DAT allows stock market investors to gain exposure to crypto assets through familiar tools and intermediaries.

Author: Cosmo Jiang, General Partner

Compiled by: Deep Tide TechFlow

Pantera Capital has created a fund to provide investors with opportunities related to Digital Asset Treasury (DAT).

As a pioneer in this emerging industry, Pantera has firmly established itself as a cornerstone investor in some of the first DAT projects in the U.S., including DeFi Development Corp. (DFDV) and Cantor Equity Partners (CEP). Our rigorous due diligence process has facilitated several high-performing investments in a short period.

Pantera's early involvement and initial successes have led the way for this growing trend. Therefore, we are fortunate to be the preferred partner for many potential DAT teams, many of which are still in the conceptual stage and seek our strategic guidance to mitigate potential risks.

We currently have a strong reserve of investment opportunities and plan to open participation channels for investors through the Pantera DAT Fund. Over the past few months, we have evaluated over fifty project proposals and summarized the key factors for success and failure, further optimizing our investment due diligence process and our ability to support the companies we invest in. Pantera's investment strategy centers on wisely supporting high-quality entrepreneurs, and we are excited to continue practicing this philosophy in this emerging field.

Timely Opportunity

This year's stock market has shown a traditional investor embrace of digital assets—whether through ETFs, such as Circle's IPO, or forms like DAT. A significant factor driving this trend is Coinbase's inclusion in the S&P 500 index. Today, every fund manager globally is compelled to incorporate digital assets into their index systems and must pay attention to them. We believe this trend is just beginning and will become a long-term and robust driving force, extending this growth cycle.

DAT represents a new frontier for public market exposure to crypto assets, benefiting from this broader structural trend. DAT allows stock market investors to gain exposure to crypto assets through familiar tools and intermediaries. We believe the ecosystem of digital asset treasury companies will significantly expand, and there is still an opportunity to be at the forefront of this field.

Therefore, we believe investing in this fund is timely. Being at the beginning of an emerging category is rare, and identifying and acting quickly is crucial to seizing this investment opportunity.

In our previous blockchain letter, we elaborated on the investment logic of investing in DAT and the reasons it may trade at a premium to its net asset value (NAV) in the long term. In this context, we hope to further explain why the investment strategy of the Pantera DAT Fund is attractive.

Asymmetric Risk/Return Potential

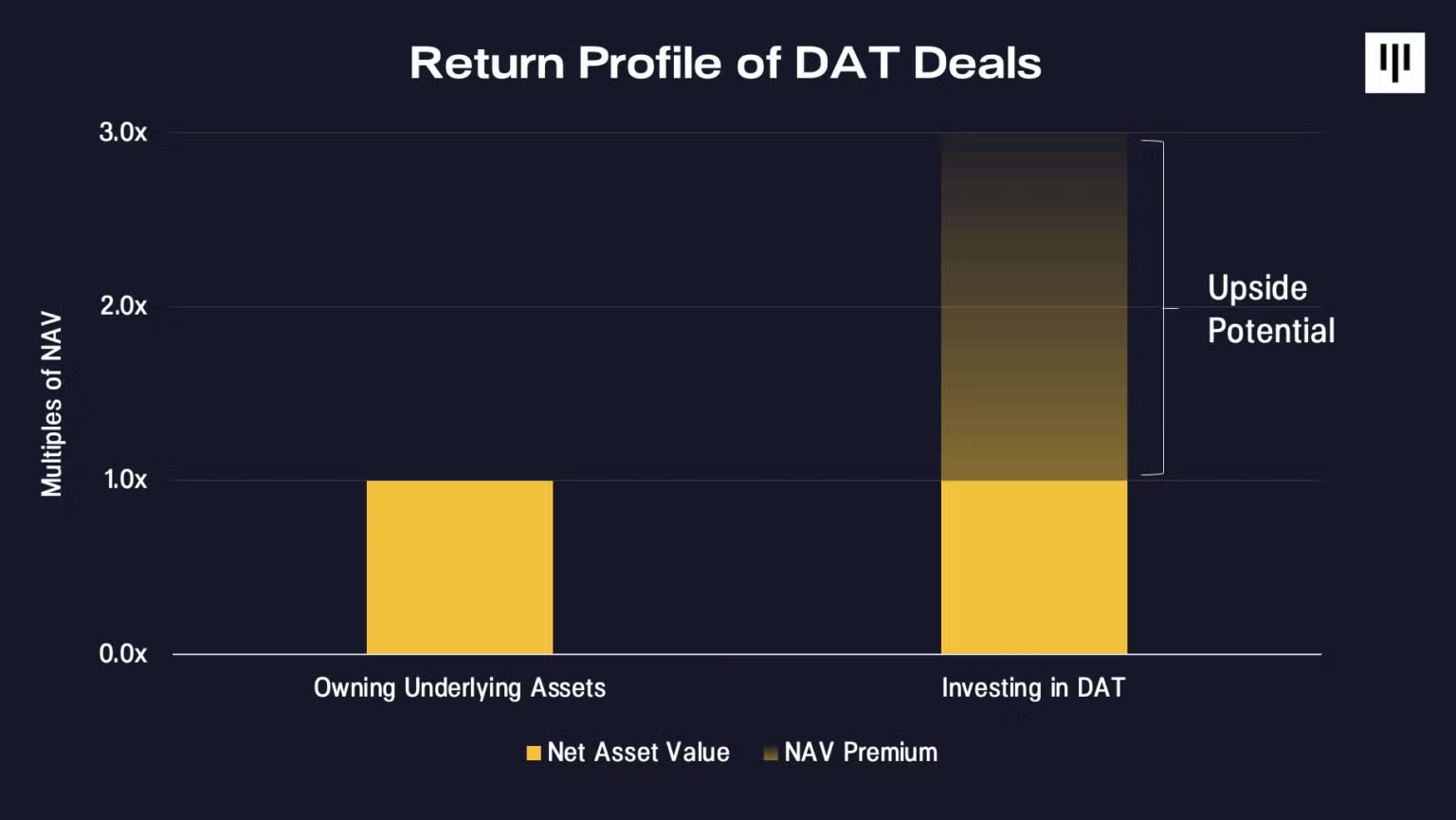

The Pantera DAT Fund can participate in the initial investments of DAT projects, meaning we invest at prices close to or equal to the underlying token value (1.0x NAV), even before DAT trades publicly and potentially at a premium. We believe this approach has asymmetric risk/return characteristics, presenting a scenario of "high upside, low downside" compared to directly holding the underlying tokens.

Here is a simple visual representation of the asymmetric return characteristics of DAT investments.

Upside Potential—"Positive Win":

The short-term upside potential of DAT investments lies in their possible NAV premium (noting that similar DAT projects trade at multiples of 1.5x to 10.0x NAV), while the long-term upside potential comes from the growth of NAV per share and the ability to maintain a premium.

Downside Risk—"Negative Loss Minimization":

Downside risk is limited because even if DAT fails to trade at a premium, the investment price for investors is around 1.0x NAV, allowing them to retain their proportionate share of the underlying NAV and the returns from the underlying tokens (e.g., spot BTC, ETH). Additionally, we believe that as the market becomes increasingly saturated, if DAT begins to trade below 1.0x NAV, consolidation opportunities will arise. A crucial part of the due diligence process is screening management teams with incentive mechanisms aligned with investor interests to ensure they can take the right actions in adverse situations—whether through mergers and acquisitions (M&A) or stock buybacks, rather than blind expansion.

Currently, market enthusiasm for DAT is very high, and the growth rate of this trend far exceeds our expectations when funding the first DAT project. Like any industry, we expect excess returns to attract competition, thereby compressing returns. Therefore, it is particularly important to seize this window of opportunity in this emerging investment category. DAT's price volatility is high, and this volatility will persist. As with other new trends, some projects will succeed, while others will fail. We firmly believe that through our intellectual leadership, value-added strategic guidance, transaction structure design, and rigorous due diligence process, we can continue to drive success.

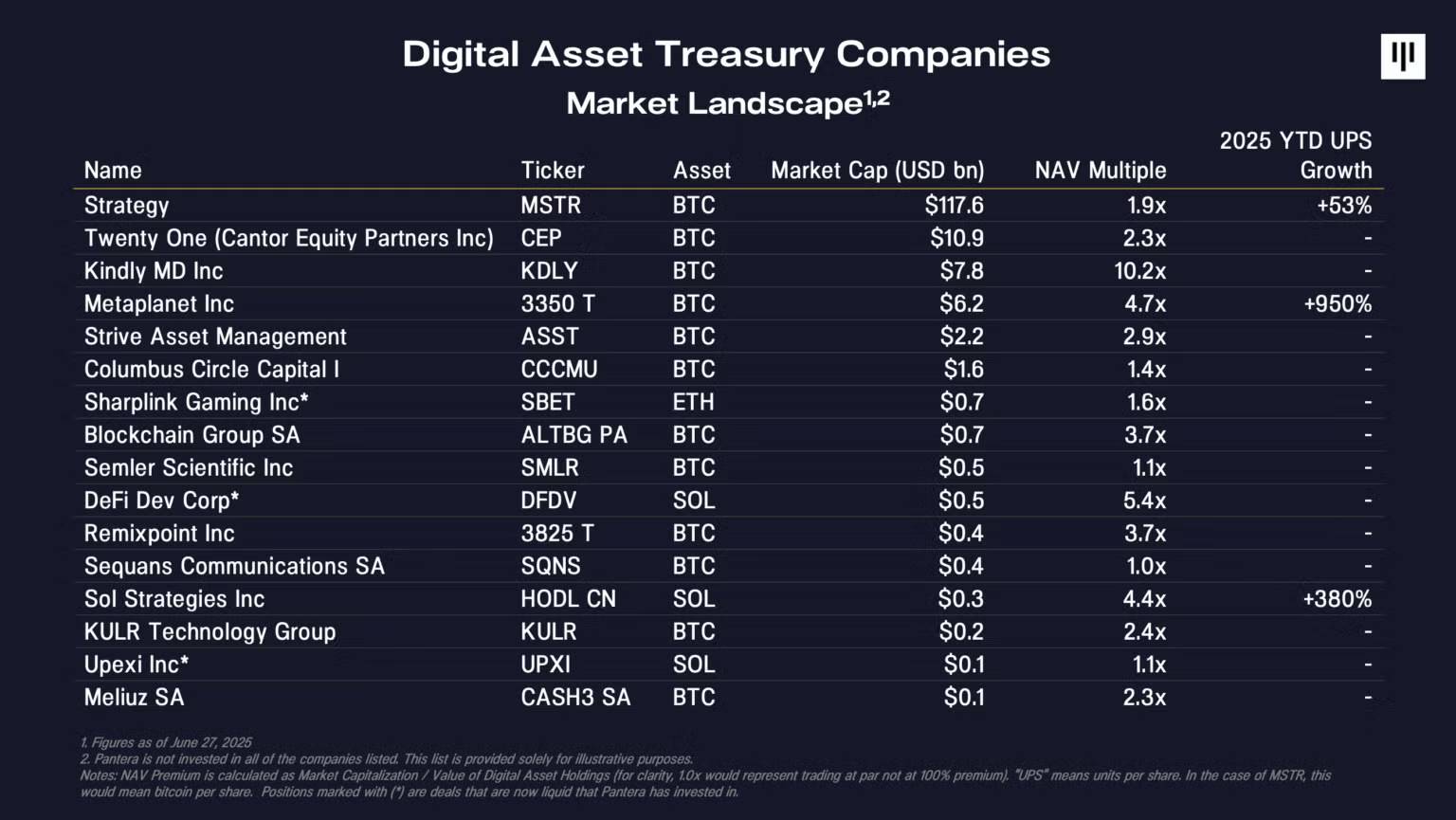

DAT Market Landscape

Thematic Discussion: The Investment Logic of Digital Asset Treasury Companies

Fundstrat Managing Partner and Research Head Tom Lee and Pantera General Partner Cosmo Jiang will delve into the growth trends of DAT. The two will discuss common concerns surrounding DAT and elaborate on the investment logic in this new field of public market crypto assets.

Pantera is proud to be a cornerstone investor in BitMine Immersion Technologies, where Tom Lee will serve as the company's chairman and assist in formulating the company's Ethereum treasury strategy. This is the first of many transactions we expect to complete through the Pantera DAT Fund.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。