Good evening, brothers!

Assets can generally be divided into three main categories:

The first category is currency-based assets. This category includes money market funds, bonds, mortgages, bank deposits, etc. These assets are usually considered to have a high safety factor, but this is not the case. Due to the existence of inflation, holding currency-type assets inevitably leads to a continuous shrinkage of purchasing power. The assets that seem the "safest" are actually the most "dangerous." As the popular saying goes, some seemingly stable jobs are just "stably poor."

The second category is non-yielding assets. Take gold as an example; it has little practical use and cannot reproduce itself. The vast majority of people invest in gold because they believe its price will continue to rise, but this is not the case. According to statistics from Professor Jeremy Siegel, from 1802 to 2012, a $1 investment in gold could only appreciate to $4.52, while a $1 investment in stocks could appreciate to $704,997.

The third category is income-generating assets. Farms can produce corn, real estate can generate rental income, and some excellent companies can generate profits; these all belong to productive assets. For these cash "cows," their asset value does not depend on trading but on their ability to produce. This type of asset does not require a "white knight" and can effectively combat inflation, making it our ideal investment choice.

When we make money in the market, we are turning our funds into assets that can create value!

……

For investors focused on the development of virtual assets in Hong Kong, the new stablecoin regulatory framework effective August 1 in Hong Kong provides a clear industrial picture.

According to news from the Chasing Wind Trading Desk, this week, JPMorgan and Guosen Securities published research reports indicating that a global market exceeding $230 billion is welcoming compliance entry in Hong Kong. For investors, this means that stablecoin issuers, licensed virtual asset exchanges, and related financial and technology service providers in Hong Kong will become direct beneficiaries.

BTC: On the 4-hour level, the price continues to stay above the middle band of the Bollinger Bands, and the price trend remains strong. The short-term market is approaching overbought, so caution is needed for a price correction.

On the daily level, the price continues to stay above the moving average support, and the price trend is strong.

In summary, the support level is 108300, and the resistance level is 108600.

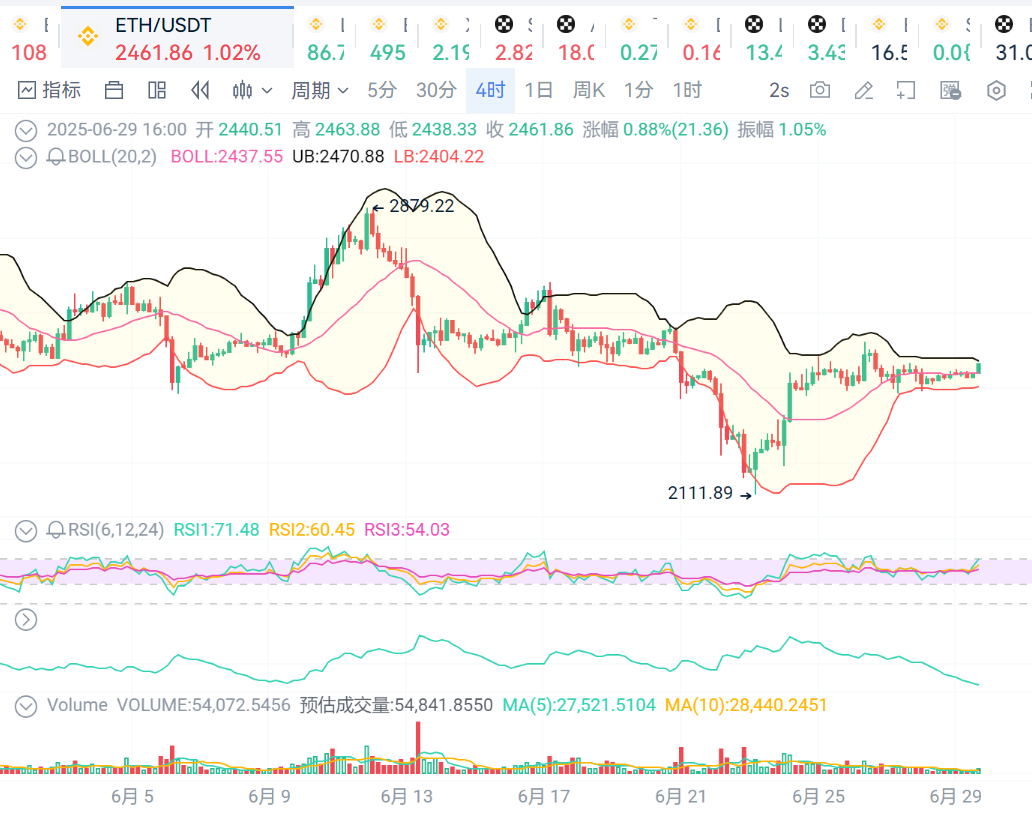

ETH: On the 4-hour level, the price continues to stay above the middle band of the Bollinger Bands, and the price trend is strong, with a support level of 2450 and a resistance level of 2470.

LTC: The price continues to stay near the upper band of the Bollinger Bands, and the price trend is strong, with a support level of 85 and a resistance level of 88.

BCH: The price continues to stay near the middle band of the Bollinger Bands, and the price trend is volatile, with a support level of 480 and a resistance level of 510.

That's all for now, good night!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。