Today's homework is difficult to write, and many friends are asking why, if the core PCE data caused the $BTC drop, the US stock market is still rising. If that's not the reason, why does Bitcoin tend to drop when the stock market is rising? This question is indeed quite troubling, and I don't have an accurate answer; I can only attempt to respond roughly.

The reason may still lie in $CRCL and $COIN. The key information today is the core PCE. Although the data isn't good, inflation is rising mainly due to issues with US housing and commodities. Housing has actually started to cool down; it just takes some time for that to reflect in the PCE. The rise in commodity inflation is more due to expectations around tariffs.

Once tariffs are implemented, these issues can be resolved, so the US PCE data isn't very serious. PCE is not the main reason for the BTC drop. In fact, the PCE data has led to an increase in US investors' expectations for a Federal Reserve interest rate cut, including comments from Powell yesterday and several Federal Reserve officials today who are preparing for a rate cut in September.

For CRCL, which relies on interest from US Treasury bonds, a rate cut is the least desirable outcome because it means a decrease in income. Although the current discussions sound grand, the essence is that CRCL's returns over the past two years have relied on high interest rates from US Treasuries. Once rates start to decline, CRCL's returns and expectations will decrease. As for whether CRCL can break into the payment sector and achieve results, I believe we won't see that in the short term. The drop in CRCL has also dragged down COIN, and COIN's decline has made many investors who bought in at high prices uncomfortable.

I believe the cryptocurrency market may have peaked in the short term, especially since the drop from the Middle East conflict has not yet recovered. Some investors may reinvest from the cryptocurrency market back into US stocks. The new highs in the stock market are also a stimulus for investors—Nvidia, Tesla, Apple, Microsoft—aren't they more appealing?

Of course, this is just my personal view, and I think the correlation between Bitcoin and the US stock market is still very high. A small divergence isn't significant; it's happened many times in history, but in the larger direction, they will still remain aligned.

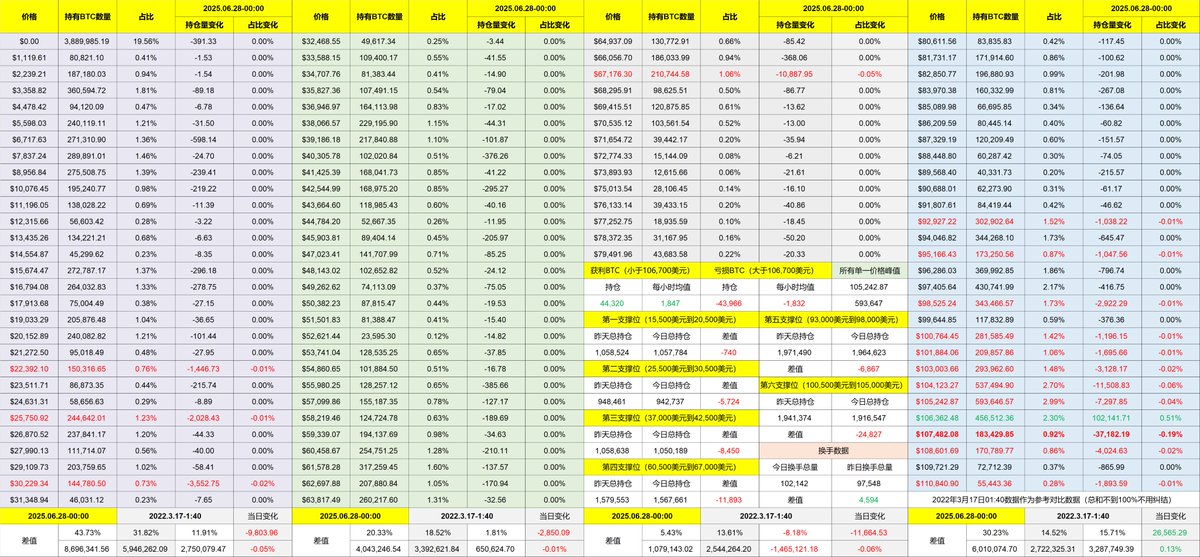

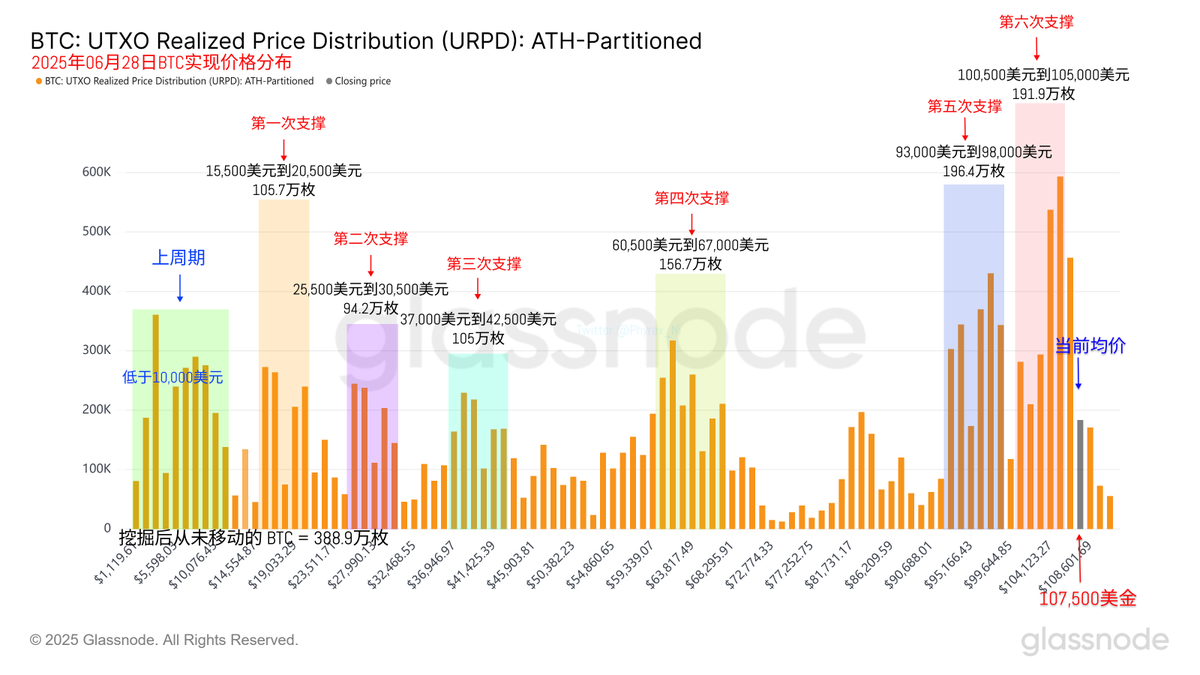

Looking back at Bitcoin's data, there's nothing new. Although the price has slightly adjusted downwards, there is currently no systemic risk observed. The US stock market has also shown signs of a slight pullback, and the support level remains stable, with not much increase in turnover, so I won't elaborate further.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。