Circle Banking License Could Reshape Stablecoin Trust in the U.S.

Circle, the company who introduced the USDC stablecoin, is taking a big step. It has applied for a national trust bank license in the U.S. This comes after its IPO on June 5, which gave it a huge $18 billion valuation. As reported by the Reuters, the financial institution would be called First National Digital Currency Bank, N.A.

If approved, the Circle Banking License will allow the company to hold its own reserves and store digital assets for big clients.

Circle Moves to Secure U.S. Trust Bank Status

The application of the Circle Banking License is different from a normal bank status. It cannot take cash deposits or provide loans. But it will be able to:

-

Safely hold its own USDC reserves

-

Store tokenized assets like stocks and bonds on the blockchain

-

Offer custody services to institutional investors

It’s reserves are now held by BNY Mellon and managed by BlackRock. These comprise the U.S. Treasury bills and cash. With the new authority, firm will handle most of these reserves independently.

Why Does This Matter?

The company aims to have robust regulations and win the trust of users and regulators. Its CEO, Jeremy Allaire, explained that going public and seeking a bank charter demonstrates that the organisation is serious about trust and compliance.

If the Circle Banking License is approved, it will join Anchorage Digital as one of the only crypto firms with this type of license. It shows that crypto firms are ready to work under U.S. rules.

New Laws Could Help Stablecoins

This announcement is during the time, the U.S. lawmakers are on the edge to passing a new stablecoin law called the Genius Act. The law would require companies to back stablecoins with real money and reveal what assets they hold every month.

The Senate has already passed the Genius Act . The House of Representatives is expected to vote on it soon. If the law passes, the organisation will already be in a good position to follow it.

Strong Market Response

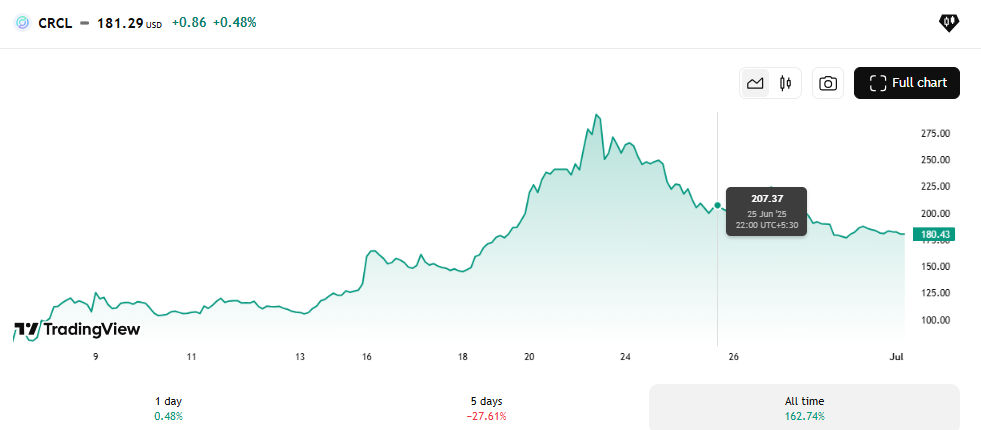

Circle’s IPO was a big success . Began trading at the NYSE as CRCL. On the first day only, the stock surged by 168%.

Source: TradingView

This reflects that the company has investors’ confidence. If the Circle Banking License is granted, it could bring more trust to USDC and stablecoins in general.

What Does This Means for Crypto?

There is a chance that a Circle Banking License would make cryptocurrency more adoptable in the real world. Stablecoins have been used as an intermediate transmitter of money among cryptocurrencies. However, they had the possibility of being used in the everyday payment as more rules and trust were added.

By managing its own reserves and following U.S. rules, the company is setting a high standard. This move will encourage more companies to follow the similar path. Other major organizations operating in the crypto industry like Ripple and OKX have chances to introduce its IPO and then look for such statutory status at the global level.

Final Thoughts

The Circle Banking License is not just about one organisation. It depicts how the digital assets sector is transforming. With robust regulations, stablecoins like USDC can be secure and more trusted. This could assist bring crypto and traditional finance closer than ever before.

Also read: Can Trump Powell Rate Cut Note Start Word War? 1% Pivot Says Yes免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。