. Future banks will use ETH as their architecture, with Goldman and JPMorgan deploying stablecoins on the Layer 1 blockchain. To secure these stablecoins, banks will acquire and stake Ethereum . Commercial banks will first buy and stake it, followed by central banks. This will lead to becoming a world reserve asset, similar to how Bitcoin was done with Bitcoin years ago. An ETH treasury vehicle will help banks navigate this trend.

ETH being compared to Bitcoin reflects its growing impact in the blockchain space. While their use cases differ, the focus on smart contracts and decentralized applications might shift dynamics in the crypto landscape. Worth monitoring for tech evolution, not just market trends.

Also read: Arbitrum Price Crash Follows Whale Moves: What is Next for ARB?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。