Author: Sun Lijian, Fudan Development Institute

The current U.S. tariff policy is leading to a decline in market confidence in the dollar. At the 2025 Lujiazui Forum, stablecoins, as alternatives to the dollar, became a hot topic of discussion. Attendees expressed that dollar stablecoins may further promote dollarization, bringing various side effects. What exactly are stablecoins? How do different sectors view the prospects of stablecoins? Where are they headed? Sun Lijian, Director of the Financial Research Center at Fudan Development Institute, accepted an invitation from Shanghai Television's News Comprehensive Channel to interpret these related issues. The following content has been edited by the Development Institute based on the interview and additional content provided by Professor Sun for readers' reference. You can also click to read the original text to view the interview video.

The current U.S. tariff policy is leading to a decline in market confidence in the dollar. At the 2025 Lujiazui Forum, stablecoins, as alternatives to the dollar, became a hot topic of discussion. Attendees expressed that dollar stablecoins may further promote dollarization, bringing various side effects. What exactly are stablecoins? How do different sectors view the prospects of stablecoins? Where are they headed? Sun Lijian, Director of the Financial Research Center at Fudan Development Institute, accepted an invitation from Shanghai Television's News Comprehensive Channel to interpret these related issues. The following content has been edited by the Development Institute based on the interview and additional content provided by Professor Sun for readers' reference. You can also click to read the original text to view the interview video.

Q1

Host: Professor Sun, could you first help clarify for our audience, especially those who are new to this topic, as stablecoins are still quite unfamiliar to most people in China? For example: What are the differences between stablecoins and cryptocurrencies like Bitcoin? What are the main categories of stablecoins in the market (such as fiat-backed, algorithmic, and asset-backed)? Who is qualified to issue them (tech companies, financial institutions)? How is their stability mechanism achieved, and is it really stable? What are the main uses of stablecoins?

Sun Lijian: Dollar stablecoins (USD Stablecoin) are cryptocurrencies pegged to the dollar, designed to maintain price stability while combining the advantages of traditional fiat currencies and cryptocurrencies. Their core design goal is to maintain a 1:1 exchange rate peg (i.e., 1 stablecoin ≈ 1 dollar). They serve as a bridge between traditional finance and the crypto world, possessing unique key characteristics and operational mechanisms. First, their core feature is stability anchoring. Unlike Bitcoin, which relies on underlying technology, stablecoins require collateral in dollar assets for issuance, thus integrating the advantages of credit money and cryptocurrencies in terms of credit, liquidity, and convenience. However, despite the credit basis of cryptocurrencies also stemming from public chains, their scarcity results in their financial asset properties being far stronger than their currency function for payment and settlement, leading to significant price volatility and speculative elements. Bitcoin's price volatility is around 20%, while stablecoins only experience about 0.5% fluctuations. This difference makes Bitcoin more of a tool for wealth value pursuit, while stablecoins primarily serve the functions of payment, settlement, and hedging.

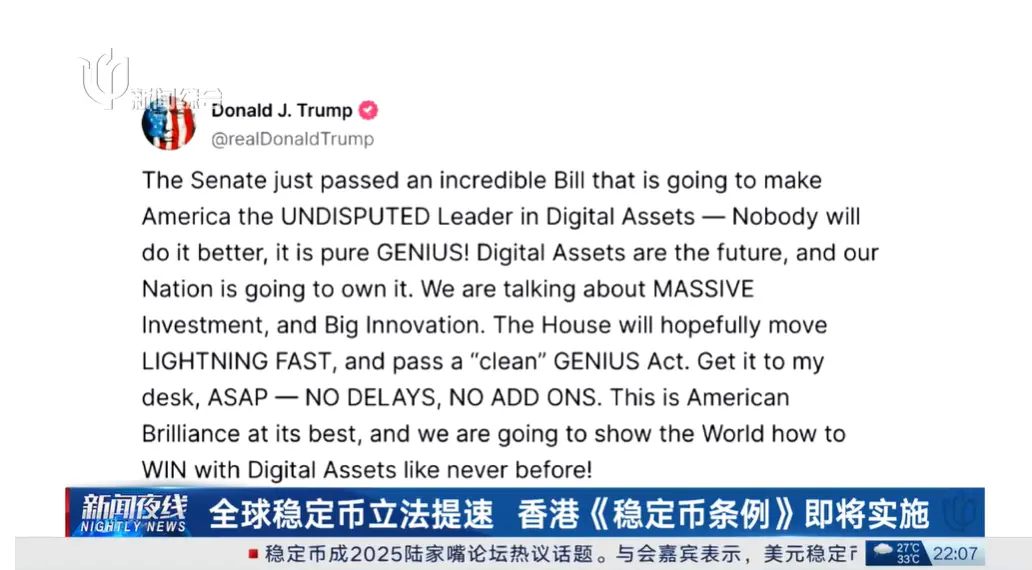

Its operational mechanism has two distinct characteristics. First, regarding the reserve mechanism, issuers must hold equivalent dollar or U.S. Treasury assets as reserve assets. For example, mainstream stablecoins like USDT and USDC require that for every stablecoin issued, 1 dollar or a U.S. short-term Treasury bond maturing within 93 days must be reserved to ensure users can exchange stablecoins for dollars at a 1:1 ratio at any time. Second, they must comply with regulatory requirements. According to the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" passed by the U.S. on June 17, 2025, stablecoin issuers must hold reserves supported by at least 1:1 in highly liquid assets such as cash, short-term U.S. Treasury bonds, or government money market funds, and undergo regular audits while strictly adhering to compliance requirements such as anti-money laundering and know your customer regulations.

Of course, stablecoins have developed into a rich variety of types, and their operational models vary by type. Fiat-backed stablecoins (the mainstream model) operate by having issuers deposit dollars or short-term U.S. Treasury assets in banks, requiring at least 1 dollar to be reserved for every stablecoin issued. For example, USDC, issued by Circle, publishes audit reports monthly, with its reserve assets including cash and U.S. Treasury bonds, achieving a reserve ratio of 101.2% in 2024. USDT, issued by Tether, includes commercial paper in addition to cash as reserve assets, which has sparked controversy over transparency issues, but its cash ratio has risen to 82% in 2024. Crypto asset collateralized stablecoins require users to pledge volatile crypto assets like ETH, usually needing over-collateralization of 150%-200% to generate stablecoins. A representative case is DAI (issued by MakerDAO), where collateralizing 150 million dollars' worth of ETH can generate 100 million dollars' worth of DAI, maintaining the peg to the dollar through an automatic liquidation mechanism via smart contracts. Algorithmic stablecoins do not rely on any physical collateral but adjust market supply and demand through algorithms (such as issuing tokens to buy back stablecoins), though this model carries higher risks; for instance, UST (Terra) collapsed in 2022 due to a series of liquidations, plummeting from 1 dollar to 0.02 dollars, resulting in a 40 billion dollar market cap evaporation and drawing widespread market attention and warnings.

With this understanding, we can discuss the core functions of stablecoins and the expansion of their use cases. The core functions of stablecoins are primarily reflected in four aspects: first, they serve as a "safe haven" in the crypto market. When Bitcoin crashes, traders convert their assets to USDT or USDC for hedging, with a single-day maximum inflow reaching 4.3 billion dollars in 2024 (Binance data). Second, stablecoins accelerate cross-border payments. Filipino workers have used USDT for remittances, with fees as low as 0.1%, compared to an average fee of 6.3% for traditional banks (World Bank 2024 data). Third, stablecoins are the infrastructure of the DeFi ecosystem. In decentralized exchanges like Uniswap, 80% of trading pairs involve dollar stablecoins (e.g., ETH/USDC). Finally, stablecoins can serve as a tool against fiat currency inflation. For example, people in Argentina have exchanged their wages for USDT to avoid an annual inflation rate of up to 289% (June 2024 data).

Lastly, dollar stablecoins still face inherent risks and regulatory challenges. First, we can recognize their risks from several factual characteristics. The first case is that Tether was fined 41 million dollars in 2021 for concealing reserve shortfalls, leading U.S. regulators to require stablecoin issuers to disclose audit reports monthly (new regulations in 2024). The second case is the collapse of Silicon Valley Bank, which caused USDC to briefly de-peg (March 2023), triggering a bank run. The EU subsequently required stablecoin issuers to isolate their reserve assets (according to MiCA regulations). The third case is that North Korean hackers laundered 100 million dollars through USDT in 2023 (according to a UN report), prompting the FATF to include stablecoins under travel rule regulations (2024).

In summary, dollar stablecoins are essentially a tokenized projection of the dollar in the blockchain world, a "digital extension" of dollar hegemony. They amplify the global penetration of the dollar through technological means but also bring systemic risks. For ordinary users, they are efficient cross-border payment tools; for nations, they represent a new battleground for monetary sovereignty—this is precisely the core motivation behind China's vigorous development of the internationalization of the digital yuan and the construction of an independent payment network. The Federal Reserve is advancing the research and development of a digital dollar (CBDC), which may ultimately integrate or replace private stablecoins, further reinforcing the dollar's dominance in the digital age.

Q2

Host: Recently, two significant events have occurred in the stablecoin market. First, on the evening of June 5, Circle, the issuer of the world's second-largest dollar stablecoin USDC, officially listed on the New York Stock Exchange at an issuance price of 31 dollars, which has now skyrocketed to 199.59 dollars; the second event is that on June 17, the U.S. Senate voted to pass legislation concerning stablecoins, which will be handed over to the House of Representatives for a vote. On June 12, Ant Group disclosed that it would apply for a stablecoin license in Hong Kong and Singapore. Previously, JD Group was one of the first three institutions selected for the Hong Kong Monetary Authority's stablecoin issuer sandbox. Professor Sun, everyone is now concerned about stablecoins, and even businesses are continuously switching to the stablecoin ecosystem. Can you analyze for everyone: What impact will dollar stablecoins have on the existing monetary system?

Sun Lijian: Dollar stablecoins (such as USDT and USDC), as crypto assets pegged to the dollar, are profoundly reshaping the underlying logic of the global monetary system. Their impact on the existing monetary system is primarily reflected in the following aspects:

First, regarding the impact on the status of the dollar, there are two main points. One is that the issuance and circulation of dollar stablecoins, which are tied to the dollar and U.S. Treasury bonds, actually serve to reinforce the dollar's hegemonic position. After the passage of the "GENIUS Act," dollar stablecoins have become a new channel for absorbing global "non-dollar funds," allowing global investors to convert their local currency funds into dollar assets, indirectly flowing into the U.S. market and strengthening the dollar's global dominance. In other words, stablecoins bind digital currencies to the credit of the U.S. sovereign state, expanding the usage boundaries of the dollar and dollar assets, effectively increasing the digital seigniorage of the dollar, which helps consolidate dollar hegemony. The second point is that it will accelerate the digital dollarization process. In countries and regions where local currencies are unstable and inflation is severe, people save in stablecoins to hedge against local currency depreciation and high inflation. In high-inflation countries like Argentina and Turkey, the penetration rate of dollar stablecoins exceeds 30% (IMF 2024), with people using them to replace local currency savings, leading to the ineffectiveness of domestic monetary policy. Venezuelans have transferred assets to foreign exchanges via USDT, with capital outflows reaching 2.4 billion dollars in 2023 (Chainalysis data), which not only weakens the effectiveness of foreign exchange controls but also further promotes the "digital dollarization" process. Additionally, we note that even within the U.S., the interest rates in the stablecoin market (such as USDC deposit rates on Compound) typically respond to Federal Reserve rate hikes 3-6 weeks later than traditional banks, reflecting that the use of stablecoins is weakening the effectiveness of domestic policy. On the other hand, stablecoins are rapidly expanding globally, especially in cross-border remittances, where they are low-cost and efficient, further promoting the global "digital dollarization" process.

Next, let's delve into their impact on financial markets. The demand for reserve assets for dollar stablecoins will affect the U.S. Treasury bond market. According to the new law, stablecoins must be backed by highly liquid, low-risk assets, which increases demand for short-term U.S. Treasury bonds and influences their yield trends. An influx of stablecoin funds increases demand for dollars or U.S. Treasury bonds, which may lower the yield on 3-month Treasury bonds. Conversely, when stablecoin funds flow out, yields may rise, potentially suppressing yield volatility and weakening the Federal Reserve's ability to adjust the financial environment through short-term interest rates. Furthermore, the collapse of Silicon Valley Bank in 2023 caused USDC to briefly de-peg to 0.87 dollars, triggering a massive liquidation wave in decentralized finance (DeFi), with liquidation amounts reaching 620 million dollars within 24 hours. Additionally, previously existing interest-bearing stablecoins caused severe disintermediation, directly impacting the stability of the banking system. However, the "GENIUS Act" prohibits stablecoins from paying interest, which somewhat reduces the risk of disintermediation.

Third, the impact of stablecoins on the international monetary order is complex and dual-faceted. On one hand, stablecoins demonstrate a strong dollar-binding trend in the current international financial landscape. 99% of fiat-backed stablecoin market value is pegged to the dollar, seemingly reinforcing the dollar's dominant position in the global financial system, with 90% of cross-border crypto payments settled in dollar stablecoins (BIS data). This market share expands the dollar's pricing share in trade and finance, especially in Southeast Asia and Latin America. The Eurozone is no exception, as more and more companies are using USDC for energy trade settlements, with its share rising from 3% in 2021 to 17% in 2024 (ECB report), which undoubtedly erodes the euro's position in cross-border payments. On the other hand, dollar stablecoins may fall into the "trilemma" of digital currencies. The price mechanism of stablecoins, which is tied to credit money (the dollar), resembles a fixed exchange rate system while also possessing the ability for rapid and convenient asset conversion (similar to a freely open capital account). Furthermore, the dollar's stability mechanism does not constrain the Federal Reserve's monetary policy; rather, stablecoins may further amplify the operational space of the Federal Reserve's monetary policy. Therefore, if the market triggers a depreciation of the dollar and an increase in the risk of U.S. Treasury defaults, it could lead to outflows of stablecoins, a sharp drop in Treasury prices, and even a potential crash of stablecoins.

Fourth, the impact on monetary dominance. Stablecoins will intensify currency competition among major powers. The U.S. consolidates its financial hegemony through stablecoins, prompting non-dollar countries to accelerate the development of local digital currencies, such as the digital yuan and digital euro, leading to a global competitive landscape for digital currencies. In the future, the international monetary system may split into a dollar stablecoin camp and a multipolar CBDC system.

Fifth, the emergence of stablecoins poses significant challenges to financial regulation while also bringing new regulatory dilemmas. The global circulation characteristics of stablecoins may allow them to bypass capital controls in various countries, becoming part of the "shadow banking" system. If a stablecoin run occurs, the issuer's sale of U.S. Treasuries could disrupt the global bond market, triggering a chain of financial turmoil. Therefore, only through global regulatory synergy can such risks be effectively mitigated. Unfortunately, global coordinated regulation lags behind the pace of innovation, facing two major challenges: first, jurisdictional conflicts. For example, Tether, the issuer of USDT, is registered in the Cayman Islands, with servers in Switzerland, while users are spread across the globe, making regulatory responsibility ambiguous. Second, there is a compliance gap. Currently, only 35% of stablecoins comply with the FATF's travel rule (anti-money laundering standards), meaning stablecoins can easily become tools for illegal fund flows. On the other hand, the U.S. has effectively controlled major stablecoin issuers (Circle, Paxos) through regulatory means (such as the "Payment Stablecoin Act"), thereby gaining hegemonic status over global capital flow data.

Sixth, promoting regulatory innovation. The development of stablecoins has prompted governments and international organizations to strengthen regulation in the cryptocurrency field, driving the improvement and innovation of regulatory frameworks. For instance, the U.S. "GENIUS Act" and Hong Kong's "Stablecoin Regulation Draft" provide legal basis and norms for the issuance, trading, and regulation of stablecoins to prevent the potential risks mentioned above.

Q3

Host: The rapid development of dollar stablecoins has led some to believe that this will strengthen the dollar's position and also bring side effects; however, others argue that stablecoins are merely innovative tools, and it is still difficult to judge their prospects, so we need not worry too much at this time. Finally, could Professor Sun explain to us: What impact will dollar stablecoins have on China? For China's financial regulatory authorities, in the face of stablecoin innovation, should the focus be on strict control or cautious regulation and proactive layout?

Sun Lijian: The impact of dollar stablecoins on China is primarily reflected in aspects such as financial markets, exchange rates and monetary policy, the pricing power of the renminbi, and the stability of the financial system. First, in terms of financial markets, there are four specific points. First is capital flow. Dollar stablecoins provide a channel for capital to bypass traditional foreign exchange controls, potentially leading to abnormal short-term capital flows that could impact financial market stability, such as affecting the liquidity of A-shares. In 2023, capital outflows through USDT reached 12 billion dollars, with methods including false trade and virtual mining. Additionally, the use of USDT for cross-border e-commerce in China accounted for 35%, likely to evade foreign exchange controls and anti-money laundering regulations. Second is exchange rates and monetary policy. The proliferation of dollar stablecoins will weaken the international payment position of the renminbi, reducing its demand in cross-border trade. Furthermore, the Federal Reserve's use of stablecoins to indirectly ease or tighten policy may exacerbate global inflation or trigger fluctuations in financial markets, indirectly affecting the monetary policy space of the People's Bank of China. Third is renminbi pricing power. The emergence of RMB-denominated derivatives (such as futures contracts) priced in USDT in the Hong Kong offshore market has diverted pricing power. Fourth is the threat to financial system stability. This is reflected in the risk of cross-market transmission. During the 2023 Silicon Valley Bank crisis, the de-pegging of USDC led to an 18% single-day drop in the digital asset sector of the Hong Kong stock market (Hang Seng Tech Index). It is also reflected in the liquidity siphoning effect. Domestic investors hold over 5 billion dollars in USDT through gray channels (Peking University Digital Finance Research Center), diverting bank deposits.

Next is the impact on payment systems. The characteristics of dollar stablecoins being fast, low-cost, and not requiring the banking system for cross-border payments have led to their application in certain cross-border trade scenarios, squeezing the development space of the renminbi cross-border payment system (CIPS). In Southeast Asian trade, the settlement share of dollar stablecoins is 42%, far exceeding the 6% of the digital renminbi (BIS 2024), weakening the regional influence of the renminbi.

Third is the impact on monetary sovereignty. Dollar stablecoins promote global "dollarization" in digital form, further enhancing the international status of the dollar and eroding the monetary sovereignty of other countries, including China, which may affect the internationalization process of the renminbi in the long run. On the other hand, there is a risk of U.S. extraterritorial jurisdiction. The U.S. "Stablecoin Act" requires issuers to freeze suspicious addresses, which could cut off cross-border payment channels for Chinese entities. Finally, this also involves the loss of data sovereignty. For example, the USDC issuer Circle provided the U.S. government with over 2,000 wallet addresses associated with China (2023 report).

To address the above risks and challenges, China needs to take proactive measures. First, in terms of regulation. This includes strict control over the use of stablecoins domestically. The central bank has explicitly prohibited financial institutions from participating in stablecoin-related services, combating illegal stablecoin activities through the "Anti-Money Laundering Law" and the "Cybersecurity Law." Strengthening the review of cross-border stablecoin projects to prevent capital outflows and financial risks. For instance, in recent years, relevant regulatory authorities have cut off banks/payment institutions from providing channels for cryptocurrency trading, blocking 120 overseas exchange IPs (with 35 added in 2024), and domestic USDT trading volume has decreased by 82% (2023-2024). Additionally, the foreign exchange administration's "On-chain Eye" system tracks blockchain transactions and issues warnings for cross-border stablecoin flows exceeding 50,000 dollars. In 2023, 67 cases were cracked, recovering 430 million dollars. Furthermore, offshore risk isolation has been strengthened. Hong Kong requires that 100% of stablecoin reserve assets be held in Chinese-funded banks and prohibits promotion to mainland residents. As a result, the Hong Kong Securities and Futures Commission revoked the licenses of three platforms in 2024. However, on the other hand, to better leverage Hong Kong's position as an international financial center and its customer acquisition capabilities, it is necessary to utilize the existing offshore dollar network system and the characteristics of the dollar peg system. Therefore, initiating pilot projects for dollar stablecoins aligns with Hong Kong's development needs and the strategic intent of solidifying its status as an international financial center. Currently, the Hong Kong Monetary Authority has established a stablecoin regulatory system, launched sandbox testing, and requires issuers to operate with licenses, ensuring that reserve assets are 100% covered and redeemable, relying on Hong Kong to explore stablecoins pegged to the renminbi to promote offshore circulation and cross-border settlement efficiency.

Second, in terms of technology and innovation. First, there is a need to strengthen the promotion of the digital renminbi. Expanding the pilot scope and application scenarios of the digital renminbi, constructing a controllable digital payment ecosystem to squeeze the survival space of dollar stablecoins. In particular, the multilateral central bank digital currency bridge function is playing an active role. For example, connecting with 30 multinational banks to handle China-Saudi oil trade settlements (with a peak of 120 million dollars in a single month in 2024), improving efficiency by 80% compared to traditional SWIFT. Additionally, the construction of Hong Kong as an offshore hub has made significant progress. The pilot for digital renminbi stock trading settlement has already been operational (launched in Q3 2024). The Monetary Authority issued digital renminbi bonds to Saudi Aramco (initial issuance of 2 billion). Furthermore, the Shanghai International Energy Exchange has launched a digital renminbi-denominated gold contract (with an average daily trading volume of 12 billion CNY in 2024). Second, there is a need to promote technological research and patent layout. Supporting enterprises in developing blockchain technologies that comply with regulations, promoting the integration of cryptographic algorithms, privacy computing, and compliance auditing to enhance technological competitiveness in the digital currency field. Third, it is essential to prevent technological obsolescence risks. Specific content includes addressing threats from quantum computing, as current blockchain encryption algorithms may be cracked around 2030, necessitating accelerated research and development of quantum-resistant digital renminbi; addressing interoperability shortcomings, as the digital renminbi is incompatible with agreements of overseas CBDCs (such as the digital euro), which restricts multilateral clearing efficiency. Fourth, establishing standards for cross-border smart contracts. The Central Bank Digital Currency Research Institute is leading the ISO/TC68 "Digital Currency Cross-Border Clearing and Settlement Protocol" international standard (draft for 2025). Fifth, innovating penetrating regulatory tools. Embedding "regulatory probes" in the digital renminbi to track large cross-border flows in real-time, for example, Shenzhen Customs has intercepted 24 million dollars in smuggled funds in a pilot program.

Third, in terms of international cooperation. China needs to participate in global governance of stablecoins through platforms like the IMF and FSB, promoting mutual recognition of rules between "on-chain dollars" and the digital renminbi, actively participating in the formulation of international rules, and enhancing its voice in the digital currency field. Additionally, leveraging the role of "energy anchoring" in the Belt and Road Initiative, signing agreements with Russia and Iran to settle 30% of oil and gas imports in digital renminbi (target for 2025). Furthermore, strengthening the construction of international alliances. Prioritizing support from "middle-ground" countries, such as establishing a digital currency emergency reserve pool with ASEAN to address potential run risks posed by dollar stablecoins. At the same time, China is also working to differentiate itself from the U.S. and Western camps, promoting cooperation with France to develop an open-source cross-border payment protocol, circumventing U.S.-dominated technical standards, thereby gaining a more advantageous position in the global digital currency competition.

In summary, to win the "digital currency war," the following three-step strategy needs to be implemented. In the short term, it is essential to maintain the bottom line by cutting off the penetration of dollar stablecoins domestically through stringent regulation to protect financial sovereignty; in the medium term, it is necessary to build an ecosystem that binds the digital renminbi to energy trade, bulk commodities, and other real anchors, gradually expanding its international usage network; the long-term goal is to dominate the rules and promote the construction of a multilateral digital currency governance system, such as upgrading the "currency bridge" to a global clearing hub, reshaping the international monetary competitive landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。