Author: Prathik Desai

Translation: Block unicorn

Introduction

Mr. Kennedy made his fortune during Prohibition (the period from 1920 to 1933 when the sale, production, and distribution of alcoholic beverages were banned in the U.S.) by running a liquor business, and after Prohibition ended, he became the first chairman of the Securities and Exchange Commission. It is said that President Roosevelt remarked about this appointment, "Let the thief catch the thief." Kennedy then passionately cleaned up Wall Street, implementing rules that still govern the securities market today.

A similar story in the modern cryptocurrency space is the transformation of OKX from a regulatory outcast to a potential IPO candidate.

According to a report on Sunday, the Seychelles-based cryptocurrency exchange OKX is considering going public in the U.S., just four months after agreeing to pay a $505 million fine to the U.S. government for operating without a license.

In February 2025, this second-largest centralized exchange (CEX) in the world admitted to processing over $1 trillion in unlicensed transactions involving U.S. users, knowingly violating anti-money laundering laws, and agreed to pay a hefty fine of over $500 million. Now, they hope to invite U.S. investors to purchase shares in the company.

Nothing signifies "we have turned a new page" more than voluntarily accepting the quarterly earnings call requirements, disclosures, and filings requested by the U.S. Securities and Exchange Commission (SEC).

Can a cryptocurrency company succeed on Wall Street? Circle has recently proven that it is possible. In the past few weeks, this USDC stablecoin issuer has shown that if crypto companies take a compliant route, investors will eagerly invest.

Circle's stock price skyrocketed from $31 to nearly $249 in just a few weeks, quickly creating billionaires and setting a new precedent for cryptocurrency IPOs. Even Coinbase, the largest cryptocurrency exchange in the U.S., which has been public for four years, saw a 40% increase in the past 10 days, trading close to its highest price in four years.

Can OKX achieve similar success on the exchange?

Circle's regulatory record at the time of its IPO was very clear. They had been testifying in Congress and publishing transparency reports for years. Meanwhile, OKX recently acknowledged facilitating $5 billion in suspicious transactions and criminal proceeds and had to make strong commitments to avoid repeating past mistakes.

Different CEX, Different Stories

To understand OKX's IPO prospects, let's look at Coinbase, the only large cryptocurrency exchange that has successfully entered the public market. OKX and Coinbase earn money in the same way: by charging fees for each cryptocurrency transaction.

When the crypto market is booming, like during a bull market, they can make a lot of money. Both platforms offer basic cryptocurrency services: spot trading, staking, and custody services. However, their business development approaches are vastly different.

Coinbase took a compliance-first approach. They hired former regulatory officials, built institutional-grade systems, and spent years preparing to go public on Wall Street. This strategy paid off, and they went public in April 2021, with a market cap now exceeding $90 billion, despite the volatile crypto market.

In 2024, Coinbase's average monthly spot trading volume was $92 billion, primarily from U.S. customers paying high fees for regulatory certainty. This is the tortoise strategy: slow and steady, focusing on doing well in one market.

OKX, on the other hand, chose the hare strategy: act quickly, capture global market share, and consider regulatory issues later. From a business perspective, this strategy has been very successful.

In 2024, OKX's average monthly spot trading volume was $98.19 billion, 6.7% higher than Coinbase, serving 50 million users across over 160 countries. With their derivatives trading (holding a 19.4% share of the global market), OKX's cryptocurrency trading volume far exceeds that of Coinbase.

OKX's daily average spot trading volume is about $2 billion, with derivatives trading exceeding $25 billion, while Coinbase's figures are $1.86 billion and $3.85 billion, respectively.

The increase in speed comes with rising costs. Coinbase has established a good relationship with U.S. regulators, while OKX has actively sought U.S. customers despite being banned from operating in the U.S. Their attitude seems to be "ask for forgiveness, not permission," a stance that has worked until they had to seek forgiveness from the Department of Justice.

There is one problem: the revenue of cryptocurrency exchanges entirely depends on people's continued enthusiasm for trading cryptocurrencies. When the market is hot, exchanges make a fortune. When the market cools, revenues can plummet overnight.

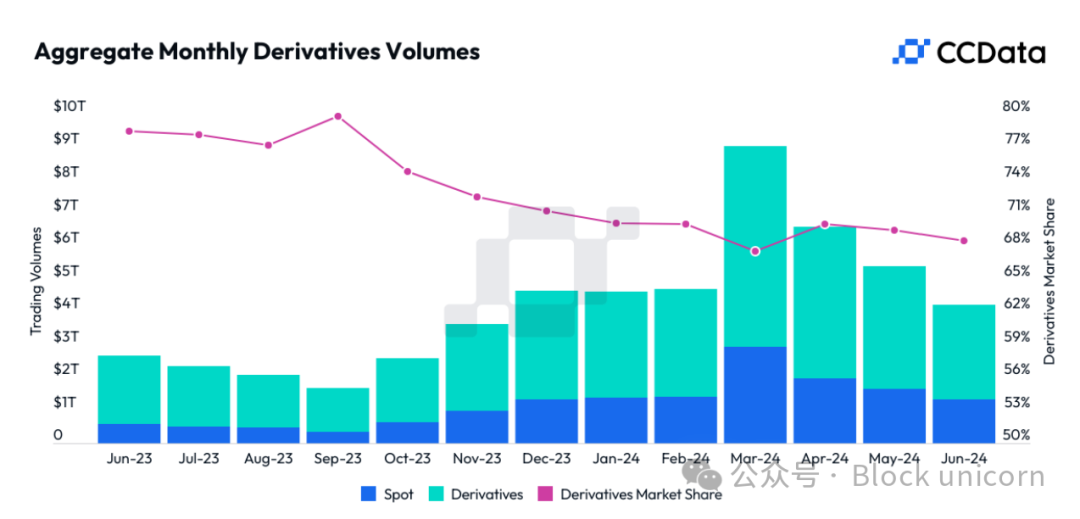

For example, in June 2024, the total trading volume of the exchange's spot and derivatives fell by more than 50% from a peak of about $9 trillion in March.

OKX's $500 million settlement agreement served as a forced education, making them understand how the U.S. financial market operates. They seem to have learned from their costly mistakes. They hired former Barclays executive Roshan Robert as CEO for the U.S., opened compliance offices in San Jose, New York, and San Francisco, employed 500 staff, and began discussing building a "defining industry super app," indicating they are serious about reform.

The interesting question is whether investors will buy into this redemption narrative.

Valuation Game

Based on trading volume, OKX's valuation should theoretically be comparable to or even higher than Coinbase's.

Coinbase's market cap is about a multiple of its monthly trading volume, with an average monthly trading volume of $92 billion and a market cap exceeding $90 billion. OKX's monthly trading volume is $98.19 billion, 6.7% higher than Coinbase. By the same multiple, OKX's valuation would reach $85.4 billion.

However, valuation is not just a mathematical issue; it also involves perception and risk.

OKX's regulatory burden may lead to a valuation discount. Their international business means profits depend on a rapidly changing regulatory environment, as they experienced in Thailand, where regulators recently banned OKX and several other exchanges from operating.

If a 20% "regulatory risk discount" is applied, OKX's valuation could be $68.7 billion. However, considering their global influence, dominance in derivatives, and higher trading volume, a valuation premium is reasonable.

A reasonable valuation range: $70 billion to $90 billion, depending on how much investors value growth versus governance.

Advantages

OKX's investment appeal is based on several competitive advantages that Coinbase lacks.

Global Scale: Coinbase primarily focuses on the U.S. market, while OKX serves markets with surging cryptocurrency adoption: Asia, Latin America, and parts of Europe where traditional banking is underdeveloped.

Dominance in Derivatives: OKX controls 19.4% of the global crypto derivatives market, while Coinbase's derivatives business is negligible. Derivatives trading fees are higher and attract more experienced traders. Coinbase recently announced the launch of perpetual contracts, meaning OKX will face more intense competition from established and regulated players like Coinbase.

Leading Trading Volume: Despite being a private company with recent regulatory issues, OKX's spot trading volume still exceeds that of publicly listed Coinbase.

Coinbase also has its advantages—a clean regulatory record and good relationships with institutional investors, who prefer predictable compliance costs over a global growth story fraught with regulatory complexities.

Potential Issues

OKX faces significant risks that differ from typical IPO concerns.

Regulatory Whiplash: OKX operates in dozens of jurisdictions where rules can change rapidly. The ban in Thailand is just the latest example. Any major market could lose significant revenue overnight.

Market Cyclicality: The revenue of crypto exchanges fluctuates with trading activity. When the crypto market calms, exchange revenues can plummet.

Reputation Risk: Despite reaching a settlement, OKX could still suffer severe reputational damage from a regulatory scandal. Crypto exchanges are inherently high-risk businesses, and technical failures or security breaches can destroy customer confidence overnight.

Our View

OKX's potential IPO could be an intriguing test to see if the public market will overlook the exchange's problematic background.

Setting aside the regulatory drama, OKX is actually more advantageous than the only successfully listed cryptocurrency exchange, Coinbase. They dominate in derivatives trading and have a global customer base.

Whether OKX has learned from its mistakes (costly lessons are often memorable) may not matter. What truly matters is whether public market investors are willing to pay growth multiples for a company operating in dozens of unpredictable regulatory environments. Coinbase has built a moat of compliance credibility in the U.S.; OKX has built a global trading empire and is now undergoing compliance transformation around it.

Both strategies can work, but they attract very different investors. Coinbase is the safe choice for institutional investors seeking regulated crypto exposure. OKX may attract those who believe the future of cryptocurrency lies in global adoption and complex trading products.

Circle has proven that investors are willing to put money into a clean crypto narrative. OKX is betting that investors will do the same for them, even with their complicated past.

Whether OKX's reform image resonates in the public market will reveal the true importance investors place on growth versus governance in the crypto space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。