Author: Gelong

This morning, I woke up to see that the hottest stock in the US market, the stablecoin pioneer Circle, plummeted by 15%. I immediately asked a friend of mine, as he had sold a put option with a strike price of 200 that expires on June 27. Last night, the price of this option surged unexpectedly.

Yesterday, Tianfeng Securities in the A-share market had a trading volume of 11.6 billion, with repeated circuit breakers and intense long-short battles. The leading broker in this wave, Guotai Junan International, also saw a nearly 15% drop yesterday. With Circle's crash last night, the bulls in these stocks are likely feeling anxious.

So what exactly is a stablecoin? Is it just a speculative trend, or is it a future trend?

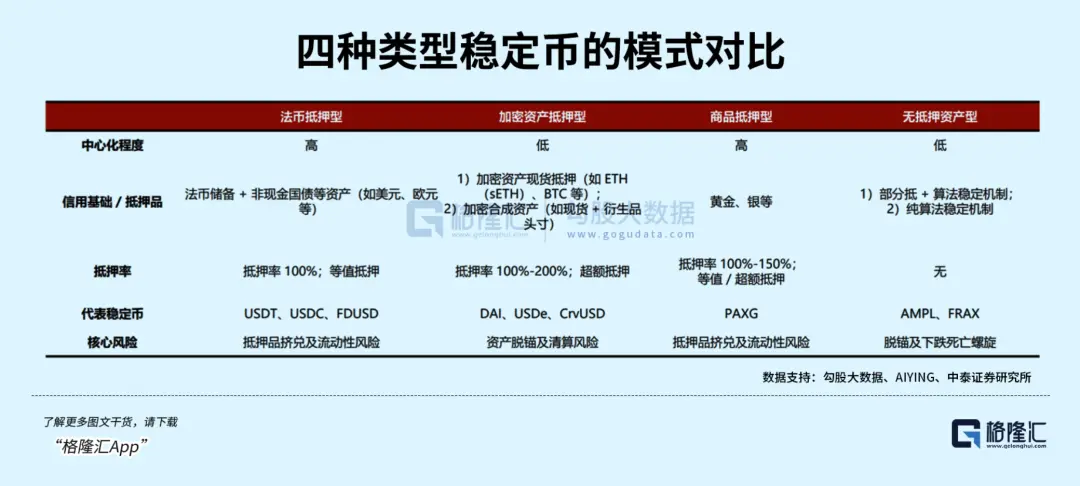

A stablecoin, as the name suggests, is a currency with a relatively stable price. Like Bitcoin, it is also a type of cryptocurrency. The difference is that its price is pegged to a stable asset. Generally, stablecoins are divided into four types, with fiat-collateralized stablecoins being the largest.

To give a simple example, if you give Circle 1 million USD, Circle will mint 1 million worth of USDC in your wallet. The USDC it issues must be backed by the assets it holds, which are generally fiat currencies (like USD) or short-term US Treasury bonds.

Because of this 1:1 peg, stablecoins like USDC essentially achieve price stability. Of course, there have been brief periods of significant drops, such as in March 2023, when Circle had 3.3 billion USD in Silicon Valley Bank, which suddenly closed, causing market panic and USDC to drop to around 0.88-0.92 USD. However, it regained its peg within two days because the Federal Reserve and FDIC guaranteed full repayment to depositors.

Many people may wonder why I would give 1 million to Circle in exchange for an equivalent stablecoin. It's important to note that Circle does not pay interest on the 1 million you give (the latest "genius" bill in the US explicitly prohibits it from paying interest), while it can use that 1 million to buy short-term US Treasury bonds and earn interest. Essentially, it is getting a free loan without interest—where can you find such a good deal?

This brings us to the trading of cryptocurrencies like Bitcoin. Before stablecoins existed, users wanting to buy Bitcoin could only use fiat currency, and the conversion between fiat and Bitcoin had to go through banks, which was very difficult, slow, and expensive at the time. Buying and selling Bitcoin had to wait for the buyer to prepare the funds, and only then could the coins be released, leading to extremely poor efficiency. Additionally, the trading infrastructure was immature, with significant price discrepancies across exchanges, lacking an intermediary bridge for cross-platform arbitrage.

This resulted in poor liquidity for early cryptocurrencies like Bitcoin. Stablecoins emerged to meet this demand, and their core significance is to break down the liquidity barriers in cryptocurrency trading. They can quickly match trades on the same exchange as Bitcoin, and stablecoins can also quickly transfer funds across chains and exchanges. Furthermore, stablecoins have the added benefit of protecting the privacy of digital currency investors. The emergence of stablecoins effectively created a barrier between Bitcoin and bank accounts, blocking the association of sensitive information.

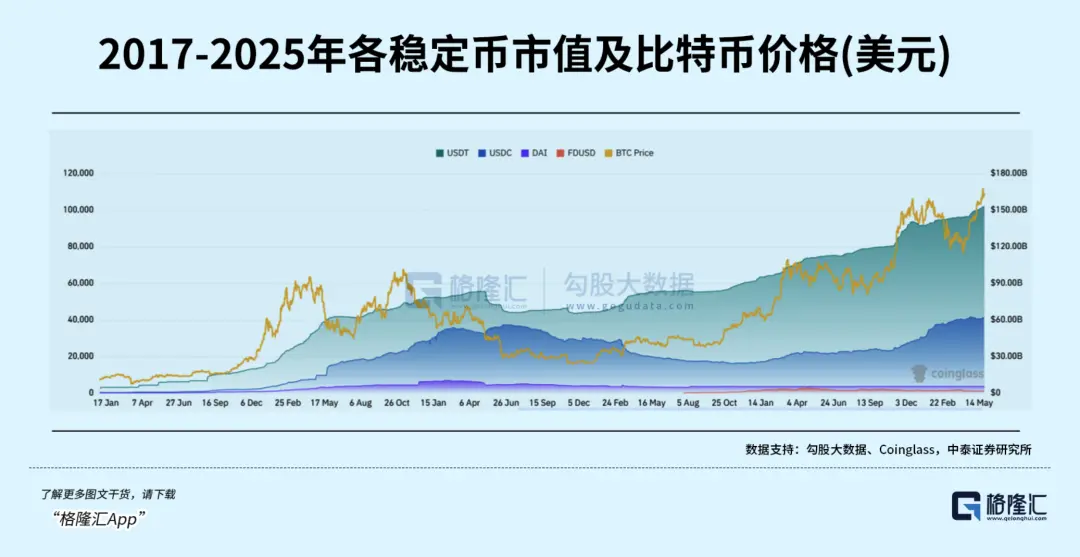

Thus, we can see that the scale of stablecoins has developed in sync with Bitcoin's price. As Bitcoin's price rises, it stimulates the expansion of Bitcoin's user base, leading to increased demand for stablecoins.

It can be said that stablecoins were born out of the trading demand for cryptocurrencies like Bitcoin.

At this point, you may realize a problem. We may not lack the technical infrastructure to create a RMB stablecoin, but we lack scenarios—what would I use a RMB stablecoin for? Reflecting on this, when Nvidia's graphics cards were dominating the market, people traced back and found it might be due to the butterfly effect of our previous gaming bans. If the development of RMB stablecoins significantly lags behind in the future, the reason may well be traced back to the ban on cryptocurrency trading in 2021.

If stablecoins only remain within the trading demand for cryptocurrencies, it doesn't really matter whether we pursue them or not; such speculative trading in capitalism is not worth engaging in. However, the application of stablecoins in another scenario suggests that they could reshape the future global monetary system.

This scenario is cross-border payments. Stablecoins can serve as efficient settlement tools, supporting instant low-fee transactions for cross-border transfers and online shopping. Because they are based on blockchain technology, the two parties can interact directly through wallets without the need for intermediaries like correspondent banks or clearing institutions in the traditional financial system, allowing settlements to be completed in as little as 30 seconds with fees controlled between 0.1% and 1%. In contrast, banks can take hours to days and charge an average comprehensive fee of 6%.

The replacement of inefficient, high-cost tools with efficient, low-cost ones is just a matter of time.

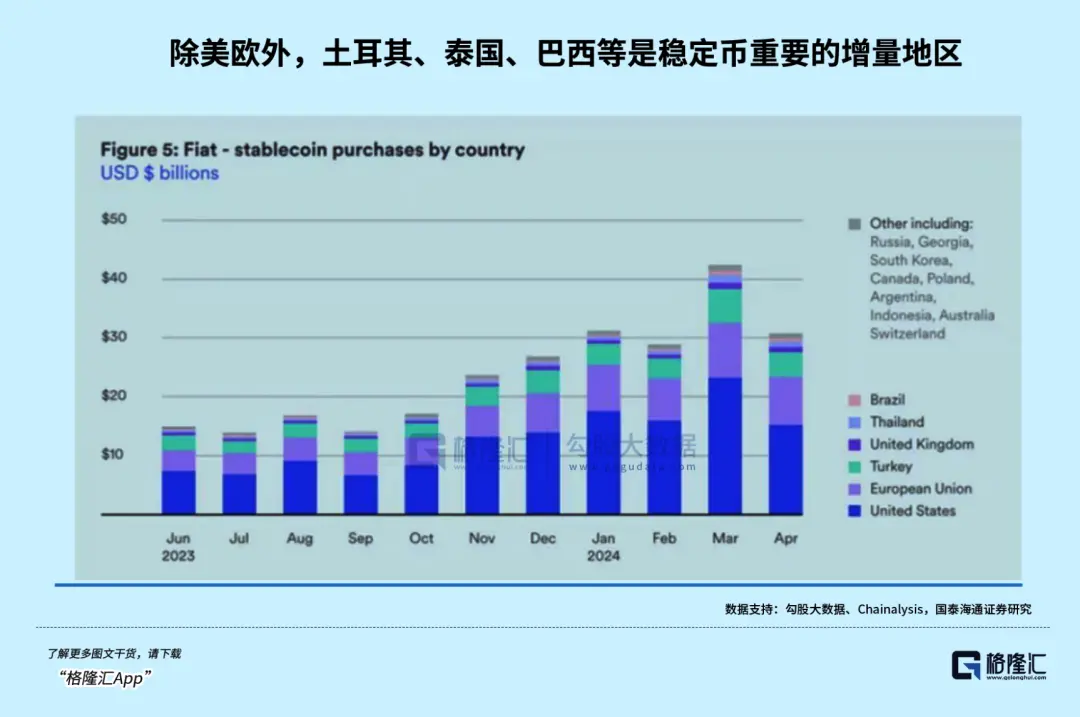

Imagine if stablecoins were to significantly penetrate the cross-border payment sector in the future; whoever has a larger volume of stablecoin usage would hold the power in the monetary system. Currently, by currency type, USD stablecoins almost occupy the entire market share. As of June 8, 2025, USD stablecoins accounted for 99.8%, while the Euro accounted for 0.2%.

Contrary to some people's claims, stablecoins have not weakened the USD; rather, USD stablecoins will greatly enhance the USD's position, not the other way around. Many countries have currencies that are practically worthless, and USD stablecoins provide residents of these countries with another option to obtain USD-level assets, enjoy stability, and not have to worry like they would with Bitcoin (if Bitcoin rises, they feel they are losing out when using it for payments; if it falls, their assets shrink).

From this perspective, the domestic market will definitely strive to develop a RMB stablecoin. Without the trading scenario of cryptocurrencies, whether it can be successfully developed is uncertain, but it is certainly a pursuit that must be undertaken. And this pursuit is precisely the kind of theme that A-share investors love the most.

Therefore, stablecoins will be a major theme in the future. In the short term, Circle has crashed, leading to a need for a correction. The crash of Circle is purely due to valuation. The total market value of USDC issued by Circle is around 61 billion USD, while at its peak, Circle's stock market value exceeded that of USDC.

Do you understand what this concept means?

As I mentioned earlier, Circle's business model is to issue USDC, getting a wave of interest-free funds to earn interest income. This is even better than banks, which have to pay deposit interest. And having a market value exceeding that of USDC is equivalent to the Industrial and Commercial Bank of China's market value exceeding its deposits. The latest data for ICBC's deposits in the first quarter of 2025 is 36 trillion, just imagine an ICBC with a market value of 36 trillion—it's truly stimulating.

So, after this wave of speculation, a significant drop is very normal, and it will definitely rise again later.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。