The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable cryptocurrency market information to the vast number of coin friends. I welcome all coin friends to follow and like, and I refuse any market smoke bombs!

Bitcoin has once again risen by a thousand points, and a portion of the previous layout has come to an end. Looking at the performance over a period of time, it has finally eased a bit. I will take some time to answer some questions for everyone. Many novice users find it almost impossible to get started in such a market. Since the beginning of this year, I have gained a lot of followers, most of whom are novices and are mainly focused on learning. Every user who finds Lao Cui is simply hoping that Lao Cui can guide them. It can be said that since two years ago, Lao Cui has hardly guided users, not because of the amount of funds. It is difficult to encounter users who resonate with oneself; users with a certain judgment ability generally disdain to seek help. However, the thinking of most users is difficult to understand and meet certain requirements. Therefore, Lao Cui has also eliminated this link, mainly responding to questions for most users. If you have any questions about the cryptocurrency circle, you can ask Lao Cui; but currently, Lao Cui indeed has not expanded other businesses and walks with consensus!

Returning to the market itself, most new users lack a basic judgment of the market. They find it difficult to understand the basis of market fluctuations, and many users do not understand the concept of blockchain, nor do they grasp the underlying logic of the cryptocurrency circle. Most have only heard that friends can profit, and the worst situation is this. The unified central idea is that if my friends can do it, I can too. Little do they know that the market a year ago is very different from now; the previous cryptocurrency circle was almost entirely capital speculation, but now it has legal support and backing from traditional capital. If one continues to view the current market with the previous perspective, the only outcome is loss. This ties into the fact that most users who find Lao Cui always ask which coins can multiply several times. Users who ask such questions are most likely novices. The premise of the cryptocurrency circle's compliance is to eliminate bubbles and major fluctuations. An extremely unstable market will only cause panic, which also indicates the huge potential of this market. Compared to the previous market trends, the current cryptocurrency circle is indeed much healthier, at least there is no situation of halving in a day.

If we view the current cryptocurrency circle from the perspective of compliance, everyone may have a clearer understanding of what was emphasized in previous articles, which you may have somewhat forgotten. The fundamental principle that all financial markets follow is the pricing between buyers and sellers, and all fluctuations are merely a struggle for pricing power. A simple example is that although housing prices have been falling, as long as you do not intend to sell your house, fundamentally speaking, the house is still worth the price you purchased it for. It is the change in supply and demand that leads to extreme instability in housing prices. In the context of the cryptocurrency circle, many friends think that the first user who bought a pizza with tens of thousands of bitcoins was extremely foolish. However, at that time, someone recognized Bitcoin, which was a reflection of its value. At that time, Bitcoin was only worth that price, but it granted Bitcoin a real trading value. Without the utilization of gray industries, there would be no current market value of Bitcoin; therefore, legal compliance for Bitcoin is not necessarily an extreme benefit. It is possible that after Bitcoin, other cryptocurrencies will emerge to replace this application value.

Bitcoin itself is a conceptual currency, and the prominence of such issues can cause excessive fluctuations in the cryptocurrency circle. It seems easy to profit, but the risks are also enormous. Those who are optimistic are extremely confident, while those who are not optimistic are extremely dismissive. Therefore, for us investors or speculators, our focus should be on profit. As long as we can profit, we just need to follow this step. It is not as difficult as you understand; as long as you believe, even if Bitcoin is at 1 million each, there will still be people willing to buy. The total market value of 21 million bitcoins can exceed 21 trillion, and everyone can actively hold at this stage. This is unrelated to the financial market; it is all about belief. Lao Cui himself does not possess such belief; being able to reach a market value of 10 trillion is already satisfying. Many friends particularly like to understand the financial market according to their habitual thinking. They are unwilling to break their own cognition and follow mainstream schools to understand the cryptocurrency circle, but is what you consider the mainstream school necessarily correct?

At least when Lao Cui first encountered Bitcoin, it was less than 2000 dollars, and it even fluctuated down to a few hundred dollars. The result told Lao Cui that the value of Bitcoin had not yet been fully realized, and there was still room for growth in the future. These gains cannot lie, and the results will not deceive. If everyone is simply seeking stable returns, they should not come to the cryptocurrency circle; the returns in the cryptocurrency circle far exceed the public's understanding. Or rather, the concept of WEB3 exceeds the current technological bottleneck, so many friends cannot see the future development. Just like ten years ago, no one believed that housing prices would fall, and twenty years ago, no one believed that the future would be dominated by the internet era. If you cannot see the development of the times, you cannot define the problems of the era; if you cannot see such problems, you can only blame your own cognition. The bible of the investment world still holds that the best investment opportunity is in original stocks, and the second-best opportunity is now.

I have digressed a bit; Lao Cui just wants to say that if you come to find Lao Cui merely to face the cryptocurrency circle with the attitude of multiplying your investments, you should not seek psychological comfort from Lao Cui; you can go pray to religion. If your core investment philosophy cannot synchronize, then you can look for other analysts; there will always be a match. Lao Cui's philosophy is also very straightforward: if you have other idle assets and can accept losses, you can speculate on so-called small coins. But if you want to consult Lao Cui on which coins are worth investing in, Lao Cui has only one answer: that is Bitcoin. Perhaps influenced by the times, all investments hope to follow their intrinsic value. Unless new technologies emerge, Lao Cui will change the original idea; as long as it has not been tested for value, Lao Cui will not recommend you to invest. Whether it is Trump coin, oil energy and military sectors during the Russia-Ukraine conflict, or the recent Bubble Mart that has led everyone to short, these in Lao Cui's eyes are not all predictions but necessary processes of event development. Therefore, many friends will say that Lao Cui's vision is very broad; Lao Cui himself does not think this is personal ability, but rather a dividend of the times!

Lao Cui summarizes: Today's article does not revolve around explaining trend movements. I hope that through this article, novice users or those who want to profit from the cryptocurrency circle can recognize the truth of the cryptocurrency circle. Discard some unrealistic fantasies; the essence of the cryptocurrency circle cannot escape the concept of traditional finance, where there are gains, there are losses. If such users cannot understand the risks associated with high profits, consulting Lao Cui is not of much significance; Lao Cui will only pour cold water on everyone. And to achieve high profits, it indeed requires passionate enthusiasm and extremely confident cognition. Lao Cui does not belong to this school; wanting to double profits in half a year is extremely common in the cryptocurrency circle, but Lao Cui will definitely not promote this spirit. Because to double profits, one must accept the clearing of principal, and this probability is also very high in the cryptocurrency circle. The 80/20 rule applies to all markets, and most users can only use the chips in their hands to support capital. Therefore, the paths of most users and Lao Cui are opposite; Lao Cui advocates steady profits, not gambling with principal. Wealth is sought in danger, and one can also lose from danger. In summary, I will still provide a brief summary of the recent market.

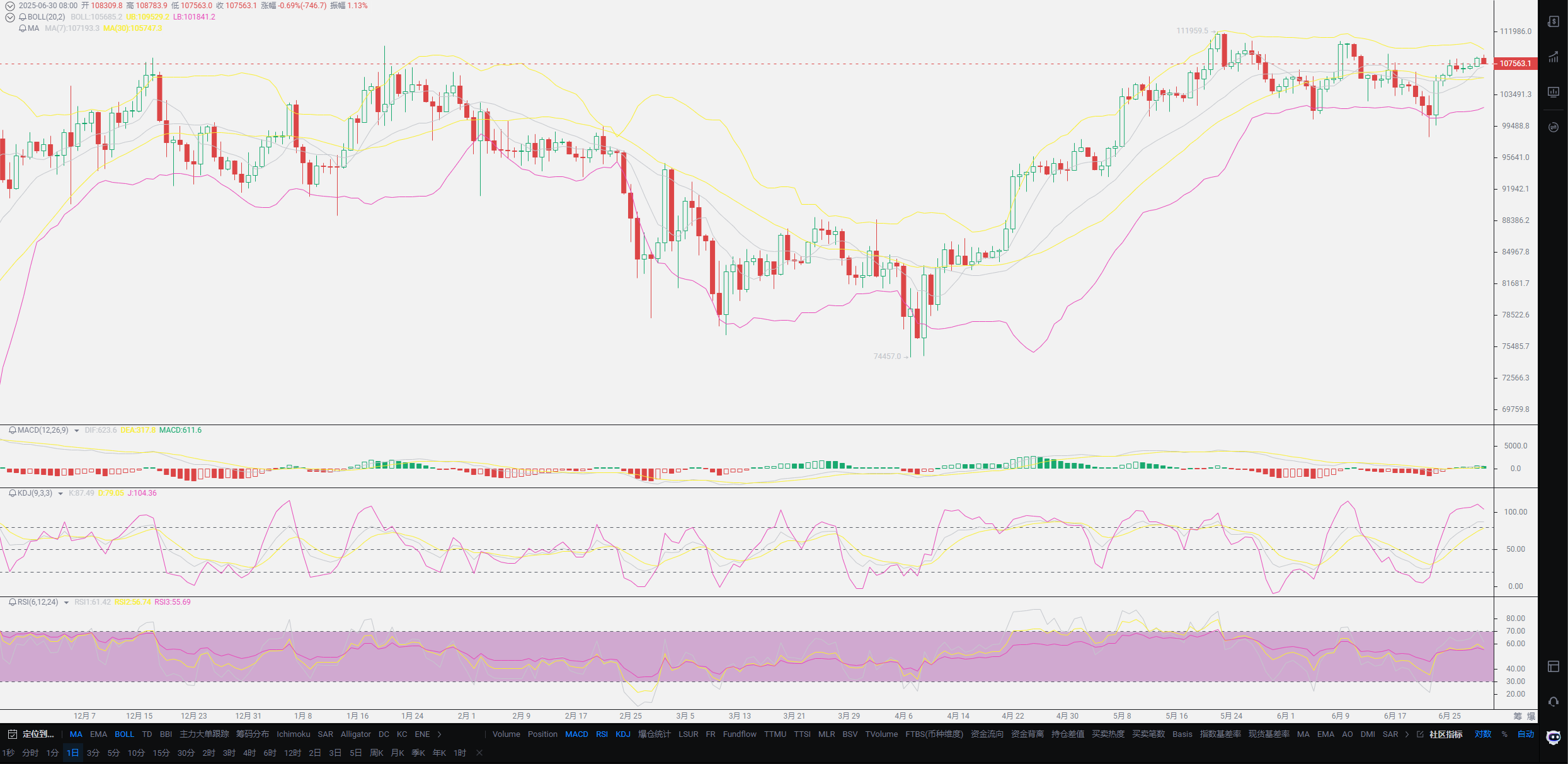

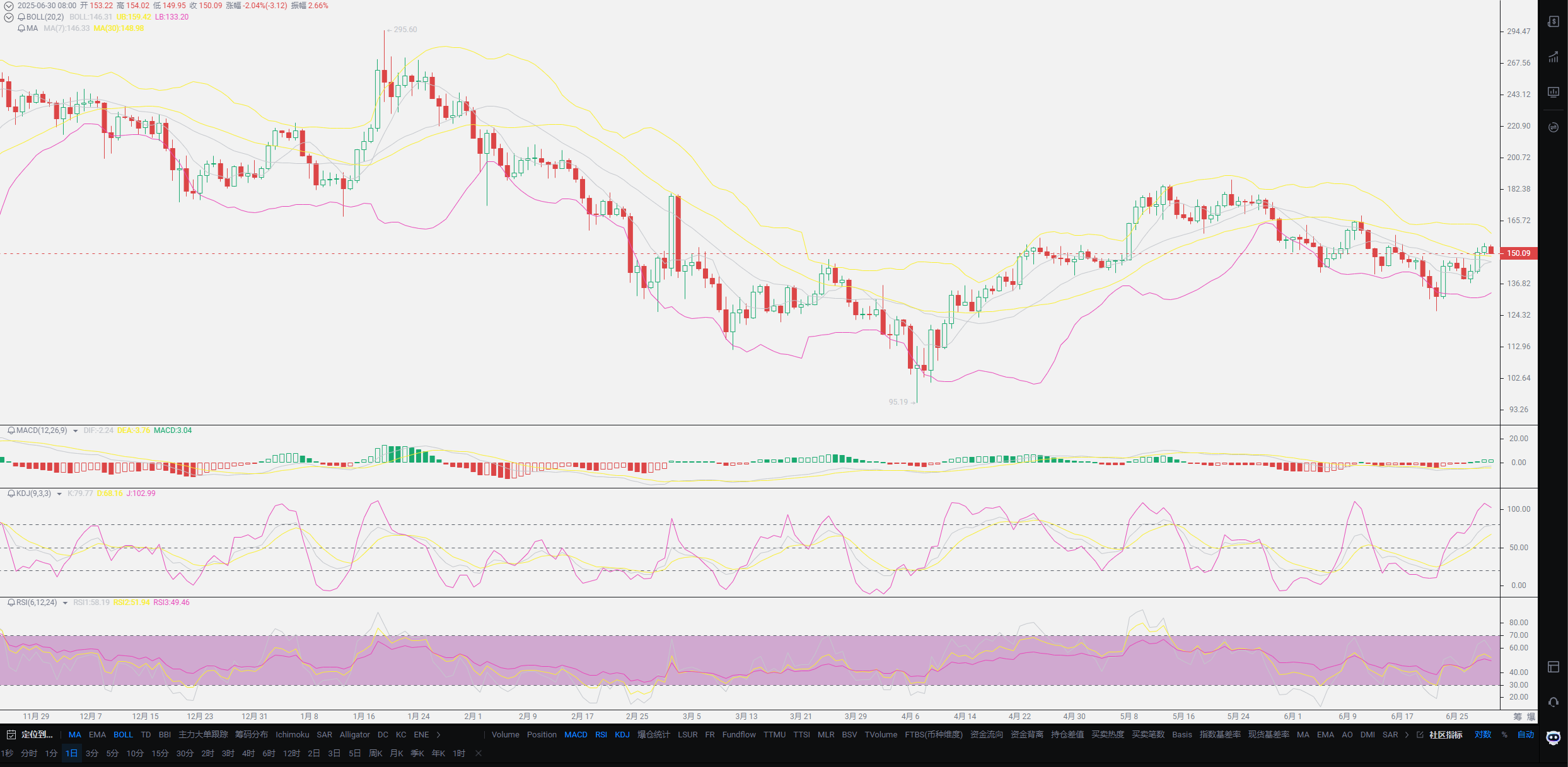

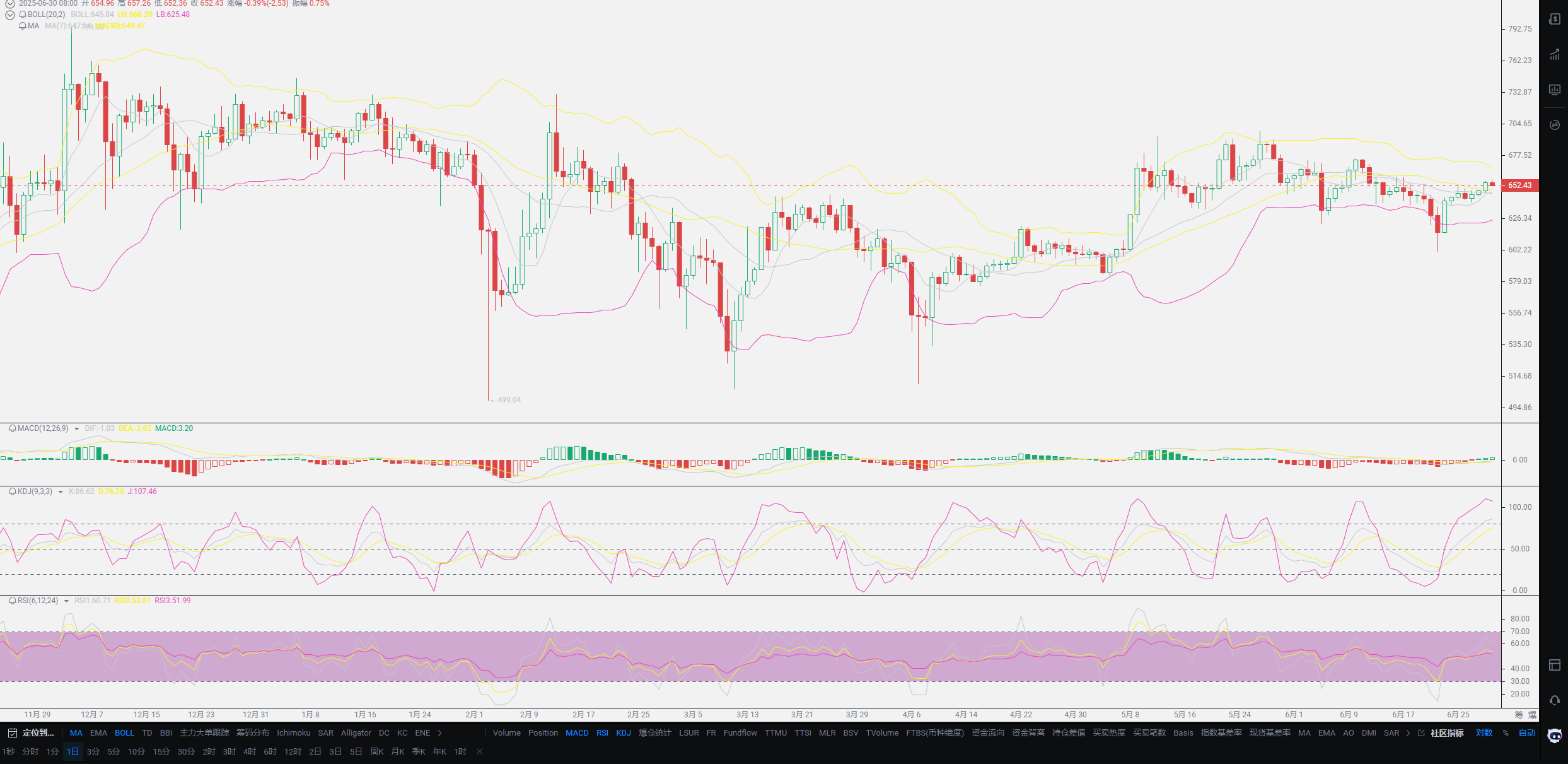

At this stage, Bitcoin or the cryptocurrency circle seems to be steadily moving towards a bullish trend, but take a look at the situation of Ethereum. As long as Ethereum cannot break through the original price range of 2700-2800 in the short term, it proves that small coins have not risen. Including SOL, such coins are still in a downward phase, with only Bitcoin rebounding sharply. At the same time, it further proves that the capital in the cryptocurrency circle is not stable. With the emergence of cryptocurrency stablecoin concept stocks, it has indeed diverted a large portion of capital, which has a significant impact on small coins and is a competitive relationship. In the short term, Lao Cui is not optimistic about the rebound of small coins, so shorting will continue. The results will also be presented to everyone at the interest rate cut meeting; before the interest rate cut, it is best to focus on short positions, and early ambush is just waiting for the delayed news of the interest rate cut to be released. The data that the Americans are currently showing us also provides no reason for an interest rate cut. Contract users should always remember that a new high is the time to short. As for spot users, Lao Cui previously advised you to enter a portion; if you follow Lao Cui's instructions now, most should also be in a profitable state, with an average price around 104,000, and you can consider exiting, waiting for the arrival of the short before re-entering! This wave of shorts should have even lower positions; if you have holdings, you can also consult Lao Cui about the exit position!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation, strategizes the big picture, does not focus on one piece or one area, and aims to win the game, while the novice fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。