Original Title: "New Chairman, Big Easing? Market Expectations for the Federal Reserve Next Year Are Very Aggressive"

Original Author: Dong Jing, Wall Street Insights

Deutsche Bank's latest research report shows that market expectations for the Federal Reserve next year have changed significantly, with the expectation that the new chairman may promote continued easing.

On June 26, according to news from the Wind Trading Desk, Deutsche Bank stated in its latest research report that financial market expectations for the Federal Reserve's policy next year have changed significantly, particularly regarding the aggressive expectations for interest rate cuts after the new Federal Reserve chairman takes office.

The current chairman of the Federal Reserve's term will expire in May next year. However, as noted in an article by Wall Street Insights, Trump is considering announcing the next Federal Reserve chairman as early as this summer, much earlier than the traditional 3-4 month transition period. Insiders revealed that Trump hopes to influence market expectations and the direction of monetary policy by announcing the successor in advance, allowing the "shadow chairman" to start making an impact before Powell's term ends.

The report also states that since last week when Federal Reserve Governor Waller and other officials made dovish remarks, the market has priced in an additional approximately 10 basis points of interest rate cuts before the end of the year.

Statistical Models Reveal Abnormal Pricing for Next Year: "New Chairman Premium" Emerges

Deutsche Bank states that the truly striking change has occurred in the expectations for interest rate cuts in the middle of next year.

The report indicates that the market seems to increasingly expect that once the new Federal Reserve chairman takes office, monetary policy will continue to be accommodative. The current chairman Powell's term will expire in May next year, making this time point a focus of market attention.

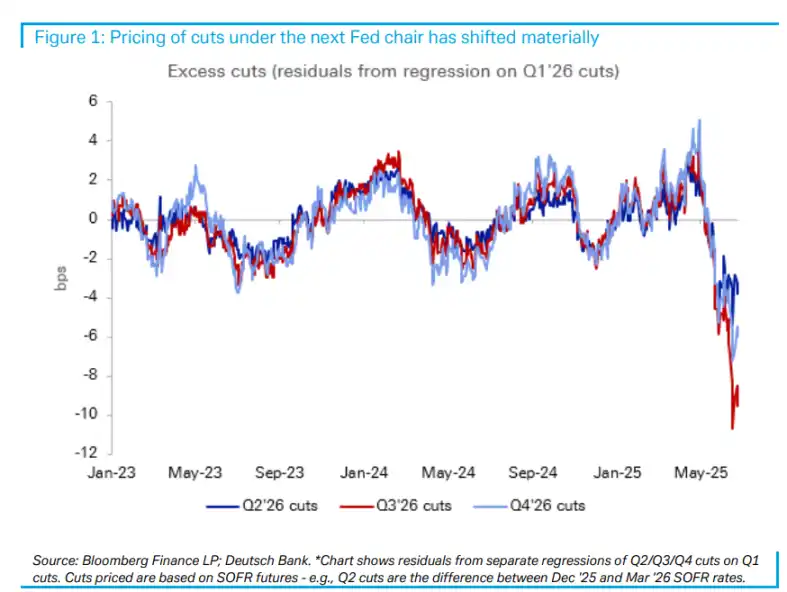

Deutsche Bank discovered an intriguing phenomenon through regression models: by regressing the pricing of interest rate cuts in the second, third, and fourth quarters of next year against the first quarter, they measured the "abnormal" degree of forward interest rate cut expectations relative to the first quarter through residual analysis.

Deutsche Bank found that over the past month, these residuals have significantly turned negative, particularly in the third quarter of 2026—during the new chairman's term. This indicates that the market is pricing in an unusually accommodative policy during the new chairman's term, a pricing pattern that deviates from historical norms in recent years.

Note: Residuals refer to the difference between actual observed values and estimated values (fitted values). "Residuals" contain important information about the fundamental assumptions of the model. If the regression model is correct, residuals can be viewed as observed errors.

However, the report also points out a cautious attitude towards this "new chairman premium." This is because formulating monetary policy requires the support of a majority vote from the FOMC, and the new Federal Reserve chairman needs to persuade colleagues to support a different policy trajectory. This institutional constraint implies that the discontinuity in policy pricing around the new chairman should be slight.

It is noteworthy that even with the aforementioned differences, market expectations for interest rate cuts in the second, third, and fourth quarters of 2026 are still lower than in the first quarter, indicating that the market does not expect a sharp policy shift but rather believes that the accommodative policy under the new chairman will last longer.

Recent Market Pricing Changes: Dovish Remarks Drive Rate Cut Expectations

An earlier article by Wall Street Insights pointed out that on Monday (June 23), Federal Reserve Governor Bowman stated regarding the economy and monetary policy that if inflationary pressures remain controlled, he would support a rate cut as early as July.

Bowman's reasoning is that risks in the labor market may be rising, while inflation seems to be stabilizing towards the Federal Reserve's 2% target. Last Friday, Federal Reserve Governor Waller stated in an interview with CNBC that he might support a rate cut next month due to concerns about a weak labor market.

Deutsche Bank noted in the report that since last Thursday, the market has priced in an additional approximately 10 basis points of interest rate cuts by the Federal Reserve before the end of the year, primarily influenced by the dovish remarks from Federal Reserve Governors Waller and Bowman. This change reflects investors' immediate response to a softening of the Federal Reserve's policy stance.

According to the latest data from FedWatch, the market is betting on a 20.7% probability of a Federal Reserve rate cut in July, an increase from a week ago (12.5%), and traders have fully priced in expectations for a rate cut at the September meeting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。