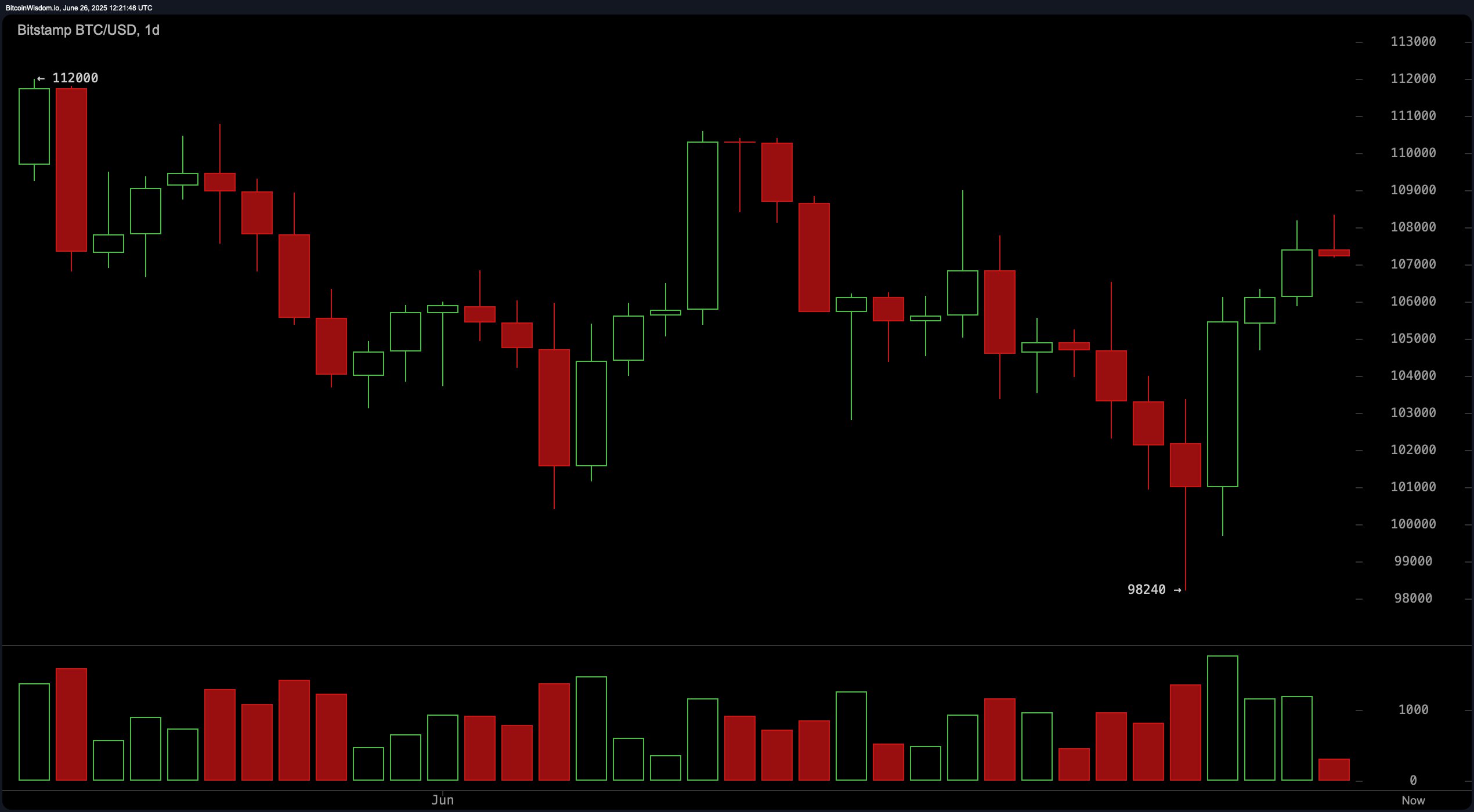

Bitcoin’s daily chart reflects a recovering macro trend, underpinned by a clear bullish structure emerging from a local bottom at approximately $98,240. The formation of a bullish engulfing pattern and several follow-through green sessions confirms upward momentum, supported by elevated buying volumes. This suggests heightened institutional activity during the reversal phase. The trend now targets the resistance zone between $108,000 and $109,000, which coincides with recent swing highs.

BTC/USD 1-day chart via Bitstamp on June 26.

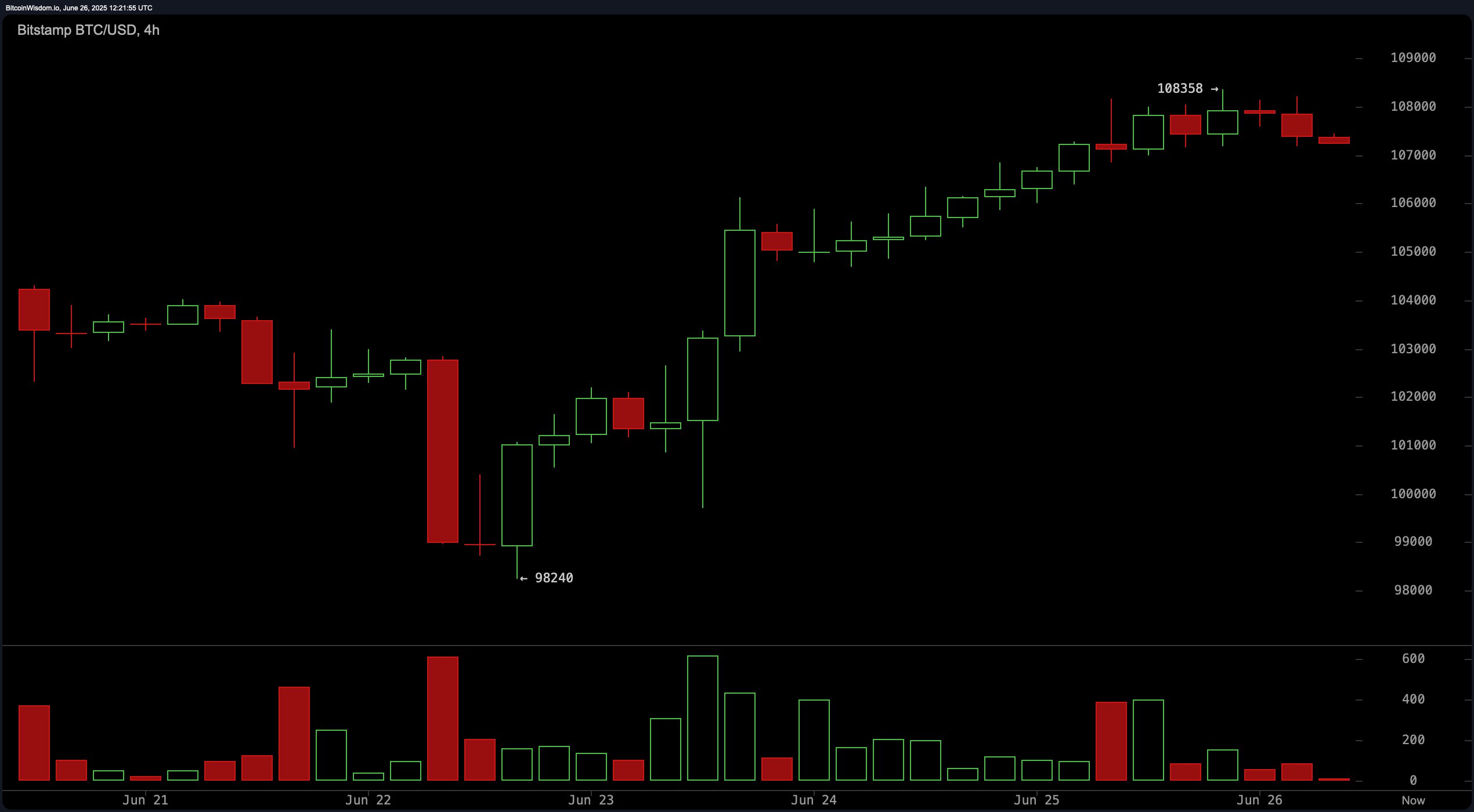

On the 4-hour chart, bitcoin has extended from $98,240 to a recent high of $108,358, signaling a strong medium-term uptrend. However, the pace has moderated, with price action adopting a rounding formation and momentum indicators reflecting exhaustion. Volume has also tapered, raising caution for potential mean reversion. Technical structure implies that bitcoin may soon retest support in the $104,000 to $105,000 region. Failure to hold this level could lead to deeper consolidation, while resilience may reset conditions for the next leg higher.

BTC/USD 4-hour chart via Bitstamp on June 26.

Short-term momentum on the 1-hour BTC/USD chart paints a more fragile picture. A double top pattern near $108,358, combined with bearish divergence between price and volume, indicates distribution. Lower highs and lows are starting to define the intraday structure, pointing to a possible corrective phase. With weakening short-term momentum, any immediate entry carries increased risk. A pullback to the $106,000–$106,500 zone accompanied by a bullish engulfing or a notable surge in volume would be a more reliable entry signal. Conversely, failure to maintain $107,000 could signal additional downside toward the $106,000 support.

BTC/USD 1-hour chart via Bitstamp on June 26.

Oscillators across timeframes are largely neutral, including the relative strength index (RSI) at 56, Stochastic oscillator at 78, commodity channel index (CCI) at 78, and average directional index (ADX) at 16, all reflecting indecisive momentum. Notably, momentum indicates a negative signal, while the moving average convergence divergence (MACD) shows a bullish signal with a level of 177, underscoring the current divergence in technical sentiment. Moving averages (MAs) remain decisively bullish across all timeframes, with all exponential and simple moving averages—from the 10-period to 200-period—confirming the uptrend and providing dynamic support levels ranging from $94,078 to $105,726.

Despite recent gains, bitcoin now stands at a technical crossroads. The prevailing daily bullish bias is tempered by short-term exhaustion, creating a mixed tactical landscape. Traders should prepare for increased volatility and potential retracements, particularly if intraday support levels break. While long-term positioning may remain favorable, prudent risk management and disciplined entries are essential until short-term confirmation of renewed strength materializes.

Bull Verdict:

If bitcoin maintains its footing above $106,000 and breaks through the $108,500 level with volume confirmation, the uptrend remains intact. The alignment of all major moving averages in a bullish posture, combined with a supportive macro chart structure, favors continued appreciation toward the $110,000–$112,000 zone.

Bear Verdict:

Should bitcoin fail to hold the $107,000 threshold and momentum continue to deteriorate, a pullback to $104,000 or even $102,000 becomes likely. Weakening short-term structure, fading volume, and divergence in oscillators could signal the early stages of a broader corrective phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。